“Resuming the real growth path”

Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) (BIST:TCELL):

- Please note that all financial data is consolidated and

comprises that of Turkcell Iletisim Hizmetleri A.S. (the “Company”

or “Turkcell”) and its subsidiaries and associates (together

referred to as the “Group”) unless otherwise stated.

- We have four reporting segments:

- "Turkcell Türkiye," which comprises our telecom, digital

services, and digital business services related businesses in

Türkiye (as used in our previous releases in periods prior to Q115,

this term covered only the mobile businesses). All non-financial

data presented in this press release is unconsolidated and

comprises Turkcell Türkiye only figures unless otherwise stated.

The terms "we," "us," and "our" in this press release refer only to

Turkcell Türkiye, except in discussions of financial data, where

such terms refer to the Group, and except where context otherwise

requires.

- “Turkcell International,” which comprises all of our telecom

and digital services-related businesses outside of Türkiye (BeST

and KKTCELL).

- As per Turkcell Group’s announcement on September 9, 2024, the

transfer of shares, along with all rights and liabilities in

Lifecell LLC, LLC Global Bilgi, and LLC Ukrtower, was completed. As

of Q324, Turkcell Group no longer holds any shares in these

companies. These operations have been classified as assets held for

sale and as discontinued operations.

- “Techfin” which comprises all of our financial services

businesses.

- “Other” which mainly comprises our non-group call center and

energy businesses, retail channel operations, smart devices

management, and consumer electronics sales through digital channels

and intersegment eliminations.

- This press release provides a year-on-year comparison of our

key indicators and figures in parentheses following the operational

and financial results for September 30, 2024 refer to the same item

as at and for the three months ended September 30, 2023. For

further details, please refer to our consolidated financial

statements and notes as at and for September 30, 2024, which can be

accessed via our website in the investor relations section

(www.turkcell.com.tr).

- Selected financial information presented in this press release

for the third quarter and nine months of 2023 and 2024 is based on

IFRS figures in TRY terms unless otherwise stated.

- In the tables used in this press release, totals may not foot

due to rounding differences. The same applies to the calculations

in the text.

- Year-on-year percentage comparisons appearing in this press

release reflect mathematical calculation.

NOTICE

This press release contains the Company’s financial information

for the period ended September 30, 2024, prepared in accordance

with International Financial Reporting Standards (“IFRS”) as issued

by the International Accounting Standards Board (“IASB”). This

press release contains the Company’s financial information prepared

in accordance with International Accounting Standard 29, Financial

Reporting in Hyperinflationary Economies (“IAS29”). Therefore, the

financial statement information included in this press release for

the periods presented is expressed in terms of the purchasing power

of the Turkish Lira as of September 30, 2024. The Company restated

all non-monetary items in order to reflect the impact of the

inflation restatement reporting in terms of the measuring unit

current as of September 30, 2024. Comparative financial information

has also been restated using the general price index of the current

period.

This release includes forward-looking statements within the

meaning of Section 27A of the U.S. Securities Act of 1933, Section

21E of the U.S. Securities Exchange Act of 1934, and the Safe

Harbor provisions of the U.S. Private Securities Litigation Reform

Act of 1995. This includes, in particular, and without limitation,

our targets for revenue growth, EBITDA margin, and operational

capex over sales ratio for the full year 2024. In establishing such

guidance and outlooks, the Company has used a certain number of

assumptions regarding factors beyond its control, in particular in

relation to macro-economic indicators, such as expected inflation

levels, that may not be realized or achieved. More generally, all

statements other than statements of historical facts included in

this press release, including, without limitation, certain

statements regarding our operations, financial position, and

business strategy, may constitute forward-looking statements.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as, among others, “will,”

“expect,” “intend,” “estimate,” “believe,” “continue,” and

“guidance.”

Forward-looking statements are not guarantees of future

performance and involve certain risks and uncertainties that are

difficult to predict. In addition, certain forward-looking

statements are based upon assumptions as to future events that may

not prove to be accurate. Many factors could cause the actual

results, performance, or achievements of the Company to be

materially different from any future results, performance, or

achievements that may be expressed or implied by forward-looking

statements. Should one or more of these risks or uncertainties

materialize or underlying assumptions prove incorrect, actual

results may vary materially from those described herein as

anticipated, believed, estimated, expected, intended, planned, or

projected.

These forward-looking statements are based upon a number of

assumptions and other important factors that could cause our actual

results, performance, or achievements to differ materially from our

future results, performance, or achievements expressed or implied

by such forward-looking statements. All subsequent written and oral

forward-looking statements attributable to us are expressly

qualified in their entirety by reference to these cautionary

statements. For a discussion of certain factors that may affect the

outcome of such forward- looking statements, see our Annual Report

on Form 20-F for 2023 filed with the U.S. Securities and Exchange

Commission, and in particular, the risk factor section therein.

These forward-looking statements should not be relied upon as

representing the Company’s views as of any date subsequent to the

date of this press release. All forward-looking statements in this

press release are based on information currently available to the

Company, and we undertake no duty to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

The Company makes no representation as to the accuracy or

completeness of the information contained in this press release,

which remains subject to verification, completion, and change. No

responsibility or liability is or will be accepted by the Company

or any of its subsidiaries, board members, officers, employees, or

agents as to or in relation to the accuracy or completeness of the

information contained in this press release or any other written or

oral information made available to any interested party or its

advisers.

FINANCIAL HIGHLIGHTS

TRY million

Q323

Q324

y/y%

9M23

9M24

y/y%

Revenue

37,590

40,171

6.9%

108,295

114,592

5.8%

EBITDA1

16,091

17,757

10.4%

44,485

49,031

10.2%

EBITDA Margin (%)

42.8%

44.2%

1.4pp

41.1%

42.8%

1.7pp

EBIT2

5,795

6,552

13.1%

14,188

15,810

11.4%

EBIT Margin (%)

15.4%

16.3%

0.9pp

13.1%

13.8%

0.7pp

Net Income / (Loss)

(4,495)

14,280

n.m

(5,707)

20,555

n.m

THIRD QUARTER HIGHLIGHTS

- As per our announcement on September 9, 2024, we completed the

transfer of shares, along with all rights and liabilities in

Lifecell LLC, LLC Global Bilgi, and LLC Ukrtower operating in

Ukraine. Turkcell Group no longer holds any shares in these

companies.

- Solid operational profitability:

- Group revenues up 6.9% year-on-year, with Turkcell Türkiye’s

strong ARPU and subscriber net add performance primarily driven by

postpaid and techfin segment contribution

- Robust performance by Techfin segment; Paycell revenues up

19.6%; Financell revenues up 38.1%

- EBITDA rose 10.4%, leading to an EBITDA margin of 44.2%; EBIT

up 13.1%, resulting in an EBIT margin of 16.3%.

