TDCX Inc. (NYSE: TDCX) (“TDCX” or the “Company”), an

award-winning digital customer experience (CX) solutions provider

for technology and blue-chip companies, today announced its

unaudited financial results for the third quarter ended September

30, 2023.

Third Quarter 2023 Financial Highlights1

- Total revenue of US$119.8 million, down 5.4% year-on-year,

including a 5.3% point negative impact of foreign exchange rates

compared with the prior year period, and down 0.1% in constant

currency terms2

- Profit for the period of US$23.2 million, up 2.3% year-on-year,

primarily driven by cost optimization efforts, lower tax and higher

interest income

Mr. Laurent Junique, Chief Executive Officer and Founder of

TDCX, said, “Our focused approach to growing our business continues

to yield results. There remain bright spots in select sectors amid

market uncertainties. This quarter, we welcomed new clients

including a leading global airline based out of Asia and one of the

world’s most popular mobile messaging apps. Such wins are testament

to the sector expertise we have built in travel and hospitality and

social media platforms.

“We are also seeing results from our efforts to diversify our

client base. Our revenue from clients outside the top five has

increased 51 per cent year-on-year. I am confident that the steps

we have taken to enhance our value to our clients and to increase

our efficiency will position us strongly for the long term.”

(US$ million1, except for

%)

Q3 2022

Q3 2023

% Change

Revenue

126.6

119.8

-5.4%

(-0.1% on a constant currency

basis)2

Profit for the period

22.7

23.2

2.3%

Net profit margin (%)

17.9%

19.4%

EBITDA2

37.5

33.3

-11.0%

EBITDA Margins2

(%)

29.6%

27.8%

Adjusted EBITDA2, 3

36.7

33.3

-9.1%

Adjusted EBITDA Margins2,3

(%)

29.0%

27.8%

Adjusted Net Income2,3

22.8

23.3

2.2%

Q3 23 Business

Highlights

Continued strong client growth

- Client count4,5 up 31% year-on-year, bringing total client

count to 94 as of September 30, 2023, compared with 72 as of

September 30, 2022

- Newly launched clients include one of the world’s most popular

mobile messaging apps and a leading global airline based out of

Asia

Improved revenue diversification

- Revenue from clients outside the top five rose 51%

year-on-year5

- Revenue mix from top five clients lowered to 71% in Q3 23, from

82% in Q3 22

Contribution from new geographies

- Revenue from new geographies6 was five times in Q3 23 versus Q3

22

Full Year 2023 Outlook

For the full year 2023, TDCX expects its financial results to

be:

2023 Outlook

Revenue growth (YoY)

Range: 2% - 4%

(On a constant currency

basis2,7)

Adjusted EBITDA

margin1

Approximately 25% - 27%

Detailed Financial Information on the

Form 6-K

Please refer to

https://investors.tdcx.com/financials/quarterly-results/default.aspx

for the detailed financial information contained in Form 6-K.

__________________ 1 FX rate of US$1 = S$1.3648, being the

approximate rate in effect as of September 30, 2023, assumed in

converting financials from SG dollar to U.S. dollar.

2 For a discussion of the use of non-IFRS financial measures,

see “Non-IFRS Financial Measures”.

3 The reported amounts for Adjusted EBITDA and Adjusted Net

Income for the three months ended September 30, 2023 include

adjustments for certain items (i.e., acquisition-related

professional fees and net foreign exchange gains or losses) which

were not included in similar non-IFRS financial measures previously

reported for the corresponding period last year. The amount of

adjustment for net foreign exchange gain previously reported in

prior periods did not include unrealized losses or gains resulting

from change in fair value of derivatives. In order to place the

current disclosure in the appropriate context and enhance its

comparability, similar adjustments have been made for net foreign

exchange gain, Adjusted EBITDA and Adjusted Net Income for the

three months ended September 30, 2022.

4 “Client count” refers to launched campaigns that are revenue

generating.

5 Includes additional clients attributable to our Hong Kong

subsidiary.

6 Refers to sites in Colombia, India, Romania, South Korea, Hong

Kong, Türkiye, Vietnam, Brazil and Indonesia.

7 We have not reconciled non-IFRS forward-looking revenue growth

at constant currency to its most directly comparable IFRS measure,

as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. The revenue

growth outlook indicated for 2023 is calculated and presented at

constant currency, as it would require unreasonable efforts to

predict factors out of our control or not readily predictable, such

as currency exchange movements over the course of an entire

year.

Webcast and Conference Call Information

TDCX senior management will host a conference call to discuss

the third quarter 2023 unaudited financial results.

A live webcast of this conference call will be available on

TDCX’s website. Access information on the conference call and

webcast is as follows:

Date and time:

November 21, 2023, 7:30 PM (U.S. Eastern

Time) November 22, 2023, 8:30 AM (Singapore / Hong Kong Time)

Webcast link:

https://events.q4inc.com/earnings/TDCX/Q3-2023

Dial-in numbers:

U.S. Toll Free: +1 833 470

1428

U.S. (Local): +1 404 975 4839

Singapore: +65 3158 0255

Hong Kong: +852 5803 6418

UK Toll Free: +44 808 189

6484

All others: Dial-in numbers

Participant Access Code: 704387

A replay of the conference call will be available at TDCX’s

investor relations website (investors.tdcx.com). An archived

webcast will be available at the same link above.

About TDCX INC.

Singapore-headquartered TDCX provides transformative digital CX

solutions, enabling world-leading and disruptive brands to acquire

new customers, to build customer loyalty and to protect their

online communities.

