Form 8-K - Current report

March 08 2024 - 8:34AM

Edgar (US Regulatory)

0001524472false00015244722024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2024

XYLEM INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Indiana | | 001-35229 | | 45-2080495 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| | | | |

| 301 Water Street SE | | 20003 |

| Washington | | DC | | |

| (Address of principal executive offices) | | (Zip Code) |

(202) 869-9150

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange of which registered |

| Common Stock, par value $0.01 per share | | XYL | | New York Stock Exchange |

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On May 24, 2023, Xylem Inc. (the “Company”) completed the acquisition of Evoqua Water Technologies Corp. (“Evoqua”). For the periods ended June 30, 2023, September 30, 2023 and December 31, 2023, the Company’s reportable segments included legacy Evoqua’s Integrated Solutions and Services (“ISS”) segment as a new and fourth reportable segment.

On December 13, 2023, the Company announced a change to its reportable segments effective January 1, 2024. As a result, for financial statement periods ending after January 1, 2024, the Company will report the financial position and results of operations of its ISS segment together with the dewatering business, formerly within the Water Infrastructure segment, and the assessment services business, formerly within the Measurement and Control Solutions segment, in a new segment that will be referred to as Water Solutions and Services. The Company’s Water Infrastructure reportable segment will no longer include the results of the dewatering business, and the Company’s Measurement and Control Solutions reportable segment will no longer include the results of the assessment services business. The Company's Applied Water reportable segment will remain unchanged.

The Company believes this organizational redesign, which creates its services platform, will deliver a unified customer experience and accelerate the growth of its services offerings.

For informational purposes and to provide investors with historical information on a basis consistent with its new reporting structure, the Company has provided certain recast financial information reflecting the new reportable segments. The recast financial information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation. These changes have no impact on the Company’s historical consolidated financial position or results of operations. The recast financial information does not represent a restatement of previously issued financial statements.

Attached as Exhibit 99.1 are schedules containing financial information that has been recast to reflect historical orders, revenue, operating income, adjusted operating income, earnings before interest, taxes, depreciation and amortization (“EBITDA”) and adjusted EBITDA for each of the Company’s operating segments for the first, second, third and fourth quarters of 2023 and the years ended December 31, 2023, 2022 and 2021. The Company considers certain non-GAAP (or “adjusted”) measures provided in Exhibit 99.1 to be useful to management and investors evaluating our operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations, liquidity and management of assets. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives, including, but not limited to, dividends, acquisitions, share repurchases and debt repayment. These adjusted metrics are consistent with how management views our business and are used to make financial, operating and planning decisions. These metrics, however, are not measures of financial performance under GAAP and should not be considered a substitute for revenue, operating income, net income, earnings per share (basic and diluted) or net cash from operations as determined in accordance with GAAP.

The information contained in Exhibit 99.1 should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended December, 31, 2023.

The information furnished pursuant to this Item 7.01 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits.

| | | | | |

Exhibit

No. | Description |

| |

| Recast segment information of Xylem Inc. (furnished pursuant to Item 7.01) |

| 104.0 | The cover page from Xylem Inc.'s Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | XYLEM INC. |

| | | | |

| Date: March 8, 2024 | | By: | | /s/ William K. Grogan |

| | | | William K. Grogan |

| | | | Senior Vice President and Chief Financial Officer

(Authorized Officer of Registrant) |

XYLEM INC.

RECAST ORDERS, REVENUE, OPERATING INCOME, ADJUSTED OPERATING INCOME, EBITDA AND ADJUSTED EBITDA BY SEGMENT

($ MILLIONS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2021 | | Year Ended

December 31, 2022 | | Year Ended

December 31, 2023 |

| As Previously Reported | | As Recast(a) | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| Orders | | | | | | | | | | | |

| Water Infrastructure | $ | 2,471 | | | $ | 1,834 | | | $ | 2,607 | | | $ | 1,916 | | | $ | 3,060 | | | $ | 2,313 | |

| Applied Water | 1,860 | | | 1,860 | | | 1,794 | | | 1,794 | | | 1,770 | | | 1,770 | |

| Measurement and Control Solutions | 1,969 | | | 1,845 | | | 1,856 | | | 1,736 | | | 1,803 | | | 1,670 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 868 | | | — | |

| Water Solutions and Services | — | | | 761 | | | — | | | 811 | | | — | | | 1,748 | |