- Net income was positive at TRY 14.3 billion, including the sale

of subsidiaries in Ukraine

- Net leverage level at 0.1x; long FX position of US$228

million

- Profitability-centric operational performance:

- Turkcell Türkiye subscriber base3 up by 322 thousand quarterly

net additions

- 515 thousand quarterly mobile postpaid net additions; 1.5

million net additions in the first nine months of the year

- 47 thousand quarterly fiber net additions

- 67 thousand new fiber homepasses in Q324

- Mobile ARPU4 growth of 6.9%; residential fiber ARPU growth of

15.1%

- Data usage of 4.5G users at 19.5 GB in Q324

- Since inflation exceeded expectations in the second half of the

year, we have revised our revenue growth guidance5 for 2024 to

around 7%. We maintain our EBITDA margin target of around 42%, and

operational capex over sales ratio6 guidance at around 23%.

(1) EBITDA is a non-GAAP financial measure. See page 14 for the

explanation of how we calculate Adjusted EBITDA and its

reconciliation to net income. (2) EBIT is a non-GAAP financial

measure and is equal to EBITDA minus depreciation and amortization

expenses. (3) Including mobile, fixed broadband, IPTV, and

wholesale (MVNO&FVNO) subscribers (4) Excluding M2M (5) The

guidance for the year 2024 includes the effects of implementing

inflation accounting in accordance with IAS 29. Our 2024 guidance

has been established using a certain number of assumptions

regarding factors beyond our control, including in relation to

macroeconomic indicators such as expected inflation levels. In

particular, our 2024 guidance is based on an assumed annual

inflation rate of 43% (previously 37%), applied on a monthly basis.

Please note that this paragraph contains forward-looking statements

based on our current estimates and expectations regarding market

conditions for each of our different businesses. No assurance can

be given that actual results will be consistent with such estimates

and expectations. For a discussion of factors that may affect our

results, see our Annual Report on Form 20-F for 2023 filed with the

U.S. Securities and Exchange Commission, and in particular, the

risk factor section therein. (6) Excluding license fees For further

details, please refer to our consolidated financial statements and

notes as at September 30, 2024, via our website in the Investor

Relations section (www.turkcell.com.tr).

COMMENTS BY CEO, ALİ TAHA KOÇ, PhD

Resuming the Real Growth Path

As we celebrate our 30th anniversary at Turkcell Group, we

remain committed to creating value for our stakeholders through

strong foundations and an innovative vision. In line with our

strategic goals, we took a significant step by completing the sale

of our assets in Ukraine on September 9, 2024. The proceeds from

this transaction have been reflected in our third-quarter financial

results.

We have proudly led Türkiye's digitalization journey for over 30

years. We will now share our expertise and vision on the global

stage. With my recent election to the board of directors of GSMA,

the global GSM association, I am honored to represent not just the

Turkcell brand but also Türkiye. We will continue to make

significant contributions to the mobile communications sector and

the broader digital landscape under the GSMA umbrella.

We continue the renewable energy investments in line with our

plans. Recently, we completed the first phase of our solar energy

investments, installing 54 MW of power, with 6.4 MW already

activated in the third quarter. Following the acquisition of the

necessary permits, we will progressively bring the remaining

capacity online.

We delivered a strong quarter, driven by a robust ARPU

performance of Turkcell Türkiye, an expanding postpaid subscriber

base, and contributions from our Techfin business. In the third

quarter of 2024, our group revenues rose by 6.9% on an annual basis

to TRY 40.2 billion, while our EBITDA1 margin increased by 1.4

points to 44.2% despite the wage increase we made to protect the

purchasing power of our employees, who are our focus of value. Our

net income reached TRY 14.3 billion, with our strong operations,

which contributed TRY 3.1 billion, along with the proceeds from the

asset sale in Ukraine. In the third quarter, Turkcell Türkiye's

subscriber base increased by 322 thousand to 43.5 million.

Despite the aggressive competition, we achieved strong

operational results

In the third quarter, we continued to deliver a strong

operational performance. We gained a net of 515 thousand postpaid

subscribers, bringing our total net additions in the last 12 months

to 1.9 million. As a result, the share of our postpaid subscriber

base grew by 4 percentage points year-on-year, reaching 74%. Thanks

to our expanding postpaid subscriber base, price adjustments, and

successful upsell, our Mobile ARPU2 growth increased to 6.9%

year-over-year. Since May, we have observed increased activity in

the Mobile Number Portability (MNP) market due to the aggressive

pricing actions of competitors. This trend intensified further in

the third quarter as competition heightened. Increased competition,

along with seasonality, resulted in a mobile churn rate of 2.2% for

the third quarter.

In line with our customer-focused approach, we introduced our

'30th Year 1000 Mbps Speed Campaign' to our fixed broadband

customers in September. In the fixed broadband segment, we remain

focused on fiber subscribers, having gained 47 thousand net

subscribers thanks to the strong demand for our high-speed and

end-to-end fiber service, while our subscriber base exceeded 2.4

million. The share of our 12-month contract packages, implemented

to mitigate the effects of inflation, increased by 23 percentage

points year-on-year among our residential fiber subscribers,

reaching 82%. In the third quarter of 2024, our residential fiber

ARPU rose 15.1% year-on-year thanks to the increasing 12-month

contract subscriber share, upsell strategy and price adjustments in

fixed broadband services and IPTV.

Our Techfin business continues to support financial

performance

Our strategic focus area, Techfin, which includes our Financell3

and Paycell brands, continued to support group revenue strongly in

the third quarter. Financell grew by 38.1% on an annual basis,

recording a revenue of TRY 1.1 billion, supported by the increase

in average interest rates, while the net interest margin of 4.1%

continued to improve. On the other hand, Paycell revenues grew by

19.6%, reaching TRY 970 million, driven by the high demand for our

POS solutions and the increasing volume of Paycell Card. The

transaction volume of the "Pay Later" mobile payment service, which

has the largest share in Paycell revenues, increased by 24%

(non-group) to TRY 3.1 billion. Since its launch, our POS solutions

have exceeded demand expectations, maintaining a strong performance

with an 86% increase in transaction volume.

The number of standalone paid users of our digital services4

decreased by 14% year-on-year, reaching 5.0 million, in line with

our expectations as we prioritized profitability. Meanwhile, our

TV+ platform, which has consistently expanded its market share

since its launch, has now become the second-largest player in the

market, according to the ICTA's second-quarter report.

