Company reports fiscal fourth quarter and year-end 2023 results

achieving 40% growth in Annual Recurring Revenue(1) to $51.1

million

- $100 million of annual revenue up 37% over prior year

- Annual Recurring Revenue (“ARR”)(1) increased 40%

year-over-year to $51.1 million

- Q4 revenue hits 30 million, up 36% year-over-year

- Record Net Dollar Retention (“NDR”)(1) of 129% improves

year-over-year from 105%

- Record gross margins of $16.5 million in Q4, up 56%

year-over-year

- Total expenses of $19.8 million in Q4, declining 3% from $20.3

million year-over-year

- EBITDA(1) improved 82% to a loss of $1.5 million in Q4 2023

from a $8.1 million loss in Q4 2022

- Company in excellent position as it enters fiscal 2024 to

produce another record year

Blackline Safety Corp. (“Blackline” or the

“Company”) (TSX: BLN), a global leader in connected

safety technology, today reported its fiscal fourth quarter and

annual financial results for the period ended October 31, 2023.

Management Commentary

“We are delighted to achieve a significant milestone, reaching

$100 million in total annual revenue as we recorded our 27th

consecutive quarter of year-over-year total revenue growth. This

includes our fourth quarter, where we reached $30.0 million in

total revenue, a 36% increase over the prior year’s quarter. We are

proud of our execution during the year: increasing ARR(1) 40% to

$51.1 million, achieving 33% more in hardware revenue, while

decreasing total annual expenses 10%, leading to a dramatic

reduction in EBITDA(1) loss,” said Cody Slater, CEO and Chair,

Blackline Safety Corp.

“In Q3 of last year, we embarked on a path to profitability. In

that quarter, our EBITDA(1) loss represented 79% of our revenue and

our cash used in operating activities was 105%. In Q4 2023, our

EBITDA(1) loss was reduced to less than 5%, our cash used in

operating activities as a percentage of revenue(1) was improved to

7%, all while achieving top line growth of 36%. Even though we did

not hit our ambitious goal of reaching EBITDA positive results I am

confident the Company has transformed itself into an engine that

can continue to deliver top line growth in the future and generate

significant profitability in the long run,” continued Slater.

Blackline set a new record in quarterly gross profit of $16.5

million which was driven by strength in both our product and

service segments that delivered increases of 66% and 53%,

respectively. The Company’s strong fiscal fourth quarter gross

margin percentages(1) of 32% for hardware and 77% for service are

an excellent benchmark for fiscal 2024 and will contribute to

Blackline’s path sustained profitability. Q4 2023 marked the fourth

consecutive quarter of 33% year-over-year revenue growth or better.

We expect to continue our revenue and market share growth while

maintaining cost discipline to target consistent positive Adjusted

EBITDA(1) in the seasonally stronger second half of fiscal

2024.

Blackline delivered industry-leading NDR(1) reaching a new high

of 129% in Q4 2023. Our solutions are core to the health, safety

and compliance practices of our customers across industrial markets

who continue to value the workforce visibility and safety that our

integrated technology solution provides.

Geographically, the Company experienced year-over-year growth

across the board with the United States growing 89% while our Rest

of World and Canada markets grew 14% and 12%, respectively. Europe

grew 1% compared to a strong fourth quarter in the prior year and

it remains a key driver of growth for Blackline in fiscal 2024.

Mr. Slater continued, “Blackline achieved its highest quarterly

gross profit ever at $16.5 million, overall margin percentage was

the highest in three years at 55%, driven by service margin of 77%

and product margin of 32%. The improvements in these metrics

continue to be driven by our lean manufacturing, increasing scale,

value added software services and enhanced pricing model. The trend

of margin improvements is a key contributor to a sustainable

profitable financial model.”

“With the close of our expanded two-year credit facility in

October, with a total capacity of $25 million, we remain in a

strong financial position with total cash, short-term investments,

and availability on our credit facility of $29.2 million all in

addition to our lease securitization facility, which has $53.2

million available. As we continue to reduce our cash burn through

cost optimization, margin expansion and revenue growth, it is clear

that we have the capital resources available to continue on our

path to a sustainable free cash flow generating business.”

