European Residential Real Estate Investment Trust ("ERES" or the

"REIT") (TSX: ERE.UN) announced today its results for the three

months ended March 31, 2021.

FIRST QUARTER 2021

HIGHLIGHTS

- Strong operating results continued

for the three months ended March 31, 2021, fueled by accretive

acquisitions since the comparable prior year period and ongoing

strong rental growth, with a 3.9% increase in both stabilized Net

Average Monthly Rent ("AMR") and stabilized Occupied AMR.

- Turnover was 3.8% for the three

months ended March 31, 2021, with rental uplift on turnover of

13.3% for the period, compared to turnover of 4.1% and rental

uplift on turnover of 7.9% in the prior year period.

- Occupancy for both the residential

and commercial properties remained stable at 98.3% and 100.0%,

respectively, as at March 31, 2021, with 78% of residential vacancy

in the current period due to renovation.

- NOI increased by 10% for the three

months ended March 31, 2021 compared to the first quarter of 2020,

primarily due to contribution from accretive acquisitions since the

prior year period as well as the aforementioned higher monthly

rents, supporting a stable NOI margin of 75.5%.

- The REIT continues to collect

residential rental revenue at a rate consistent with its historical

average, and its two office properties also provide stable and

consistent cash flows.

- The fair value of the REIT’s

property portfolio remained stable at €1.47 billion as at March 31,

2021, consisting of €1.36 billion in multi-residential properties

and €0.11 billion in commercial properties.

- Liquidity and leverage remain

strong, supported by the REIT's staggered mortgage profile with a

four-year weighted average term to maturity and a weighted average

effective interest rate of 1.61%. The REIT has immediately

available liquidity of €101 million as at March 31, 2021, and its

total debt to gross book value is 47.3%.

- On March 10, 2021, the REIT

extended its Pipeline Agreement with CAPREIT for an additional

two-year period, ending on March 29, 2023, under the same terms and

conditions, which makes available to the REIT a further €165

million to acquire properties.

- On February 23, 2021, the Board of

Trustees approved an increase in the REIT's monthly distribution

from its previous rate of €0.00875 per Unit (equivalent to €0.105

per Unit annualized) to €0.00917 per Unit (equivalent to €0.110 per

Unit annualized). Accordingly, during the three months ended March

31, 2021, the REIT declared monthly distributions of €0.00875 per

Unit in respect of January and February, and €0.00917 per Unit in

respect of March.

"In passing the two-year milestone since ERES's

inception, we reflect on what has proven to be an extremely

atypical operating environment, characterized by extraordinary

uncertainty and volatility, and these circumstances have provided

the backdrop to more than half of our historical record thus far,"

commented Phillip Burns, Chief Executive Officer. "In this context,

we are very pleased with ERES's strong and stable performance and

the track record it has established to date, which highlights the

core value inherent in our strategy. This first quarter of 2021 has

been no exception to that trend, and while we will continue to

strengthen operationally and grow internally, we continue to aim to

grow externally through accretive acquisitions in the quarters to

come."

STEADFAST OPERATIONAL GROWTH, DESPITE

CONTINUING ADVERSITYFor the three months ended March 31,

2021, property revenues were €18.8 million, up from €17.1 million

for the three months ended March 31, 2020. The increase is

primarily due to accretive acquisitions since the prior year period

and an increase in AMR on the stabilized portfolio. Stabilized Net

AMR for the multi-residential portfolio increased by 3.9% to €890

per suite at March 31, 2021, from €857 per suite at the same time

last year, driven by increased rents on annual indexation, turnover

and conversion of regulated suites to liberalized suites.

Stabilized Occupied AMR also increased by 3.9% compared to the

prior year period.

Net Operating Income ("NOI") was €14.2 million

for the three months ended March 31, 2021, up from €13.0 million

for the three months ended March 31, 2020. The increase in NOI was

likewise driven by contribution from acquisitions since the prior

year period as well as higher monthly rents on stabilized

properties. This was offset by higher property operating costs as a

percentage of operating revenues, primarily due to higher R&M,

including an increase in cleaning costs associated with the third

wave of the COVID-19 pandemic, as well as certain one-time

recoverable R&M expenses incurred in the REIT's commercial

portfolio. In aggregate, total portfolio NOI margin remained strong

at 75.5% for the three months ended March 31, 2021, compared to

76.0% in the quarter ended March 31, 2020.

Funds from Operations ("FFO") for the three

months ended March 31, 2021 were €8.3 million (€0.036 per Unit),

compared to €7.6 million (€0.033 per Unit) in the prior year

period. Adjusted Funds from Operations ("AFFO") for the three

months ended March 31, 2021 were €7.3 million (€0.032 per Unit),

compared to €6.8 million (€0.030 per Unit) in the same prior year

period. The increases in FFO and AFFO were driven by the positive

impact of increased stabilized NOI and accretive acquisitions since

the prior year period. FFO and AFFO are calculated in accordance

with the recommendations of the Real Property Association of Canada

("REALpac") as published in its white paper in February 2019 with

the exception of certain adjustments which are: (i) general and

administrative expenses related to structuring and (ii) acquisition

research costs.