TDCX helps clients achieve their customer experience aspirations

by harnessing technology, human intelligence and its global

footprint. It serves clients in fintech, gaming, technology, travel

and hospitality, digital advertising and social media, streaming

and e-commerce. TDCX’s expertise and strong footprint in Asia has

made it a trusted partner for clients, particularly high-growth,

new economy companies, looking to tap the region’s growth

potential.

TDCX’s commitment to delivering positive outcomes for our

clients extends to its role as a responsible corporate citizen. Its

Corporate Social Responsibility program focuses on positively

transforming the lives of its people, its communities and the

environment.

TDCX employs more than 17,800 employees across 30 campuses

globally, specifically in Brazil, Colombia, Hong Kong, India,

Indonesia, Japan, Malaysia, Mainland China, Philippines, Romania,

Singapore, South Korea, Spain, Thailand, Türkiye, and Vietnam. For

more information, please visit www.tdcx.com.

Convenience Translation

The Company’s financial information is stated in Singapore

dollars, the legal currency of Singapore. Unless otherwise noted,

all translations from Singapore dollars to U.S. dollars and from

U.S. dollars to Singapore dollars in this press release were made

at a rate of S$1.3648 to US$1.00, the approximate rate in effect as

of September 30, 2023. We make no representation that any Singapore

dollar or U.S. dollar amount could have been, or could be,

converted into U.S. dollars or Singapore dollar, as the case may

be, at any particular rate, the rate stated herein, or at all.

Non-IFRS Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with IFRS, we use the

following non-IFRS financial measures to help evaluate our

operating performance:

“EBITDA” represents profit for the year/ period before interest

expense, interest income, income tax expense and depreciation and

amortization expense. “EBITDA margin” represents EBITDA as a

percentage of revenue.

“Adjusted EBITDA” represents profit for the year/ period before

interest expense, interest income, income tax expense, depreciation

and amortization expense, acquisition-related professional fees,

net foreign exchange gains or losses and equity-settled share-based

payment expense (or net reversal) incurred in connection with our

Performance Share Plan. “Adjusted EBITDA margin” represents

Adjusted EBITDA as a percentage of revenue.

“Adjusted Net Income” represents profit for the year/ period

before acquisition-related professional fees, net foreign exchange

gains or losses and equity-settled share-based payment expense (or

net reversal) incurred in connection with our Performance Share

Plan, net of any tax impact of such adjustments.

Revenue at constant currency is calculated by translating the

revenue of our local subsidiaries in each period in the respective

local functional currencies to the Company and its subsidiaries’

presentation currency, using the average currency conversion rates

in effect during the comparable prior period, rather than at the

actual currency conversion rates in effect during that period.

We believe that EBITDA, EBITDA Margin, Adjusted EBITDA, Adjusted

EBITDA Margin, Adjusted Net Income, Revenue at Constant Currency

and Revenue Growth at Constant Currency help us to compare our

operating performance on a consistent basis by removing the impact

of items not directly resulting from our core operations, and

thereby help us to identify underlying trends in our operating

results, enhancing our understanding of past performance and future

prospects.

We exclude items from Adjusted EBITDA and Adjusted Net Income,

including acquisition-related professional fees, net foreign

exchange gains or losses and equity-settled share-based payment

expense (or net reversal) incurred in connection with our

Performance Share Plan, as they are not indicative of our ongoing

operating performance, and adjusting for such items is meaningful

and useful to readers to understand the underlying performance of

the business by eliminating the impact of certain items that may

obscure trends in the underlying performance of the business.

The above non-IFRS financial measures have limitations as

analytical tools and should not be considered in isolation or

construed as an alternative to revenue, net income, or any other

measure of performance or as an indicator of our operating

performance. The non-IFRS financial measures presented here may not

be comparable to similarly titled measures presented by other

companies because other companies may calculate similarly titled

measures differently. For more information on the non-IFRS

financial measures, including full reconciliations to the nearest

IFRS measure, please see the form 6-K section captioned “Non-IFRS

Financial Measures” or the presentation slides.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. In some cases,

you can identify these forward-looking statements by the use of

words such as “outlook,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,”

“intends,” “trends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. Among

other things, the outlook for the full year, the business outlook

and quotations from management in this announcement, as well as the

Company’s strategic and operational plans, contain forward-looking

statements. The Company may also make written or oral

forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: the performance of TDCX’s largest

clients; the successful implementation of its business strategy;

the continued service of its founder and certain of its key

employees and management; its ability to compete effectively; its

ability to navigate difficulties and successfully expand its

operations into countries in which it has no prior operating

experience; its ability to maintain its pricing, control costs or

continue to grow its business; its ability to attract and retain

enough highly trained employees; its compliance with service level

and performance requirements by, and contractual obligations with,

its clients; its exposure to various risks in Southeast Asia; its

contractual relationship with key clients; clients and prospective

clients’ spending on omnichannel CX solutions and content, trust

and safety services; its ability to successfully identify, acquire

and integrate companies; its spending on employee salaries and

benefits expenses; and its involvement in any disputes, legal,

regulatory, and other proceedings arising out of its business

operations. Further information regarding these and other risks is

included in the Company’s filings with the SEC. All information

provided in this press release and in the attachments is as of the

date of this press release, and the Company undertakes no

obligation to update any forward-looking statement, except as

required under applicable law.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

For the three months ended

September 30,

2023

2022

US$’000

S$’000

S$’000

Revenue

119,791

163,491

172,770

Employee benefits expense

(78,717

)

(107,433

)

(112,325

)

Depreciation and amortization

expense

(7,853

)

(10,718

)

(10,207

)

Rental and maintenance

expense

(2,249

)

(3,069

)

(2,648

)

Recruitment expense

(1,550

)

(2,116

)

(4,452

)

Transport and travelling

expense

(218

)

(297

)

(386

)

Telecommunication and technology

expense

(2,603

)

(3,552

)

(3,080

)

Interest expense

(438

)

(598

)

(429

)

Other operating expense (1)

(2,260

)

(3,084

)

(655

)

Share of profit from an

associate

-

-

61

Interest income

2,411

3,290

1,233

Other operating income

1,136

1,550

1,840

Profit before income

tax

27,450

37,464

41,722

Income tax expense

(4,263

)

(5,818

)

(10,799

)

Profit for the period

23,187

31,646

30,923

Item that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign operations

(499

)

(681

)

(6,880

)

Total comprehensive income for

the period

22,688

30,965

24,043

Profit

attributable to:

- Owners of TDCX Inc.