Fiscal Fourth Quarter 2023 and Recent Financial and

Operational Highlights

- Total revenue of $30.0 million, a 36% increase over the prior

year’s Q4

- Service revenue of $15.0 million, a 38% increase over the prior

year’s Q4

- Product revenue of $15.0 million, a 35% increase over the prior

year’s Q4

- United States growth continues to be strong with an 89% revenue

increase over the prior year’s Q4

- Canadian market contributed 12% revenue growth over the prior

year’s Q4

- Rest of World revenue grew 14% compared to the prior year’s

Q4

- ARR(1) growth of 40% year-over-year to $51.1 million

- Total Q4 expenses were $19.8 million, declining $0.5 million

compared to the prior year’s Q4

- Expanded credit facility with ATB Financial to $25 million

- Introduced new features for award-winning G7 EXO area gas

monitor

- Unveiled Protect and Protect Plus service plans for G6 and new

features, including an emergency SOS button, real-time connectivity

and an expanded suite of data analytics

- Named to Globe & Mail’s Report on Business Top Growing

Companies for fifth consecutive year

- Awarded $3.5 million contract by leading North American energy

company to protect over 850 workers

- Secured $1.3 million worth of contracts with leading Middle

East energy companies

- Announced over $2.0 million in total contract value for

hundreds of fire and hazmat organizations globally

Financial highlights

Three-months ended

October 31,

(CAD thousands, except per share and

percentage amounts)

2023

2022

% Change

Product revenue

15,042

11,131

35

Service revenue

14,993

10,899

38

Total Revenue

30,035

22,030

36

Gross margin

16,452

10,517

56

Gross margin percentage(1)

55 %

48 %

Total Expenses

19,776

20,317

(3)

Total Expenses as a percentage of

revenue(1)

66 %

92 %

Net loss

(4,455)

(9,940)

(55)

Loss per common share - Basic and

diluted

(0.06)

(0.14)

(57)

EBITDA (1)

(1,480)

(8,073)

82

EBITDA per common share (1) – Basic and

diluted

(0.02)

(0.12)

83

Adjusted EBITDA(1 & 2)

(1,829)

(7,653)

76

Adjusted EBITDA per common share(1 &

2) - Basic and diluted

(0.03)

(0.11)

73

(1) This news release presents certain

non-GAAP and supplementary financial measures, as well as non-GAAP

ratios to assist readers in understanding the Company’s

performance, further details on these measures and ratios are

included in the “Non-GAAP and Supplementary Financial Measures”

section of this press release.

(2) Adjusted EBITDA is adjusted for all

periods presented as Management updated the non-GAAP composition to

remove the adjustment of product research and development costs and

included the adjustment for foreign exchange gains or losses as

noted in the Non-GAAP Financial Measures section. The amounts

presented in the table above reflected the restated figures to

align with the updated composition.

Key Financial Information

Total revenue for fiscal fourth quarter was $30.0 million, an

increase of 36% compared to $22.0 million in the prior year’s

quarter. Total revenue for each geographical market increased with

the United States leading the growth up 89% while other regions

also demonstrated strong growth with Canada up 12% and Rest of

World up 14%. Europe also improved over a strong quarter in the

prior year, growing 1%.

Service revenue during the fiscal fourth quarter was $15.0

million, an increase of 38% compared to $10.9 million in the prior

year’s quarter. Software services revenue increased 34% to $13.2

million and rental revenue increased 69% to $1.8 million. The

increase in software services revenue was attributable to new

activations of devices sold over the past 12 months as well as net

growth within our existing customer base of $2.5 million which

resulted in NDR of 129%.

Rental revenue continues to be strong, with year-over-year

growth of 69% as our rental team expanded their offering globally

during the year for short-term, project-based offerings across

North America for the industrial construction, turnaround, and

maintenance markets.

