Sensata Technologies (NYSE: ST), a global industrial technology

company and leading provider of sensors, sensor-rich solutions, and

electrical protection devices used in mission-critical systems to

help its customers address increasingly complex engineering and

operating performance requirements, today announced financial

results for its fourth quarter and full year ended December 31,

2024.

"Sensata had a strong finish to the year with fourth quarter

revenue exceeding expectations, full year free cash flow increasing

by over 40% compared to prior year, and adjusted operating margin

increasing for the fourth consecutive quarter," said Stephan von

Schuckmann, Sensata's Chief Executive Officer. “I believe that

there is a significant opportunity to create shareholder value by

returning Sensata, over time, to growth, driving operational

excellence, and efficiently deploying capital. Our high value and

differentiated margin businesses, strong global engineering

footprint, and deep, long-lasting customer relationships provide us

an excellent foundation on which to build for future success.”

Operating Results - Fourth Quarter

Operating results for the fourth quarter of 2024 compared to the

fourth quarter of 2023 are summarized below. These results include

non-GAAP financial measures, each of which is defined and

reconciled to the most directly comparable GAAP measure later in

this press release.

Revenue:

- Revenue was $907.7 million, a decrease of $84.8 million, or

8.5%, compared to $992.5 million in the fourth quarter of

2023.

Operating income/(loss):

- Operating income was $73.8 million, or 8.1% of revenue, an

increase of $275.2 million compared to operating loss of $201.4

million, or (20.3%) of revenue, in the fourth quarter of 2023.

- Adjusted operating income was $174.9 million, or 19.3% of

revenue, a decrease of $8.8 million, or 4.8%, compared to adjusted

operating income of $183.7 million, or 18.5% of revenue, in the

fourth quarter of 2023.

Earnings/(loss) per share:

- Earnings per share was $0.04, an increase of $1.38 compared to

a loss per share of $1.34 in the fourth quarter of 2023.

- Adjusted earnings per share was $0.76, a decrease of $0.05, or

6.2%, compared to adjusted earnings per share of $0.81 in the

fourth quarter of 2023.

Sensata generated $170.7 million of operating cash flow and

$138.9 million of free cash flow in the fourth quarter of 2024.

Sensata ended the quarter with $593.7 million of cash on hand.

In the quarter, Sensata used cash to repurchase shares valued at

approximately $21.6 million and paid $17.9 million in dividends to

shareholders.

Operating Results - Full Year

Operating results for the year ended December 31, 2024 compared

to the year ended December 31, 2023 are summarized below. These

results include non-GAAP financial measures, each of which is

defined and reconciled to the most directly comparable GAAP measure

later in this press release.

Revenue:

- Revenue was $3,932.8 million, a decrease of $121.3 million, or

3.0%, compared to $4,054.1 million in the year ended December 31,

2023.

Operating income:

- Operating income was $149.3 million, or 3.8% of revenue, a

decrease of $32.4 million, or 17.8%, compared to operating income

of $181.7 million, or 4.5% of revenue, in the year ended December

31, 2023.

- Adjusted operating income was $748.5 million, or 19.0% of

revenue, a decrease of $25.5 million, or 3.3%, compared to adjusted

operating income of $774.0 million, or 19.1% of revenue, in the

year ended December 31, 2023.

Earnings/(loss) per share:

- Earnings per share was $0.85, an increase of $0.88, compared to

a loss per share of $0.03 in the year ended December 31, 2023.

- Adjusted earnings per share was $3.44, a decrease of $0.17, or

4.7%, compared to adjusted earnings per share of $3.61 in the year

ended December 31, 2023.

Sensata generated $551.5 million of operating cash flow and

$393.0 million of free cash flow in the year ended December 31,

2024.

In July 2024, Sensata redeemed $700 million of bonds that were

scheduled to mature in October 2025. The redemption was funded by

proceeds from the $500 million senior notes issuance in June 2024

and approximately $200 million of cash on hand.

For the twelve months ended December 31, 2024, Sensata

repurchased shares valued at approximately $68.9 million and paid

$72.2 million of dividends to shareholders.

Guidance

“Taking into consideration the approximately $300 million of

revenue exited in 2024, we expect that full year 2025 revenue will

be organically flat with 2024 at approximately $3.6 billion," said

Brian Roberts, EVP and CFO of Sensata. "For the first quarter of

2025, our guidance reflects the return to a more normalized margin

seasonality. As revenue increases in the second quarter, typically

our seasonally strongest quarter, we expect adjusted operating

margins to return to 19.0% or better and then continue to improve

in the second half of 2025.”

