Reinsurance Group of America, Incorporated (NYSE: RGA) (the

“Company”) announced today that it has priced an aggregate

principal amount of $650 million of 5.750% senior notes due 2034

(the “Senior Notes”) pursuant to a public offering. The Company

expects to use the net proceeds from the offering for general

corporate purposes.

BofA Securities, Inc., U.S. Bancorp Investments, Inc. and Wells

Fargo Securities, LLC are acting as the joint book-running managers

for the offering, and Credit Agricole Securities (USA) Inc., HSBC

Securities (USA) Inc. and SMBC Nikko Securities America, Inc. are

serving as co-managers.

The Senior Notes have a maturity date of September 15, 2034,

with a par-call option three months prior to maturity, an issue

price of 99.287% and feature a fixed-rate coupon of 5.750%, payable

semiannually. The Company expects to complete the offering of the

Senior Notes on May 13, 2024, subject to the satisfaction of

customary closing conditions.

This offering is being conducted as a public offering by means

of a prospectus supplement filed as part of a shelf registration

statement previously filed with the Securities and Exchange

Commission (the “SEC”) on Form S-3. This news release does not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of, the Senior Notes in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. This offering is

being made solely by means of a prospectus and prospectus

supplement.

Copies of the prospectus and final prospectus supplement

relating to the offering, when available, may be obtained by

contacting: BofA Securities, Inc., NC1-022-02-25, 201 North Tryon

Street, Charlotte, NC 28255-0001, Attention: Prospectus Department,

Email: dg.prospectus_requests@bofa.com, (800) 294-1322; U.S.

Bancorp Investments, Inc., 214 Tryon Street, 26th Floor, Charlotte,

North Carolina 28202, Facsimile: (877) 774-3462, Attention: Debt

Capital Markets; or Wells Fargo Securities, LLC, 608 2nd Avenue

South, Suite 1000, Minneapolis, Minnesota 55402, Attention: WFS

Customer Service, by telephone at (800) 645-3751 or by e-mail at

wfscustomerservice@wellsfargo.com. Before you invest, you should

read the prospectus and the final prospectus supplement, when

available, and the documents that are incorporated by reference

therein for more complete information about the offering. Investors

may also obtain these documents for free by visiting the EDGAR

system on the SEC’s website at www.sec.gov or by contacting the

underwriters listed above with your request.

About RGA

Reinsurance Group of America, Incorporated (NYSE: RGA) is a

global industry leader specializing in life and health reinsurance

and financial solutions that help clients effectively manage risk

and optimize capital. Founded in 1973, RGA is one of the world’s

largest and most respected reinsurers and remains guided by a

powerful purpose: to make financial protection accessible to all.

As a global capabilities and solutions leader, RGA empowers

partners through bold innovation, relentless execution, and

dedicated client focus – all directed toward creating sustainable

long-term value. RGA has approximately $3.7 trillion of life

reinsurance in force and assets of $106.0 billion as of March 31,

2024.

Cautionary Note Regarding Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

federal securities laws including statements relating to the

Company’s offering of the Senior Notes and its intended use of

proceeds. Forward-looking statements often contain words and

phrases such as “anticipate,” “assume,” “believe,” “continue,”

“could,” “estimate,” “expect,” “if,” “intend,” “likely,” “may,”

“plan,” “potential,” “pro forma,” “project,” “should,” “will,”

“would,” and other words and terms of similar meaning or that are

otherwise tied to future periods or future performance, in each

case in all derivative forms. Forward-looking statements are based

on management’s current expectations and beliefs concerning future

developments and their potential effects on the Company.

Forward-looking statements are not a guarantee of future

performance and are subject to risks and uncertainties, some of

which cannot be predicted or quantified. Future events and actual

results, performance, and achievements could differ materially from

those set forth in, contemplated by or underlying the

forward-looking statements.

