Kelt Enters Into an Agreement to Acquire Strategic Montney Assets

in Its Core Area Near Grande Prairie

CALGARY, ALBERTA--(Marketwired - Jun 16, 2014) - Kelt

Exploration Ltd. ("Kelt" or the "Company") (TSX:KEL) has entered

into an agreement to acquire a private Canadian oil and gas company

with crude oil and natural gas assets located at Valhalla/La Glace,

adjacent to the Company's core producing areas at Pouce Coupe and

Spirit River in west central Alberta. The acquisition is subject to

standard industry closing conditions and closing is expected to

occur on or around July 2, 2014.

The consideration to be paid by Kelt is $165.0 million, before

closing adjustments, and will be financed by existing cash on hand

and the issuance of 4.3 million common shares of Kelt to the

shareholders of the private Canadian oil and gas company. Based on

the five day volume weighted average price of Kelt shares that

traded on the Toronto Stock Exchange from June 9th to 13th of

$13.58, the value of the common share consideration is $58.0

million. The balance of $107.0 million will be paid in cash.

Key Attributes of

Assets to be Acquired

- Current net production is estimated to be approximately 2,300

BOE per day (70% oil and 30% gas) from Triassic horizons, primarily

from the Montney formation and also including production from the

Halfway and Charlie Lake formations.

- At index pricing for crude oil of WTI US$95.00 per barrel and

for natural gas at AECO $4.50 per GJ, operating netbacks are

approximately $40.00 per BOE, providing approximately $33.6 million

of annual operating income at current production levels.

- Petroleum and natural gas reserves to be acquired have been

evaluated internally by Kelt effective December 31, 2013:

- Proved developed producing reserves were 3.4 million BOE, with

$1.5 million in associated future development capital;

- Total proved reserves were 6.2 million BOE, with $38.4 million

in associated future development capital; and

- Total proved plus probable reserves were 11.7 million BOE, with

$60.7 million in associated future development capital.

- Long-life reserves with a proved plus probable reserve life

index of 14.0 years based on current production.

- Infrastructure component with interests in major oil and gas

facilities including the following:

- 100% ownership interest in an oil battery, recently upgraded to

handle 3,500 barrels of oil per day and 20.0 mmcf of gas per day;

and

- 100% ownership interests in gas compressors and oil and gas

gathering pipelines.

- The Valhalla/La Glace assets include an extensive land position

that is a complementary fit geographically to Kelt's existing core

areas at Pouce Coupe and Spirit River and are located approximately

18 miles south of Pouce Coupe/Spirit River and approximately 15

miles northwest of Grande Prairie. The acquisition includes 38,400

gross acres (60 gross sections) and 32,981 net acres (51.5 net

sections) of land.

- The Valhalla/La Glace assets will be operated from Kelt's

established field office located in Grande Prairie, Alberta.

Acquisition

Metrics

- Based on current production and not adjusting for land and

infrastructure value, production is being acquired for $71,700 per

flowing BOE per day (70% oil and 30% gas).

- Based on proved plus probable reserves and after taking into

account future development capital costs, reserves are being

acquired for $19.23 per BOE, giving the Company an acquisition

recycle ratio of 2.1 times using commodity prices of US95.00 per

barrel for WTI oil and $4.50 per GJ for AECO gas.

Future Upside

Potential

The Company has identified 58 gross (56.0 net) horizontal

drilling locations primarily targeting the Montney formation. This

would entail in excess of $290.0 million gross ($280.0 million net)

in future capital spending, adding to the Company's significant

drilling inventory and opportunity for future growth in the years

ahead.

The Montney drilling inventory located at Valhalla/La Glace is

primarily on 100% working interest lands targeting crude oil with

associated gas.

