NuVista Energy Ltd. ("

NuVista" or the

"

Company") (TSX:

NVA) is pleased

to announce record-setting quarterly production and share

repurchases in the fourth quarter of 2023.

Production for the quarter ended December 31,

2023 achieved a new record for NuVista, reaching a field-estimated

85,900 Boe/d, well above our fourth quarter guidance range of

82,000 – 84,000 Boe/d. This production included approximately 31%

condensate, 9% NGLs, and 60% natural gas. The increased production

is the result of strong performance from the new wells in the 2023

development program across all assets, coupled with continued

success in the debottlenecking of NuVista and 3rd party midstream

facilities. Full year 2023 production is estimated to be

approximately 77,200 Boe/d, above the previous guidance range of

76,000 – 77,000 Boe/d.

In the fourth quarter, progress on our return of

capital to shareholders was significant with a record total of $103

million deployed as promised towards return of capital (shares

repurchased on NCIB and share-based compensation settled with

cash). In 2023 in total, we repurchased and subsequently cancelled

15.3 million common shares, bringing the total to 28.8 million

common shares since inception of our share repurchase program in

mid-2022, with a weighted average price of $11.85 per share.

NuVista is pleased to note that during 2023, we

added 15.5 gross sections (98% working interest) of land in our

Wapiti area, most of which closed in the fourth quarter. This low

risk and well delineated land is located directly adjacent to

existing NuVista land and infrastructure, and adds to our inventory

of high-quality locations. Additionally, it enhances land

configuration efficiency and optimizes pipeline and field facility

utilization for growth beyond 100,000 Boe/d. These land

acquisitions are expected to lead to immediate reserves additions,

and to augment drilling locations planned for the 2024 and 2025

program.

With fourth quarter activity as expected, and

the aforementioned land acquisitions, net capital expenditures(1)

for 2023 have been increased from the originally expected $475

million to approximately $520 million. Net debt(2) for year-end

2023 is estimated to be $180 million, well below the Company soft

ceiling of approximately $350 million. The net debt ceiling ensures

that based on current production levels, our net debt to adjusted

funds flow ratio(2) remains comfortably below 1.0x in a stress test

price environment of US$45/Bbl WTI oil and US$2.00/MMBtu NYMEX

natural gas. NuVista exited 2023 with $17 million drawn on our $450

million covenant-based credit facility.

Drilling, completion, and pipeline operations

have resumed efficiently after a well-earned Christmas break for

our crews. At Wapiti, two rigs are drilling on a 6-well pad in

Elmworth, after which they will move to Pipestone South and Gold

Creek. In addition, we have begun completion operations at a

12-well pad in Pipestone North. The new cogeneration unit at our

Wembley Gas Plant in the Pipestone North area was commissioned and

has started up smoothly in the fourth quarter of 2023, with

commissioning of the gas plant heat utilization portion ongoing as

planned. The project was built in partnership with our gas plant

working interest partners, and five Indigenous Nations on whose

traditional territories NuVista operates. The investment in the

cogeneration project was facilitated by the Alberta Indigenous

Opportunities Corporation, and the project benefited from the

Alberta Environment and Parks “Industrial Energy Efficiency and

Carbon Capture Utilization and Storage” (IEE CCUS) grant program.

The project is expected to provide stable and predictable revenues

to the Nations while reducing NuVista’s costs and carbon

emissions.

Production for the first quarter of 2024 is

expected to be in the range of 77,000 – 80,000 Boe/d, followed by a

significant ramp-up of production through the remainder of the year

as new pads are brought online. This first quarter guidance

includes an allowance for the shut-in of existing adjacent wells

during the fraccing of new wells. Guidance for 2024 is re-affirmed

at 83,000 – 87,000 Boe/d of production and approximately $500

million of capital expenditures.

We look forward to releasing our full financial

results for the quarter and year ended December 31, 2023 prior to

the opening of markets on February 29, 2024.Notes:

(1) ”Net capital expenditures” is a non-GAAP

measures. Reference should be made to the section entitled

"Non-GAAP and other financial measures" in this news release for

further information.(2) “Net debt” and “net debt

to adjusted funds flow ratio” are capital management measures.

Reference should be made to the section entitled "Non-GAAP and

other financial measures" in this news release for further

information.

