Dear shareholders, friends,

Both from a professional viewpoint and as

largest private holder, I have felt the urge to share my uncensored

mind on the disproportionate decline in CLINUVEL’s value.

Naturally, I experience chagrin as a substantial

shareholder, but in earnest I am more concerned and engaged with

the many of you who had invested 12 to 17 years ago, speculating

that the Company would sustain a $2B plus valuation throughout 2022

given its financial strength to date.

For the benefit of the 2.5% recently joined

shareholders, I distinguish CLINUVEL’s genesis through a few

sections, and address the all-important issue of timing.

Early yearsA new business plan

was required for a company nearing insolvency in October 2005.

Operating at a cost of capital of 14% to 16%, we financed the

project mostly across two equity rounds at nearly $62 million.

Directors had not agreed on prospective earnings as too much

R&D uncertainty loomed. At the time, pharmaceutical executives

on the Board, surrounded by their advisors, ran internal analyses

consigned to multiple commercial scenarios: all valuations came out

considerably lower than today’s.

Middle yearsFrom 2010 to 2016,

limited equity placements totalled $28 million at premium to

market, a significant departure from common practice, but

underpinning our position that CUV had been trading at discounted

value. All shareholders have benefited from our decision to step

away from the pattern of serial equity issuances at a discount to

market. In parallel, we cut pharma expenditures to a minimum, while

advancing SCENESSE® (afamelanotide 16mg) to market.

The regulatory pathway was equally novel and at

times fraught with significant, yet calculated, risk. The gain of

our managers overcoming the challenges was calculated as an

indelible value to the Company in taking this experience forward to

new medicinal therapies for future growth.

Recent yearsThe final chapter

of the trilogy enumerated a commercial expansion. Contrary to

industry habits, we established teams focused on distribution,

market access, and pricing. Fast forward some years, pricing

negotiations played out well in the majority of countries, whereby

the Company reached profitability during the first year of

commercially distributing SCENESSE® (2016/17). As predicted some

countries would resist any agreement on pharmaceutical pricing

proposed, arguing allocation of resources towards other

therapies.

Our strategy aims for organic and inorganic

growth. The house is building a pipeline of melanocortin molecules

and new formulations. As a logical nexus to our photoprotective

injectable SCENESSE®, we set out to develop a series of topical

(leave on) products serving to protect and assist DNA damaged skin

inflicted by solar radiation.

We work with a number of investment banks and

brokers through well-defined acquisition targets for the accretive

match.

TimeNaturally, time translates

to value in our sector and there is a definitive answer as to how

long it will take to see the final diversified construct.

In navigating the fuselage, I would be bitterly

disappointed in not seeing all plans realised within the term of my

final employment contract, ending July 2025.

Four years ago we made public our objectives to

be achieved by end of 2023, and our staff is aligned in attaining

the majority of these. Save for good health, if our global ensemble

continues to work the odd hours in fulfilling a once-in-a-lifetime

opportunity, then realisation should be within reach. For having

entered a knowledge economy, specialised professionals matter most,

hence much effort is put in retaining them.

Lest we forget, we have witnessed the eruption

of the chrysalis maturing to a financial stronghold, giving us

corporate choices. By staying the course, we eliminate the

perennial investors’ concern that innovators are unable to survive

the consequences of unexpected market conditions.

As bitterly cold winds blow, CLINUVEL fortifies

it financial fur, and as current sentiments ebb, the overall

strategy may well be recognised.

ConclusionIf the recent

healthcare indexes - NBI and XHJ – are of any reference, one sees

higher volatility across the underlying listed stocks. As the NBI

reached a high of over 5,400 in September 2021, it has retreated to

a level around 3,850 at present, a loss approximating 30%.

Uncoincidentally, on 23 September CUV reached an all-time high of

$43.58 to come off to current levels, a stronger decline but very

much following the biotech trend worldwide. In essence, we see a

temporary flight from perceived high-risk sectors and theme stocks,

as CLINUVEL is currently characterised, to blue chip safer

havens.

Our challenge remains to identify and attract

new institutional shareholders, willing to invest longer-term as

opposed to those who enter and exit positions short-term. Gauging

from our interaction with a number of US and EU specialised funds,

I cannot help but be confident that we will succeed in this mission

too.

As to you long-term holders, testing times force

us to reflect on the original investment decision, and our hope for

future markets and market value. It is certain that many more

challenges will befall CLINUVEL during its odyssey, however I

experienced that there is an intangible – but real – value embedded

in the resilience of a focussed team.

I have long regarded the daily mark to market

glance at 1600 hours as a distraction, and in so far daily

operations and labour towards our construct matter, market

sentiments or even euphoria neither rocks the boat nor alter our

objectives.

As eight to nine year cycles wash over us, my

teams will come through this nadir too, for we had prepared

CLINUVEL precisely for these events and corrections occurring. I

leave you with a parable, in reminding that the Company could

equally have been in a development phase facing clinical or

regulatory setbacks, holding little cash at hand under current

market conditions. We incessantly worked to escape the what-ifs,

and so we have.