| Total | $ | 6,300 | | | $ | 6,300 | | | $ | 6,257 | | | $ | 6,257 | | | $ | 7,501 | | | $ | 7,501 | |

| | | | | | | | | | | |

| Revenue | | | | | | | | | | | |

| Water Infrastructure | $ | 2,247 | | | $ | 1,647 | | | $ | 2,364 | | | $ | 1,686 | | | $ | 2,967 | | | $ | 2,215 | |

| Applied Water | 1,613 | | | 1,613 | | | 1,767 | | | 1,767 | | | 1,853 | | | 1,853 | |

| Measurement and Control Solutions | 1,335 | | | 1,234 | | | 1,391 | | | 1,275 | | | 1,729 | | | 1,612 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 815 | | | — | |

| Water Solutions and Services | — | | | 701 | | | — | | | 794 | | | — | | | 1,684 | |

| Total | $ | 5,195 | | | $ | 5,195 | | | $ | 5,522 | | | $ | 5,522 | | | $ | 7,364 | | | $ | 7,364 | |

| | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2021 | | Year Ended

December 31, 2022 | | Year Ended

December 31, 2023 |

| As Previously Reported | | As Recast(a) | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| Operating Income | | | | | | | | | | | |

| Water Infrastructure | $ | 387 | | | $ | 277 | | | $ | 418 | | | $ | 279 | | | $ | 419 | | | $ | 275 | |

| Applied Water | 240 | | | 240 | | | 258 | | | 258 | | | 310 | | | 310 | |

| Measurement and Control Solutions | 12 | | | 27 | | | 2 | | | 19 | | | 113 | | | 133 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 8 | | | — | |

| Water Solutions and Services | — | | | 95 | | | — | | | 122 | | | — | | | 132 | |

| Corporate and Other | (54) | | | (54) | | | (56) | | | (56) | | | (198) | | | (198) | |

| Total | $ | 585 | | | $ | 585 | | | $ | 622 | | | $ | 622 | | | $ | 652 | | | $ | 652 | |

| | | | | | | | | | | |

Adjustments(b) | | | | | | | | | | | |

| Water Infrastructure | $ | 12 | | | $ | 15 | | | $ | 15 | | | $ | 13 | | | $ | 100 | | | $ | 93 | |

| Applied Water | 8 | | | 8 | | | 13 | | | 13 | | | 14 | | | 14 | |

| Measurement and Control Solutions | 3 | | | 65 | | | 92 | | | 80 | | | 90 | | | 80 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 97 | | | — | |

| Water Solutions and Services | — | | | 14 | | | — | | | 14 | | | — | | | 114 | |

| Corporate and Other | 3 | | | 3 | | | 2 | | | 2 | | | 119 | | | 119 | |

| Total | $ | 26 | | | $ | 105 | | | $ | 122 | | | $ | 122 | | | $ | 420 | | | $ | 420 | |

| | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2021 | | Year Ended

December 31, 2022 | | Year Ended

December 31, 2023 |

| As Previously Reported | | As Recast(a) | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| Adjusted Operating Income | | | | | | | | | | | |

| Water Infrastructure | $ | 399 | | | $ | 292 | | | $ | 433 | | | $ | 292 | | | $ | 519 | | | $ | 368 | |

| Applied Water | 248 | | | 248 | | | 271 | | | 271 | | | 324 | | | 324 | |

| Measurement and Control Solutions | 15 | | | 92 | | | 94 | | | 99 | | | 203 | | | 213 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 105 | | | — | |

| Water Solutions and Services | — | | | 109 | | | — | | | 136 | | | — | | | 246 | |

| Corporate and Other | (51) | | | (51) | | | (54) | | | (54) | | | (79) | | | (79) | |

| Total | $ | 611 | | | $ | 690 | | | $ | 744 | | | $ | 744 | | | $ | 1,072 | | | $ | 1,072 | |

| | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2021 | | Year Ended

December 31, 2022 | | Year Ended

December 31, 2023 |

| As Previously Reported | | As Recast(a) | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| EBITDA | | | | | | | | | | | |

| Water Infrastructure | $ | 433 | | | $ | 307 | | | $ | 467 | | | $ | 310 | | | $ | 532 | | | $ | 367 | |