Product revenue during the fiscal fourth quarter was $15.0

million, a 35% increase compared to $11.1 million in the prior

year’s quarter. The increase in the current year period reflects

the Company’s expanded sales network and past investments in our

global sales team through their targeted demand generation and

sales development activities.

Overall, gross margin percentage(1) for the fiscal fourth

quarter was 55%, a 7% increase compared to the prior year’s

quarter. The increase in total gross margin percentage(1) was due

to a combination of higher sales volume, our enhanced pricing

strategy, continued cost optimization across our business and a

shift in revenue mix towards higher margin service revenue. Product

revenue comprised 50% of total revenue in the fourth quarter,

compared to 51% in the prior year’s quarter, while service revenue

made up 50% of total revenue for the quarter, compared to 49% in

the prior year’s quarter. Service gross margin percentage(1)

increased to 77% compared to the prior year’s quarter of 70%. This

was primarily due to our continued service revenue growth, through

additional value-added features and our scale absorbing more fixed

cost of sales.

Product gross margin percentage(1) for the fiscal fourth quarter

increased to 32% from 26% in the prior year’s quarter and 29% in

the fiscal third quarter. The Company has been able to mitigate

most global supply chain challenges that it has experienced since

the third quarter of 2021, while implementing other lean

manufacturing initiatives and cost optimizations. During the

quarter the Company continued to process sales using our updated

pricing structure. The Company has been able to automate more of

its manufacturing line, improving the efficiency and throughput of

its operations.

Finance expense, net was $295 for the fiscal fourth quarter

compared to finance income, net of $107 in the prior year’s

quarter. Finance expenses were higher in the quarter due to

increases in prime lending rates, interest expense on the Company’s

securitization facility and interest expense on the amount drawn on

the Company’s senior secured operating facility over the last year.

This increase was partially offset by higher interest revenue from

finance leases and financial assets held for cash management

purposes.

Net loss for the fiscal fourth quarter was $4.5 million, or

$(0.06) per share, compared to $9.9 million or $(0.14) per share in

the prior year’s quarter. Net loss decreased due to an increase in

total gross margin as well as decreases in product research and

development costs.

EBITDA(1) for the fiscal fourth quarter was $(1.5) million or

$(0.02) per share compared to $(8.1) million or $(0.12) in the

prior year’s quarter. The $6.6 million improvement in EBITDA(1) is

primarily due to the increase in total gross margin, as well as the

decrease in total expenses.

Adjusted EBITDA(1) for the fiscal fourth quarter was $(1.8)

million or $(0.03) per share compared to $(7.7) million or $(0.11)

per share in the prior year’s quarter. The $5.9 million improvement

in Adjusted EBITDA(1) is primarily due to the increase in total

gross margin, as well as the decrease in total expenses.

At the end of the fiscal fourth quarter, Blackline had total

cash and short-term investments on hand of $16.0 million and $13.2

million available on its senior secured operating facility. The

decrease in cash and short-term investments is mainly due to

operating losses which were offset by net advances from the

Company's operating credit facility of $1.6 million during the

quarter.

Blackline’s Annual Consolidated Financial Statements and

Management’s Discussion and Analysis on Financial Condition and

Results of Operations for the year ended October 31, 2023, are

available on SEDAR+ under the Company’s profile at

www.sedarplus.ca. All results are reported in Canadian dollars.

Conference Call

A conference call and live webcast have been scheduled for 11:00

am ET on Thursday, January 18, 2024. Participants should dial

1-800-319-4610 or +1-416-915-3239 at least 10 minutes prior to the

conference time. A live webcast will also be available at

https://www.gowebcasting.com/13108. Participants should join the

webcast at least 10 minutes prior to the start time to register and

install any necessary software. If you cannot make the live call, a

replay will be available within 24 hours by dialing 1-800-319-6413

and entering access code 0356.