23,188

31,647

30,922

- Non-controlling interests

(1

)

(1

)

1

23,187

31,646

30,923

Total

comprehensive income attributable to:

- Owners of TDCX Inc.

22,689

30,966

24,042

- Non-controlling interests

(1

)

(1

)

1

22,688

30,965

24,043

Basic earnings per share (in US$

or S$) (2)

0.16

0.22

0.21

Diluted earnings per share (in

US$ or S$) (2)

0.16

0.22

0.21

_______________________________ (1) We reported foreign exchange

gains or losses, as applicable, on a net basis for the relevant

period under the “other operating expense” line item. (2) Basic and

diluted earnings per share

For the three months ended

September 30,

2023

2022

Weighted average number of

ordinary shares for the purposes of basic earnings per share

144,935,217

144,943,516

Weighted average number of

ordinary shares for the purposes of diluted earnings per share

144,958,043

144,943,516

The translation of Singapore Dollar amounts into United States

Dollar amounts (“USD”) for the unaudited condensed interim

consolidated statement of profit or loss and other comprehensive

income above are included solely for the convenience of readers

outside of Singapore and have been made at the rate of S$1.3648 to

US$1.00, the approximate rate of exchange at September 30, 2023.

Such translations should not be construed as representations that

the Singapore Dollar amounts could be converted into USD at that or

any other rate.

Comparison of the Three Months Ended September 30, 2023 and

2022

Revenue. Our revenue decreased by 5.4% to S$163.5 million

(US$119.8 million) for the three months ended September 30, 2023

from S$172.8 million for the three months ended September 30, 2022

primarily driven by a 29.9% decrease in revenue from content, trust

and safety services followed by a 2.8% decrease in revenue from

omnichannel CX solutions services rendered partially offset by a

3.5% increase in revenue from sales and digital marketing

services.

- Our revenue from omnichannel CX solutions services decreased by

2.8% to S$98.1 million (US$71.9 million) from S$100.9 million for

the same period of 2022 primarily due to lower volumes requirement

by existing clients in the digital advertising and media and

fintech verticals, partially offset by a higher demand for our

services by existing clients in the travel and hospitality, gaming,

fast-moving consumer goods, financial services, technology and

e-commerce verticals.

- Our revenue from sales and digital marketing services increased

by 3.5% to S$44.3 million (US$32.4 million) from S$42.8 million for

the same period of 2022 primarily due to the expansion of existing

campaigns by key digital advertising and media clients, fast moving

consumer goods, technology and scaled up contributions from new

clients secured during 2022.

- Our revenue from content, trust and safety services decreased

by 29.9% to S$19.7 million (US$14.4 million) from S$28.1 million

for the same period of 2022 primarily due to the contraction of

volumes requirement by the digital advertising and media vertical

client but mitigated partially by higher volumes in the travel and

hospitality vertical.

- Our revenue from our other service fees increased by 47.1% to

S$1.5 million (US$1.1 million) from S$1.0 million for the same

period of 2022 primarily due to an expansion of existing

campaigns.

The following table sets forth our service provided by amount

for the three months ended September 30, 2023 and 2022.

For the three months ended

September 30,

2023

2022

US$’000

S$’000

S$’000

Revenue by service

Omnichannel CX solutions

71,853

98,064

100,902

Sales and digital marketing

32,446

44,283

42,799

Content, trust and safety

14,403

19,657

28,058

Other service fees #

1,089

1,487

1,011

Total revenue

119,791

163,491

172,770

# Other service fees comprise revenue from other business

process and other services.

Employee Benefits Expense. Our employee benefits expense

decreased by 4.4% to S$107.4 million (US$78.7 million) from S$112.3

million for the same period of 2022 primarily due to lower

equity-settled share-based payment expenses resulting from changed

expectations of the remaining awarded tranches reflecting the

changing business and operating climate and recalibration of

employee headcount and costs of several key operating units in

response to business volume changes but offset partially by the

presence of the acquired Hong Kong subsidiary that was completed on

October 13, 2022 and commencement of greenfield operations of

Türkiye, Brazil and Vietnam. For the quarter ended September 30,

2023, the equity-settled share-based payment expense decreased to

S$0.8 million (US$0.6 million) as compared to the corresponding

quarter in 2022 of S$3.8 million.

Depreciation and Amortization Expense. Our depreciation

and amortization expense increased by 5.0% to S$10.7 million

(US$7.9 million) from S$10.2 million for the same period of 2022

primarily due to the shift to leased office spaces in Türkiye and

South Korea, take up of additional office space by the Philippines

operations and the presence of the Hong Kong unit that was acquired

on October 13, 2022 to become a wholly-owned subsidiary of the

Group.

Rental and Maintenance Expense. Our rental and

maintenance expense increased by 15.9% to S$3.1 million (US$2.2

million) from S$2.6 million for the same period of 2022 primarily

due to the set-up of the new Brazil operation and higher office

upkeep costs at the Philippines site.