| Applied Water | 261 | | | 267 | | | 275 | | | 281 | | | 329 | | | 336 | |

| Measurement and Control Solutions | 155 | | | 150 | | | 138 | | | 136 | | | 248 | | | 252 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 138 | | | — | |

| Water Solutions and Services | — | | | 145 | | | — | | | 172 | | | — | | | 317 | |

| Corporate and Other/Regional Selling Locations | (24) | | | (44) | | | (170) | | | (189) | | | (155) | | | (180) | |

| Total | $ | 825 | | | $ | 825 | | | $ | 710 | | | $ | 710 | | | $ | 1,092 | | | $ | 1,092 | |

| | | | | | | | | | | |

Adjustments(c) | | | | | | | | | | | |

| Water Infrastructure | $ | 14 | | | $ | 17 | | | $ | 13 | | | $ | 16 | | | $ | 66 | | | $ | 59 | |

| Applied Water | 10 | | | 9 | | | 17 | | | 17 | | | 17 | | | 16 | |

| Measurement and Control Solutions | 9 | | | 8 | | | 29 | | | 28 | | | 30 | | | 29 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 43 | | | — | |

| Water Solutions and Services | — | | | 5 | | | — | | | 6 | | | — | | | 52 | |

| Corporate and Other/Regional Selling Locations | 32 | | | 26 | | | 171 | | | 163 | | | 144 | | | 144 | |

| Total | $ | 65 | | | $ | 65 | | | $ | 230 | | | $ | 230 | | | $ | 300 | | | $ | 300 | |

| | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2021 | | Year Ended

December 31, 2022 | | Year Ended

December 31, 2023 |

| As Previously Reported | | As Recast(a) | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| Adjusted EBITDA | | | | | | | | | | | |

| Water Infrastructure | $ | 447 | | | $ | 324 | | | $ | 480 | | | $ | 326 | | | $ | 598 | | | $ | 426 | |

| Applied Water | 271 | | | 276 | | | 292 | | | 298 | | | 346 | | | 352 | |

| Measurement and Control Solutions | 164 | | | 158 | | | 167 | | | 164 | | | 278 | | | 281 | |

| Integrated Solutions and Services | — | | | — | | | — | | | — | | | 181 | | | — | |

| Water Solutions and Services | — | | | 150 | | | — | | | 178 | | | — | | | 369 | |

| Corporate and Other/Regional Selling Locations | 8 | | | (18) | | | 1 | | | (26) | | | (11) | | | (36) | |

| Total | $ | 890 | | | $ | 890 | | | $ | 940 | | | $ | 940 | | | $ | 1,392 | | | $ | 1,392 | |

| | | | | | | | | | | |

| Adjusted EBITDA Margin | | | | | | | | | | | |

| Water Infrastructure | 19.9 | % | | 19.7 | % | | 20.3 | % | | 19.3 | % | | 20.2 | % | | 19.2 | % |

| Applied Water | 16.8 | % | | 17.1 | % | | 16.5 | % | | 16.9 | % | | 18.7 | % | | 19.0 | % |

| Measurement and Control Solutions | 12.3 | % | | 12.8 | % | | 12.0 | % | | 12.9 | % | | 16.1 | % | | 17.4 | % |

| Integrated Solutions and Services | N/A | | N/A | | N/A | | N/A | | 22.2 | % | | N/A |

| Water Solutions and Services | N/A | | 21.4 | % | | N/A | | 22.4 | % | | N/A | | 21.9 | % |

| Total | 17.1 | % | | 17.1 | % | | 17.0 | % | | 17.0 | % | | 18.9 | % | | 18.9 | % |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1Q 2023 | | 2Q 2023 | | 3Q 2023 | | 4Q 2023 |

| As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| Orders | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 639 | | | $ | 461 | | | $ | 751 | | | $ | 563 | | | $ | 850 | | | $ | 656 | | | $ | 820 | | | $ | 633 | |

| Applied Water | 483 | | | 483 | | | 445 | | | 445 | | | 422 | | | 422 | | | 420 | | | 420 | |

| Measurement and Control Solutions | 448 | | | 415 | | | 497 | | | 470 | | | 375 | | | 343 | | | 483 | | | 442 | |

| Integrated Solutions and Services | — | | | — | | | 163 | | | — | | | 384 | | | — | | | 321 | | | — | |

| Water Solutions and Services | — | | | 211 | | | — | | | 378 | | | — | | | 610 | | | — | | | 549 | |