About Blackline Safety Corp

Blackline Safety is a technology leader driving innovation in

the industrial workforce through IoT (Internet of Things). With

connected safety devices and predictive analytics, Blackline

enables companies to drive towards zero safety incidents and

improved operational performance. Blackline provides wearable

devices, personal and area gas monitoring, cloud-connected software

and data analytics to meet demanding safety challenges and enhance

overall productivity for organizations with coverage in more than

100 countries. Armed with cellular and satellite connectivity,

Blackline provides a lifeline to tens of thousands of people,

having reported over 226 billion data-points and initiated over

seven million emergency alerts. For more information, visit

BlacklineSafety.com and connect with us on Facebook, Twitter,

LinkedIn and Instagram.

Non-GAAP and Supplementary Financial Measures

This press release presents certain non-GAAP and supplementary

financial measures, including key performance indicators used by

management and typically used by our competitors in the

software-as-a-service industry, as well as non-GAAP ratios to

assist readers in understanding the Company’s performance. These

measures do not have any standardized meaning and therefore are

unlikely to be comparable to similar measures presented by other

issuers and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP.

Management uses these non-GAAP and supplementary financial

measures, as well as non-GAAP ratios and key performance indicators

to analyze and evaluate operating performance. Blackline also

believes the non-GAAP and supplementary financial measures defined

below are commonly used by the investment community for valuation

purposes, and are useful complementary measures of profitability,

and provide metrics useful in Blackline’s industry.

Throughout this news release, the following terms are used,

which do not have a standardized meaning under GAAP.

Key Performance Indicators

The Company recognizes service revenues ratably over the term of

the service period under the provisions of agreements with

customers. The terms of agreements, combined with high customer

retention rates, provides the Company with a significant degree of

visibility into near-term revenues. Management uses several

metrics, including the ones identified below, to measure the

Company’s performance and customer trends, which are used to

prepare financial plans and shape future strategy. Key performance

indicators may be calculated in a manner different than similar key

performance indicators used by other companies.

- “Annual Recurring Revenue” is the total annualized value

of recurring service amounts (ultimately recognized as software

services revenue) of all service contracts at a point in time.

Annualized service amounts are determined solely by reference to

the underlying contracts, normalizing for the varying revenue

recognition treatments under IFRS 15 Revenue from Contracts with

Customers. It excludes one-time fees, such as for non-recurring

professional services, and assumes that customers will renew the

contractual commitments on a periodic basis as those commitments

come up for renewal, unless such renewal is known to be

unlikely.

- “Net Dollar Retention” compares the aggregate service

revenue contractually committed for a full period under all

customer agreements of our total customer base as of the beginning

of each period to the total service revenue of the same group at

the end of the period. It includes the effect of our service

revenue that expands, renews, contracts or is declined, but

excludes the total service revenue from new activations during the

period. We believe that NDR provides a fair measure of the strength

of our recurring revenue streams and growth within our existing

customer base.

Non-GAAP Financial Measures

A non-GAAP financial measure: (a) depicts the historical or

expected future financial performance, financial position or cash

of the Company; (b) with respect to its composition, excludes an

amount that is included in, or includes an amount that is excluded

from, the composition of the most comparable financial measure

presented in the primary consolidated financial statements; (c) is

not presented in the primary financial statements of the Company;

and (d) is not a ratio.

Non-GAAP financial measures presented and discussed in this news

release are as follows:

“EBITDA” is useful to securities analysts, investors and

other interested parties in evaluating operating performance by

presenting the results of the Company which excludes the impact of

certain non-cash or non-operational items. EBITDA is calculated as

earnings before interest expense, interest income, income taxes,

depreciation and amortization.

“Adjusted EBITDA” is useful to securities analysts,

investors and other interested parties in evaluating operating

performance by presenting the results of the Company which excludes

the impact of certain non-operational items and certain non-cash

and non-recurring items, such as stock-based compensation expense.