During a recent visit to Disraeli’s residence at

Hughenden Manor, in absorbing his speech to the House of Parliament

in 1834, I could not help to think about your vehicle: “I have

brought myself, by long meditation to the conviction that a human

being with a settled purpose must accomplish it, and that nothing

can resist a will which will stake even existence upon its

fulfillment.”

Keep your composure at times when it matters,

thank you.

Yours sincerely,

Philippe Wolgen

Managing DirectorCLINUVEL PHARMACEUTICALS

LTD

About CLINUVEL PHARMACEUTICALS

LIMITED

CLINUVEL (ASX: CUV; ADR LEVEL 1: CLVLY; XETRA-DAX: UR9) is a

global specialty pharmaceutical group focused on developing and

commercialising treatments for patients with genetic, metabolic,

systemic, and life-threatening, acute disorders, as well as

healthcare solutions for the general population. As pioneers in

photomedicine and the family of melanocortin peptides, CLINUVEL’s

research and development has led to innovative treatments for

patient populations with a clinical need for systemic

photoprotection, DNA repair, repigmentation and acute or

life-threatening conditions who lack alternatives.

CLINUVEL’s lead therapy, SCENESSE® (afamelanotide 16mg), is

approved for commercial distribution in Europe, the USA, Israel and

Australia as the world’s first systemic photoprotective drug for

the prevention of phototoxicity (anaphylactoid reactions and burns)

in adult patients with erythropoietic protoporphyria (EPP).

Headquartered in Melbourne, Australia, CLINUVEL has operations in

Europe, Singapore and the USA. For more information, please go to

https://www.clinuvel.com.

SCENESSE®, PRÉNUMBRA®, and NEURACTHEL® are registered trademarks

of CLINUVEL.

Head of Investor Relations Mr

Malcolm Bull, CLINUVEL PHARMACEUTICALS LTD

Investor Enquiries

https://www.clinuvel.com/investors/contact-us

Forward-Looking Statements

This release contains forward-looking

statements, which reflect the current beliefs and expectations of

CLINUVEL’s management. Statements may involve a number of known and

unknown risks that could cause our future results, performance or

achievements to differ significantly from those expressed or

implied by such forward-looking statements. Important factors that

could cause or contribute to such differences include risks

relating to: our ability to develop and commercialise

pharmaceutical products; the COVID-19 pandemic and/or other world,

regional or national events affecting the supply chain for a

protracted period of time, including our ability to develop,

manufacture, market and sell biopharmaceutical products;

competition for our products, especially SCENESSE® (afamelanotide

16mg), PRÉNUMBRA® or NEURACTHEL®; our ability to achieve expected

safety and efficacy results in a timely manner through our

innovative R&D efforts; the effectiveness of our patents and

other protections for innovative products, particularly in view of

national and regional variations in patent laws; our potential

exposure to product liability claims to the extent not covered by

insurance; increased government scrutiny in either Australia, the

U.S., Europe, Israel, China and Japan of our agreements with third

parties and suppliers; our exposure to currency fluctuations and

restrictions as well as credit risks; the effects of reforms in

healthcare regulation and pharmaceutical pricing and reimbursement;

that the Company may incur unexpected delays in the outsourced

manufacturing of SCENESSE®, PRÉNUMBRA® or NEURACTHEL® which may

lead to it being unable to supply its commercial markets and/or

clinical trial programs; any failures to comply with any government

payment system (i.e. Medicare) reporting and payment obligations;

uncertainties surrounding the legislative and regulatory pathways

for the registration and approval of biotechnology and consumer

based products; decisions by regulatory authorities regarding

approval of our products as well as their decisions regarding label

claims; our ability to retain or attract key personnel and

managerial talent; the impact of broader change within the

pharmaceutical industry and related industries; potential changes

to tax liabilities or legislation; environmental risks; and other

factors that have been discussed in our 2021 Annual Report.

Forward-looking statements speak only as of the date on which they

are made, and the Company undertakes no obligation, outside of

those required under applicable laws or relevant listing rules of

the Australian Securities Exchange, to update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. More information on preliminary and

uncertain forecasts and estimates is available on request, whereby

it is stated that past performance is not an indicator of future

performance.

www.clinuvel.com

Level

11 535

Bourke

Street Melbourne

- Victoria, Australia, 3000T +61 3 9660

4900F +61 3 9660 4999

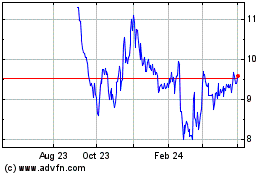

Clinuvel Pharmaceuticals (TG:UR9)

Historical Stock Chart

From Dec 2024 to Jan 2025

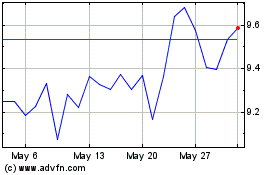

Clinuvel Pharmaceuticals (TG:UR9)

Historical Stock Chart

From Jan 2024 to Jan 2025