| Total | $ | 1,570 | | | $ | 1,570 | | | $ | 1,856 | | | $ | 1,856 | | | $ | 2,031 | | | $ | 2,031 | | | $ | 2,044 | | | $ | 2,044 | |

| | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 589 | | | $ | 410 | | | $ | 704 | | | $ | 519 | | | $ | 803 | | | $ | 612 | | | $ | 871 | | | $ | 674 | |

| Applied Water | 453 | | | 453 | | | 478 | | | 478 | | | 465 | | | 465 | | | 457 | | | 457 | |

| Measurement and Control Solutions | 406 | | | 378 | | | 415 | | | 384 | | | 440 | | | 413 | | | 468 | | | 437 | |

| Integrated Solutions and Services | — | | | — | | | 125 | | | — | | | 368 | | | — | | | 322 | | | — | |

| Water Solutions and Services | — | | | 207 | | | — | | | 341 | | | — | | | 586 | | | — | | | 550 | |

| Total | $ | 1,448 | | | $ | 1,448 | | | $ | 1,722 | | | $ | 1,722 | | | $ | 2,076 | | | $ | 2,076 | | | $ | 2,118 | | | $ | 2,118 | |

| | | | | | | | | | | | | | | |

| Operating Income | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 70 | | | $ | 46 | | | $ | 106 | | | $ | 70 | | | $ | 128 | | | $ | 84 | | | $ | 115 | | | $ | 75 | |

| Applied Water | 83 | | | 83 | | | 84 | | | 84 | | | 73 | | | 73 | | | 70 | | | 70 | |

| Measurement and Control Solutions | 20 | | | 26 | | | 26 | | | 29 | | | 27 | | | 35 | | | 40 | | | 43 | |

| Integrated Solutions and Services | — | | | — | | | (7) | | | — | | | (3) | | | — | | | 18 | | | — | |

| Water Solutions and Services | — | | | 18 | | | — | | | 26 | | | — | | | 33 | | | — | | | 55 | |

| Corporate and Other | (42) | | | (42) | | | (90) | | | (90) | | | (34) | | | (34) | | | (32) | | | (32) | |

| Total | $ | 131 | | | $ | 131 | | | $ | 119 | | | $ | 119 | | | $ | 191 | | | $ | 191 | | | $ | 211 | | | $ | 211 | |

| | | | | | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1Q 2023 | | 2Q 2023 | | 3Q 2023 | | 4Q 2023 |

| As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

Adjustments(b) | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 4 | | | $ | 4 | | | $ | 23 | | | $ | 22 | | | $ | 24 | | | $ | 23 | | | $ | 49 | | | $ | 44 | |

| Applied Water | 3 | | | 3 | | | 2 | | | 2 | | | 6 | | | 6 | | | 3 | | | 3 | |

| Measurement and Control Solutions | 24 | | | 21 | | | 20 | | | 18 | | | 23 | | | 21 | | | 23 | | | 20 | |

| Integrated Solutions and Services | — | | | — | | | 25 | | | — | | | 52 | | | — | | | 20 | | | — | |

| Water Solutions and Services | — | | | 3 | | | — | | | 28 | | | — | | | 55 | | | — | | | 28 | |

| Corporate and Other | 23 | | | 23 | | | 70 | | | 70 | | | 19 | | | 19 | | | 7 | | | 7 | |

| Total | $ | 54 | | | $ | 54 | | | $ | 140 | | | $ | 140 | | | $ | 124 | | | $ | 124 | | | $ | 102 | | | $ | 102 | |

| | | | | | | | | | | | | | | |

| Adjusted Operating Income | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 74 | | | $ | 50 | | | $ | 129 | | | $ | 92 | | | $ | 152 | | | $ | 107 | | | $ | 164 | | | $ | 119 | |

| Applied Water | 86 | | | 86 | | | 86 | | | 86 | | | 79 | | | 79 | | | 73 | | | 73 | |

| Measurement and Control Solutions | 44 | | | 47 | | | 46 | | | 47 | | | 50 | | | 56 | | | 63 | | | 63 | |

| Integrated Solutions and Services | — | | | — | | | 18 | | | — | | | 49 | | | — | | | 38 | | | — | |

| Water Solutions and Services | — | | | 21 | | | — | | | 54 | | | — | | | 88 | | | — | | | 83 | |