In our Digital Business Services portfolio, the revenues from

our four next-generation data centers, with a total IT capacity of

55 MW –33 MW of which is active—and cloud services offering

value-added services, grew by 43% in the third quarter, reaching

TRY 639 million. We are committed to expanding the capacity of our

data centers, which will remain a key strategic priority in the

years ahead.

We revise our guidance

Due to higher-than-expected inflation in the second half of the

year, we have revised our year-end inflation forecast upwards.

Accordingly, we are updating our revenue growth target5 for 2024 to

approximately 7%. We maintain our EBITDA margin expectation at

approximately 42% and our operational capex to sales6 ratio target

at approximately 23%.

I extend my heartfelt thanks to all our employees for their

contributions to our success and express my gratitude to our Board

of Directors for their continued support.

(1) EBITDA is a non-GAAP financial measure. See page 14 for the

explanation of how we calculate Adjusted EBITDA and its

reconciliation to net income (2) Excluding M2M (3) Following the

change in organizational structure, the revenues of Turkcell

Sigorta Aracılık Hizmetleri A.Ş. (Insurance Agency), which was

previously managed under Financell, are now classified as "Other"

in the Techfin segment as of the first quarter of 2023. (4)

Including IPTV, OTT TV, fizy, lifebox and GAME+ (5) Our

expectations for 2024 incorporate the effects of inflation

accounting under IAS 29. These projections are based on assumptions

regarding factors beyond our control, including key macroeconomic

indicators such as inflation. Specifically, we are assuming an

annual inflation rate of 43%, applied on a monthly basis, (previous

estimate: 37%). This paragraph contains forward-looking statements

that reflect our current estimates and expectations regarding

market conditions across all of our businesses. However, there can

be no assurance that these forward-looking statements will occur as

anticipated. For a discussion of the various factors that could

impact the outcome of these forward-looking statements, please

refer to our 2023 annual report on Form 20-F filed with the SEC,

specifically the risk factors section. (6) Excluding license

fees

FINANCIAL AND OPERATIONAL REVIEW

Financial Review of Turkcell Group

Profit & Loss Statement (million

TRY)

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Revenue

37,590.1

40,171.4

6.9%

108,295.3

114,592.2

5.8%

Cost of revenue1

(17,967.2)

(17,990.5)

0.1%

(53,854.2)

(53,417.0)

(0.8%)

Cost of revenue1/Revenue

(47.8%)

(44.8%)

3.0pp

(49.7%)

(46.6%)

3.1pp

Gross Margin1

52.2%

55.2%

3.0pp

50.3%

53.4%

3.1pp

Administrative expenses

(1,216.6)

(1,632.6)

34.2%

(3,280.1)

(4,307.9)

31.3%

Administrative expenses/Revenue

(3.2%)

(4.1%)

(0.9pp)

(3.0%)

(3.8%)

(0.8pp)

Selling and marketing expenses

(2,026.2)

(2,539.3)

25.3%

(5,566.5)

(7,073.1)

27.1%

Selling and marketing

expenses/Revenue

(5.4%)

(6.3%)

(0.9pp)

(5.1%)

(6.2%)

(1.1pp)

Net impairment losses on financial and

contract assets

(289.5)

(252.1)

(12.9%)

(1,109.7)

(763.1)

(31.2%)

EBITDA2

16,090.5

17,756.9

10.4%

44,484.8

49,031.1

10.2%

EBITDA Margin

42.8%

44.2%

1.4pp

41.1%

42.8%

1.7pp

Depreciation and

amortization

(10,295.9)

(11,205.1)

8.8%

(30,296.4)

(33,221.5)

9.7%

EBIT3

5,794.6

6,551.8

13.1%

14,188.4

15,809.6

11.4%

EBIT Margin

15.4%

16.3%

0.9pp

13.1%

13.8%

0.7pp

Net finance income / (costs)

2,187.2

(345.2)

(115.8%)

(4,813.8)

(1,777.6)

(63.1%)

Finance income

3,885.3

2,783.6

(28.4%)

14,720.3

7,237.5

(50.8%)

Finance costs

(4,405.9)

(4,654.8)

5.6%

(22,510.3)

(14,978.9)

(33.5%)

Monetary gain / (loss)

2,707.8

1,525.9

(43.6%)

2,976.1

5,963.7

100.4%

Other income / (expenses)

(2,916.1)

(179.3)

(93.9%)

(3,018.8)

(665.9)

(77.9%)

Non-controlling interests

2.3

0.7

(69.6%)

4.3

8.6

100.0%

Share of profit of equity accounted

investees

(65.5)

(672.3)

926.4%

(195.4)

(1,568.2)

702.6%

Income tax expense

(9,763.5)

(2,289.7)

(76.5%)

(13,520.4)

(3,679.9)

(72.8%)

Profit /(loss) from discontinued

operations

265.8

11,214.4

4,119.1%

1,648.9

12,428.0

653.7%

Net Income

(4,495.1)

14,280.4

n.m

(5,706.7)

20,554.5

n.m

(1) Excluding depreciation and amortization expenses. (2) EBITDA

is a non-GAAP financial measure. See page 14 for the explanation of

how we calculate Adjusted EBITDA and its reconciliation to net

income. (3) EBIT is a non-GAAP financial measure and is equal to

EBITDA minus depreciation and amortization expenses.

Revenue of the Group rose 6.9% year-on-year in Q324. This

was mainly driven by Turkcell Türkiye’s strong performance

supported by a larger postpaid subscriber base that generates more

ARPU than prepaid subscribers, upsell efforts and a solid increase

in fixed segment ARPU. The Techfin segment’s solid revenue growth

of 30.9% also supported the Group revenue increase.

Turkcell Türkiye revenues, comprising 87% of Group revenues,

rose 7.1% year-on-year to TRY34,854 million (TRY32,550

million).

- Consumer segment4 revenues grew 10.8%

year-on-year on the back of rising postpaid subscriber share, price

adjustments, and upsell efforts.

- Corporate segment4 revenues declined by

1.4% year-on-year. Constrained demand in the tightening economic

environment negatively impacted the hardware revenues of digital

business services, which declined by 44.1% year-on-year. Recurring

service revenues rose 18% year on year.

(4) Following the change in organizational structure, the

revenues from sole proprietorship subscribers that we define as

Merchant, which were previously managed under the Corporate

segment, are being reported under the Consumer segment as of and

from the third quarter of 2023. Within this scope, past data has

been revised for comparative purposes.

- Standalone digital services revenues across

consumer and corporate segments rose 4% year-on-year, primarily

attributed to price adjustments, despite the continued shrinkage of

the paid user base in consequence of our profitability-focused

strategy.