STRONG AND CONSERVATIVE FINANCIAL

POSITIONERES's liquidity and leverage remain strong,

supported by the REIT's staggered mortgage profile with a four-year

weighted average term to maturity and a weighted average effective

interest rate of 1.61%. The majority of the REIT's mortgages are

also non-amortizing, with no maturities occurring until December

2022. The REIT has immediately available liquidity of €101 million

as at March 31, 2021, and its total debt to gross book value is

47.3%.

"The extension of the Pipeline Agreement with

CAPREIT during the first quarter of 2021 further expands ERES's

strong standalone liquidity position, providing a significant

supplemental source of in-place capital to bolster acquisition

capacity," added Stephen Co, Chief Financial Officer. "This is

symbolic of ERES's intentions for 2021 and onward, while also

representing CAPREIT's support for ERES."

DISTRIBUTIONSDuring the three

months ended March 31, 2021, the REIT declared monthly

distributions of €0.00875 per Unit (equivalent to €0.105 per Unit

annualized) in respect of January and February, and €0.00917 per

Unit (equivalent to €0.110 per Unit annualized) in respect of

March, following an increase in the REIT's monthly distribution

rate. Such distributions are paid to Unitholders of record on each

record date, on or about the 15th day of the month following the

record date. The REIT intends to continue to make regular monthly

distributions, subject to the discretion of its Board of

Trustees.

CONFERENCE CALLA conference

call hosted by Phillip Burns, Chief Executive Officer and Stephen

Co, Chief Financial Officer, will be held on Wednesday, May 5, 2021

at 9:00 am EST. The telephone numbers for the conference call are:

Local/International: (416) 406-0743, North American Toll Free:

(800) 898-3989. The Passcode for the call is 5247379#.

A slide presentation to accompany Management’s

comments during the conference call will be available an hour and a

half prior to the conference call. To view the slides, access the

ERES REIT website at www.eresreit.com, click on “Investor Info”,

and follow the link at the top of the page. Please log on at least

15 minutes before the call commences.

The telephone numbers to listen to the call

after it is completed (Instant Replay) are local/international

(905) 694-9451 or North American toll free (800) 408-3053. The

Passcode for the Instant Replay is 3781063#. The Instant Replay

will be available until midnight, May 30, 2021. The call and

accompanying slides will also be archived on the ERES REIT website

at www.eresreit.com.

FINANCIAL AND OPERATING

HIGHLIGHTSFinancial Highlights

|

For the Three Months Ended March 31, |

2021 |

|

2020 |

|

Portfolio Performance |

|

|

|

Residential Properties |

|

|

|

Residential Occupancy 1 |

98.3 |

% |

|

98.3 |

% |

|

Residential Net AMR 1 |

€ |

886 |

|

|

€ |

857 |

|

|

Number of residential suites 1 |

6,047 |

|

|

5,632 |

|

|

Commercial Properties |

|

|

|

Commercial Occupancy 1 |

100.0 |

% |

|

100.0 |

% |

|

Commercial Net ABR 1 |

€ |

17.8 |

|

|

€ |

17.7 |

|

|

GLA of commercial properties (sqf) 1 |

450,911 |

|

|

450,911 |

|

|

|

|

|

|

Operating Revenues (000s) |

€ |

18,822 |

|

|

€ |

17,060 |

|

|

NOI (000s) |

€ |

14,210 |

|

|

€ |

12,965 |

|

|

NOI Margin |

75.5 |

% |

|

76.0 |

% |

|

|

|

|

|

Financial Performance |

|

|

|

FFO per Unit – Basic 2, 3 |

€ |

0.036 |

|

|

€ |

0.033 |

|

|

AFFO per Unit – Basic 2, 3 |

€ |

0.032 |

|

|

€ |

0.030 |

|

|

Cash distributions per Unit 3 |

€ |

0.026 |

|

|

€ |

0.026 |

|

|

FFO payout ratio 2, 3 |

74.0 |

% |

|

79.2 |

% |

|

AFFO payout ratio 2, 3 |

83.9 |

% |

|

88.9 |

% |

|

|

|

|

|

Liquidity and Leverage |

|

|

|

Total Debt to Gross Book Value 1, 4 |

47.3 |

% |

|

44.8 |

% |

|

Weighted Average Mortgage Effective Interest Rate 1, 5 |

1.61 |

% |

|

1.64 |

% |

|

Weighted Average Mortgage Term (years) 1 |

4.16 |

|

|

5.09 |

|

|

Debt Service Coverage (times) 6 |

3.49 |

|

|

3.24 |

|

|

Interest Coverage Ratio (times) 6 |

4.01 |

|

|

3.72 |

|

|

Available Liquidity |

€ |

100,636 |

|

|

€ |

87,082 |

|

1 As at March 31.2 These measures are

not defined by International Financial Reporting Standards

("IFRS"), do not have standard meanings and may not be comparable

with other industries or companies3 Includes Class B LP

Units.4 Gross book value is defined as the gross book value of

the REIT's assets as per the REIT's financial statements,

determined on a fair value basis for investment

properties.5 Includes impact of deferred financing costs, fair

value adjustment and interest rate swaps.6 Based on trailing

four quarters.