Revised 2014

Guidance

Upon closing and after giving effect to the Valhalla/La Glace

acquisition, including the issuance of Kelt common shares, the

Company has revised its 2014 guidance as follows:

|

Previous Guidance |

Revised Guidance |

Percent Change |

| Average 2014 Production |

|

|

|

|

|

Oil (bbls/d) |

2,575 |

3,285 |

28% |

|

|

NGLs (bbls/d) |

755 |

850 |

13% |

|

|

Gas (mcf/d) |

46,020 |

48,090 |

4% |

|

|

Combined (BOE/d) |

11,000 |

12,150 |

10% |

| WTI oil price (US$/bbl) |

92.00 |

92.00 |

- |

| NYMEX natural gas price (US$/MMBTU) |

4.60 |

4.60 |

- |

| AECO natural gas price ($/GJ) |

4.55 |

4.55 |

- |

| Exchange rate (US$/CA$) |

0.9174 |

0.9174 |

- |

| Funds from operations ($MM) |

103.0 |

116.0 |

13% |

|

|

Per share, diluted |

0.85 |

0.94 |

11% |

| Capital expenditures, including acquisitions ($MM) |

250.0 |

428.0 |

71% |

| Debt, net of working capital at year-end ($MM) |

3.0 |

110.0 |

|

The impact on average 2014 production relating to the

acquisition is reflected from the anticipated closing date of July

2, 2014. Full year benefits of the acquired production will be

recognized in 2015 and is reflected in the exit 2014 production

rate shown in the table below.

Revised 2014 Exit

Forecast

Upon closing and after giving effect to the Valhalla/La Glace

acquisition, including the issuance of Kelt common shares, the

Company has revised its 2014 exit production forecast as follows

(annualized funds from operations is calculated using a forecasted

WTI oil price of US$95.00 per barrel and an AECO gas price of $4.50

per GJ):

|

Previous Forecast |

Revised Forecast |

Percent Change |

| EXIT 2014 Production |

|

|

|

|

|

Oil (bbls/d) |

2,970 |

4,395 |

48% |

|

|

NGLs (bbls/d) |

1,025 |

1,210 |

18% |

|

|

Gas (mcf/d) |

54,030 |

58,170 |

8% |

|

|

Combined (BOE/d) |

13,000 |

15,300 |

18% |

| Annualized funds from operations ($MM) |

132.0 |

161.5 |

22% |

|

|

Per share, diluted |

1.06 |

1.26 |

19% |

| Debt, net of working capital at year-end ($MM) |

3.0 |

110.0 |

|

| Debt/funds from operations ratio |

0.0 x |

0.7 x |

|

Financial

Position

After giving effect to the acquisition, including the issuance

of Kelt common shares, Kelt estimates that it will have bank debt,

net of working capital, of approximately $110.0 million at the end

of 2014. Based on forecasted exit annualized funds from operations

of $161.5 million, the Company would have a debt to funds from

operations ratio of 0.7 times, giving the Company sufficient

financial flexibility to carry out a growth oriented capital

expenditure budget in 2015.

Prior to the Valhalla/La Glace acquisition, Kelt has an

agreement with a syndicate of financial institutions for a

committed term credit facility whereby the lenders approved a

borrowing base of $170.0 million and a committed amount of $100.0

million. Upon closing and after giving effect to the acquisition,

Kelt expects to increase the amount of its term credit

facility.

About Kelt

Kelt is a Calgary, Alberta, Canada-based oil and gas company

focused on exploration, development and production of crude oil and

natural gas resources, primarily in west central Alberta and

northeastern British Columbia.

Cautionary Statement and Advisory Regarding Forward-Looking

Statements and Information

Certain information with respect to the Company contained

herein, including expectations, beliefs, plans, goals, objectives,

assumptions, information and statements about future events,

conditions, results of operations, performance, Kelt's planned

capital expenditure program, or management's assessment of future

potential, contain forward-looking statements. In particular,

forward-looking statements contained in this press release include,

but are not limited to: the timing and completion of the

acquisition of the Canadian private oil and gas company, the

issuance of common shares, the impact on production, the

quantification of potential future drilling locations and resulting

impact on capital expenditures. These forward-looking statements

are based on assumptions and are subject to numerous risks and

uncertainties, certain of which are beyond the Company's control,

including the impact of general economic conditions, industry

conditions, volatility of commodity prices, currency exchange rate

fluctuations, imprecision of reserve estimates, environmental

risks, competition from other explorers, stock market volatility,

and ability to access sufficient capital. We caution that the

foregoing list of risks and uncertainties is not exhaustive.