Q1 2025 Guidance

$ in millions, except EPS

Q1-25 Guidance

Q4-24

B/(W)

Revenue

$870 - $890

$907.7

(4%) - (2%)

Adjusted Operating Income

$158 - $164

$174.9

(10%) - (6%)

Adj. Operating Margin

18.2% - 18.4%

19.3%

(110) - (90) bps

Adjusted Net Income

$105 - $110

$114.5

(8%) - (4%)

Adjusted EPS

$0.70 - $0.73

$0.76

(8%) - (4%)

Sensata’s financial guidance does not reflect potential impacts

of recently announced tariffs which may be imposed or threatened to

be imposed by the United States on Canada, China, Mexico, and other

countries as well as any retaliatory actions that may be taken.

Conference Call and Webcast

Sensata will conduct a conference call today at 4:30 p.m.

Eastern Time to discuss its fourth quarter and full year 2024

financial results and its outlook for the first quarter of 2025.

The dial-in numbers for the call are 1-844-784-1726 or

1-412-380-7411. Callers should reference the "Sensata Q4 2024

Financial Results Conference Call." A live webcast of the

conference call will also be available on the investor relations

page of Sensata’s website at http://investors.sensata.com.

Additionally, a replay of the call will be available until February

18, 2025. To access the replay, dial 1-877-344-7529 or

1-412-317-0088 and enter confirmation code: 9019340.

About Sensata Technologies

Sensata Technologies is a global industrial technology company

striving to create a safer, cleaner, more efficient and electrified

world. Through its broad portfolio of mission-critical sensors,

electrical protection components and sensor-rich solutions, Sensata

helps its customers address increasingly complex engineering and

operating performance requirements. With more than 18,000 employees

and global operations in 15 countries, Sensata serves customers in

the automotive, heavy vehicle & off-road, industrial, and

aerospace markets. Learn more at www.sensata.com and follow Sensata

on LinkedIn, Facebook, X and Instagram.

Non-GAAP Financial Measures

We supplement the reporting of our financial information

determined in accordance with U.S. generally accepted accounting

principles (“GAAP”) with certain non-GAAP financial measures. We

use these non-GAAP financial measures internally to make operating

and strategic decisions, including the preparation of our annual

operating plan, evaluation of our overall business performance, and

as a factor in determining compensation for certain employees. We

believe presenting non-GAAP financial measures is useful for

period-over-period comparisons of underlying business trends and

our ongoing business performance. We also believe presenting these

non-GAAP measures provides additional transparency into how

management evaluates the business.

Non-GAAP financial measures should be considered as supplemental

in nature and are not meant to be considered in isolation or as a

substitute for the related financial information prepared in

accordance with U.S. GAAP. In addition, our non-GAAP financial

measures may not be the same as, or comparable to, similar non-GAAP

measures presented by other companies.

The non-GAAP financial measures referenced by Sensata in this

release include: adjusted net income, adjusted earnings per share

(“EPS”), adjusted operating income, adjusted operating margin, free

cash flow, organic revenue growth, market outgrowth, adjusted

corporate and other expenses, adjusted earnings before interest,

taxes, depreciation and amortization ("EBITDA"), net debt, and net

leverage ratio. We also refer to changes in certain non-GAAP

measures, usually reported either as a percentage or number of

basis points, between two periods. Such changes are also considered

non-GAAP measures.

Adjusted net income (or loss) is defined as net income

(or loss), determined in accordance with U.S. GAAP, excluding

certain non-GAAP adjustments which are detailed in the accompanying

reconciliation tables. Adjusted EPS is calculated by

dividing adjusted net income (or loss) by the number of diluted

weighted-average ordinary shares outstanding in the period. We

believe that these measures are useful to investors and management

in understanding our ongoing operations and in analysis of ongoing

operating trends.

Adjusted operating income (or loss) is defined as

operating income (or loss), determined in accordance with U.S.

GAAP, excluding certain non-GAAP adjustments which are detailed in

the accompanying reconciliation tables. Adjusted operating

margin is calculated by dividing adjusted operating income (or

loss) by net revenue. We believe that these measures are useful to

investors and management in understanding our ongoing operations

and in analysis of ongoing operating trends.

Free cash flow is defined as net cash provided by/(used

in) operating activities less additions to property, plant and

equipment and capitalized software. We believe that this measure is

useful to investors and management as a measure of cash generated

by business operations that will be used to repay scheduled debt

maturities and can be used to fund acquisitions, repurchase

ordinary shares, or for the accelerated repayment of debt

obligations.

Organic revenue growth (or decline) is defined as the

reported percentage change in net revenue calculated in accordance

with U.S. GAAP, excluding the period-over-period impact of foreign

exchange rate differences as well as the net impact of

acquisitions, divestitures, and product life-cycle management, if

material, for the 12-month period following the respective

transaction date(s). We believe that this measure is useful to

investors and management in understanding our ongoing operations

and in analysis of ongoing operating trends.

Adjusted EBITDA is defined as net income (or loss),

determined in accordance with U.S. GAAP, excluding interest

expense, net, provision for (or benefit from) income taxes,

depreciation expense, amortization of intangible assets, and the

following non-GAAP adjustments, if applicable: (1) restructuring

related and other, (2) financing and other transaction costs, and

(3) deferred gain or loss on derivative instruments. We believe

that this measure is useful to investors and management in

understanding our ongoing operations and in analysis of ongoing

operating trends.