Adjusted EBITDA is calculated as earnings before interest expense,

interest income, income taxes, depreciation and amortization,

stock-based compensation expense, foreign exchange loss (gain), and

non-recurring impact transactions, if any. The Company considers an

item to be non-recurring when a similar revenue, expense, loss or

gain is not reasonably likely to occur within the next two years or

has not occurred during the prior two years.

Reconciliation of non-GAAP financial measures

Reconciliation of non-GAAP financial

measures

Three-months ended October

31,

(CAD thousands)

2023

2022

% Change

Net loss

(4,455)

(9,940)

(55)

Depreciation and amortization

1,843

1,727

7

Finance expense (income), net

297

(107)

NM

Income taxes

835

247

238

EBITDA

(1,480)

(8,073)

82

Stock-based compensation expense(1)

537

385

39

Foreign exchange loss (gain)(2)

(886)

35

NM

Adjusted EBITDA(3)

(1,829)

(7,653)

76

(1) Stock-based compensation expense

relates to the Company’s stock compensation plan and stock option

expense is extracted from cost of sales, general and administrative

expenses, sales and marketing expenses and product research and

development costs on the consolidated statements of loss and

comprehensive loss.

(2) During the fourth fiscal quarter of

2022, Management updated the non-GAAP composition to include an

adjustment for foreign exchange loss (gain). Comparative periods

have been restated to reflect this change

(3) Adjusted EBITDA is adjusted for all

periods presented as Management updated the non-GAAP composition to

remove the adjustment of product research and development costs as

noted in the Non-GAAP Financial Measures section. The amounts

presented in the table above reflect the restated figures to align

with the updated composition. NM – Not meaningful

Non-GAAP Ratios

A non-GAAP ratio is a financial measure presented in the form of

a ratio, fraction, percentage or similar representation and that

has a non-GAAP financial measure as one or more of its

components.

Non-GAAP ratios presented and discussed in this news release is

follows:

“EBITDA per common share” is useful to securities

analysts, investors and other interested parties in evaluating

operating and financial performance. EBITDA per common share is

calculated on the same basis as net income (loss) per common share,

utilizing the basic and diluted weighted average number of common

shares outstanding during the periods presented.

“Adjusted EBITDA per common share” is useful to

securities analysts, investors and other interested parties in

evaluating operating and financial performance. Adjusted EBITDA per

common share is calculated on the same basis as net income (loss)

per common share, utilizing the basic and diluted weighted average

number of common shares outstanding during the periods

presented.

Supplementary Financial Measures

A supplementary financial measure: (a) is, or is intended to be,

disclosed on a periodic basis to depict the historical or expected

future financial performance, financial position or cash flow of

the Company; (b) is not presented in the financial statements of

the Company; (c) is not a non-GAAP financial measure; and (d) is

not a non-GAAP ratio.

Supplementary financial measures presented and discussed in this

news release is as follows:

- “Gross margin percentage” represents gross margin as a

percentage of revenue

- “Annual Recurring Revenue” represents total annualized

value of recurring service amounts of all service contracts

- “Net Dollar Retention” represents the aggregate service

revenue contractually committed

- “Product gross margin percentage” represents product

gross margin as a percentage of product revenue

- “Service gross margin percentage” represents service

gross margin as a percentage of service revenue

- “Cash used in operating activities as a percentage of

revenue” represents cash used in operating activities as a

percentage of total revenue

- “Total expenses as a percentage of revenue” represents

total expenses as a percentage of total revenue

Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and

forward-looking information (collectively “forward-looking

information”) within the meaning of applicable securities laws

relating to, among other things, Blackline’s expectation to deliver

top line growth and significant profitability in the long run;