- Wholesale revenues were down 9.9%

year-on-year to TRY2,378 million (TRY2,639 million), resulting from

alternative data solutions in the market.

Turkcell International1 revenues, comprising 2% of Group

revenues, rose 20.6% to TRY935 million (TRY775 million).

Techfin segment revenues, comprising 5% of Group revenues, were

up 30.9% year-on-year to TRY2,132 million (TRY1,629 million).

Financell’s revenue grew 38.1%, and Paycell’s revenues increased

19.6% year-on-year. Please refer to the Techfin section for

details.

Other segment revenues, at 6% of Group revenues, which mostly

include non-group call center and energy business revenues and

consumer electronics sales revenues, declined 14.6% year-on-year to

TRY2,251 million (TRY2,636 million). This was primarily caused by

weak demand for consumer electronics.

Cost of revenue (excluding depreciation and amortization)

decreased to 44.8% (47.8%) as a percentage of revenues in Q324. The

decline in the cost of goods sold (2.2pp), interconnection cost

(1.1pp), and other cost items (1.2pp) outweighed the rise in

personnel expenses (0.9pp) and funding cost (0.6pp) as a percentage

of revenues.

Administrative Expenses increased to 4.1% (3.2%) as a

percentage of revenues in Q324. This was mainly led by higher

employee expenses (0.7pp) as a percentage of revenues.

Selling and Marketing Expenses increased to 6.3% (5.4%)

as a percentage of revenues in Q324, due mainly to the rise in

personnel expenses (0.6pp) as a percentage of revenues.

Net impairment losses on financial and contract assets

decreased to 0.6% (0.8%) as a percentage of revenues in Q324.

EBITDA2 grew 10.4% year-on-year in Q324, leading to an

EBITDA margin of 44.2% (42.8%).

- Turkcell Türkiye’s EBITDA rose 12.6%

year-on-year to TRY16,739 million (TRY14,865 million) with an

EBITDA margin of 48.0% (45.7%). The primary contributors to margin

improvement were lower interconnection costs and a reduction in

cost of goods sold as a percentage of revenues.

- Turkcell International EBITDA declined 1.2%

year-on-year to TRY365 million (TRY369 million), leading to an

EBITDA margin of 39.1% (47.6%). The increase in personnel expenses

led to a margin dilution.

- Techfin segment EBITDA decreased 4.1%

year-on-year to TRY595 million (TRY620 million) with an EBITDA

margin of 27.9% (38.1%). This was driven by increases in funding

costs for Financell and administrative expenses as a percentage of

revenues.

- The EBITDA of other subsidiaries was at

TRY58 million (TRY236 million).

Depreciation and amortization expenses increased 8.8%

year-on-year in Q324.

Net finance expense of TRY345 million (positive TRY2,187

million) was recorded for Q324, including a TRY1.5 billion monetary

gain and net FX losses of TRY1.8 billion.

See Appendix A for details of net foreign exchange gain and

loss.

Other expenses decreased to TRY179 million (TRY2,916

million) in Q324.

Income tax expense was TRY2,290 million (TRY9,764

million) in this quarter. Higher corporate tax was more than offset

by lower deferred tax expenses.

(1) As per our Company’s announcement on September 9, 2024, we

no longer hold any shares in companies operating in Ukraine as of

Q324. (2) EBITDA is a non-GAAP financial measure. See page 14 for

the explanation of how we calculate adjusted EBITDA and its

reconciliation to net income.

Profit /(loss) from discontinued operations of TRY11,214

million (TRY266 million) was recorded in Q324. This figure includes

Ukrainian assets sales.

Net income of the Group was TRY14.3 billion (negative

TRY4,495 million) in Q324, thanks to our solid operations and the

proceeds from the sale of our Ukrainian assets.

Total cash & debt: Thanks to the proceeds from the

sale of our companies operating in Ukraine, consolidated cash as of

September 30, 2024, increased to TRY81,009 million compared to

TRY67,901 million as of December 31, 2023. Excluding FX swap

transactions, 57% of our cash is in US$, 21% in EUR, 1% in CNY, and

22% in TRY.

Consolidated debt as of September 30, 2024, decreased to

TRY106,728 million from TRY114,237 million as of December 31, 2023.

TRY3,894 million of our consolidated debt is comprised of lease

obligations. Please note that 40% of our consolidated debt is in

US$, 35% in EUR, 3% in CNY, and 21% in TRY.

Net debt1 as of September 30, 2024, decreased to TRY9,360

million from TRY32,339 million as of December 31, 2023, with a net

debt to EBITDA ratio of 0.1x times.

Turkcell Group had a long FX position of US$228 million at the

end of the quarter (Please note that this figure takes hedging

portfolio and advance payments into account). The long FX position

of US$228 million is almost in line with our FX neutral definition,

which is between -US$200 million and +US$200 million.

Capital expenditures: Capital expenditures, including

non-operational items, were at TRY9,562 million in Q324.

Operational capital expenditures (excluding license fees) at the

Group level were at 18.1% of total revenues in Q324.

Capital expenditures (million

TRY)

Quarter

Nine Months

Q3232

Q3243

9M232

9M243

Operational Capex

6,045.2

7,251.9

20,366.3

22,461.2

License and Related Costs

14.7

6.9

5,069.2

22.7

Non-operational Capex (Including IFRS15

& IFRS16)

6,452.8

2,303.6

13,335.5

9,003.5

Total Capex

12,512.7

9,562.4

38,770.9

31,487.4

(1) The net debt calculation includes "financial assets”

reported under current and non-current assets. Required reserves

held in CBRT balances are also considered in net debt calculation.

We believe that these assets are highly liquid and can be easily

converted to cash without significant change in value. (2)

Including Ukraine operations (3) Excluding Ukraine operations

Operational Review of Turkcell Türkiye

Summary of Operational Data

Q323

Q224

Q324

y/y %

q/q %

Number of subscribers

(million)1

42.7

43.2

43.5

1.9%

0.7%

Mobile Postpaid (million)

26.7

28.1

28.6

7.1%

1.8%

Mobile M2M (million)

4.3

4.7

4.9

14.0%

4.3%

Mobile Prepaid (million)

11.5

10.4

10.1

(12.2%)

(2.9%)

Fiber (thousand)

2,247.8

2,380.3

2,427.6

8.0%

2.0%

ADSL (thousand)

765.1

767.8

765.0

(0.0%)

(0.4%)

Superbox (thousand)2

720.7

746.4

715.2

(0.8%)

(4.2%)

Cable (thousand)

39.0

38.1

37.3

(4.4%)

(2.1%)

IPTV (thousand)

1,375.0

1,484.4

1,483.8

7.9%

(0.0%)

Churn (%)3

Mobile Churn (%)

2.0%

1.5%

2.2%

0.2pp

0.7pp

Fixed Churn (%)

1.6%

1.2%

1.6%

-

0.4pp

Average mobile data usage per user

(GB/user)

18.0

18.6

18.6

3.3%

-

(1) Including mobile, fixed broadband, IPTV, and wholesale

(MVNO&FVNO) subscribers (2) Superbox subscribers are included

in mobile subscribers. (3) Churn figures represent average monthly

churn figures for the respective quarters.