Adjusted corporate and other expenses is defined as

corporate and other expenses calculated in accordance with U.S.

GAAP, excluding the portion of non-GAAP adjustments described below

that relate to corporate and other expenses. We believe adjusted

corporate and other expenses is useful to management and investors

in understanding the impact of non-GAAP adjustments on operating

expenses not allocated to our segments.

Gross leverage ratio is defined as gross debt divided by

last twelve months (LTM) adjusted EBITDA. We believe that gross

leverage ratio is a useful measure to management and investors in

understanding trends in our overall financial condition.

Net debt is defined as total debt, finance lease, and

other financing obligations less cash and cash equivalents. We

believe net debt is a useful measure to management and investors in

understanding trends in our overall financial condition.

Net leverage ratio is defined as net debt divided by last

twelve months (LTM) adjusted EBITDA. We believe the net leverage

ratio is a useful measure to management and investors in

understanding trends in our overall financial condition.

In discussing trends in our performance, we may refer to certain

non-GAAP financial measures or the percentage change of certain

non-GAAP financial measures in one period versus another,

calculated on a constant currency basis. Constant currency

is determined by stating revenues and expenses at prior period

foreign currency exchange rates and excludes the impact of foreign

currency exchange rates on all hedges and, as applicable, net

monetary assets. We believe these measures are useful to investors

and management in understanding our ongoing operations and in

analysis of ongoing operating trends.

Safe Harbor Statement

This earnings release includes "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements may be identified by

terminology such as "may," "will," "could," "should," "expect,"

"anticipate," "believe," "estimate," "predict," "project,"

"forecast," "continue," "intend," "plan," "potential,"

"opportunity," "guidance," and similar terms or phrases.

Forward-looking statements involve, among other things,

expectations, projections, and assumptions about future financial

and operating results, objectives, business and market outlook,

trends, priorities, growth, shareholder value, capital

expenditures, cash flows, demand for products and services, share

repurchases, and Sensata’s strategic initiatives, including those

relating to acquisitions and dispositions and the impact of such

transactions on our strategic and operational plans and financial

results. These statements are subject to risks, uncertainties, and

other important factors relating to our operations and business

environment, and we can give no assurances that these

forward-looking statements will prove to be correct.

A wide variety of potential risks, uncertainties, and other

factors could materially affect our ability to achieve the results

either expressed or implied by these forward-looking statements,

including, but not limited to, risks related to instability and

changes in the global markets, supplier interruption or

non-performance, changes in trade-related tariffs and risks with

uncertain trade environments, the acquisition or disposition of

businesses, adverse conditions or competition in the industries

upon which we are dependent, intellectual property, product

liability, warranty, and recall claims, public health crises,

market acceptance of new product introductions and product

innovations, labor disruptions or increased labor costs, and

changes in existing environmental or safety laws, regulations, and

programs.

Investors and others should carefully consider the foregoing

factors and other uncertainties, risks, and potential events

including, but not limited to, those described in Item 1A: Risk

Factors in our most recent Annual Report on Form 10-K and as may be

updated from time to time in Item 1A: Risk Factors in our Quarterly

Reports on Form 10-Q or other subsequent filings with the United

States Securities and Exchange Commission. All such forward-looking

statements speak only as of the date they are made, and we do not

undertake any obligation to update these statements other than as

required by law.

SENSATA TECHNOLOGIES HOLDING PLC

Condensed Consolidated Statements of Operations (In

thousands, except per share amounts) (Unaudited)

For the three months ended

December 31,

For the full year ended

December 31,

2024

2023

2024

2023

Net revenue

$

907,690

$

992,494

$

3,932,764

$

4,054,083

Operating costs and expenses:

Cost of revenue

661,794

702,287

2,776,931

2,792,825

Research and development

35,952

42,623

169,276

178,867

Selling, general and administrative

108,424

87,532

392,196

350,655

Amortization of intangible assets

23,412

38,553

145,744

173,860

Goodwill impairment charge

—

321,700

150,100

321,700

Restructuring and other charges, net

4,344

1,238

149,241

54,500

Total operating costs and expenses

833,926

1,193,933

3,783,488

3,872,407

Operating income/(loss)

73,764

(201,439

)

149,276

181,676

Interest expense

(37,593

)

(43,328

)

(155,793

)

(182,184

)

Interest income

783

7,572

16,180

31,324

Other, net

(1,759

)

(4,759

)

(21,500

)

(12,974

)

Income/(loss) before taxes

35,195

(241,954

)

(11,837

)

17,842

Provision for/(benefit from) income

taxes

29,408

(39,716

)

(140,314

)

21,751

Net income/(loss)

$

5,787

$

(202,238

)

$

128,477

$

(3,909

)

Net income/(loss) per share:

Basic

$

0.04

$

(1.34

)

$

0.85

$

(0.03

)

Diluted

$

0.04

$

(1.34

)

$

0.85

$

(0.03

)

Weighted-average ordinary shares

outstanding:

Basic

149,563

151,090

150,401

152,089

Diluted

149,845

151,090

150,733

152,089

SENSATA TECHNOLOGIES HOLDING PLC

Condensed Consolidated Balance Sheets (In thousands)

(Unaudited)

December 31,

2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

593,670

$

508,104

Accounts receivable, net of allowances

660,180

744,129

Inventories

614,455

713,485

Prepaid expenses and other current

assets

158,934

136,686

Total current assets

2,027,239

2,102,404

Property, plant and equipment, net

821,653

886,010

Goodwill

3,383,800

3,542,770

Other intangible assets, net

492,878

883,671

Deferred income tax assets

288,189

131,527

Other assets

129,505

134,605

Total assets

$

7,143,264

$

7,680,987

Liabilities and shareholders'

equity

Current liabilities:

Current portion of long-term debt and

finance lease obligations

$

2,414

$

2,276

Accounts payable

362,186

482,301

Income taxes payable

29,417

32,139

Accrued expenses and other current

liabilities

317,341

307,002

Total current liabilities

711,358

823,718

Deferred income tax liabilities

235,689

359,073

Pension and other post-retirement benefit

obligations

27,910

38,178

Finance lease obligations, less current

portion

20,984

22,949

Long-term debt, net

3,176,098

3,373,988

Other long-term liabilities

80,782

66,805

Total liabilities

4,252,821

4,684,711

Total shareholders' equity

2,890,443

2,996,276

Total liabilities and shareholders'

equity

$

7,143,264

$

7,680,987

SENSATA TECHNOLOGIES HOLDING PLC

Condensed Consolidated Statements of Cash Flows (In

thousands) (Unaudited)

For the year ended December

31,

2024

2023

Cash flows from operating

activities:

Net income/(loss)

$

128,477

$

(3,909

)

Adjustments to reconcile net income/(loss)

to net cash provided by operating activities:

Depreciation

167,135

133,105

Amortization of debt issuance costs

5,734

6,772

Goodwill impairment charge

150,100

321,700

Loss/(gain) on sale of business

98,750

(5,877

)

Share-based compensation

38,459

29,994

Loss on debt financing

9,757

1,413

Amortization of intangible assets

145,744

173,860

Deferred income taxes

(233,408

)

(54,159

)

Loss on equity investments, net

13,976

711

Unrealized loss on derivative instruments

and other

86,506

35,986

Changes in operating assets and

liabilities, net of effects of acquisitions

(54,451

)

(160,301

)

Acquisition-related compensation

payments

(5,232

)

(22,620

)

Net cash provided by operating

activities

551,547

456,675

Cash flows from investing

activities:

Additions to property, plant and equipment

and capitalized software

(158,555

)

(184,609

)

Investment in debt and equity

securities

3,681

(390

)

Proceeds from the sale of business, net of

cash sold

135,717

19,000

Other

—

994

Net cash used in investing activities

(19,157

)

(165,005

)

Cash flows from financing

activities:

Proceeds from exercise of stock options

and issuance of ordinary shares

4,605

5,346

Payment of employee restricted stock tax

withholdings

(11,661

)

(12,280

)

Proceeds from borrowings on debt

500,000

—

Payments on debt

(701,870

)

(848,897

)

Dividends paid

(72,210

)

(71,543

)

Payments to repurchase ordinary shares

(68,891

)

(88,398

)

Distributions to and purchases of

noncontrolling interest

(79,393

)

—

Payments of debt financing costs

(13,381

)

(787

)

Net cash used in financing activities

(442,801

)

(1,016,559

)

Effect of exchange rate changes on cash

and equivalents

(4,023

)

7,475

Net change in cash and cash

equivalents

85,566

(717,414

)

Cash and cash equivalents, beginning of

year

508,104

1,225,518

Cash and cash equivalents, end of

year

$

593,670

$

508,104

Segment Performance

For the three months ended

December 31,

For the full year ended

December 31,

$ in 000s

2024

2023

2024

2023

Performance Sensing (1)

Revenue

$

646,704

$

691,762

$

2,743,593

$

2,749,934

Operating income

$

151,998

$

170,549

$

676,065

$

697,621

% of Performance Sensing revenue

23.5

%

24.7

%

24.6

%

25.4

%

Sensing Solutions (1)

Revenue

$

260,986

$

267,039

$

1,061,282

$

1,156,688

Operating income

$

79,347

$

79,281

$

312,632

$

338,172

% of Sensing Solutions revenue

30.4

%

29.7

%

29.5

%

29.2

%

Other (1)

