Imperial Metals Corporation (“Imperial”) (TSX:III)

reports Red Chris metal production (100%) for the first quarter of

2022 was 13.3 million pounds copper and 12,088 ounces gold,

compared to 14.7 million pounds copper and 13,610 ounces gold

produced during the fourth quarter of 2021. Imperial’s 30% portion

of the Red Chris first quarter production was 4 million pounds

copper and 3,626 ounces gold.

Metal production was lower by 9.6% for copper

and 11% for gold compared to the prior period primarily due to

lower recoveries (72.6% versus 81.1% for copper and 51.9% compared

to 59.7% for gold) and mill throughput due to unscheduled downtime

of the SAG mill and winter conditions affecting the tailings

line.

Progress towards block cave mining is advancing

with the exploration decline at 1,225 metres as of April 20, 2022

and surface infrastructure development related to the decline is

expected to be substantially complete in June 2022. The

Block Cave Feasibility Study is targeted to be completed by June

2023.

Brian Kynoch, President of Imperial, stated,

“Drilling continues to expand and define the East Ridge zone, which

is located immediately east of the current development area. The

East Ridge zone is developing into one of the more significant

zones of mineralization at Red Chris. In the context of future

development, the zone is strategically located close to the current

active operating area and the advancing exploration decline passes

near the zone, which will allow for easier access.”

Exploration drilling at Red Chris is ongoing

with up to eight drills in operation throughout the first quarter

with five drills focusing on expanding the East Ridge zone and

three gathering geotechnical information for infrastructure related

to the development of a block cave. Drilling throughout the quarter

totalled 17,543 metres.

Results from drill hole RC773 returned 256

metres grading 0.47% copper and 0.34 g/t gold from 826 metres

including an interval of 54 metres of 0.89% copper and 0.82 g/t

gold from 958 metres and 18 metres of 1.3% copper and 1.4 g/t gold

from 994 metres. This hole also returned 24 metres from 1278 metres

of 1.8% copper and 2.8 g/t gold. This hole is drilled on section

line 38N, and is approximately 150 metres above hole RC740, and is

the second hole to intersect the East Ridge zone mineralization on

this section, which is located near the eastern edge of drilling

zone to date.

Results from drill hole RC777 returned 480

metres grading 0.41% copper and 0.42 g/t gold from 1012 metres

including an interval of 78 metres from 1324 metres of 0.74% copper

and 0.79 g/t gold and 10 metres from 1324 metres of 1.1% copper and

1.6 g/t gold. Notable intercepts from hole RC779 include 560 metres

of 0.45% copper and 0.35 g/t gold from 1216 metres including 98

metres of 0.72% copper and 0.59 g/t gold from 1502 metres and 12

metres of 1.2% copper and 1.1 g/t gold from 1542 metres. Both these

holes are on section line 37N and extend the East Ridge

mineralization to depth on this section, with hole RC777 located

about 100 metres beneath hole RC735 and RC779 is located 100 metres

beneath RC777.

Hole RC785 extended the corridor to the east, a

further 100 metres beyond RC740 (previously reported), and returned

the deepest significant intercept in the East Ridge which remains

open at depth. Results from RC785 include 214 metres from 1,532

metres of 0.37% copper and 0.26 g/t gold, and 24 metres of 1.1%

copper and 0.83 g/t gold from 1,532 metres.

|

Drill Holes |

From (m) |

To (m) |

Width (m) |

Copper (%) |

Gold (g/t) |

|

East Ridge: |

|

|

|

|

|

|

RC773 |

826 |

1082 |

256 |

0.47 |

0.34 |

|

including |

958 |

1012 |

54 |

0.89 |

0.82 |

|

including |

994 |

1012 |

18 |

1.3 |

1.4 |

|

and |

1276 |

1444 |

168 |

0.51 |

0.51 |

|

including |

1278 |

1302 |

24 |

1.8 |

2.8 |

|

RC777 |

1012 |

1492 |

480 |

0.41 |

0.42 |

|

including |

1324 |

1402 |

78 |

0.74 |

0.79 |

|

including |

1324 |

1334 |

10 |

1.1 |

1.6 |

|

RC779 |

1216 |

1776 |

560 |

0.45 |

0.35 |

|

including |

1502 |

1600 |

98 |

0.72 |

0.59 |

|

including |

1542 |

1554 |

12 |

1.2 |

1.1 |

|

RC785 |

1532 |

1746 |

214 |

0.37 |

0.26 |

|

Including |

1532 |

1556 |

24 |

1.1 |

0.83 |

Jim Miller-Tait, P.Geo., Imperial Metals Vice

President Exploration, is the designated Qualified Person as

defined by National Instrument 43-101 for the Red Chris exploration

program and has reviewed this news release. Red Chris samples

for the 2021/2022 drilling reported were analysed at Bureau Veritas

Mineral Laboratories in Vancouver. A full QA/QC program using

blanks, standards and duplicates was completed for all diamond

drilling samples submitted to the labs. Significant assay

intervals reported represent apparent widths. Insufficient

geological information is available to confirm the geological model

and true width of significant assay intervals.

Cross section, plan view maps and drillhole data

are available on imperialmetals.com.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%), and the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb Dhillon | Chief Financial Officer

| 604.488.2658Jim Miller-Tait |

Vice President Exploration |

604.488.2676

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Imperial

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding Imperial’s

expectations and timing with respect to current and planned

drilling programs at Red Chris, including plans to expand and

define the extent and continuity of mineralization at the East

Ridge zone; the progress and advancement of the exploration

decline; and the timing regarding completion of the Block Cave

Feasibility Study and surface infrastructure development related to

the exploration decline.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Imperial to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

release, Imperial has applied certain factors and assumptions that

are based on information currently available to Imperial as well as

Imperial’s current beliefs and assumptions. These factors and

assumptions and beliefs and assumptions include, the risk factors

detailed from time to time in Imperial’s interim and annual

financial statements and management’s discussion and analysis of

those statements, all of which are filed and available for review

on SEDAR at www.sedar.com. Although Imperial has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, imperialmetals.com events or results not to be as

anticipated, estimated or intended, many of which are beyond

Imperial’s ability to control or predict. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements

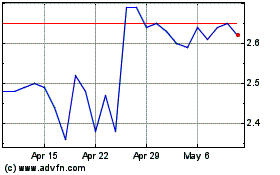

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

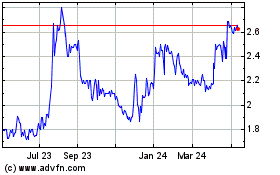

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024