Blackline’s expectation that strong gross margin percentages for

hardware and service are an excellent benchmark for fiscal 2024 and

will push Blackline to sustained profitability; that the Company

expects to continue revenue and market share growth while

maintaining cost discipline to achieve consistent positive Adjusted

EBITDA in the second half of fiscal 2024; that the Europe region

remains a key driver of growth for Blackline in fiscal 2024; and

the Company’s expectation to continue to reduce cash burn through

cost optimization, margin expansion and revenue growth which the

Company expects will lead to a sustainable free cash generating

business. Blackline provided such forward-looking statements in

reliance on certain expectations and assumptions that it believes

are reasonable at the time. The material assumptions on which the

forward-looking information in this news release are based, and the

material risks and uncertainties underlying such forward-looking

information, include: expectations and assumptions concerning

business prospects and opportunities, customer demands, the

availability and cost of financing, labor and services, that

Blackline will pursue growth strategies and opportunities in the

manner described herein, and that it will have sufficient resources

and opportunities for the same, that other strategies or

opportunities may be pursued in the future, and the impact of

increasing competition, business and market conditions; the

accuracy of outlooks and projections contained herein; that future

business, regulatory, and industry conditions will be within the

parameters expected by Blackline, including with respect to prices,

margins, demand, supply, product availability, supplier agreements,

availability, and cost of labour and interest, exchange, and

effective tax rates; projected capital investment levels, the

flexibility of capital spending plans, and associated sources of

funding; cash flows, cash balances on hand, and access to the

Company’s credit facility being sufficient to fund capital

investments; foreign exchange rates; near-term pricing and

continued volatility of the market; accounting estimates and

judgments; the ability to generate sufficient cash flow to meet

current and future obligations; the Company’s ability to obtain and

retain qualified staff and equipment in a timely and cost-efficient

manner; the Company’s ability to carry out transactions on the

desired terms and within the expected timelines; forecast

inflation, including on the Company’s components for its products,

the impacts of the military conflict between Russia and Ukraine and

between Israel and Palestine on the global economy; and other

assumptions, risks, and uncertainties described from time to time

in the filings made by Blackline with securities regulatory

authorities. Although Blackline believes that the expectations and

assumptions on which such forward-looking information is based are

reasonable, undue reliance should not be placed on the

forward-looking information because Blackline can give no assurance

that they will prove to be correct. Forward-looking information

addresses future events and conditions, which by their very nature

involve inherent risks and uncertainties, including the risks set

forth above and as discussed in Blackline’s Management’s Discussion

and Analysis and Annual Information Form for the year ended October

31, 2023 and available on SEDAR+ at www.sedarplus.ca. Blackline’s

actual results, performance or achievement could differ materially

from those expressed in, or implied by, the forward-looking

information and, accordingly, no assurance can be given that any of

the events anticipated by the forward-looking information will

transpire or occur, or if any of them do so, what benefits

Blackline will derive therefrom. Management has included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

readers with a more complete perspective on Blackline’s future

operations and such information may not be appropriate for other

purposes. Readers are cautioned that the foregoing lists of factors

are not exhaustive. These forward-looking statements are made as of

the date of this press release and Blackline disclaims any intent

or obligation to update publicly any forward-looking information,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

(1) This news release presents certain

non-GAAP and supplementary financial measures, including key

performance indicators used by management and typically used by

companies in the software-as-a-service industry, as well as

non-GAAP ratios to assist readers in understanding the Company’s

performance. Further details on these measures and ratios are

included in the “Key Performance Indicators,” and “Non-GAAP and

Supplementary Financial Measures” sections of this news

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240118786373/en/

INVESTOR AND ANALYST CONTACT Shane Grennan, Chief

Financial Officer sgrennan@blacklinesafety.com Telephone: +1 403

630 8400

MEDIA CONTACT Christine Gillies, Chief Product &

Marketing Officer cgillies@blacklinesafety.com Telephone: +1 403

629 9434

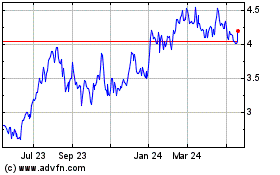

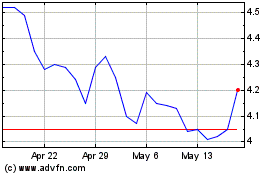

Blackline Safety (TSX:BLN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Blackline Safety (TSX:BLN)

Historical Stock Chart

From Dec 2023 to Dec 2024