Revenue

$

—

$

33,693

$

127,889

$

147,461

Operating income

$

—

$

2,742

$

28,054

$

7,485

% of Other revenue

0.0

%

8.1

%

21.9

%

5.1

%

(1) In the three months ended March 31, 2024, we realigned our

business as a result of organizational changes that better allocate

our resources to support changes to our business strategy. The most

significant changes include combining our Automotive and Heavy

Vehicle and Off-Road ("HVOR") businesses (with the combined

business remaining in Performance Sensing) and moving the various

assets and liabilities comprising our vehicle area network and data

collection businesses (the "Insights Business") out of Performance

Sensing to a new operating segment, which is not aggregated within

either of our reportable segments. We combined the Automotive and

HVOR businesses to better leverage our core capabilities and

prioritize product focus. We also moved certain shorter-cycle

businesses from Performance Sensing to Sensing Solutions, which

will benefit from organizing these businesses together, by allowing

us to scale core capabilities and better serve our customers. Prior

year amounts have been reclassified.

Revenue by Business, Geography, and End Market

(Unaudited)

(percent of total revenue)

For the three months

ended December 31,

For the full year

ended December 31,

2024

2023

2024

2023

Performance Sensing (1)

71.2 %

69.7 %

69.8 %

67.8 %

Sensing Solutions (1)

28.8 %

26.9 %

27.0 %

28.5 %

Other (1)

— %

3.4 %

3.2 %

3.7 %

Total

100.0 %

100.0 %

100.0 %

100.0 %

(percent of total revenue)

For the three months

ended December 31,

For the full year

ended December 31,

2024

2023

2024

2023

Americas

39.1 %

43.3 %

43.3 %

45.0 %

Europe

26.7 %

25.6 %

27.0 %

26.3 %

Asia/Rest of World

34.2 %

31.0 %

29.7 %

28.7 %

Total

100.0 %

100.0 %

100.0 %

100.0 %

(percent of total revenue)

For the three months

ended December 31,

For the full year

ended December 31,

2024

2023

2024

2023

Automotive (1)

59.4 %

55.7 %

56.2 %

53.7 %

Heavy vehicle and off-road (2)

16.2 %

17.7 %

17.6 %

17.7 %

Industrial, Appliance, HVAC (3), &

other

19.0 %

18.3 %

18.1 %

20.4 %

Aerospace

5.4 %

4.9 %

4.8 %

4.6 %

All other (2)

— %

3.5 %

3.3 %

3.6 %

Total

100.0 %

100.0 %

100.0 %

100.0 %

(1) Includes amounts reflected in the Sensing Solutions segment

as follows: $35.5 million and $30.1 million of revenue in the three

months ended December 31, 2024 and 2023, respectively, and $134.7

million and $115.1 million of revenue in the years ended December

31, 2024 and 2023, respectively. (2) Effective January 1, 2024 we

moved Insights from the Heavy vehicle and off-road operating

segment within Performance Sensing, creating another operating

segment in "Other". Additionally, we moved the Insights business to

the "other" end market. Prior period information in the tables

above has been recast to reflect this alignment. (3) Heating,

ventilation and air conditioning.

GAAP to Non-GAAP Reconciliations

The following unaudited tables provide a reconciliation of the

difference between each of the non-GAAP financial measures

referenced herein and the most directly comparable U.S. GAAP

financial measure. Amounts presented in these tables may not appear

to recalculate due to the effect of rounding.

Operating income and margin, income tax,

net income, and earnings per share

($ in thousands, except per share

amounts)

For the three months ended

December 31, 2024

Operating Income

Operating Margin

Income Taxes

Net Income

Diluted EPS

Reported (GAAP)

$

73,764

8.1

%

$

29,408

$

5,787

$

0.04

Non-GAAP adjustments:

Restructuring related and other (1)

82,037

9.0

%

(2,828

)

79,209

0.53

Financing and other transaction costs

(5,660

)

(0.6

%)

—

(4,326

)

(0.03

)

Amortization of intangible assets

23,412

2.6

%

—

23,412

0.16

Deferred loss on derivative

instruments

1,333

0.1

%

(1,069

)

4,070

0.03

Amortization of debt issuance costs

—

—

%

—

1,225

0.01

Deferred taxes and other tax related

—

—

%

5,085

5,085

0.03

Total adjustments

101,122

11.1

%

1,188

108,675

0.73

Adjusted (non-GAAP)

$

174,886

19.3

%

$

28,220

$

114,462

$

0.76

(1) Primarily includes other various restructuring-related

charges, including those related to our 2H 2024 Plan.