Recruitment Expense. Our recruitment expense decreased by

52.5% to S$2.1 million (US$1.6 million) from S$4.5 million for the

same period of 2022 primarily due to lower hiring and work permit

renewal activities of largely foreign talents in Singapore and

Malaysia.

Transport and Travelling Expense. Our transport and

travelling expenses remained stable during the two comparative

periods.

Telecommunication and Technology Expense. Our

telecommunication and technology expense increased by 15.3% to

S$3.6 million (US$2.6 million) from S$3.1 million for the same

period of 2022 due to software and telecommunication requirement of

campaigns of certain existing and new sites.

Interest Expense. Our interest expense increased by 39.4%

to $0.6 million (US$0.4 million) from $0.4 million for the same

period of 2022 primarily on the back of higher lease liability

interest arising mainly from the shifting to leased office spaces

in Türkiye and South Korea sites, additional office spaces taken up

by the Philippines operations and the presence of the Hong Kong

unit that was acquired on October 13, 2022 to become a wholly-owned

subsidiary of the Group.

Other Operating Expense. Our other operating expense

increased by 370.8% to S$3.1 million (US$2.3 million) from S$0.7

million for the same period of 2022 primarily due to lower net

foreign exchange gain but partially offset by lower professional

and advisory engagement fees.

Share of Profit from an Associate. This relates to our

share of profit from an associated company in Hong Kong which later

became a wholly-owned subsidiary on October 13, 2022 following the

acquisition of the controlling shares in that business.

Interest Income. Our interest income increased by 166.8%

to S$3.3 million (US$2.4 million) from S$1.2 million for the same

period of 2022 primarily due to higher placements of liquid funds

in interest earning deposits and an uptrend in deposit interest

rates during the period.

Other Operating Income. Our other operating income

decreased by 15.8% to S$1.6 million (US$1.1 million) from S$1.8

million for the same period of 2022 primarily due to lower

government grants received by our Singapore subsidiaries. This is

partially offset by the fair value gains on the financial assets

measured at fair value through profit or loss.

Profit Before Income Tax. As a result of the foregoing,

we achieved a profit before income tax of S$37.5 million (US$27.5

million) for the three months ended September 30, 2023 (S$41.7

million for the corresponding period of 2022).

Income Tax Expense. Our income tax expense decreased by

46.1% to S$5.8 million (US$4.3 million) from S$10.8 million for the

same period of 2022 primarily due to the reinstatement of tax

incentive in the Philippines that was temporarily suspended in

2022, lower profitability of a few key operating units and

non-recurrence of the one-off ‘prosperity tax’ in Malaysia that was

implemented in 2022.

Profit for the Period. As a result of the foregoing, our

profit for the period increased by 2.3% to S$31.6 million (US$23.2

million) from S$30.9 million for the same period of 2022.

Exchange differences on translation of foreign

operations. Exchange differences on translation of foreign

operations recognized in other comprehensive income decreased by

90.1% to a loss of S$0.7 million (US$0.5 million) from a loss of

S$6.9 million for the same period of 2022. This is largely due to

the smaller impact of the functional currencies of several key

foreign operations weakening against the Singapore Dollar during

the three months ended September 30, 2023 as compared with the

corresponding period of 2022.

Total Comprehensive Income for the Period. As a result of

the foregoing, our total comprehensive income for the period

increased by 28.8% to S$31.0 million (US$22.7 million) from S$24.0

million for the same period of 2022.

Additional Adjustments to Certain Non-IFRS Financial

Measures

With effect from January 1, 2023, we have decided to include

adjustments for net foreign exchange gains or losses and

acquisition-related professional fees in Adjusted EBITDA, Adjusted

Net Income and Adjusted EPS, in addition to an adjustment for

equity-settled share-based payment expense (or net reversal) that

was included in such previously reported non-IFRS measures in prior

periods. Over the course of the previous year, we have identified

such additional items as not indicative of our ongoing operating

performance, and adjusting for such items is meaningful and useful

to readers to understand the underlying performance of the business

by eliminating the impact of certain items that may obscure trends

in the underlying performance of the business. For further

information, see “Non-IFRS Financial Measures” below.

Share Repurchase Program

On March 14, 2022, we announced that the board of directors had

approved a US$30.0 million share repurchase program. The share

repurchase program commenced on March 14, 2022. The repurchase

program does not have an expiration date and may be suspended,

modified or discontinued at any time without prior notice. We

expect to fund repurchases under this program with our existing

cash balance.

Our proposed repurchases may be made from time to time on the

open market at prevailing market prices, in privately negotiated

transactions, in block trades, and/or through other legally

permissible means, depending on market conditions and in accordance

with applicable rules and regulations and its insider trading

policy. Our board of directors will review the share repurchase

program periodically and may authorize adjustment of its terms and

size. All share repurchases are subject to and will be carried out,

if at all, in accordance with applicable regulatory

requirements.

From July 1, 2023 to November 17, 2023, we purchased 930,913

American Depositary Shares (ADSs) at a cost of US$5,542,000 under

our share repurchase program.

