By Suzanne Kapner and Sarah Nassauer

Retailers, from Walmart Inc. to Nordstrom Inc., are reporting

strong quarterly sales, evidence that the robust U.S. economy is

spurring people to shop and that some chains have found ways to

compete in an increasingly online world.

Buoyed by rising wages and employment as well as tax cuts,

Americans are spending more on products as diverse as jeans,

handbags and wall paint. That has translated to rising sales at not

just at Walmart and Nordstrom, but also Home Depot Inc. and Coach

owner Tapestry Inc., which also reported stronger results this

week.

"Customers tell us that they feel better about the current

health of the U.S. economy as well as their personal finances,"

Walmart Chief Executive Doug McMillon told investors Thursday.

"They're more confident about their employment opportunities."

Walmart said its quarterly sales rose at the fastest rate in

over a decade. Home Depot said paint sales were the strongest in

five years. Nordstrom said sales of beauty products were "extremely

strong," even as other department-store chains posted mixed

results.

"The retail apocalypse that everyone had been talking about

really hasn't happened," said Eric Rosenthal, a senior director of

leveraged finance at Fitch Ratings.

Walmart, which gets more than half of its U.S. revenue from

groceries and staples, often tracks its home economy. Gross

domestic product -- the value of all goods and services produced

across the U.S. -- rose 4.1% in the second quarter.

The chain, which booked $128 billion in global quarterly

revenue, has drawn more shoppers to its supercenters as it remodels

stores and lowers prices. It also reported a 40% jump in U.S.

e-commerce sales. Though e-commerce is a sliver of Walmart's

business, the growth showed that the company's heavy investments

are helping the chain hold its ground against Amazon.com Inc.

Walmart shares surged 9.3% to $98.64 on Thursday, giving a boost

to the entire retail sector. While Walmart's shares have lagged

behind, many retail stocks have climbed sharply this year as sales

have stabilized and investors' fears have eased. Nordstrom, which

reported its results after markets closed, jumped 12% to $58.40 in

after-hours trading.

That isn't to say traditional retailers aren't still facing

challenges from Amazon, whose rapid growth and discounting has

squeezed industry profits. Analysts also caution that potential

tariffs could force retailers to raise prices and eventually crimp

demand. The key test of the industry's health -- and shoppers'

appetite to spend -- has yet to come: The holiday quarter drives

the lion's share of the retail business.

The improving economy isn't lifting everyone. J.C. Penney Co.

said Thursday that its sales fell and its loss doubled to $101

million in the second quarter. The chain, which is searching for a

CEO, also lowered its forecasts for the year. Its shares plunged

27% to $1.76.

Retailers that have pulled out of the slump have had a sharp

focus on their core customers and invested in serving them better

by plowing money both into their physical stores and online

operations. They have become smarter about how they manage their

inventory, leaving them with fewer surplus goods and markdowns at

the end of a season. And they have secured more exclusive brands

that can't be found elsewhere.

Investors can be punishing when retailers show even the

slightest sign of weakness. Macy's Inc. shares fell 16% on

Wednesday after the chain reported that same-store sales rose just

0.5%, largely because of the shift of a promotional event to the

first quarter. The chain's profit jumped 50%.

Troubled retailers continue to close locations at a rapid pace.

About 4,375 U.S. stores have shut since the beginning of 2017,

almost double the number of openings, according to Coresight

Research.

And a steady parade of retailers have filed for bankruptcy this

year, including Toys 'R' Us Inc., regional department-store

operator Bon-Ton and teen chain Claire's.

Those moves weeded out weaker competitors and cleared out some

of the overcapacity that has plagued the industry. As a result, the

remaining chains are on more solid footing and are getting a boost

from a stronger economy, analysts say.

Heading into the critical holiday season, the National Retail

Federation raised its 2018 sales forecast to a minimum of 4.5%

growth compared with last year. Previously, the trade group had

expected sales to increase by a range of 3.8% to 4.4%.

As shoppers reduced their spending in recent years, one of the

biggest categories to take a hit was apparel. But that trend is

reversing, with apparel sales up 5.2% from January through July,

compared with the same period a year earlier, and on track to have

their best year since 2011, according to Craig Johnson, president

of the consulting firm Customer Growth Partners.

"The single biggest driver for retail growth is growth in

disposable income, and disposable income is much stronger than it

was five years ago," Mr. Johnson said.

Joanne Charles, of Valley Stream, N.Y., said she is spending the

extra money in her paycheck from the tax cuts. The 50-year-old

event planner said she recently bought four dresses at Macy's and

is splurging on makeup and other nonnecessities.

On Wednesday, Ms. Charles browsed the Macy's in Manhattan with

her daughter Jonelle Carrera, who was shopping for clothes for a

new job that she starts at a nonprofit next week. The 30-year-old

Ms. Carrera said that when she graduated from college in 2010, "it

was hard to find a job, but there are more positions posted

today."

Some of that extra spending has been fueled by borrowing, which

has pushed household debt to record highs, according to Beth Ann

Bovino, chief U.S. economist at S&P Global Ratings. But Ms.

Bovino said that when taken as a percentage of disposable income,

household debt is the lowest it has been since the recession.

"I feel great about the economy," said Sally Wiggins, of New

City, N.Y. While the 57-year-old, who works in hotel sales, said

she is buying more clothes and shoes for her three college-aged

children, her biggest purchase has been a home on the Gulf Coast

that she and her husband are using as a vacation rental. She said

the property has been booked all summer, "so other people must be

feeling good about the economy too."

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

August 16, 2018 17:39 ET (21:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

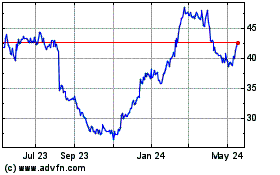

Tapestry (NYSE:TPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

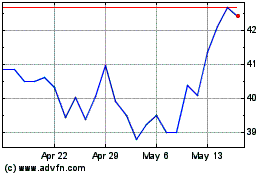

Tapestry (NYSE:TPR)

Historical Stock Chart

From Nov 2023 to Nov 2024