Statements relating to "reserves" are deemed to be forward

looking statements as they involve the implied assessment, based on

current estimates and assumptions that the reserves can be

profitably produced in the future.

Kelt's actual results, performance or achievement could differ

materially from those expressed or implied by these forward-looking

statements and, accordingly, no assurance can be given that any

events anticipated by the forward-looking statements will transpire

or occur. As a result, undue reliance should not be placed on

forward-looking statements.

In addition, the reader is cautioned that historical results are

not necessarily indicative of future performance. The

forward-looking statements contained herein are made as of the date

hereof and the Company does not intend, and does not assume any

obligation, to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise

unless expressly required by applicable securities laws.

Certain information set out herein may be considered as

"financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding Kelt's reasonable expectations as to the

anticipated results of its proposed business activities for the

periods indicated. Readers are cautioned that the financial outlook

may not be appropriate for other purposes.

Non-GAAP Measures

This press release contains certain financial measures, as

described below, which do not have standardized meanings prescribed

by GAAP. As these measures are commonly used in the oil and gas

industry, the Company believes that their inclusion is useful to

readers. The reader is cautioned that these amounts may not be

directly comparable to measures for other companies where similar

terminology is used. "Operating netback" is calculated by deducting

royalties, production expenses and transportation expenses from oil

and gas revenue. "Funds from operations" is calculated by adding

back settlement of decommissioning obligations and change in

non-cash operating working capital to cash provided by operating

activities. Funds from operations per common share is calculated on

a consistent basis with profit (loss) per common share, using basic

and diluted weighted average common shares as determined in

accordance with GAAP. Funds from operations and operating netbacks

are used by Kelt as key measures of performance and are not

intended to represent operating profits nor should they be viewed

as an alternative to cash provided by operating activities, profit

or other measures of financial performance calculated in accordance

with GAAP.

Measurements and Abbreviations

All dollar amounts are referenced in thousands of Canadian

dollars, except when noted otherwise. Where amounts are expressed

on a barrel of oil equivalent ("BOE") basis, natural gas volumes

have been converted to oil equivalence at six thousand cubic feet

per barrel and sulphur volumes have been converted to oil

equivalence at 0.6 long tons per barrel. The term BOE may be

misleading, particularly if used in isolation. A BOE conversion

ratio of six thousand cubic feet per barrel is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

References to oil in this press release include crude oil and field

condensate. References to natural gas liquids ("NGLs") include

pentane, butane, propane, and ethane. References to gas in this

press release include natural gas and sulphur.

|

bbls |

Barrels |

|

mcf |

thousand cubic feet |

|

MMBTU |

million British Thermal Units |

|

AECO-C |

Alberta Energy Company "C" Meter Station of the Nova Pipeline

System |

|

WTI |

West

Texas Intermediate |

|

NYMEX |

New

York Mercantile Exchange |

Kelt Exploration Ltd.David J. WilsonPresident and Chief

Executive Officer(403) 201-5340Kelt Exploration Ltd.Sadiq H.

LalaniVice President, Finance and Chief Financial Officer(403)

215-5310www.keltexploration.com

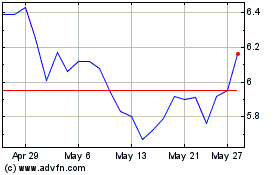

Kelt Exploration (TSX:KEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kelt Exploration (TSX:KEL)

Historical Stock Chart

From Feb 2024 to Feb 2025