($ in thousands, except per share

amounts)

For the three months ended

December 31, 2023

Operating

(Loss)/Income

Operating Margin

Income Tax

Net (Loss)/Income

Diluted EPS

Reported (GAAP)

$

(201,439

)

(20.3

%)

$

(39,716

)

$

(202,238

)

$

(1.34

)

Non-GAAP adjustments:

Restructuring related and other (1)

345,926

34.9

%

(992

)

344,934

2.28

Financing and other transaction costs

2,111

0.2

%

(49

)

6,651

0.04

Amortization of intangible assets

37,301

3.8

%

—

37,301

0.25

Deferred gain on derivative

instruments

(218

)

0.0

%

471

(2,521

)

(0.02

)

Amortization of debt issuance costs

—

—

%

—

1,664

0.01

Deferred taxes and other tax related

—

—

%

(62,493

)

(62,493

)

(0.41

)

Total adjustments

385,120

38.8

%

(63,063

)

325,536

2.15

Adjusted (non-GAAP)

$

183,681

18.5

%

$

23,347

$

123,298

$

0.81

(1) Includes $321.7 million of charges to impair goodwill in our

Insights reporting unit, presented on the consolidated statement of

operations in goodwill impairment charge. Also includes $11.4

million of charges arising as an indirect result of actions taken

in the Q3 2023 Plan, of which approximately $2.1 million was

recorded in restructuring and other charges, net, with the

remainder primarily in cost of revenue.

For the year ended December

31, 2024

($ in millions, except per share

amounts)

Operating Income

Operating Margin

Income

Taxes

Net Income

Diluted

EPS

Reported (GAAP)

$

149,276

3.8

%

$

(140,314

)

$

128,477

$

0.85

Non-GAAP adjustments:

Restructuring related and other (1)

321,415

8.2

%

(5,063

)

316,352

2.10

Financing and other transaction costs

(2)

133,066

3.4

%

(1,373

)

155,426

1.03

Amortization of intangible assets (3)

142,130

3.6

%

—

142,130

0.94

Deferred loss/(gain) on derivative

instruments

2,595

0.1

%

508

(368

)

—

Amortization of debt issuance costs

—

—

%

—

5,734

0.04

Deferred taxes and other tax related

—

—

%

(228,690

)

(228,690

)

(1.52

)

Total adjustments

599,206

15.2

%

(234,618

)

390,584

2.59

Adjusted (non-GAAP)

$

748,482

19.0

%

$

94,304

$

519,061

$

3.44

(1) Primarily includes (1) a $150.1 million non-cash goodwill

impairment charge related to the Dynapower reporting unit, (2)

certain actions related to restructuring of our IT operations and

product lifecycle management including product line

discontinuations within the Sensing Solutions segment, resulting in

total costs of $46.7 million, including severance, contract

termination costs, and charges related to asset write-downs, (3)

approximately $105.8 million of other various restructuring-related

charges, including those related to our 2H 2024 Plan, (4)

approximately $12.6 million of costs associated with exiting Spear,

primarily recorded in restructuring and other charges, net, and (5)

a $6.2 million pension settlement charge, recorded in restructuring

and other charges, net. (2) Primarily includes (1) a loss of $98.8

million on the sale of the Insights business, (2) a $14.0 million

net loss on debt and equity investments, (3) $11.7 million of

transaction costs incurred, primarily related to the sale of the

Insights business, and (4) a $9.8 million loss related to the

redemption of the 5.0%Senior Notes. (3) In the three months ended

December 31, 2024, we discontinued the use of adjustments to

exclude step-up depreciation and amortization in our non-GAAP

measures and we adjusted operating income and net income to exclude

the amortization of all our intangible assets. The year ended

December 31, 2023 has not been recast. If we had excluded the

impact of step-up depreciation and included all amortization in our

results for the years ended December 31, 2024 and 2023, operating

income and adjusted net income would have increased by an

additional $3.6 million and $5.3 million, respectively, would have

been recognized.

For the year ended December

31, 2023

($ in millions, except per share

amounts)

Operating Income

Operating Margin

Income

Taxes

Net (Loss)/Income

Diluted

EPS

Reported (GAAP)

$

181,676

4.5

%

$

21,751

$

(3,909

)

$

(0.03

)

Non-GAAP adjustments:

Restructuring related and other (1)

411,494

10.2

%

(3,659

)

407,835

2.67

Financing and other transaction costs

(2)

16,286

0.4

%

2,727

24,219

0.16

Amortization of intangible assets (3)

168,582

4.2

%

—

168,582

1.11

Deferred gain on derivative

instruments

(4,078

)

(0.1

%)

273

(1,733

)

(0.01

)

Amortization of debt issuance costs

—

—

%

—

6,771

0.04

Deferred taxes and other tax related

—

—

%

(50,391

)

(50,391

)

(0.33

)

Total adjustments

592,284

14.6

%

(51,050

)

555,283

3.64

Adjusted (non-GAAP)

