Snap Inc. (NYSE: SNAP) announced today that it intends to offer,

subject to market conditions and other factors, $700 million

aggregate principal amount of senior notes due 2033, or the notes,

in a private offering that is exempt from the registration

requirements of the Securities Act of 1933, as amended, or the

Securities Act. The notes will be general and unsecured senior

obligations of Snap and will be fully and unconditionally

guaranteed in the future, jointly and severally, by each of Snap’s

domestic subsidiaries that guarantees certain of its other

indebtedness, if any, subject to certain exceptions.

Snap intends to use the net proceeds from the offering, together

with cash on hand, to repurchase a portion of some or all of its

outstanding convertible senior notes due 2025, or the 2025 notes,

its outstanding convertible senior notes due 2026, or the 2026

notes, its outstanding convertible senior notes due 2027, or the

2027 notes, and/or its outstanding convertible senior notes due

2028, or the 2028 notes, and any remaining net proceeds from the

offering for general corporate purposes, including working capital,

operating expenses, capital expenditures, acquisitions of

complementary businesses, or other repurchases of Snap’s

securities.

In addition, Snap expects that some or all of the holders of the

2025 notes, the 2026 notes, the 2027 notes, or the 2028 notes that

it repurchases may purchase shares of Snap Class A common stock in

open market transactions or enter into or unwind various

derivatives with respect to Snap Class A common stock to unwind

hedge positions that they have with respect to their investment in

the 2025 notes, the 2026 notes, the 2027 notes, or the 2028 notes.

These transactions, in turn, may place upward pressure on the

trading price of Snap Class A common stock, causing Snap Class A

common stock to trade at higher prices than would be the case in

the absence of these purchases.

The notes have not been and will not be registered under the

Securities Act or any state securities laws. The notes will only be

offered or sold to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A promulgated under the

Securities Act, and outside the United States to non-U.S. persons

pursuant to Regulation S under the Securities Act.

In connection with the issuance of the 2026 notes, Snap entered

into capped call transactions with certain financial institutions.

If Snap repurchases any of the 2026 notes, it may enter into

agreements with the existing option counterparties to terminate a

portion of the existing capped call transactions. In connection

with the termination of any of these transactions, Snap expects the

existing option counterparties or their respective affiliates to

sell shares of Snap Class A common stock or unwind various

derivatives to unwind their hedge in connection with those

transactions. This activity could decrease (or reduce the size of

any increase in) the market price of Snap Class A common stock at

that time. In connection with the termination of the existing

option transactions, Snap will receive payments in amounts that

depend in part on the market price of Snap Class A common stock

over a valuation period following the pricing of the notes.

This press release is not an offer to sell and is not soliciting

an offer to buy any securities, nor will it constitute an offer,

solicitation, or sale of the securities in any state or

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction. Any offers of

the notes will be made only by means of a private offering

memorandum.

About Snap Inc.

Snap Inc. is a technology company. We believe the camera

presents the greatest opportunity to improve the way people live

and communicate. We contribute to human progress by empowering

people to express themselves, live in the moment, learn about the

world, and have fun together.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, as amended, about Snap and

Snap’s industry that involve substantial risks and uncertainties.

All statements other than statements of historical facts contained

in this press release, including statements regarding the proposed

terms of the notes, the completion, timing, and size of the

proposed offering of the notes, the anticipated use of the net

proceeds from the proposed offering of the notes, the expected

repurchases of the 2025 notes, the 2026 notes, the 2027 notes,

and/or the 2028 notes, and effects thereof, and any potential

termination of a portion of the capped call transactions in

connection with the expected repurchases of the 2026 notes, are

forward-looking statements. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “going to,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” or the negative of these words or other similar terms or

expressions. Snap cautions you that the foregoing may not include

all of the forward-looking statements made in this press

release.

You should not rely on forward-looking statements as predictions

of future events. Snap has based the forward-looking statements

contained in this press release primarily on its current

expectations and projections about future events and trends,

including its financial outlook, macroeconomic uncertainty, and

geo-political conflicts, that it believes may continue to affect

Snap’s business, financial condition, results of operations, and

prospects. These forward-looking statements are subject to risks

and uncertainties related to: Snap’s financial performance; the

ability to attain and sustain profitability; the ability to

generate and sustain positive cash flow; the ability to attract and

retain users, partners, and advertisers; competition and new market

entrants; managing Snap’s growth and future expenses; compliance

with new laws, regulations, and executive actions; the ability to

maintain, protect, and enhance Snap’s intellectual property; the

ability to succeed in existing and new market segments; the ability

to attract and retain qualified team members and key personnel; the

ability to repay or refinance outstanding debt, or to access

additional financing; future acquisitions, divestitures, or

investments; and the potential adverse impact of climate change,

natural disasters, health epidemics, macroeconomic conditions, and

war or other armed conflict, as well as risks, uncertainties, and

other factors described in “Risk Factors” in Snap’s Annual Report

on Form 10-K for the year ended December 31, 2024 and Snap’s other

filings with the SEC, which are available on the SEC’s website at

www.sec.gov. In addition, any forward-looking statements contained

in this press release are based on assumptions that Snap believes

to be reasonable as of this date. Snap undertakes no obligation to

update any forward-looking statements to reflect events or

circumstances after the date of this press release or to reflect

new information or the occurrence of unanticipated events, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210839987/en/

Investors and Analysts: ir@snap.com

Press: press@snap.com

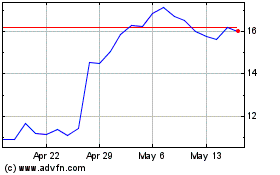

Snap (NYSE:SNAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

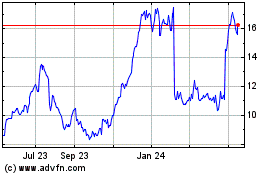

Snap (NYSE:SNAP)

Historical Stock Chart

From Feb 2024 to Feb 2025