ARPU (Average Monthly Revenue per User)

(TRY)

Q323

Q224

Q324

y/y %

q/q %

Mobile ARPU, blended

226.6

228.8

239.0

5.5%

4.5%

Mobile ARPU, blended (excluding

M2M)

253.3

258.8

270.9

6.9%

4.7%

Postpaid

262.8

263.0

269.7

2.6%

2.5%

Postpaid (excluding M2M)

310.2

313.5

321.8

3.7%

2.6%

Prepaid

143.4

137.3

154.1

7.5%

12.2%

Fixed Residential ARPU, blended

254.1

283.0

294.4

15.9%

4.0%

Residential Fiber ARPU

259.8

286.9

299.1

15.1%

4.3%

In Q324, Turkcell Türkiye experienced a net increase of 322

thousand subscribers, resulting in a total subscriber base of 43.5

million. The mobile subscriber base totaled 38.7 million, with a

net add of 250 thousand in this quarter. Our commitment to

expanding our postpaid subscriber base, coupled with successful

switch performance, led to a quarterly net add of 515 thousand

postpaid subscribers. Over the first nine months of the year, we

recorded net adds of 1.5 million postpaid subscribers. Accordingly,

postpaid subscribers account for 73.9% (69.8%) of our mobile

segment as of the end of Q324. Despite the high tourist activity

during the summer months, our prepaid customer base contracted by

266 thousand during the quarter. This reduction can be primarily

attributed to the widespread usage of alternative data solutions

(eSIM technology).

As the market leader in the mobile segment, we prioritize market

rationalization. Nevertheless, we have faced aggressive pricing

actions from competitors since May 2024, leading to high volatility

in the MNP (Mobile Number Portability) market which increased by

47% compared to the previous quarter. Accordingly, the average

monthly mobile churn rate slightly increased to 2.2% in Q324.

Please recall that the innovative campaigns, primarily the “30th

Anniversary Double-Up,” as well as Ramadan and Eid holidays,

contributed to the previous quarter’s churn rate. Our mobile ARPU

(excluding M2M) rose 6.9% year-on-year, driven mainly by a rising

postpaid subscriber base, price adjustments, and upsell

efforts.

In the fixed business, our subscriber base exceeded 3.2 million

on 44 thousand quarterly net additions. Thanks to our fiber focus,

the fiber subscriber base grew by 47 thousand in this quarter.

Residential fiber ARPU growth was 15.1% year-on-year in Q324 due to

an increase in the share of 12-month contract subscribers and

expanding high-speed tariffs’ share, price adjustments, and premium

pricing in IPTV. The average monthly fixed churn rate remained

steady at 1.6% in Q324 on a yearly basis.

TURKCELL INTERNATIONAL

BeST1

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Number of subscribers (million)

1.5

1.5

-

1.5

1.5

-

Active (3 months)

1.2

1.2

-

1.2

1.2

-

Revenue (million BYN)

45.0

56.5

25.6%

126.9

157.4

24.0%

EBITDA (million BYN)

20.5

25.4

23.9%

58.4

74.5

27.6%

EBITDA margin (%)

45.5%

45.0%

(0.5pp)

46.1%

47.4%

1.3pp

Net income / (loss) (million BYN)

(12.3)

(0.6)

(95.1%)

(30.4)

(3.0)

(90.1%)

Capex (million BYN)

21.6

29.7

37.5%

54.1

81.5

50.6%

Revenue (million TRY)

358.8

508.1

41.6%

1,425.7

1,587.8

11.4%

EBITDA (million TRY)

161.8

225.4

39.3%

655.7

751.0

14.5%

EBITDA margin (%)

45.1%

44.4%

(0.7pp)

46.0%

47.3%

1.3pp

Net income / (loss) (million

TRY)

(108.4)

(4.9)

(95.5%)

(347.2)

(27.2)

(92.2%)

(1) BeST, in which we hold a 100% stake, has operated in Belarus

since July 2008.

BeST revenues grew 25.6% year-on-year in Q324 in local

currency terms, driven by a rise in data, voice revenues, and

bulk-SMS in Q324. BeST’s EBITDA grew 23.9% year-on-year, resulting

in an EBITDA margin of 45.0%. BeST’s revenues in TRY terms rose

41.6% year-on-year in Q324.

BeST continued to offer LTE services to all six regions,

encompassing 4.4 thousand sites in Q324. Enhanced LTE coverage has

enabled BeST to expand its 4G subscriber base. Accordingly, 4G

users reached 85% of the 3-month active subscriber base, which

continued to support mobile data consumption and digital services

usage. Additionally, the average monthly data usage among 4G

subscribers increased 7% year-on-year, reaching 20.4 GB in

Q324.

Kuzey Kıbrıs Turkcell2 (million

TRY)

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Number of subscribers (million)

0.6

0.6

-

0.6

0.6

-

Revenue

389.5

401.5

3.1%

1,077.7

1,156.6

7.3%

EBITDA

162.3

158.0

(2.6%)

404.4

386.3

(4.5%)

EBITDA margin (%)

41.7%

39.4%

(2.3pp)

37.5%

33.4%

(4.1pp)

Net income

(247.2)

16.8

n.m

(332.8)

(165.0)

(50.4%)

(2) Kuzey Kıbrıs Turkcell, in which we hold a 100% stake, has

operated in Northern Cyprus since 1999.

Kuzey Kıbrıs Turkcell revenues increased by 3.1%

year-on-year in the third quarter of 2024 due to price adjustments.

The EBITDA of Kuzey Kıbrıs Turkcell declined by 2.6%, resulting in

a 39.4% EBITDA margin. This margin decrease was primarily

attributed to increased personnel expenses.

TECHFIN

Paycell Financial Data (million

TRY)

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Revenue

811.3

970.1

19.6%

2,171.0

2,650.0

22.1%

EBITDA

399.2

436.1

9.2%

1,025.1

1,235.9

20.6%

EBITDA margin (%)

49.2%

45.0%

(4.2pp)

47.2%

46.6%

(0.6pp)

Net income

(14.7)

190.2

n.m

61.6

468.3

660.2%

Paycell has seen another quarter of robust financial results.