$

773,960

19.1

%

$

72,801

$

551,374

$

3.61

(1) Primarily includes (1) $321.7 million of charges to impair

goodwill of our Insights reporting unit in the fourth quarter of

2023, (2) $28.8 million of charges related to the exit of the Spear

Marine Business, $14.4 million of which was recorded in

restructuring and other charges, net, with the remainder primarily

in cost of revenue, (3) $23.5 million of charges incurred as part

of the Q3 2023 Plan, recorded in restructuring and other charges,

net, and (4) $18.8 million of charges arising as an indirect result

of actions taken in the Q3 2023 Plan, of which approximately $2.1

million was recorded in restructuring and other charges, net, with

the remainder primarily in cost of revenue. Refer to our Annual

Report on Form 10-K for additional information on the goodwill

impairment charge, the Q3 2023 Plan, and the exit of the Spear

Marine Business. (2) Primarily includes $15.3 million of expense

related to acquisition-related compensation arrangements (recorded

in restructuring and other charges, net) and $5.4 million of debt

financing loss related to our repayment of the 5.625% Senior Notes

in December 2023 and our term loan in the first half of 2023

(recorded in other, net), partially offset by a $5.9 million gain

on the sale of a business (recorded in restructuring and other

charges, net). (3) Includes $13.5 million of accelerated

amortization related to the exit of the Spear Marine Business in

the second quarter of 2023. In the three months ended December 31,

2024, we discontinued the use of adjustments to exclude step-up

depreciation in our non-GAAP measures and we adjusted operating

income and net income to exclude the amortization of all our

intangible assets. The year ended December 31, 2023 has not been

recast. If we had recast the year ended December 31, 2023, to align

with the current period definition, adjusted net income would have

increased by an additional $5.3 million.

Non-GAAP adjustments by location in

statements of operations

(in thousands)

For the three months ended

December 31,

For the full year

ended December 31,

2024

2023

2024

2023

Cost of revenue (1)

$

37,468

$

22,194

$

84,212

$

37,766

Selling, general and administrative

(2)

35,898

2,890

74,273

10,639

Amortization of intangible assets (3)

23,412

37,098

141,380

167,679

Goodwill impairment charge (4)

—

321,700

150,100

321,700

Restructuring and other charges, net

(5)

4,344

1,238

149,241

54,500

Operating income adjustments

101,122

385,120

599,206

592,284

Interest expense, net

1,225

1,664

5,734

6,771

Other, net (6)

5,140

1,815

20,262

7,278

Provision for/(benefit from) income taxes

(7)

1,188

(63,063

)

(234,618

)

(51,050

)

Net income adjustments

$

108,675

$

325,536

$

390,584

$

555,283

(1) The three and twelve months ended December 31, 2024 includes

$34.0 million of charges in both periods, arising as an indirect

result of actions taken in the 2H 2024 Plan. The twelve months

ended December 31, 2024 also includes a charge of $41.3 million

related to restructuring of our IT operations and product lifecycle

management including product line discontinuations within the

Sensing Solutions segment. The three and twelve months ended

December 31, 2023 includes $9.4 million and $16.5 million,

respectively, of charges arising as an indirect result of actions

taken in the Q3 2023 Plan. The twelve months ended December 31,

2023 also includes a charge of $13.0 million to write down

inventory related to the Spear Marine Business, which was exited in

the second quarter of 2023. (2) The three and twelve months ended

December 31, 2024 includes (1) $22.7 million in costs related to

the 2H 2024 Plan, (2) $11.7 million of transaction costs related to

divestitures made within the year, and (3) additional costs to

remediate the material weaknesses identified in our internal

controls over financial reporting for the year ended December 31,

2023. (3) The twelve months ended December 31, 2023 includes $13.5

million of accelerated amortization related to the exit of the

Spear Marine Business in the second quarter of 2023. (4) In the

third quarter of 2024, we impaired the goodwill associated with our

Dynapower reporting unit. In the fourth quarter of 2023, we

impaired goodwill associated with our Insights reporting unit. (5)

The twelve months ended December 31, 2024 includes (1) a loss of

$98.8 million on the sale of our Insights business in the third

quarter of 2024, (2) $11.2 million of charges related to the exit

of Spear, and (3) a $6.0 million pension settlement charge. The

twelve months ended December 31, 2023 includes (1) $22.8 million of

charges related to the Q3 2023 Plan incurred in the second half of

2023, (2) $15.3 million of expense related to compensation

arrangements entered into concurrent with the closing of certain

acquisitions, and (3) $14.4 million of charges related to the exit

of the Spear Marine Business in the second quarter of 2023. (6) The

year ended December 31, 2024 includes $14.8 million of

mark-to-market losses on our equity investments and a $9.8 million

loss related to the redemption of the 5.0% Senior Notes in the

third quarter of 2024. (7) The year ended December 31, 2024

includes a deferred tax benefit of $257.7 million related to the

transfer of certain intellectual property, and a current tax

expense of $2.1 million related to the repatriation of profit from

certain subsidiaries to their parent company in the Netherlands.

The decision to repatriate these profits was the result of our goal

to reduce our balance sheet exposure and corresponding earnings

volatility related to changes in foreign currency exchange rates as

well as to fund our deployment of capital.