| Corporate and Other | (19) | | | (19) | | | (20) | | | (20) | | | (15) | | | (15) | | | (25) | | | (25) | |

| Total | $ | 185 | | | $ | 185 | | | $ | 259 | | | $ | 259 | | | $ | 315 | | | $ | 315 | | | $ | 313 | | | $ | 313 | |

| | | | | | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1Q 2023 | | 2Q 2023 | | 3Q 2023 | | 4Q 2023 |

| As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| EBITDA | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 84 | | | $ | 55 | | | $ | 131 | | | $ | 89 | | | $ | 158 | | | $ | 110 | | | $ | 159 | | | $ | 113 | |

| Applied Water | 87 | | | 88 | | | 89 | | | 91 | | | 79 | | | 80 | | | 74 | | | 77 | |

| Measurement and Control Solutions | 54 | | | 56 | | | 61 | | | 59 | | | 60 | | | 66 | | | 73 | | | 71 | |

| Integrated Solutions and Services | — | | | — | | | 13 | | | — | | | 63 | | | — | | | 62 | | | — | |

| Water Solutions and Services | — | | | 31 | | | — | | | 60 | | | — | | | 112 | | | | | 114 | |

| Corporate and Other/Regional Selling Locations | (37) | | | (42) | | | (83) | | | (88) | | | (22) | | | (30) | | | (13) | | | (20) | |

| Total | $ | 188 | | | $ | 188 | | | $ | 211 | | | $ | 211 | | | $ | 338 | | | $ | 338 | | | $ | 355 | | | $ | 355 | |

| | | | | | | | | | | | | | | |

Adjustments(c) | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 5 | | | $ | 5 | | | $ | 20 | | | $ | 17 | | | $ | 12 | | | $ | 12 | | | $ | 29 | | | $ | 25 | |

| Applied Water | 4 | | | 4 | | | 2 | | | 2 | | | 6 | | | 7 | | | 5 | | | 3 | |

| Measurement and Control Solutions | 9 | | | 9 | | | 4 | | | 4 | | | 9 | | | 7 | | | 8 | | | 9 | |

| Integrated Solutions and Services | — | | | — | | | 17 | | | — | | | 20 | | | — | | | 6 | | | — | |

| Water Solutions and Services | — | | | 1 | | | — | | | 19 | | | — | | | 21 | | | — | | | 11 | |

| Corporate and Other/Regional Selling Locations | 30 | | | 29 | | | 75 | | | 76 | | | 26 | | | 26 | | | 13 | | | 13 | |

| Total | $ | 48 | | | $ | 48 | | | $ | 118 | | | $ | 118 | | | $ | 73 | | | $ | 73 | | | $ | 61 | | | $ | 61 | |

| | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | |

| Water Infrastructure | $ | 89 | | | $ | 60 | | | $ | 151 | | | $ | 106 | | | $ | 170 | | | $ | 122 | | | $ | 188 | | | $ | 138 | |

| Applied Water | 91 | | | 92 | | | 91 | | | 93 | | | 85 | | | 87 | | | 79 | | | 80 | |

| Measurement and Control Solutions | 63 | | | 65 | | | 65 | | | 63 | | | 69 | | | 73 | | | 81 | | | 80 | |

| Integrated Solutions and Services | — | | | — | | | 30 | | | — | | | 83 | | | — | | | 68 | | | — | |

| Water Solutions and Services | — | | | 32 | | | — | | | 79 | | | — | | | 133 | | | — | | | 125 | |

| Corporate and Other/Regional Selling Locations | (7) | | | (13) | | | (8) | | | (12) | | | 4 | | | (4) | | | — | | | (7) | |

| Total | $ | 236 | | | $ | 236 | | | $ | 329 | | | $ | 329 | | | $ | 411 | | | $ | 411 | | | $ | 416 | | | $ | 416 | |

| | | | | | | | | | | | | | | |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1Q 2023 | | 2Q 2023 | | 3Q 2023 | | 4Q 2023 |

| As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast | | As Previously Reported | | As Recast |

| Adjusted EBITDA Margin | | | | | | | | | | | | | | | |

| Water Infrastructure | 15.1 | % | | 14.6 | % | | 21.4 | % | | 20.4 | % | | 21.2 | % | | 19.9 | % | | 21.6 | % | | 20.5 | % |