Reclassifications and comparative figures

In the third quarter of 2022, foreign exchange gains was

reported under “other operating income” line item while foreign

exchange losses for the quarter was reported under “other operating

expenses” line item. From the fourth quarter of 2022 onwards, we

reported foreign exchange gains or losses on a net basis under

“other operating expenses” line item. Accordingly,

reclassifications relating to foreign exchange gains and losses

have been made to prior period’s financial statements to enable

comparability with the current period’s financial statements and

therefore, the below mentioned line items have been amended in the

unaudited condensed interim consolidated statement of profit or

loss and other comprehensive income. Comparative figures have been

adjusted to conform to the current period’s presentation. The items

were reclassified as follows:

Previously reported

After reclassification

S$’000

S$’000

For the

three months ended September 30, 2022:

Other operating income

6,775

1,840

Other operating expenses

(5,590

)

(655

)

For the

nine months ended September 30, 2022:

Other operating income

12,076

4,341

Other operating expenses

(12,962

)

(5,227

)

NON-IFRS FINANCIAL MEASURES

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS,

revenue at constant currency, and revenue growth at constant

currency are non-IFRS financial measures. TDCX monitors EBITDA,

EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted

Net Income, Adjusted Net Income margin, Adjusted EPS, revenue at

constant currency and revenue growth at constant currency because

they assist the Company in comparing its operating performance on a

consistent basis by removing the impact of items not directly

resulting from its core operations.

EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA

margin

“EBITDA” represents profit for the period before interest

expense, interest income, income tax expense, and depreciation and

amortization expense. “EBITDA margin” represents EBITDA as a

percentage of revenue. “Adjusted EBITDA” represents profit for the

period before interest expense, interest income, income tax

expense, depreciation and amortization expense, equity-settled

share-based payment expense (or net reversal) incurred in

connection with our Performance Share Plan, net foreign exchange

gain or loss and acquisition-related professional fees. “Adjusted

EBITDA margin” represents Adjusted EBITDA as a percentage of

revenue.

For the three months ended

September 30,

2023

2022 (4)

US$’000

S$’000

Margin

S$’000

Margin

Revenue

119,791

163,491

—

172,770

—

Profit for the period and net

profit margin

23,187

31,646

19.4

%

30,923

17.9

%

Adjustments for:

Depreciation and amortization

expense

7,853

10,718

6.5

%

10,207

5.9

%

Income tax expense

4,263

5,818

3.5

%

10,799

6.3

%

Interest expense

438

598

0.4

%

429

0.2

%

Interest income

(2,411

)

(3,290

)

(2.0

%)

(1,233

)

(0.7

%)

EBITDA and EBITDA margin

33,330

45,490

27.8

%

51,125

29.6

%

Adjustment:

Equity-settled share-based

payment expense (1)

558

762

0.5

%

3,837

2.2

%

Net foreign exchange gain (2)

(761

)

(1,039

)

(0.6

%)

(4,931

)

(2.8

%)

Acquisition-related professional

fees (3)

179

244

0.1

%

—

—

Adjusted EBITDA and Adjusted

EBITDA margin (4)

33,306

45,457

27.8

%

50,031

29.0

%

For the nine months ended

September 30,

2023

2022 (5)

US$’000

S$’000

Margin

S$’000

Margin

Revenue

366,022

499,547

—

487,449

—

Profit for the period and net

profit margin

64,611

88,181

17.7

%

79,928

16.4

%

Adjustments for:

Depreciation and amortization

expense

24,113

32,909

6.5

%

29,059

6.0

%

Income tax expense

14,037

19,158

3.8

%

29,097

6.0

%

Interest expense

1,158

1,580

0.3

%

1,387

0.3

%

Interest income

(5,991

)

(8,177

)

(1.6

%)

(1,922

)

(0.4

%)

EBITDA and EBITDA margin

97,928

133,651

26.7

%

137,549

28.3

%

Adjustment:

Equity-settled share-based

payment (net reversal) / expense (1)

(2,563

)

(3,498

)

(0.7

%)

15,352

3.1

%

Net foreign exchange gain (2)

(1,610

)

(2,197

)

(0.4

%)

(7,786

)

(1.6

%)

Acquisition-related professional

fees (3)

1,125

1,535

0.3

%

—

—

Adjusted EBITDA and Adjusted

EBITDA margin (5)

94,880

129,491

25.9

%

145,115

29.8

%

_______________________________ (1) Refer to equity-settled

share-based payment expense (or net reversal) arising from TDCX

Performance Share Plan.

(2) Refer to realized and unrealized losses or gains resulting

from changes in exchange rates between the functional currency and

the currency in which a foreign currency transaction is

denominated, net of unrealized losses or gains resulting from

change in fair value of derivatives. The amount of adjustment for

net foreign exchange gain previously reported in prior periods did

not include unrealized losses or gains resulting from change in

fair value of derivatives. In order to place the current disclosure

in the appropriate context and enhance its comparability, similar

adjustments have been made for net foreign exchange gain for the

three and nine months ended September 30, 2022.

(3) Refer to fees incurred on third-party service providers in

connection with a discontinued acquisition.

(4) The reported amounts for Adjusted EBITDA for the three

months ended September 30, 2023 include adjustments for certain

items (i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EBITDA for the three months ended September 30,

2022.

(5) The reported amounts for Adjusted EBITDA for the nine months

ended September 30, 2023 include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EBITDA for the nine months ended September 30,

2022.

Adjusted Net Income and Adjusted Net Income margin

“Adjusted Net Income” represents profit for the period before

equity-settled share-based payment expense (or net reversal)

incurred in connection with our Performance Share Plan, net foreign

exchange gain or loss and acquisition-related professional fees,

net of any tax impact of such adjustments. “Adjusted Net Income

margin” represents Adjusted Net Income as a percentage of

revenue.

