UMC Signs 30-Year, 30 Billion kWh Offshore Wind Power Agreement with CIP’s Fengmiao I Offshore Wind Farm

December 18 2024 - 5:31AM

Business Wire

United Microelectronics Corporation (NYSE: UMC; TWSE:

2303)(“UMC”), today announced the signing of a Corporate Power

Purchase Agreement (CPPA) with Fengmiao I Offshore Wind Farm

(“Fengmiao I”), developed by Copenhagen Infrastructure Partners’

(“CIP”) flagship fund, CI V. UMC will purchase more than 30 billion

kilowatt-hours of power from Fengmiao I over least 30 years,

marking the largest renewable energy transaction in UMC’s history.

This agreement will help UMC achieve its goal of 50% renewable

energy use by 2030 as part of the company’s roadmap to net zero

emissions and 100% renewable energy by 2050.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241218499375/en/

UMC signed a Corporate Power Purchase

Agreement with CIP’s Fengmiao I Offshore Wind Farm, which will

contribute to the company‘s goal of net zero emissions and 100%

renewable energy by 2050. (From left) UMC Senior Division Director

Andy Lin, UMC Associate Vice President Po Wen Wu, UMC Vice

President Linwu Kuo, UMC Vice President TS Wu, CIP Partner and

Chairman of Fengmiao Offshore Wind Farm Thomas Wibe Poulsen, CIP

Regional Managing Director Marina Hsu, CEO of CIP Taiwan Round 3

Projects Thomas Correll, Project CEO of Fengmiao I Wind Farm Joris

Hol. (Photo: Business Wire)

TS Wu, Vice President of UMC, said, "UMC is pleased to sign this

landmark power purchase agreement with CIP’s Fengmiao I, marking

UMC’s largest renewable energy deal to date and a significant

milestone in our net zero journey. This agreement demonstrates our

commitment to sustainable development to our stakeholders, and also

contributes to UMC’s carbon reduction goals and ESG vision. As a

responsible corporate citizen, UMC actively works on cutting

emissions and energy consumption by installing high efficiency

greenhouse gas abatement equipment and improving the energy

efficiency of our manufacturing processes. At the same time, we

will continue to expand renewable energy use as we advance towards

our 2050 net zero goal.”

Thomas Wibe Poulsen, APAC Regional Partner for CIP’s Flagship

Funds and Chairman of Fengmiao Offshore Wind Farm, said, “The

decision of UMC, a leading global semiconductor company, to

cooperate with Fengmiao I underscores the market’s high confidence

in CIP’s technical and financial capability to deliver offshore

wind projects.”

UMC follows its net zero roadmap, defined by science-based

targets, by taking three key actions: persistent and proactive

carbon emission reduction, 100% renewable energy usage, and

investment in net- zero technologies. In 2023, UMC Group achieved a

26% reduction in scope 1 and scope 2 greenhouse gas emissions from

2020 base levels, reaching its 2030 target ahead of schedule.

Therefore, UMC has revised its original 2030 target of 25%

reduction to a more ambitious 42% reduction goal to accelerate the

pace of its net zero transition.

About UMC UMC (NYSE: UMC, TWSE: 2303) is a leading global

semiconductor foundry company. The company provides high-quality IC

fabrication services, focusing on logic and various specialty

technologies to serve all major sectors of the electronics

industry. UMC’s comprehensive IC processing technologies and

manufacturing solutions include Logic/Mixed-Signal, embedded

High-Voltage, embedded Non-Volatile-Memory, RFSOI, BCD etc. Most of

UMC's 12-in and 8-in fabs with its core R&D are located in

Taiwan, with additional ones throughout Asia. UMC has a total of 12

fabs in production with combined capacity of more than 400,000

wafers per month (12-in equivalent), and all of them are certified

with IATF 16949 automotive quality standard. UMC is headquartered

in Hsinchu, Taiwan, plus local offices in United States, Europe,

China, Japan, Korea & Singapore, with a worldwide total of

20,000 employees. For more information, please visit:

http://www.umc.com.

Note from UMC Concerning Forward-Looking Statements Some

of the statements in the foregoing announcement are forward-looking

within the meaning of the U.S. Federal Securities laws, including

statements about introduction of new services and technologies,

future outsourcing, competition, wafer capacity, business

relationships and market conditions. Investors are cautioned that

actual events and results could differ materially from these

statements as a result of a variety of factors, including

conditions in the overall semiconductor market and economy;

acceptance and demand for products from UMC; and technological and

development risks. Further information regarding these and other

risks is included in UMC’s filings with the U.S. Securities and

Exchange Commission. UMC does not undertake any obligation to

update any forward-looking statement as a result of new

information, future events or otherwise, except as required under

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241218499375/en/

Media UMC Corporate Communications

Michelle Yun 886-3-578-2258 x16951 michelle_yun@umc.com

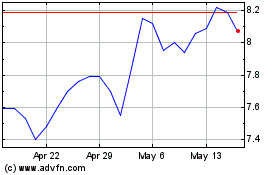

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

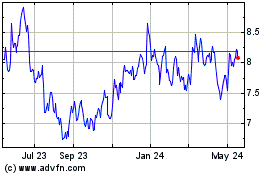

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Dec 2023 to Dec 2024