| Applied Water | 20.1 | % | | 20.3 | % | | 19.0 | % | | 19.5 | % | | 18.3 | % | | 18.7 | % | | 17.3 | % | | 17.5 | % |

| Measurement and Control Solutions | 15.5 | % | | 17.2 | % | | 15.7 | % | | 16.4 | % | | 15.7 | % | | 17.7 | % | | 17.3 | % | | 18.3 | % |

| Integrated Solutions and Services | N/A | | N/A | | 24.0 | % | | N/A | | 22.6 | % | | N/A | | 21.1 | % | | N/A |

| Water Solutions and Services | N/A | | 15.5 | % | | N/A | | 23.2 | % | | N/A | | 22.7 | % | | N/A | | 22.7 | % |

| Total | 16.3 | % | | 16.3 | % | | 19.1 | % | | 19.1 | % | | 19.8 | % | | 19.8 | % | | 19.6 | % | | 19.6 | % |

(a)Adjusted operating income amounts for 2021 have been recast to adjust for historical purchase accounting intangible amortization consistent with previously reported adjusted operating income amounts for 2022 and 2023.

(b)Adjustments consist of restructuring and realignment costs, special charges and purchase accounting intangible amortization.

(c)Adjustments consist of share-based compensation expense, restructuring and realignment costs and special charges. The recast information reflects depreciation, amortization and share-based compensation specifically identified to the segments which were previously reported within Corporate and other and Regional selling locations as part of an overall allocation.

Xylem Inc. Non-GAAP Reconciliation

Recast - GAAP vs. Organic & Constant Currency Growth -Year ended December 31, 2023

($ Millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (As Recast - GAAP) | | (As Adjusted - Organic) | | Constant

Currency |

| | | (A) | | (B) | | | | (C) | | (D) | | (E)=B+C+D | | (F) = E/A | | (G) = (E - C) / A |

| Orders | | Orders | | Change

2023 v. 2022 | | % Change

2023 v. 2022 | | Acquisitions/

Divestitures | | FX

Impact | | Change

Adj. 2023 v. 2022 | | % Change

Adj. 2023 v. 2022 | | |

| 2023 | | 2022 | | | | | | | | | | | | | | |

| Year Ended December 31 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 7,501 | | | $ | 6,257 | | | $ | 1,244 | | | 20 | % | | $ | (1,220) | | | $ | 41 | | | $ | 65 | | | 1 | % | | 21 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 2,313 | | | 1,916 | | | 397 | | | 21 | % | | (352) | | | 17 | | | 62 | | | 3 | % | | 22 | % |

| Applied Water | 1,770 | | | 1,794 | | | (24) | | | (1) | % | | — | | | 18 | | | (6) | | | — | % | | — | % |

| Measurement and Control Solutions | 1,670 | | | 1,736 | | | (66) | | | (4) | % | | — | | | (1) | | | (67) | | | (4) | % | | (4) | % |

| Water Solutions and Services | 1,748 | | | 811 | | | 937 | | | 116 | % | | (868) | | | 7 | | | 76 | | | 9 | % | | 116 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended December 31 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 2,044 | | | $ | 1,439 | | | $ | 605 | | | 42 | % | | $ | (451) | | | $ | (17) | | | $ | 137 | | | 10 | % | | 41 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 633 | | | 452 | | | 181 | | | 40 | % | | (130) | | | (9) | | | 42 | | | 9 | % | | 38 | % |

| Applied Water | 420 | | | 400 | | | 20 | | | 5 | % | | — | | | (2) | | | 18 | | | 5 | % | | 5 | % |

| Measurement and Control Solutions | 442 | | | 391 | | | 51 | | | 13 | % | | — | | | (5) | | | 46 | | | 12 | % | | 12 | % |

| Water Solutions and Services | 549 | | | 196 | | | 353 | | | 180 | % | | (321) | | | (1) | | | 31 | | | 16 | % | | 180 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (As Recast - GAAP) | | (As Adjusted - Organic) | | Constant