Free cash flow

($ in thousands)

Three months ended December

31,

Full year ended December

31,

2024

2023

% Change

2024

2023

% Change

Net cash provided by operating

activities

$

170,713

$

105,098

62.4

%

$

551,547

$

456,675

20.8

%

Additions to property, plant and equipment

and capitalized software

(31,796

)

(48,385

)

34.3

%

(158,555

)

(184,609

)

14.1

%

Free cash flow

$

138,917

$

56,713

144.9

%

$

392,992

$

272,066

44.4

%

Adjusted corporate and other

expenses

Three months ended December

31,

Full year ended December

31,

(in thousands)

2024

2023

2024

2023

Corporate and other expenses (GAAP)

$

(129,825

)

$

(414,220

)

$

(572,490

)

$

(633,242

)

Restructuring related and other

75,041

345,594

284,404

366,509

Financing and other transaction costs

(3,008

)

1,205

20,836

6,771

Amortization of intangible assets

—

203

750

903

Deferred gain on derivative

instruments

1,333

(218

)

2,595

(4,078

)

Total Adjustments

73,366

346,784

308,585

370,105

Adjusted corporate and other expenses

$

(56,459

)

$

(67,436

)

$

(263,905

)

$

(263,137

)

Adjusted EBITDA

Three months ended December

31,

Full year ended December

31,

(in thousands)

2024

2023

2024

2023

Net income/(loss)

$

5,787

$

(202,238

)

$

128,477

$

(3,909

)

Interest expense, net

36,810

35,756

139,613

150,860

Provision for/(benefit from) income

taxes

29,408

(39,716

)

(140,314

)

21,751

Depreciation expense

66,423

36,228

167,135

133,105

Amortization of intangible assets

23,412

38,553

145,744

173,860

EBITDA

161,840

(131,417

)

440,655

475,667

Non-GAAP Adjustments

Restructuring related and other

45,636

345,926

285,014

411,494

Financing and other transaction costs

(4,326

)

6,700

156,799

21,492

Deferred loss/(gain) on derivative

instruments

5,139

(2,992

)

(876

)

(2,006

)

Adjusted EBITDA

$

208,289

$

218,217

$

881,592

$

906,647

Debt and leverage (gross and

net)

As of

($ in thousands)

December 31, 2024

December 31, 2023

Current portion of long-term debt and

finance lease obligations

$

2,414

$

2,276

Finance lease obligations, less current

portion

20,984

22,949

Long-term debt, net

3,176,098

3,373,988

Total debt and finance lease

obligations

3,199,496

3,399,213

Less: Premium/(discount), net

997

(1,568

)

Less: Deferred financing costs

(24,899

)

(24,444

)

Total gross indebtedness

$

3,223,398

$

3,425,225

Adjusted EBITDA (LTM)

$

881,592

$

906,647

Gross leverage ratio

3.7

3.8

As of

($ in thousands)

December 31, 2024

December 31, 2023

Total gross indebtedness

$

3,223,398

$

3,425,225

Less: Cash and cash equivalents

593,670

508,104

Net Debt

$

2,629,728

$

2,917,121

Adjusted EBITDA (LTM)

$

881,592

$

906,647

Net leverage ratio

3.0

3.2

Guidance

For the three months ending

March 31, 2025

($ in millions, except per share

amounts)

Operating Income

Net Income

EPS

Low

High

Low

High

Low

High

GAAP

$

108.3

$

112.6

$

50.1

$

53.1

$

0.32

$

0.34

Restructuring related and other

20.4

21.0

20.4

21.0

0.14

0.14

Financing and other transaction costs

6.0

7.0

6.0

7.0

0.04

0.05

Amortization of intangible assets

23.3

23.4

23.3

23.4

0.16

0.16

Deferred (gain)/loss on derivative

instruments(1)

—

—

—

—

—

—

Amortization of debt issuance costs

—

—

1.3

1.4

0.01

0.01

Deferred taxes and other tax related

—

—

3.9

4.1

0.03

0.03

Non-GAAP

$

158.0

$

164.0

$

105.0

$

110.0

$

0.70

$

0.73

Weighted-average diluted shares

outstanding (in millions)

150.0

150.0

(1) We are unable to predict movements in commodity prices and,

therefore, the impact of mark-to-market adjustments on our

commodity forward contracts to our projected operating results. In

prior periods such adjustments have been significant to our

reported GAAP earnings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211349495/en/

Media & Investors: James Entwistle +1(508) 954-1561

jentwistle@sensata.com investors@sensata.com

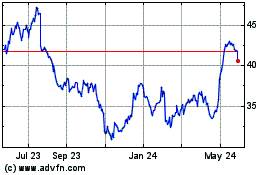

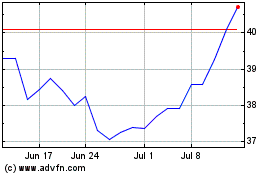

Sensata Technologies (NYSE:ST)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sensata Technologies (NYSE:ST)

Historical Stock Chart

From Feb 2024 to Feb 2025