Revenues grew by 19.6% year-on-year in the quarter. The main

drivers of this performance were POS solutions and prepaid card

& money transactions, thanks to increasing volume and

commission. Paycell’s EBITDA rose 9.2% year-on-year, resulting in

an EBITDA margin of 45.0% in Q324.

Strong momentum on the POS solution has continued in this

quarter, resulting in an 86% volume increase on a yearly basis. The

Pay Later service, the revenues of which account for 56% of the

Paycell topline, reached a TRY3.1 billion transaction volume

(non-group) in Q324, up 24% year-on-year. 3-month active Pay Later

users grew by 5% to 6.2 million. Moreover, the Paycell card

transaction volume experienced robust growth, rising 87%

year-on-year to TRY7.4 billion. Meanwhile, the total transaction

volume across all services expanded by 46% to TRY26.7 billion

year-on-year in Q324.

Financell1 Financial Data (million

TRY)

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Revenue

816.7

1,128.1

38.1%

2,234.7

3,153.7

41.1%

EBITDA

279.8

209.1

(25.3%)

913.2

465.1

(49.1%)

EBITDA margin (%)

34.3%

18.5%

(15.8pp)

40.9%

14.7%

(26.2pp)

Net income

(1,016.4)

1.8

n.m

(1,044.0)

(151.2)

(85.5%)

(1) Following the change in the organizational structure, the

revenues of Turkcell Sigorta Aracılık Hizmetleri A.Ş. (Insurance

Agency), which was previously managed under Financell, have been

reclassified from Financell to "Other" in the Techfin segment as of

the first quarter of 2023.

Financell’s revenues rose 38.1% year-on-year in Q324, driven

mainly by the expanding loan portfolio, as well as the higher

average interest rate on the loan portfolio when compared to the

same period of the last year. EBITDA margin realized at 18.5%.

Financell’s loan portfolio was at TRY6.3 billion in Q324.

Financell’s cost of risk was at 2.8% at the end of the quarter. As

we emphasized in the previous quarter, Financell began offering

loans at varying rates based on customers’ individual risk

profiles. This approach not only improves customer access and

financial inclusion, but also mitigates the negative impact of

installment limitations on consumer loans for smartphones above

TRY12,000 threshold.

Turkcell Group Subscribers

Turkcell Group registered subscribers amounted to approximately

45.6 million as of September 30, 2024. This figure is calculated by

taking the number of subscribers of Turkcell Türkiye, and of each

of our subsidiaries. It includes the total number of mobile, fiber,

ADSL, cable, and IPTV subscribers of Turkcell Türkiye and the

mobile subscribers of BeST and Kuzey Kıbrıs Turkcell.

Turkcell Group Subscribers

Q323

Q224

Q324

y/y%

q/q%

Turkcell Türkiye subscribers1

(million)

42.7

43.2

43.5

1.9%

0.7%

BeST (Belarus)

1.5

1.5

1.5

-

-

Kuzey Kıbrıs Turkcell

0.6

0.6

0.6

-

-

Turkcell Group Subscribers

(million)

44.8

45.3

45.6

1.8%

0.7%

lifecell (Ukraine)2

11.4

11.3

-

-

-

(1) Subscribers to more than one service are counted separately

for each service. Including mobile, fixed broadband, IPTV, and

wholesale (MVNO&FVNO) subscribers (2) As per our Company’s

announcement on September 9, 2024, we no longer hold any shares in

companies operating in Ukraine

OVERVIEW OF THE MACROECONOMIC ENVIRONMENT

The foreign exchange rates used in our financial reporting,

along with certain macroeconomic indicators, are set out below.

Quarter

Nine Months

Q323

Q224

Q324

y/y%

q/q%

9M23

9M24

y/y%

GDP Growth (Türkiye)

6.5%

2.5%

n.a

n.a

n.a

5.3%

n.a

n.a

Consumer Price Index

(Türkiye)(yoy)

61.5%

71.6%

49.4%

(12.1pp)

(22.2pp)

61.5%

49.4%

(12.1pp)

US$ / TRY rate

Closing Rate

27.3767

32.8262

34.0900

24.5%

3.8%

27.3767

34.0900

24.5%

Average Rate

26.7052

32.3812

33.4706

25.3%

3.4%

22.1011

32.2047

45.7%

EUR / TRY rate

Closing Rate

29.0305

35.1284

38.0180

31.0%

8.2%

29.0305

38.0180

31.0%

Average Rate

28.9644

34.8265

36.6689

26.6%

5.3%

23.9133

34.9603

46.2%

US$ / UAH rate

Closing Rate

36.5686

40.5374

41.1664

12.6%

1.6%

36.5686

41.1664

12.6%

Average Rate

36.5686

40.0161

41.0237

12.2%

2.5%

36.5686

39.7560

8.7%

US$ / BYN rate

Closing Rate

3.2870

3.1624

3.2113

(2.3%)

1.5%

3.2870

3.2113

(2.3%)

Average Rate

3.1329

3.2221

3.1684

1.1%

(1.7%)

2.9381

3.2001

8.9%

RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS: We

believe Adjusted EBITDA, among other measures, facilitates

performance comparisons from period to period and management

decision making. It also facilitates performance comparisons from

company to company. Adjusted EBITDA as a performance measure

eliminates potential differences caused by variations in capital

structures (affecting interest expense), tax positions (such as the

impact of changes in effective tax rates on periods or companies)

and the age and book depreciation of tangible and intangible assets

(affecting relative depreciation expense and amortization expense).

We also present Adjusted EBITDA because we believe it is frequently

used by securities analysts, investors and other interested parties

in evaluating the performance of other mobile operators in the

telecommunications industry in Europe, many of which present

Adjusted EBITDA when reporting their results.

Our Adjusted EBITDA definition includes Revenue, Cost of Revenue

excluding depreciation and amortization, Selling and Marketing

expenses, Administrative expenses and Net impairment losses on

financial and contract assets, but excludes finance income and

expense, other operating income and expense, investment activity

income and expense, share of profit of equity accounted investees

and minority interest.

Nevertheless, Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation from, or as a

substitute for analysis of our results of operations, as reported

under IFRS. The following table provides a reconciliation of

Adjusted EBITDA, as calculated using financial data prepared in

accordance with IFRS to net profit, which we believe is the most

directly comparable financial measure calculated and presented in

accordance with IFRS.