For the three months ended

September 30,

2023

2022 (4)

US$’000

S$’000

Margin

S$’000

Margin

Profit for the period and net

profit margin

23,187

31,646

19.4

%

30,923

17.9

%

Adjustment for:

Equity-settled share-based

payment

558

762

0.5

%

3,837

2.2

%

expense (1)

Net foreign exchange gain (2)

(643

)

(877

)

(0.5

%)

(3,655

)

(2.1

%)

Acquisition-related professional

fees (3)

179

244

-

—

—

Adjusted Net Income and Adjusted

Net Income margin (4)

23,281

31,775

19.4

%

31,105

18.0

%

For the nine months ended

September 30,

2023

2022 (5)

US$’000

S$’000

Margin

S$’000

Margin

Profit for the period and net

profit margin

64,611

88,181

17.7

%

79,928

16.4

%

Adjustment for:

Equity-settled share-based

payment

(2,563

)

(3,498

)

(0.7

%)

15,352

3.1

%

(net reversal) / expense (1)

Net foreign exchange gain (2)

(1,323

)

(1,805

)

(0.4

%)

(5,708

)

(1.1

%)

Acquisition-related professional

fees (3)

1,125

1,535

0.3

%

—

—

Adjusted Net Income and Adjusted

Net Income margin (5)

61,850

84,413

16.9

%

89,572

18.4

%

_______________________________ (1) Refer to equity-settled

share-based payment expense (or net reversal) arising from TDCX

Performance Share Plan.

(2) Refer to realized and unrealized losses or gains resulting

from changes in exchange rates between the functional currency and

the currency in which a foreign currency transaction is

denominated, net of unrealized losses or gains resulting from

change in fair value of derivatives and net of tax effects. The

amount of adjustment for net foreign exchange gain previously

reported in prior periods did not include unrealized losses or

gains resulting from change in fair value of derivatives. In order

to place the current disclosure in the appropriate context and

enhance its comparability, similar adjustments have been made for

net foreign exchange gain for the three and nine months ended

September 30, 2022.

(3) Refer to fees incurred on third-party service providers in

connection with a discontinued acquisition.

(4) The reported amounts for Adjusted Net Income for the three

months ended September 30, 2023 include adjustments for certain

items (i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted Net Income for the three months ended September 30,

2022.

(5) The reported amounts for Adjusted Net Income for the nine

months ended September 30, 2023 include adjustments for certain

items (i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted Net Income for the nine months ended September 30,

2022.

Adjusted EPS

“Adjusted EPS” represents earnings available to shareholders

excluding the impact of equity-settled share-based payment expense

(or net reversal), net foreign exchange gain or loss and

acquisition-related professional fees.

Adjusted EPS is calculated as earnings available to shareholders

excluding the impact of equity-settled share-based payment expense

(or net reversal), net foreign exchange gain or loss and

acquisition-related professional fees, divided by the diluted

weighted-average number of shares outstanding.

For the three months ended

September 30,

2023

2022 (4)

Amount

Per Share

Amount

Per Share

Amount

Per Share

US$’000

US$

S$’000

S$

S$’000

S$

Reported earnings available to

shareholders and EPS

23,188

0.16

31,647

0.22

30,922

0.21

Adjustments for:

Equity-settled share-based

payment expense (1)

558

-

762

0.01

3,837

0.03

Net foreign exchange gain (2)

(643

)

-

(877

)

(0.01

)

(3,655

)

(0.03

)

Acquisition-related professional

fees (3)

179

-

244

-

—

-

Adjusted earnings available to

shareholders and Adjusted EPS (4)

23,282

0.16

31,776

0.22

31,104

0.21

For the nine months ended

September 30,

2023

2022 (5)

Amount

Per Share

Amount

Per Share

Amount

Per Share

US$’000

US$

S$’000

S$

S$’000

S$

Reported earnings available to

shareholders and EPS

64,570

0.45

88,125

0.61

79,926

0.55

Adjustments for:

Equity-settled share-based

payment (net reversal) / expense (1)

(2,563

)

(0.03

)

(3,498

)

(0.03

)

15,352

0.11

Net foreign exchange gain (2)

(1,323

)

(0.01

)

(1,805

)

(0.01

)

(5,708

)

(0.04

)

Acquisition-related professional

fees (3)

1,125

0.01

1,535

0.01

—

—

Adjusted earnings available to

shareholders and Adjusted EPS (5)

61,809

0.42

84,357

0.58

89,570

0.62

_______________________________ (1) Refer to equity-settled

share-based payment expense arising from TDCX Performance Share

Plan.

(2) Refer to realized and unrealized losses or gains resulting

from changes in exchange rates between the functional currency and

the currency in which a foreign currency transaction is

denominated, net of unrealized losses or gains resulting from

change in fair value of derivatives and net of tax effects. The

amount of adjustment for net foreign exchange gain previously

reported in prior periods did not include unrealized losses or

gains resulting from change in fair value of derivatives. In order

to place the current disclosure in the appropriate context and

enhance its comparability, similar adjustments have been made for

net foreign exchange gain for the three and nine months ended

September 30, 2022.

(3) Refer to fees incurred on third-party service providers in

connection with a discontinued acquisition.

(4) The reported amounts for Adjusted EPS for the three months

ended September 30, 2023 include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EPS for the three months ended September 30, 2022.

(5) The reported amounts for Adjusted EPS for the nine months

ended September 30, 2023 include adjustments for certain items

(i.e., acquisition-related professional fees and net foreign

exchange gains or losses) which were not included in similar

non-IFRS financial measures previously reported in prior periods.

In order to place the current disclosure in the appropriate context

and enhance its comparability, similar adjustments have been made

for Adjusted EPS for the nine months ended September 30, 2022.

Revenue at Constant Currency and Revenue Growth at Constant

Currency

Revenue at constant currency, which is revenue adjusted for the

translation effect of foreign currencies so that certain financial

results can be viewed without the impact of fluctuations in foreign

currency exchange rates, thereby facilitating period-to-period

comparisons of our business performance. Revenue at constant

currency is calculated by translating the revenue of our local

subsidiaries in each period in the respective local functional

currencies to TDCX Inc.’s and its consolidated subsidiaries’

(together, the “Group”) presentation currency, using the average

currency conversion rates in effect during the comparable prior

period (rather than at the actual currency conversion rates in

effect during the current reporting period). Revenue growth at

constant currency means the period-over-period change in revenue at

constant currency compared against revenue in the prior period.