Currency |

| | | (A) | | (B) | | | | (C) | | (D) | | (E)=B+C+D | | (F) = E/A | | (G) = (E - C) / A |

| Orders | | Orders | | Change

2023 v. 2022 | | % Change

2023 v. 2022 | | Acquisitions/

Divestitures | | FX

Impact | | Change

Adj. 2023 v. 2022 | | % Change

Adj. 2023 v. 2022 | | |

| 2023 | | 2022 | | | | | | | | | | | | | | |

| Quarter Ended September 30 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 2,031 | | | $ | 1,419 | | | $ | 612 | | | 43 | % | | $ | (547) | | | $ | (18) | | | $ | 47 | | | 3 | % | | 42 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 656 | | | 424 | | | 232 | | | 55 | % | | (163) | | | (7) | | | 62 | | | 15 | % | | 53 | % |

| Applied Water | 422 | | | 409 | | | 13 | | | 3 | % | | — | | | (4) | | | 9 | | | 2 | % | | 2 | % |

| Measurement and Control Solutions | 343 | | | 388 | | | (45) | | | (12) | % | | — | | | (5) | | | (50) | | | (13) | % | | (13) | % |

| Water Solutions and Services | 610 | | | 198 | | | 412 | | | 208 | % | | (384) | | | (2) | | | 26 | | | 13 | % | | 207 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 1,856 | | | $ | 1,684 | | | $ | 172 | | | 10 | % | | $ | (222) | | | $ | 23 | | | $ | (27) | | | (2) | % | | 12 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 563 | | | 558 | | | 5 | | | 1 | % | | (59) | | | 10 | | | (44) | | | (8) | % | | 3 | % |

| Applied Water | 445 | | | 480 | | | (35) | | | (7) | % | | — | | | 6 | | | (29) | | | (6) | % | | (6) | % |

| Measurement and Control Solutions | 470 | | | 444 | | | 26 | | | 6 | % | | — | | | 3 | | | 29 | | | 7 | % | | 7 | % |

| Water Solutions and Services | 378 | | | 202 | | | 176 | | | 87 | % | | (163) | | | 4 | | | 17 | | | 8 | % | | 89 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended March 31 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 1,570 | | | $ | 1,715 | | | $ | (145) | | | (8) | % | | $ | — | | | $ | 53 | | | $ | (92) | | | (5) | % | | (5) | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 461 | | | 482 | | | (21) | | | (4) | % | | — | | | 23 | | | 2 | | | — | % | | — | % |

| Applied Water | 483 | | | 505 | | | (22) | | | (4) | % | | — | | | 18 | | | (4) | | | (1) | % | | (1) | % |

| Measurement and Control Solutions | 415 | | | 513 | | | (98) | | | (19) | % | | — | | | 6 | | | (92) | | | (18) | % | | (18) | % |

| Water Solutions and Services | 211 | | | 215 | | | (4) | | | (2) | % | | — | | | 6 | | | 2 | | | 1 | % | | 1 | % |

Xylem Inc. Non-GAAP Reconciliation

Recast - GAAP vs. Organic & Constant Currency Growth -Year ended December 31, 2023

($ Millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (As Recast - GAAP) | | (As Adjusted - Organic) | | Constant

Currency |

| | | (A) | | (B) | | | | (C) | | (D) | | (E)=B+C+D | | (F) = E/A | | (G) = (E - C) / A |

| Revenue | | Revenue | | Change

2023 v. 2022 | | % Change

2023 v. 2022 | | Acquisitions/

Divestitures | | FX

Impact | | Change

Adj. 2023 v. 2022 | | % Change

Adj. 2023 v. 2022 | | |

| 2023 | | 2022 | | | | | | | | | | | | | | |

| Year Ended December 31 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 7,364 | | | $ | 5,522 | | | $ | 1,842 | | | 33 | % | | $ | (1,177) | | | $ | 25 | | | $ | 690 | | | 12 | % | | 34 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 2,215 | | | 1,686 | | | 529 | | | 31 | % | | (362) | | | 8 | | | 175 | | | 10 | % | | 32 | % |

| Applied Water | 1,853 | | | 1,767 | | | 86 | | | 5 | % | | — | | | 10 | | | 96 | | | 5 | % | | 5 | % |

| Measurement and Control Solutions | 1,612 | | | 1,275 | | | 337 | | | 26 | % | | — | | | — | | | 337 | | | 26 | % | | 26 | % |

| Water Solutions and Services | 1,684 | | | 794 | | | 890 | | | 112 | % | | (815) | | | 7 | | | 82 | | | 10 | % | | 113 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended December 31 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 2,118 | | | $ | 1,506 | | | $ | 612 | | | 41 | % | | $ | (459) | | | $ | (17) | | | $ | 136 | | | 9 | % | | 40 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 674 | | | 484 | | | 190 | | | 39 | % | | (137) | | | (7) | | | 46 | | | 10 | % | | 38 | % |