Turkcell Group (million TRY)

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Consolidated profit before minority

interest

(4,497.4)

14,279.7

n.m

(5,711.0)

20,546.0

n.m

Profit /(loss) from discontinued

operations

265.8

11,214.4

4,119.1%

1,648.9

12,428.0

653.7%

Income tax expense

(9,763.5)

(2,289.7)

(76.5%)

(13,520.4)

(3,679.9)

(72.8%)

Consolidated profit before income tax

& minority interest

5,000.3

5,355.0

7.1%

6,160.4

11,797.9

91.5%

Share of profit of equity accounted

investees

(65.5)

(672.3)

926.4%

(195.4)

(1,568.2)

702.6%

Finance income

3,885.3

2,783.6

(28.4%)

14,720.3

7,237.5

(50.8%)

Finance costs

(4,405.9)

(4,654.8)

5.6%

(22,510.3)

(14,978.9)

(33.5%)

Monetary gain / (loss)

2,707.8

1,525.9

(43.6%)

2,976.1

5,963.7

100.4%

Other income / (expenses)

(2,916.1)

(179.3)

(93.9%)

(3,018.8)

(665.9)

(77.9%)

EBIT

5,794.6

6,551.8

13.1%

14,188.4

15,809.6

11.4%

Depreciation and amortization

(10,295.9)

(11,205.1)

8.8%

(30,296.4)

(33,221.5)

9.7%

Adjusted EBITDA

16,090.5

17,756.9

10.4%

44,484.8

49,031.1

10.2%

RECONCILIATION OF ARPU: ARPU is an operational

measurement tool and the methodology for calculating performance

measures such as ARPU varies substantially among operators and is

not standardized across the telecommunications industry, and

reported performance measures thus vary from those that may result

from the use of a single methodology. Management believes this

measure is helpful in assessing the development of our services

over time. The following table shows the reconciliation of Turkcell

Türkiye revenues to such revenues included in the ARPU calculations

for Q3 2023 and Q3 2024.

Reconciliation of ARPU

Q323

Q324

Turkcell Türkiye Revenue (million

TRY)

32,550.2

34,853.5

Telecommunication services revenue

30,975.5

33,552.8

Equipment revenue

1,249.2

933.1

Other*

325.5

367.6

Revenues which are not

attributed to ARPU calculation1

(4,329.3)

(4,208.2)

Turkcell Türkiye revenues included in

ARPU calculation2

27,895.5

30,277.7

Mobile blended ARPU (TRY)

226.6

239.0

Average number of mobile subscribers

during the year (million)

38.0

38.6

Fixed residential ARPU (TRY)

254.1

294.4

Average number of fixed residential

subscribers during the year (million)

2.7

3.0

(1) Revenue from fixed corporate and wholesale business; digital

business sales; tower business, and other non-subscriber-based

revenues (2) Revenues from Turkcell Türkiye included in ARPU

calculation comprise telecommunication services revenue, equipment

revenue and revenues which are not attributed to ARPU calculation.

*Including call center revenues

ABOUT TURKCELL: Turkcell is a digital operator

headquartered in Türkiye, serving its customers with its unique

portfolio of digital services along with voice, messaging, data,

and IPTV services on its mobile and fixed networks. Turkcell Group

companies operate in 3 countries – Türkiye, Belarus, and Northern

Cyprus. Turkcell launched LTE services in its home country on April

1st, 2016, employing LTE-Advanced and 3 carrier aggregation

technologies in 81 cities. Turkcell offers up to 10 Gbps fiber

internet speed with its FTTH services. Turkcell Group reported

TRY40.2 billion revenue in Q324 with total assets of TRY326.7

billion as of September 30, 2024. It has been listed on the NYSE

and the BIST since July 2000, and is the only dual-listed company

in Türkiye. Read more at www.turkcell.com.tr.

Appendix A – Tables

Table: Net foreign exchange gain and loss details

Million TRY

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Net FX loss before hedging

(2,343.3)

(1,582.5)

(32.5%)

(16,604.2)

(5,564.6)

(66.5%)

Swap interest income/(expense)

234.6

123.8

(47.2%)

563.8

462.4

(18.0%)

Fair value gain on derivative financial

instruments

1,011.2

(302.6)

(129.9%)

5,522.7

(1,568.4)

(128.4%)

Net FX gain / (loss) after

hedging

(1,097.5)

(1,761.4)

60.5%

(10,517.7)

(6,670.6)

(36.6%)

Table: Income tax expense details

Million TRY

Quarter

Nine Months

Q323

Q324

y/y%

9M23

9M24

y/y%

Current tax expense

143.3

(1,481.6)

(1,133.9%)

(812.8)

(1,656.3)

103.8%

Deferred tax income / (expense)

(9,906.9)

(808.1)

(91.8%)

(12,707.6)

(2,023.6)

(84.1%)

Income Tax expense

(9,763.5)

(2,289.7)

(76.5%)

(13,520.4)

(3,679.9)

(72.8%)

TURKCELL ILETISIM HIZMETLERI

A.S. IFRS SELECTED FINANCIALS (TRY Million)

Nine Months

Nine Months

Quarter Ended

Quarter Ended

Sep 30,

Sep 30,

Sep 30,

Sep 30,

2023

2024

2023

2024

Consolidated Statement of Operations Data Turkcell

Turkey

92,886.7

99,309.8

32,550.2

34,853.6

Turkcell International

2,660.7

2,866.4

775.2

934.9

Fintech

4,420.2

5,829.0

1,629.1

2,131.7

Other

8,327.6

6,587.0

2,635.6

2,251.2

Total revenue

108,295.3

114,592.2

37,590.1

40,171.4

Total cost of revenue

(84,150.6)

(86,638.4)

(28,263.1)

(29,195.5)

Total gross profit

24,144.7

27,953.7

9,326.9

10,975.8

Administrative expenses

(3,280.1)

(4,307.9)

(1,216.6)

(1,632.6)

Selling & marketing expenses

(5,566.5)

(7,073.1)

(2,026.2)

(2,539.3)

Other Income / (Expense)

(3,018.8)

(665.9)

(2,916.1)

(179.3)

Net impairment loses on financial and

contract assets

(1,109.7)

(763.1)

(289.5)

(252.1)

Operating profit

11,169.6

15,143.8

2,878.6

6,372.6

Finance costs

(22,510.3)

(14,978.9)

(4,405.9)

(4,654.8)

Finance income

14,720.3

7,237.5

3,885.3

2,783.6

Monetary gain (loss)

2,976.1

5,963.7

2,707.8

1,525.9

Share of profit of an associate and a joint venture

(195.4)

(1,568.2)

(65.5)