For the three months ended

September 30,

2023

2023

2022

S$’000

S$’000

S$’000

As reported

At constant currency

As reported

Revenue growth as reported

Foreign exchange impact

Revenue growth at constant

currency

Revenue

163,491

172,607

172,770

(5.4)%

5.3%

(0.1)%

For the nine months ended

September 30,

2023

2023

2022

S$’000

S$’000

S$’000

As reported

At constant currency

As reported

Revenue growth as reported

Foreign exchange impact

Revenue growth at constant

currency

Revenue

499,547

521,348

487,449

2.5%

4.5%

7.0%

The Company has not reconciled non-IFRS forward-looking revenue

growth at constant currency to its most directly comparable IFRS

measure, as permitted by Item 10(e)(1)(i)(B) of Regulation S-K. The

revenue growth outlook indicated for 2023 is calculated and

presented at constant currency, as it would require unreasonable

efforts to predict factors that are out of the Company’s control or

are not readily predictable, such as currency exchange movements

over the course of an entire year.

The Company uses revenue at constant currency and revenue growth

at constant currency, which are supplemental non-IFRS financial

measures, to provide better comparability of revenue trends

period-over-period (without the impact of fluctuations in foreign

currency exchange rates) because it is a global company that

transacts business in multiple currencies and reports financial

information in the Group’s functional reporting currency. Foreign

currency exchange rate fluctuations affect the amounts reported by

the Company in the Group’s functional reporting currency with

respect to its foreign revenues. Generally, when the Group’s

functional reporting currency dollar either strengthens or weakens

against other currencies, revenue at constant currency rates and

revenue growth at constant currency rates will be higher or lower

than revenue and revenue growth reported at actual exchange

rates.

The Company believes that non-IFRS financial measures such as

EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Net Income, Adjusted Net Income margin, Adjusted EPS,

revenue at constant currency and revenue growth at constant

currency help us to identify underlying trends in our operating

results, enhancing our understanding of past performance and future

prospects.

While the Company believes that such non-IFRS financial measures

provide useful information to investors in understanding and

evaluating the Company’s results of operations in the same manner

as its management, the Company’s use of such non-IFRS financial

measures have limitations as analytical tools and you should not

consider these in isolation or as a substitute for analysis of the

Company’s results of operations or financial condition as reported

under IFRS.

TDCX’s non-IFRS financial measures do not reflect all items of

income and expense that affect the Company’s operations and do not

represent the residual cash flow available for discretionary

expenditures. Further, these non-IFRS measures may differ from the

non-IFRS information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

non-IFRS financial measures to the nearest IFRS performance

measure, all of which should be considered when evaluating

performance. The Company encourages you to review the company’s

financial information in its entirety and not rely on any single

financial measure.

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of profit or loss and other comprehensive income above

are included solely for the convenience of readers outside of

Singapore and have been made at the rate of S$1.3648 to US$1.00,

the approximate rate of exchange at September 30, 2023. Such

translations should not be construed as representations that the

Singapore Dollar amounts could be converted into USD at that or any

other rate.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

For the nine months ended

September 30,

2023

2022

US$’000

S$’000

S$’000

Revenue

366,022

499,547

487,449

Employee benefits expense

(239,135

)

(326,372

)

(321,540

)

Depreciation and amortization

expense

(24,113

)

(32,909

)

(29,059

)

Rental and maintenance

expense

(7,051

)

(9,623

)

(7,290

)

Recruitment expense

(5,530

)

(7,547

)

(10,797

)

Transport and travelling

expense

(835

)

(1,140

)

(971

)

Telecommunication and technology

expense

(7,712

)

(10,526

)

(8,551

)

Interest expense

(1,158

)

(1,580

)

(1,387

)

Other operating expense (1)

(9,779

)

(13,347

)

(5,227

)

Share of profit from an

associate

-

-

135

Interest income

5,991

8,177

1,922

Other operating income

1,948

2,659

4,341

Profit before income

tax

78,648

107,339

109,025

Income tax expenses

(14,037

)

(19,158

)

(29,097

)

Profit for the period

64,611

88,181

79,928

Item that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign operations

(2,656

)

(3,625

)

1,747

Total comprehensive income for

the period

61,955

84,556

81,675

Profit

attributable to:

- Owners of the Group

64,570

88,125

79,926

- Non-controlling interests

41

56

2

64,611

88,181

79,928

Total

comprehensive income attributable to:

- Owners of the Group

61,914

84,500

81,673

- Non-controlling interests

41

56

2

61,955

84,556

81,675

Basic earnings per share (in S$)

(2)

0.45

0.61

0.55

Diluted earnings per share (in

S$) (2)