| Applied Water | 457 | | | 455 | | | 2 | | | — | % | | — | | | (4) | | | (2) | | | — | % | | — | % |

| Measurement and Control Solutions | 437 | | | 347 | | | 90 | | | 26 | % | | — | | | (4) | | | 86 | | | 25 | % | | 25 | % |

| Water Solutions and Services | 550 | | | 220 | | | 330 | | | 150 | % | | (322) | | | (2) | | | 6 | | | 3 | % | | 149 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (As Recast - GAAP) | | (As Adjusted - Organic) | | Constant

Currency |

| | | (A) | | (B) | | | | (C) | | (D) | | (E)=B+C+D | | (F) = E/A | | (G) = (E - C) / A |

| Revenue | | Revenue | | Change

2023 v. 2022 | | % Change

2023 v. 2022 | | Acquisitions/

Divestitures | | FX

Impact | | Change

Adj. 2023 v. 2022 | | % Change

Adj. 2023 v. 2022 | | |

| 2023 | | 2022 | | | | | | | | | | | | | | |

| Quarter Ended September 30 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 2,076 | | | $ | 1,380 | | | $ | 696 | | | 50 | % | | $ | (540) | | | $ | (22) | | | $ | 134 | | | 10 | % | | 49 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 612 | | | 403 | | | 209 | | | 52 | % | | (172) | | | (12) | | | 25 | | | 6 | % | | 49 | % |

| Applied Water | 465 | | | 458 | | | 7 | | | 2 | % | | — | | | (3) | | | 4 | | | 1 | % | | 1 | % |

| Measurement and Control Solutions | 413 | | | 320 | | | 93 | | | 29 | % | | — | | | (5) | | | 88 | | | 28 | % | | 28 | % |

| Water Solutions and Services | 586 | | | 199 | | | 387 | | | 194 | % | | (368) | | | (2) | | | 17 | | | 9 | % | | 193 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended June 30 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 1,722 | | | $ | 1,364 | | | $ | 358 | | | 26 | % | | $ | (178) | | | $ | 19 | | | $ | 199 | | | 15 | % | | 28 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 519 | | | 421 | | | 98 | | | 23 | % | | (53) | | | 9 | | | 54 | | | 13 | % | | 25 | % |

| Applied Water | 478 | | | 429 | | | 49 | | | 11 | % | | — | | | 4 | | | 53 | | | 12 | % | | 12 | % |

| Measurement and Control Solutions | 384 | | | 318 | | | 66 | | | 21 | % | | — | | | 2 | | | 68 | | | 21 | % | | 21 | % |

| Water Solutions and Services | 341 | | | 196 | | | 145 | | | 74 | % | | (125) | | | 4 | | | 24 | | | 12 | % | | 76 | % |

| | | | | | | | | | | | | | | | | |

| Quarter Ended March 31 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Xylem Inc. | $ | 1,448 | | | $ | 1,272 | | | $ | 176 | | | 14 | % | | $ | — | | | $ | 45 | | | $ | 221 | | | 17 | % | | 17 | % |

| | | | | | | | | | | | | | | | | |

| Water Infrastructure | 410 | | | 378 | | | 32 | | | 8 | % | | — | | | 18 | | | 50 | | | 13 | % | | 13 | % |

| Applied Water | 453 | | | 425 | | | 28 | | | 7 | % | | — | | | 13 | | | 41 | | | 10 | % | | 10 | % |

| Measurement and Control Solutions | 378 | | | 290 | | | 88 | | | 30 | % | | — | | | 7 | | | 95 | | | 33 | % | | 33 | % |

| Water Solutions and Services | 207 | | | 179 | | | 28 | | | 16 | % | | — | | | 7 | | | 35 | | | 20 | % | | 20 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

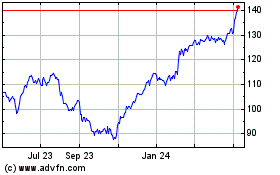

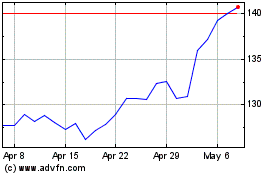

Xylem (NYSE:XYL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xylem (NYSE:XYL)

Historical Stock Chart

From Apr 2023 to Apr 2024