(672.3)

Profit before income tax from continuing operations

6,160.4

11,797.9

5,000.3

5,355.0

Income tax income/ (expense)

(13,520.4)

(3,679.9)

(9,763.5)

(2,289.7)

Profit for the year from continuing operations

(7,360.0)

8,118.0

(4,763.2)

3,065.3

Profit /(loss) from discontinued operations

1,648.9

12,428.0

265.8

11,214.4

Profit for the year

(5,711.0)

20,546.0

(4,497.4)

14,279.7

Non-controlling interests

4.3

8.6

2.3

0.7

Owners of the Company

(5,706.7)

20,554.5

(4,495.1)

14,280.4

Basic and diluted earnings per share for profit

attributable to owners of the Company (in full TL)

(2.6)

9.4

(2.1)

6.5

Basic and diluted earnings per share for profit from continuing

operations attributable to owners of the Company (in full TL)

(3.4)

3.7

(2.2)

1.4

Other Financial Data Gross margin

22.3%

24.4%

24.8%

27.3%

EBITDA(*)

44,484.8

49,031.1

16,090.5

17,756.9

Total Capex

38,770.9

31,487.4

12,512.7

9,562.4

Operational capex

20,366.3

22,461.2

6,045

7,252

Licence and related costs

5,069.2

22.7

15

7

Non-operational Capex

13,335.5

9,003.5

6,453

2,304

Consolidated Balance Sheet Data (at period

end) December 31, 2023 September 30, 2024 Cash

and cash equivalents

67,901.3

81,008.7

Total assets

335,688.2

326,664.6

Long term debt

78,726.5

71,038.0

Total debt

114,237.1

106,728.4

Total liabilities

169,619.5

152,185.7

Total shareholders’ equity

166,068.7

174,478.9

(*) Please refer to the notes on reconciliation of Non-GAAP

Financial measures on page 14For further details, please refer to

our consolidated financial statements and notes as at September 30,

2024, on our website

TURKCELL ILETISIM HIZMETLERI

A.S. TURKISH ACCOUNTING STANDARDS SELECTED FINANCIALS (TRY

Million)

Nine Months

Nine Months

Quarter Ended

Quarter Ended

Sep 30,

Sep 30,

Sep 30,

Sep 30,

2023

2024

2023

2024

Consolidated Statement of Operations Data Turkcell

Turkey

92,886.7

99,309.8

32,550.2

34,853.6

Turkcell International

2,660.7

2,866.4

775.2

934.9

Fintech

4,420.2

5,829.0

1,629.1

2,131.7

Other

8,327.6

6,587.0

2,635.6

2,251.2

Total revenues

108,295.3

114,592.2

37,590.1

40,171.4

Direct cost of revenues

(84,150.6)

(86,638.4)

(28,263.1)

(29,195.5)

Gross profit

24,144.7

27,953.7

9,326.9

10,975.8

Administrative expenses

(3,280.1)

(4,307.9)

(1,216.6)

(1,632.6)

Selling & marketing expenses

(5,566.5)

(7,073.1)

(2,026.2)

(2,539.3)

Other operating income

16,121.0

10,828.0

3,026.7

4,195.1

Other operating expense

(3,948.3)

(1,485.8)

(3,146.9)

(489.9)

Operating profit

27,470.8

25,914.9

5,963.9

10,509.1

Impairment losses determined in accordance with TFRS 9

(1,109.7)

(763.1)

(289.5)

(252.1)

Income from investing activities

8,285.8

3,169.5

1,822.4

1,323.0

Expense from investing activities

(140.1)

(137.7)

(17.4)

(42.1)

Share on profit of investments valued by

equity method

(195.4)

(1,568.2)

(65.5)

(672.3)

Income before financing costs

34,311.4

26,615.4

7,414.0

10,865.7

Finance income

6,190.5

444.3

1,325.0

52.8

Finance expense

(37,317.7)

(21,225.4)

(6,446.4)

(7,089.4)

Monetary gain (loss)

2,976.1

5,963.7

2,707.8

1,525.9

Income from continuing operations before tax and non-controlling

interest

6,160.4

11,797.9

5,000.3

5,355.0

Tax income (expense) from continuing

operations

(13,520.4)

(3,679.9)

(9,763.5)

(2,289.7)

Profit from continuing operations

(7,360.0)

8,118.0

(4,763.2)

3,065.3

Profit /(loss) from discontinued operations

1,648.9

12,428.0

265.8

11,214.4

Profit for the period

(5,711.0)

20,546.0

(4,497.4)

14,279.7

Non-controlling interest

4.3

8.6

2.3

0.7

Owners of the Parent

(5,706.7)

20,554.5

(4,495.1)

14,280.4

Earnings per share

(2.6)

9.4

(2.1)

6.5

Earnings per share from discontinued operations

(3.4)

3.7

(2.2)

1.4

Earnings per share from continuing operation

0.8

5.7

0.1

5.1

Other Financial Data Gross margin

22.3%

24.4%

24.8%

27.3%

EBITDA(*)

44,484.8

49,031.1

16,090.5

17,756.9

Total Capex

38,770.9

31,487.4

12,512.7

9,562.4

Operational capex

20,366.3

22,461.2

6,045.2

7,251.9

Licence and related costs

5,069.2

22.7

14.7

6.9

Non-operational Capex

13,335.5

9,003.5

6,452.8

2,303.6

Consolidated Balance Sheet Data (at period

end) December 31, 2023 September 30, 2024 Cash

and cash equivalents

67,901.3

81,008.7

Total assets

335,688.2

326,664.6

Long term debt

78,726.5

71,038.0

Total debt

114,237.1

106,728.4

Total liabilities

169,619.5

152,185.7

Total equity

166,068.7

174,478.9

(*) Please refer to the notes on reconciliation of Non-GAAP

Financial measures on page 14 For further details, please refer to

our consolidated financial statements and notes as at September 30,

2024, on our website

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107322272/en/

For further information please contact Turkcell

Investor Relations Tel: + 90 212 313 1888

investor.relations@turkcell.com.tr

Corporate Communications: Tel: + 90 212 313 2321

Turkcell-Kurumsal-Iletisim@turkcell.com.tr

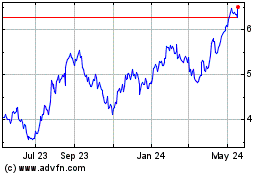

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Jan 2025 to Feb 2025

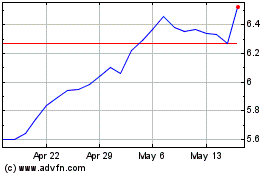

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Feb 2024 to Feb 2025