Rite Aid Receives Court Approval of "First Day" Motions to Support Business Operations

October 17 2023 - 10:05AM

Business Wire

Secures Interim Approval to Access Up to $3.45

Billion in Debtor-in-Possession Financing

Continues to Serve Customers and Deliver

Healthcare Products and Services Across Retail and Online

Platforms

Rite Aid Corporation (OTC: RADCQ) (“Rite Aid” or the “Company”)

today announced that it has received approvals from the U.S.

Bankruptcy Court for the District of New Jersey for its “First Day”

motions related to the Company’s voluntary Chapter 11 petitions

filed on October 15, 2023.

The Court granted interim approval to access up to $3.45 billion

in debtor-in-possession financing from certain of its lenders. This

financing is expected to provide sufficient liquidity to support

the Company throughout this process. Among other things, the Court

has authorized the Company to continue to pay associate wages,

salaries and benefits without interruption, pay vendors and

suppliers in full for goods and services provided on or after the

filing date of October 15, 2023, and otherwise continue to deliver

leading healthcare products and services across its retail and

online platforms.

“We are pleased to have received Court approval of these

critical First Day motions, which will enable Rite Aid to continue

serving our customers and meeting their pharmacy needs throughout

this process,” said Jeffrey S. Stein, Chief Executive Officer and

Chief Restructuring Officer of Rite Aid. “With the support of

certain of our lenders and the majority of our bondholders, we look

forward to moving through this process and emerging as a stronger

company, well-positioned for long-term success. We thank our

associates, partners, suppliers and vendors for their continued

support and our associates for their hard work and dedication.”

As previously announced, Rite Aid reached an agreement in

principle with certain of its senior secured noteholders on the

terms of a financial restructuring plan that will allow the Company

to accelerate its ongoing business transformation. Implementing the

contemplated restructuring plan will significantly reduce the

Company’s debt, increase its financial flexibility and enable it to

execute on key initiatives.

Additionally, as previously announced, Rite Aid has also entered

into an agreement with MedImpact Healthcare Systems, Inc.

(“MedImpact”), an independent pharmacy benefit solutions company,

pursuant to which MedImpact will acquire Rite Aids’ Elixir

Solutions business. Under the terms of the agreement, MedImpact

will serve as the “stalking horse bidder” in a court-supervised

sale process under section 363 of the U.S. Bankruptcy Code.

Accordingly, the proposed transaction is subject to higher and

better offers, court approval and other customary conditions.

Elixir Solutions is operating normally and continuing to serve

clients, plan sponsors, members and customers as usual. Elixir

Insurance is not included in Rite Aid’s Chapter 11 process or the

proposed transaction with MedImpact, and it is continuing to

operate and serve members as usual.

Additional Information

Additional information regarding the Company’s court-supervised

process is available at www.riteaidrestructuring.com. Court filings

and other information related to the proceedings are available on a

separate website administrated by the Company’s claims agent,

Kroll, at https://restructuring.ra.kroll.com/RiteAid; by calling

Kroll toll-free at (844) 274-2766, or (646) 440-4878 for calls

originating outside of the U.S. or Canada; or by emailing Kroll at

RiteAidInfo@ra.kroll.com.

Kirkland & Ellis LLP is serving as legal advisor, Guggenheim

Securities is serving as investment banker and Alvarez & Marsal

is serving as transformation officer and financial advisor to the

Company.

About Rite Aid

Rite Aid is a full-service pharmacy that improves health

outcomes. Rite Aid is defining the modern pharmacy by meeting

customer needs with a wide range of vehicles that offer

convenience, including retail and delivery pharmacy, as well as

services offered through our wholly owned subsidiaries, Elixir,

Bartell Drugs and Health Dialog. Elixir, Rite Aid’s pharmacy

benefits and services company, consists of accredited mail and

specialty pharmacies, prescription discount programs and an

industry leading adjudication platform to offer superior member

experience and cost savings. Health Dialog provides healthcare

coaching and disease management services via live online and phone

health services. Regional chain Bartell Drugs has supported the

health and wellness needs in the Seattle area for more than 130

years. Rite Aid employs more than 6,100 pharmacists and operates

more than 2,100 retail pharmacy locations across 17 states. For

more information, visit www.riteaid.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release includes statements that may constitute

“forward-looking statements,” including expectations regarding the

Company’s business plan and initiatives, the Company’s ability to

continue to operate its business as currently contemplated, the

effect of the Chapter 11 reorganization and the sufficiency of the

financing package described above, including the ability to access

the portion of the financing that is not currently accessible, the

Company’s ability to emerge from the Chapter 11 reorganization as a

stronger and more competitive enterprise, the Company’s continued

engagement in discussions with the potential bidders regarding the

Company’s sale processes for all, or a portion of the Company’s

assets, including the Company’s ability to consummate any

particular sale transaction, and other statements regarding the

Company’s plans and strategy. When used in this document, the words

“will,” “target,” “expect,” “continue,” “believe,” “seek,

“anticipate,” “estimate,” “intend,” “could,” “would,” “strives” and

similar expressions are generally intended to identify

forward-looking statements. These statements are made pursuant to

the safe harbor provisions of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. A number of important factors could cause actual

results of the Company and its subsidiaries to differ materially

from those indicated by such forward-looking statements. These

factors include, but are not limited to, risks and uncertainties

outlined in the risk factors detailed in Item 1A. “Risk Factors,”

of the Company’s Annual Report on Form 10-K for the fiscal year

ended March 4, 2023 (as filed with the Securities and Exchange

Commission (“SEC”) on May 1, 2023) and other risk factors

identified from time to time in the Company’s filings with the SEC.

Readers should carefully review these risk factors, and should not

place undue reliance on the Company’s forward-looking statements.

The Company undertakes no obligation to update any forward-looking

statements to reflect changes in underlying assumptions or factors,

new information, future events or other changes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231017882369/en/

INVESTORS: Byron Purcell (717) 975-3710

investor@riteaid.com

MEDIA: Joy Errico (717) 975-5718 press@riteaid.com

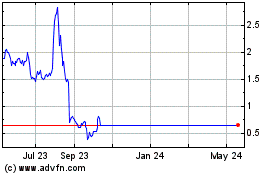

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Nov 2024 to Dec 2024

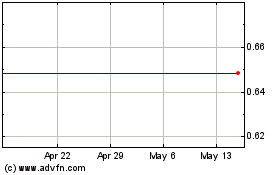

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Dec 2023 to Dec 2024