Advisories Regarding Oil and Gas

Information

BOEs may be misleading, particularly if

used in isolation. A BOE conversion ratio of 6 Mcf: 1 Bbl is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Analogous Information

Certain information in this news release may

constitute "analogous information" as defined in National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities ("NI 51-101"), including, but not limited to,

information relating to the lands acquired in the fourth quarter

which is believed to be on trend with the Company's adjacent

properties. Management believes the information is relevant as it

helps to define the characteristics of the acquired lands. NuVista

is unable to confirm that the analogous information was prepared by

a qualified reserves evaluator or auditor. Such information is not

an estimate of the reserves or resources attributable to lands held

or to be held by NuVista and there is no certainty that the

production and reserves information for the acquired lands will be

similar to the information presented herein. The reader is

cautioned that the data relied upon by NuVista may not be analogous

to the acquired lands.

Basis of presentation

Unless otherwise noted, the financial data

presented in this news release has been prepared in accordance with

Canadian generally accepted accounting principles (“GAAP”) also

known as International Financial Reporting Standards (“IFRS”). The

reporting and measurement currency is the Canadian dollar. NI

51-101 - "Standards of Disclosure for Oil and Gas Activities"

includes condensate within the product type of natural gas liquids.

NuVista has disclosed condensate values separate from natural gas

liquids (“NGLs”) herein as NuVista believes it provides a more

accurate description of NuVista's operations and results

therefrom.

Production split for Boe/d amounts referenced in

the news release are as follows:

|

Reference |

Total Boe/d |

Natural Gas% |

Condensate% |

NGLs% |

|

|

|

|

|

|

|

Q4 2023 production guidance |

82,000 – 84,000 |

61 |

% |

30 |

% |

9 |

% |

|

2023 annual production guidance |

76,000 – 77,000 |

61 |

% |

30 |

% |

9 |

% |

|

Q1 2024 production guidance |

77,000 – 80,000 |

61 |

% |

30 |

% |

9 |

% |

|

2024 annual production guidance |

83,000 – 87,000 |

61 |

% |

30 |

% |

9 |

% |

Advisory regarding forward-looking

information and statements

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. The use of any of the words “will”, “expects”,

“believe”, “plans”, “potential” and similar expressions are

intended to identify forward-looking statements. More particularly

and without limitation, this news release contains forward looking

statements, including but not limited to, management's assessment

of: NuVista’s future focus, strategy, plans, opportunities and

operations; NuVista’s commitment to returning capital to

shareholders through its value-adding growth strategy; NuVista’s

estimate of production for the fourth quarter and year end of 2023;

expectation regarding the development opportunities from acquired

lands and anticipated timing and benefits therefrom; NuVista’s

expectation of production growth beyond 100,000 Boe/d; NuVista’s

estimate of capital expenditures, net capital expenditures and net

debt for 2023; NuVista’s drilling plans and expected timing

thereof; expected benefits from the cogeneration unit at NuVista’s

Wembley Gas Plant; NuVista’s Q1 2024 production guidance; NuVista’s

2024 annual production and capital expenditure guidance and the

anticipated timing of NuVista’s 2023 annual financial results.

Statements relating to "reserves" are also deemed to be

forward-looking statements, as they involve the implied assessment,

based on certain estimates and assumptions, that the reserves

described exist in the quantities predicted or estimated and that

the reserves can be profitably produced in the future.

By their nature, forward-looking statements are

based upon certain assumptions and are subject to numerous risks

and uncertainties, some of which are beyond NuVista’s control,

including the impact of general economic conditions, industry

conditions, current and future commodity prices and inflation

rates, the impact of ongoing global events including European

tensions, with respect to commodity prices, currency and interest

rates, anticipated production rates, borrowing, operating and other

costs and adjusted funds flow, allocation and amount of capital

expenditures and the results therefrom, anticipated reserves and

the imprecision of reserve estimates, the performance of existing

wells, the success obtained in drilling new wells, the sufficiency

of budgeted capital expenditures in carrying out planned

activities, access to infrastructure and markets, competition from

other industry participants, availability of qualified personnel or

services and drilling and related equipment, stock market

volatility, effects of regulation by governmental agencies

including changes in environmental regulations, tax laws and

royalties, the ability to access sufficient capital from internal

sources and bank and equity markets, that we will be able to

execute our drilling plans and infrastructure expansion plans as

expected, those risks considered under “Risk Factors” in our Annual

Information Form. Readers are cautioned that the assumptions used

in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on

forward-looking statements. NuVista’s actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements, or if any of them do

so, what benefits NuVista will derive therefrom. NuVista has

included the forward-looking statements in this news release in

order to provide readers with a more complete perspective on

NuVista’s future operations and such information may not be

appropriate for other purposes. NuVista disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

NuVista's 2024 guidance is based on various

commodity price scenarios and economic conditions; certain guidance

estimates may fluctuate with commodity price changes and regulatory

changes. NuVista's guidance provides readers with the information

relevant to management's expectation for financial and operational

results for 2024. Readers are cautioned that the guidance estimates

may not be appropriate for any other purpose.