|

For the Three Months Ended March 31, |

2021 |

|

2020 |

|

Other Measures |

|

|

|

Weighted Average Number of Units - Basic 1 (000s) |

230,803 |

|

|

230,578 |

|

|

Closing Price of REIT Units 2, 3 |

€ |

2.93 |

|

|

€ |

2.39 |

|

|

Closing Price of REIT Units (in C$) 2 |

$ |

4.33 |

|

|

$ |

3.72 |

|

|

Market Capitalization (millions) 1, 2, 3 |

€ |

677 |

|

|

€ |

550 |

|

|

Market Capitalization (millions in C$) 1, 2 |

$ |

1,000 |

|

|

$ |

858 |

|

1 Includes Class B LP Units.2 As at

March 31.3 Based on the foreign exchange rate of 1.4759 on

March 31, 2021 (foreign exchange rate of 1.5584 on March 31,

2020).

ERES’s unaudited consolidated financial

statements and management's discussion and analysis ("MD&A")

for the three months ended March 31, 2021 can be found at

www.eresreit.com or under ERES's profile at www.sedar.com.

About European Residential Real Estate

Investment TrustERES is an unincorporated, open-ended real

estate investment trust. ERES's REIT Units are listed on the TSX

under the symbol ERE.UN. ERES is Canada’s only European-focused

multi-residential REIT, with a current initial focus on investing

in high-quality multi-residential real estate properties in the

Netherlands. ERES owns a portfolio of 139 multi-residential

properties, comprised of 6,047 suites and ancillary retail space

located in the Netherlands, and owns one office property in Germany

and one office property in Belgium.

ERES’s registered and principal business office

is located at 11 Church Street, Suite 401, Toronto, Ontario M5E

1W1.

For more information please visit our website at

www.eresreit.com.

For further information:

| Phillip Burns |

Stephen Co |

| Chief Executive Officer |

Chief Financial Officer |

| Email: p.burns@eresreit.com |

Email: s.co@eresreit.com |

Category: Earnings

Certain statements contained in this press

release constitute forward-looking statements within the meaning of

applicable Canadian securities laws which reflect ERES’s current

expectations and projections about future results. Forward-looking

statements generally can be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “expect”, “intent”, “estimate”, “anticipate”, “believe”,

“consider”, “should”, “plans”, “predict”, “estimate”, “forward”,

“potential”, “could”, “likely”, “approximately”, “scheduled”,

“forecast”, “variation” or “continue”, or similar expressions

suggesting future outcomes or events. The forward-looking

statements made in this press release relate only to events or

information as of the date on which the statements are made in this

press release. Actual results and developments are likely to

differ, and may differ materially, from those expressed or implied

by the forward-looking statements contained in this press release.

Any number of factors could cause actual results to differ

materially from these forward-looking statements as well as future

results. Although ERES believes that the expectations reflected in

forward-looking statements are reasonable, it can give no

assurances that the expectations of any forward-looking statements

will prove to be correct. Such forward-looking statements are based

on a number of assumptions that may prove to be incorrect.

Accordingly, readers should not place undue reliance on

forward-looking statements.

Except as specifically required by applicable

Canadian securities law, ERES does not undertake any obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise, after

the date on which the statements are made or to reflect the

occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing ERES’s views

as of any date subsequent to the date of this press release.

ERES uses financial measures regarding itself,

such as adjusted funds from operations, that do not have

standardized meaning under IFRS and may not be comparable to

similar measures presented by other entities (“non-IFRS measures”).

Further information relating to non-IFRS measures, is set out in

ERES’s annual information form dated March 30, 2021 under the

heading “Non-IFRS Measures” and in ERES’s MD&A under the

heading “Non-IFRS Financial Measures.”

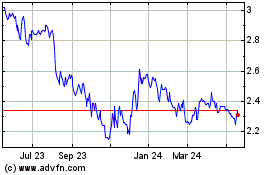

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

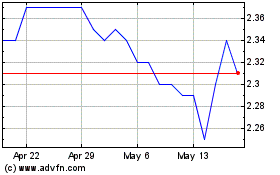

From Jan 2025 to Feb 2025

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Feb 2024 to Feb 2025