0.45

0.61

0.55

_______________________________ (1) We reported foreign exchange

gains or losses, as applicable, on a net basis for the relevant

period under the “other operating expense” line item. (2) Basic and

diluted earnings per share

For the nine months ended

September 30,

2023

2022

Weighted average number of

ordinary shares for the purposes of basic earnings per share

144,978,861

145,425,637

Weighted average number of

ordinary shares for the purposes of diluted earnings per share

145,032,964

145,425,637

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As of September 30, 2023

As of December 31, 2022

US$’000

S$’000

S$’000

ASSETS

Current assets

Cash and cash equivalents

317,729

433,637

389,100

Fixed and pledged deposits

-

-

6,551

Trade receivables

69,934

95,446

88,808

Contract assets

46,958

64,088

58,808

Other receivables

13,812

18,850

15,885

Financial assets measured at fair

value through profit or loss

42,243

57,653

29,776

Income tax receivable

314

428

354

Total current assets

490,990

670,102

589,282

Non-current assets

Pledged deposits

426

582

584

Goodwill and intangible

assets

2,005

2,737

2,924

Other receivables

1,937

2,643

5,019

Plant and equipment

25,134

34,303

41,292

Right-of-use assets

23,434

31,983

35,236

Deferred tax assets

2,799

3,820

3,463

Total non-current assets

55,735

76,068

88,518

Total assets

546,725

746,170

677,800

LIABILITIES AND EQUITY

Current liabilities

Other payables

38,123

52,030

49,723

Lease liabilities

12,142

16,572

17,818

Provision for reinstatement

cost

2,859

3,902

5,282

Income tax payable

7,066

9,644

16,560

Total current liabilities

60,190

82,148

89,383

Non-current

liabilities

Lease liabilities

13,423

18,320

20,644

Provision for reinstatement

cost

3,997

5,456

3,572

Defined benefit obligation

1,620

2,211

1,497

Deferred tax liabilities

596

813

852

Total non-current liabilities

19,636

26,800

26,565

Capital, reserves and

non-controlling interests

Share capital

15

20

19

Reserves

151,536

206,817

219,590

Retained earnings

315,319

430,346

342,260

Equity attributable to owners of

the Group

466,870

637,183

561,869

Non-controlling interests

29

39

(17

)

Total equity

466,899

637,222

561,852

Total liabilities and

equity

546,725

746,170

677,800

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of financial position above are included solely for the

convenience of readers outside of Singapore and have been made at

the rate of S$1.3648 to US$1.00, the approximate rate of exchange

at September 30, 2023. Such translations should not be construed as

representations that the Singapore Dollar amounts could be

converted into USD at that or any other rate.

UNAUDITED CONDENSED INTERIM

CONSOLIDATED STATEMENT OF CASH FLOWS

For the nine months ended

September 30,

2023

2022

US$’000

S$’000

S$’000

Operating activities

Profit before income tax

78,648

107,339

109,025

Adjustments for:

Depreciation and amortization

expense

24,113

32,909

29,059

Gain on early termination of

right-of-use assets

(6

)

(8

)

—

Changes in fair value of

financial assets at FVTPL

(763

)

(1,042

)

—

Equity-settled share-based

payment (net reversal) / expense

(2,563

)

(3,498

)

15,352

Provision for office

reinstatement cost

(3

)

(4

)

995

Bank loan transaction cost

23

32

41

Interest income

(5,991

)

(8,177

)

(1,922

)

Interest expense

1,158

1,580

1,387

Retirement benefit service

cost

502

685

566

Loss / (Gain) on disposal and

write-off of plant and equipment

29

39

(1

)

Share of profit from an

associate

—

—

(135

)

Operating cash flows before

movements in working capital

95,147

129,855

154,367

Trade receivables

(6,331

)

(8,640

)

716

Contract assets

(5,105

)

(6,967

)

(16,180

)

Other receivables

(1,066

)

(1,455

)

(2,399

)

Other payables

3,510

4,790

19,427

Cash generated from

operations

86,155

117,583

155,931

Interest received

5,991

8,177

1,922

Income tax paid

(19,667

)

(26,841

)

(27,617

)

Income tax refunded

274

374

—

Net cash from operating

activities

72,753

99,293

130,236

Investing activities

Purchase of plant and

equipment

(6,868

)

(9,374

)

(19,501

)

Proceeds from sales of plant and

equipment

21

29

50

Decrease in fixed deposits

4,677

6,383

1,735

Investment in financial assets

measured at fair value through profit or loss

(18,974

)

(25,896

)

—

Net cash used in investing

activities

(21,144

)

(28,858

)

(17,716

)

Financing activities

Dividends paid

(29

)

(40

)

(41

)

Repayment of lease

liabilities

(13,206

)

(18,023

)

(14,426

)

Interest paid

—

—

(212

)

Repayment of bank loan

—

—

(16,234

)

Repurchase of American Depositary

Shares

(4,619

)

(6,304

)

(13,590

)

Net cash used in financing

activities

(17,854

)

(24,367

)

(44,503

)

Net increase in cash and cash

equivalents

33,755

46,068

68,017

Effect of foreign exchange rate

changes on cash held in foreign currencies

(1,123

)

(1,531

)

5,277

Cash and cash equivalents at

beginning of period

285,097

389,100

313,147

Cash and cash equivalents at

end of period

317,729

433,637

386,441

The translation of Singapore Dollar amounts into United States

Dollar amounts for the unaudited condensed interim consolidated

statement of cash flows above are included solely for the

convenience of readers outside of Singapore and have been made at

the rate of S$1.3648 to US$1.00, the approximate rate of exchange

at September 30, 2023. Such translations should not be construed as

representations that the Singapore Dollar amounts could be

converted into USD at that or any other rate.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231121072401/en/

For enquiries, please contact: Investors / Analysts:

investors@tdcx.com Media: Eunice Seow eunice.seow@tdcx.com

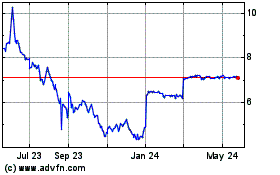

TDCX (NYSE:TDCX)

Historical Stock Chart

From Nov 2024 to Dec 2024

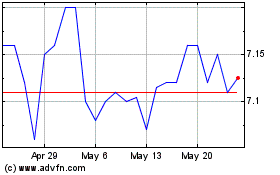

TDCX (NYSE:TDCX)

Historical Stock Chart

From Dec 2023 to Dec 2024