This news release contains information that may

be considered a financial outlook under applicable securities laws

about NuVista's potential financial position, including, but not

limited to, net debt, net capital expenditures, capital

expenditures and net debt to adjusted funds flow, all of which are

subject to numerous assumptions, risk factors, limitations and

qualifications, including those set forth herein. The actual

results of operations of NuVista will vary from the amounts set

forth in this news release and such variations may be material.

This information has been provided for illustration only and with

respect to future periods are based on budgets and forecasts that

are speculative and are subject to a variety of contingencies and

may not be appropriate for other purposes. Accordingly, these

estimates are not to be relied upon as indicative of future

results. Except as required by applicable securities laws, NuVista

undertakes no obligation to update such financial outlook. The

financial outlook contained in this news release was made as of the

date of this news release and was provided for the purpose of

providing further information about NuVista's potential future

business operations. Readers are cautioned that the financial

outlook contained in this news release is not conclusive and is

subject to change.

Non-GAAP and other financial

measures

This news release uses various specified

financial measures (as such terms are defined in National

Instrument 52-112 – Non-GAAP Disclosure and Other Financial

Measures Disclosure ("NI 51-112")) including

"non-GAAP financial measures", and “capital management measures"

(as such terms are defined in NI 51-112), which are described in

further detail below. Management believes that the presentation of

these non-GAAP measures provide useful information to investors and

shareholders as the measures provide increased transparency and the

ability to better analyze performance against prior periods on a

comparable basis.

Non-GAAP financial measures

NI 52-112 defines a non-GAAP financial measure

as a financial measure that: (i) depicts the historical or expected

future financial performance, financial position or cash flow of an

entity; (ii) with respect to its composition, excludes an amount

that is included in, or includes an amount that is excluded from,

the composition of the most directly comparable financial measure

disclosed in the primary financial statements of the entity; (iii)

is not disclosed in the financial statements of the entity; and

(iv) is not a ratio, fraction, percentage or similar

representation.

These non-GAAP financial measures are not

standardized financial measures under IFRS and might not be

comparable to similar measures presented by other companies where

similar terminology is used. Investors are cautioned that these

measures should not be construed as alternatives to or more

meaningful than the most directly comparable IFRS measures as

indicators of NuVista's performance. Set forth below are

descriptions of the non-GAAP financial measures used in this news

release.

Net capital expenditures

Net capital expenditures are equal to cash used

in investing activities, excluding changes in non-cash working

capital, and other asset expenditures. The Company includes funds

used for property acquisition or proceeds from property

dispositions within net capital expenditures as these transactions

are part of its development plans. NuVista considers net capital

expenditures to be a useful measure of cash flow used for capital

reinvestment. Reference should be made to NuVista’s Interim

Financial Statements for the three and nine months ended September

30, 2023 for additional disclosure on non-GAAP measures, including

net capital expenditures which is referenced in this news

release.

Capital management measures

NI 52-112 defines a capital management measure

as a financial measure that: (i) is intended to enable an

individual to evaluate an entity’s objectives, policies and

processes for managing the entity’s capital; (ii) is not a

component of a line item disclosed in the primary financial

statements of the entity; (iii) is disclosed in the notes to the

financial statements of the entity; and (iv) is not disclosed in

the primary financial statements of the entity. Reference should be

made to NuVista’s Interim Financial Statements for the three and

nine months ended September 30, 2023 for additional disclosure on

capital management measures, including net debt and net debt to

adjusted funds flow ratio which are referenced in this news

release.

FOR FURTHER INFORMATION CONTACT:

| Jonathan

A. Wright |

Ivan J.

Condic |

Mike J.

Lawford |

| President and CEO |

VP, Finance and CFO |

Chief Operating Officer |

| (403) 538-8501 |

(403) 538-1945 |

(403) 538-1936 |

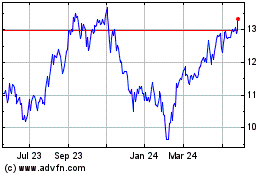

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Jan 2025 to Feb 2025

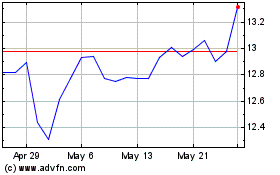

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Feb 2024 to Feb 2025