Bundling and Balancing: TiVo’s Video Trends Report Finds Consumers Are Onboard With Industry Consolidation Overhaul

October 01 2024 - 2:00PM

Business Wire

While the number of total services declined,

consumers support bundled services over new SVOD pricing

Today TiVo, a wholly owned subsidiary of entertainment

technology company Xperi Inc. (NYSE: XPER), found in its Q2 2024

Video Trends Report that consumers are pulling back on

entertainment spending as the industry works to rebalance and

bundle its current entertainment offerings.

In 2020, entertainment consumption and spending surged as the

pandemic limited consumer activities outside of the home. Now the

pendulum is swinging back as consumers are hit with ongoing

economic headwinds and a steady cadence of out-of-home

entertainment opportunities. While daily viewership hours haven’t

noticeably dropped in the last year, the average total of

entertainment spend is down $30 year-over-year, and the average

total number of services used is back to 2022 levels, when much of

America was beginning to gain relief from the pandemic — coming in

at 9.1, a drop from 10.9 in 2023. This indicates that while

consumers are cutting back on their spending, they haven’t stopped

enjoying entertainment. Instead, they have found a way to

supplement their favored pay TV and broadband services by turning

to ad-supported services and pushing major media companies to

bundle services or risk losing customers.

With this shift in viewership and spending, major media

companies that have primarily focused on subscription video on

demand (SVOD) services as their main customer attrition point in

the past have now realized the power of providing customers with

their ad-supported video on demand (AVOD) and free ad-supported

streaming TV (FAST) services as a complimentary package or bundle

to their SVOD service. Of those who use SVOD services in 2024,

about 64% of respondents said they utilize the available

ad-supported tiers, an increase of 16 percentage points from Q2

2023. Combined with the nearly 62% of respondents who stated that

they were “likely” or “much more likely” to keep their broadband

service if their provider bundled additional streaming services

with internet, indicating that people are looking for ways to save.

This new business model has proven successful for entertainment

companies as FAST subscriptions are now finding their footing in

the entertainment landscape, no longer being seen as a subscription

downgrade but as a bonus.

Consumers are also leaning into this new business model with an

increase in ad tolerance, proving that if service providers find

the right balance of paid vs. ad-supported services, consumers are

more than willing to watch ads if they believe they are receiving a

better bang for their buck. Even tier one advertisers are finding

this to be true as advertisement quality on FAST and AVOD services

— something that has been low-quality in the past — is also

improving, helping to make ad watching less of a bother for

consumers.

“In the past, we've seen over-the-top (OTT) service providers

trying to assess the limits of consumer entertainment spending, and

they are now seeing where consumers are willing to draw the line,”

said Scott Maddux, vice president of global content strategy and

business at Xperi. “Now, the same OTT service providers are

starting to see the promotional and monetary benefits of creating

bundles with their subscription video on demand, ad-supported video

on demand and free ad-supported television service options, helping

to reduce churn and, more importantly, keep their customers under

one roof rather than spread across multiple broadband and pay TV

services, allowing content providers to monetize across the full

spectrum from subscription to ad-supported.”

Additional TiVo Video Trend Report Highlights

- The discovery dilemma: Nearly 85% of respondents shared

that they are prone to browsing before they land on a show or movie

to watch, and almost 73% shared that they go into more than one app

in a typical viewing session to settle on an entertainment

option.

- Organic recommendation is best: The relevance of content

recommendations has gone down across the board, with respondents

still finding organic recommendations to be more relevant than

other forms of recommendations. Top methods of discovery continue

to be word-of-mouth/recommendations from friends (50%) and

commercials or ads that run during other shows (40%).

- Social video usage shifts slightly: Almost 80% of

respondents watch video via their social media and/or

user-generated content networks; this is a slight decline from 85%

in the spring of 2023. Top video sources include YouTube followed

by TikTok.

- Amazon rules TVOD: The share of pay TV subscribers

utilizing transactional video on demand (TVOD) services has

declined substantially, from 54.3% in Q2 2023 down to 45.7% this

year. Broadband-only subscribers’ TVOD usage has remained

consistent, at 41.3%, compared to 41.9% in Q2 2023. Amazon Prime

still leads as the top TVOD service with YouTube following in its

footsteps.

Find more information from the latest Q2 2024 Video Trends

Report here.

TiVo is also an expert in video trends and TV viewership data.

TiVo TV Viewership Data includes second-by-second data captured

from set-top-boxes within households across all 210 DMAs in the

U.S. The data reflects both live and time-shifted viewership

information which is the cornerstone of TiVo’s expertise in TV data

processing. Find more information about TiVo’s Viewership Data

here.

Methodology

Since 2012, TiVo has surveyed consumers to uncover key trends

relevant to TV providers, digital publishers, advertisers, and

consumer electronics manufacturers. The latest TiVo Video Trends

Report surveyed 4,490 adults 18 and older living in the U.S. and

Canada during the second quarter of 2024 (3,500 U.S., 990 Canada).

In addition to identifying and analyzing key trends in viewing

habits, the TiVo Video Trends Report provides insight to consumer

opinions regarding Subscription Video on Demand (SVOD),

Transactional Video on Demand (TVOD) and Advertising-Based Video on

Demand (AVOD) providers, emerging technologies, connected devices,

over-the-top (OTT) apps and content discovery features, including

personalized recommendations and search.

About TiVo

TiVo brings entertainment together, making it easy to find,

watch and enjoy. We serve up the best movies, shows and videos from

across live TV, on-demand, streaming services and countless apps,

helping people to watch on their terms. For studios, networks and

advertisers, TiVo targets a passionate group of watchers to

increase viewership and engagement across all screens. TiVo is a

wholly-owned subsidiary of Xperi Inc. Go to tivo.com and enjoy

watching.

About Xperi Inc.

Xperi invents, develops, and delivers technologies that enable

extraordinary experiences. Xperi technologies, delivered via its

brands (DTS®, HD Radio™, TiVo®), and by its startup, Perceive, are

integrated into billions of consumer devices and media platforms

worldwide, powering smart devices, connected cars and entertainment

experiences, including IMAX® Enhanced, a certification and

licensing program operated by IMAX Corporation and DTS, Inc. Xperi

has created a unified ecosystem that reaches highly engaged

consumers, driving increased value for partners, customers and

consumers.

©2024 Xperi Inc. All Rights Reserved. Xperi, TiVo, DTS, HD

Radio, DTS Play-Fi, Perceive and their respective logos are

trademark(s) or registered trademark(s) of Xperi Inc. or its

subsidiaries in the United States and other countries. IMAX is a

registered trademark of IMAX Corporation. All other trademarks and

content are the property of their respective owners.

SOURCE: Xperi, Inc.

XPER- P

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001762870/en/

Xperi Media: Allyse Sanchez, Xperi

allyse.sanchez@xperi.com

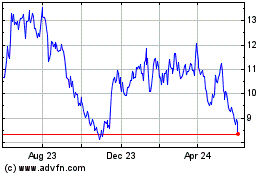

Xperi (NYSE:XPER)

Historical Stock Chart

From Oct 2024 to Nov 2024

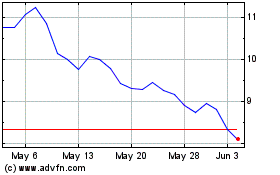

Xperi (NYSE:XPER)

Historical Stock Chart

From Nov 2023 to Nov 2024