Imperial Metals Corporation (the "Company")

(TSX:III) would like to remind its shareholders of the upcoming

deadlines and essential details of its previously announced rights

offering (the “Rights Offering”) made to the holders of common

shares of the Company (“Common Shares”) of record at the close of

business (Pacific Time) on May 31, 2022. The rights (“Rights”) will

expire at 2:00 p.m. (Pacific Time) on June 24, 2022 (the "Expiry

Time"), after which time unexercised rights will be void and of no

value.

The Company issued one Right for each

outstanding Common Share. Each Right is exercisable to acquire

0.125 Common Shares of the Company, upon payment of the

subscription price of $3.04 per Common Share (called the “Basic

Subscription Privilege”). Fractional shares will not be issued and

any fractions will be rounded down to the nearest whole number. To

illustrate: an eligible holder of 10,000 shares as of the record

date would be issued 10,000 Rights, which would entitle the holder

to subscribe for 1,250 shares (10,000 x 0.125) for an aggregate

price of C$3,800 (1,250 x C$3.04).

Shareholders who fully exercise their Rights

will be entitled to subscribe pro rata for additional Common Shares

in the Rights Offering, if available, as a result of unexercised

Rights prior to the Expiry Time, subject to certain limitations set

out in the Company’s rights offering circular dated May 19, 2022

(the “Rights Offering Circular”).

A rights offering notice (“Notice”) and Rights

DRS advice statements (“Rights DRS”) were mailed to each registered

shareholder of the Company resident in Canada and certain other

eligible jurisdictions as at the record date. Registered

shareholders who wish to exercise their Rights must forward the

completed Rights DRS, together with the applicable funds, to the

Rights agent, Computershare Investor Services Inc., on or before

the Expiry Time. Eligible shareholders who own their Common Shares

through an intermediary, such as a bank, trust company, securities

dealer or broker, will receive materials and instructions from

their intermediary.

It is important to note that many intermediaries

may have different cut off times prior to the Expiry Time. As such,

the Company recommends that all eligible shareholders who own their

Common Shares through an intermediary contact their broker or

financial advisor about the Rights Offering to ensure that they can

participate by the intermediary’s cut off time for

subscriptions.

Further details of the Rights Offering are

contained in the Rights Offering Circular, which was filed on SEDAR

under the Company’s profile at www.sedar.com and are available at

the Company’s website at www.imperialmetals.com, from your dealer

representative or by contacting the Chief Financial Officer at

604.488.2658 or by email at darb.dhillon@imperialmetals.com. The

Company has also registered the offer and sale of the shares

issuable on exercise of the Rights on a Form F-7 registration

statement under the U.S. Securities Act of 1933, as amended.

Shareholders in the United States should also review the Company’s

Registration Statement on Form F-7 which has been filed with the

United States Securities and Exchange Commission and can be found

at www.sec.gov and may also be obtained by contacting the Chief

Financial Officer at 604.488.2658 or by email at

darb.dhillon@imperialmetals.com.

The Rights Offering is subject to certain

conditions including, but not limited to, the receipt of all

necessary regulatory approvals, including the acceptance of the

Toronto Stock Exchange.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities, in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such

jurisdiction.

About ImperialImperial is a

Vancouver based exploration, mine development and operating

company. The Company, through its subsidiaries, owns a 30% interest

in the Red Chris mine, and a 100% interest in both the Mount Polley

and Huckleberry copper mines in British Columbia. Imperial also

holds a portfolio of 23 greenfield exploration properties in

British Columbia.

Company ContactsBrian Kynoch |

President | 604.669.8959Darb S. Dhillon

| Chief Financial Officer |

604.488.2658

Forward-Looking Information and Risks

Notice

Certain information contained in this news

release are not statements of historical fact and are

"forward-looking" statements. Forward-looking statements relate to

future events or future performance and reflect Company

management's expectations or beliefs regarding future events and

include, but are not limited to, specific statements regarding the

Rights Offering, including the timing and completion of the Rights

Offering, the intended use of proceeds raised under the Rights

Offering and statements regarding subsequent draw downs of the

Company’s existing credit facility and intended use of funds with

respect to any such draw down. In certain cases, forward-looking

statements can be identified by the use of words such as “plans”,

“expects” or “does not expect”, “is expected”, “outlook”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative of these terms or comparable terminology.

In this document certain forward-looking statements are identified

by words including “guidance”, “expectations”, “targeted”, “plan”,

“planned”, “estimated”, “calls for” and “expected”. Forward-looking

information is not based on historical facts, but rather on then

current expectations, beliefs, assumptions, estimates and forecasts

about the business and the industry and markets in which the

Company operates, including, amongst other things, assumptions

that: the Company will receive all necessary regulatory, stock

exchange and third party approvals in respect of the Rights

Offering; the timing of the Rights Offering will meet the Company’s

expectations based on its business and operational requirements;

the Rights Offering will provide sufficient liquidity to support

the Company’s intended use of the proceeds therefrom. Such

statements are qualified in their entirety by the inherent risks

and uncertainties surrounding future expectations. We can give no

assurance that the forward-looking information will prove to be

accurate.

By their very nature forward-looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others,

risks that the Rights Offering will not provide the expected

liquidity or benefits to the Company’s business or operations;

risks that required consents and approvals will not be received in

order to advance or complete the Rights Offering; uncertainties

relating to the cost of completing the Rights Offering; risks that

could cause the Company to allocate the proceeds of the Rights

Offering in a manner other than as disclosed, including all of the

risks related to the Company's business, financial condition,

result of operations and cash flows; and other risks of the mining

industry as well as those factors detailed from time to time in the

Company's interim and annual financial statements and management's

discussion and analysis of those statements, all of which are filed

and available for review on sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking statements.

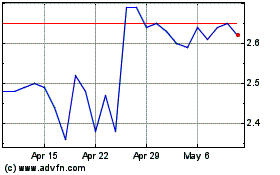

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

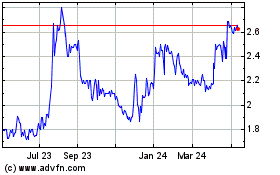

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024