Factors that could also cause results or events to differ,

possibly materially, from those expressed or implied by

forward-looking statements, include, among others: (1) adverse

changes in mortality, morbidity, lapsation or claims experience,

(2) inadequate risk analysis and underwriting, (3) adverse capital

and credit market conditions and their impact on the Company’s

liquidity, access to capital and cost of capital, (4) changes in

the Company’s financial strength and credit ratings and the effect

of such changes on the Company’s future results of operations and

financial condition, (5) the availability and cost of collateral

necessary for regulatory reserves and capital, (6) requirements to

post collateral or make payments due to declines in the market

value of assets subject to the Company’s collateral arrangements,

(7) action by regulators who have authority over the Company’s

reinsurance operations in the jurisdictions in which it operates,

(8) the effect of the Company parent’s status as an insurance

holding company and regulatory restrictions on its ability to pay

principal of and interest on its debt obligations, (9) general

economic conditions or a prolonged economic downturn affecting the

demand for insurance and reinsurance in the Company’s current and

planned markets, (10) the impairment of other financial

institutions and its effect on the Company’s business, (11)

fluctuations in U.S. or foreign currency exchange rates, interest

rates, or securities and real estate markets, (12) market or

economic conditions that adversely affect the value of the

Company’s investment securities or result in the impairment of all

or a portion of the value of certain of the Company’s investment

securities that in turn could affect regulatory capital, (13)

market or economic conditions that adversely affect the Company’s

ability to make timely sales of investment securities, (14) risks

inherent in the Company’s risk management and investment strategy,

including changes in investment portfolio yields due to interest

rate or credit quality changes, (15) the fact that the

determination of allowances and impairments taken on the Company’s

investments is highly subjective, (16) the stability of and actions

by governments and economies in the markets in which the Company

operates, including ongoing uncertainties regarding the amount of

U.S. sovereign debt and the credit ratings thereof, (17) the

Company’s dependence on third parties, including those insurance

companies and reinsurers to which the Company cedes some

reinsurance, third-party investment managers and others, (18)

financial performance of the Company’s clients, (19) the threat of

natural disasters, catastrophes, terrorist attacks, pandemics,

epidemics or other major public health issues anywhere in the world

where the Company or its clients do business, (20) competitive

factors and competitors’ responses to the Company’s initiatives,

(21) development and introduction of new products and distribution

opportunities, (22) execution of the Company’s entry into new

markets, (23) integration of acquired blocks of business and

entities, (24) interruption or failure of the Company’s

telecommunication, information technology or other operational

systems, or the Company’s failure to maintain adequate security to

protect the confidentiality or privacy of personal or sensitive

data and intellectual property stored on such systems, (25) adverse

developments with respect to litigation, arbitration or regulatory

investigations or actions, (26) the adequacy of reserves, resources

and accurate information relating to settlements, awards and

terminated and discontinued lines of business, (27) changes in

laws, regulations, and accounting standards applicable to the

Company or its business, including Long-Duration Targeted

Improvement accounting changes and (28) other risks and

uncertainties described in the prospectus supplement related to the

offering and accompanying prospectus and in the Company’s other

filings with the SEC incorporated by reference into the prospectus

supplement and accompanying prospectus.

Forward-looking statements should be evaluated together with the

many risks and uncertainties that affect the Company’s business,

including those mentioned in this release and described in the

periodic reports the Company files with the SEC. These

forward-looking statements speak only as of the date on which they

are made. The Company does not undertake any obligation to update

these forward-looking statements, even though the Company’s

situation may change in the future, except as required under

applicable securities law. For a discussion of the risks and

uncertainties that could cause actual results to differ materially

from those contained in the forward-looking statements, you are

advised to see the risk factors set forth in the prospectus

supplement under “Risk Factors” and in Item 1A – “Risk Factors” in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, as may be supplemented by Item 1A – “Risk

Factors” in the Company’s subsequent Quarterly Reports on Form 10-Q

and in our other periodic and current reports filed with the

SEC.

Source: Reinsurance Group of America, Incorporated

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508657241/en/

Jeff Hopson Senior Vice President, Investor Relations

636-736-2068 jhopson@rgare.com

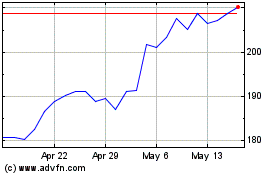

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Jan 2024 to Jan 2025