Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF;

FRANKFURT: 0AD) (“

Anfield” or the

“

Company”) is pleased to announce that it has

closed its brokered private placement in which it issued 81,820,000

units of the Company (“

Units”) at a price of

C$0.055 per Unit (the “

Offering Price”), for

aggregate gross proceeds of C$4,500,100 (the

“

Offering”).

The Offering was conducted by a syndicate of

agents led by Haywood Securities Inc., and including Red Cloud

Securities Inc. (collectively, the “Agents”).

Management and directors of Anfield subscribed for an aggregate of

9,080,000 Units representing $499,400 of the gross proceeds of the

Offering.

Each Unit was comprised of one common share in

the capital of the Company (a “Share”) plus

one-half of one Share purchase warrant (each whole such warrant, a

“Warrant”). Each Warrant entitles the holder to

purchase one additional Share (a “Warrant Share”)

at an exercise price of C$0.085 until July 10, 2025.

In consideration for their services, the Agents

received a cash commission of $255,024, and were issued an

aggregate of 4,636,800 compensation options, with each compensation

option entitling the holder to purchase one common share of the

Company at a price of $0.055 per share until July 10, 2025.

The Units were sold to purchasers pursuant to

the listed issuer financing exemption (“LIFE

Exemption”) under Part 5A of NI 45-106. Other than Units

issued to insiders of the Company, the Units will not be subject to

resale restrictions pursuant to applicable Canadian securities

laws. All Units issued to insiders of the Company are subject to

restrictions on resale until November 11, 2023 in accordance with

the policies of the TSX Venture Exchange.

The net proceeds from the Offering will be used

to fund the advancement of the Company’s uranium and vanadium

assets in the United States, and for general corporate purposes

including the anticipated acquisition of the Marquez-Juan Tafoya

uranium project in New Mexico (as previously announced by the

Company on June 6, 2023).

The Offering included participation by certain

directors of the Company in the aggregate amount of 9,080,000

Units. This participation by insiders of the Company constitutes a

“related party transaction” within the meaning of TSX Venture

Exchange Policy 5.9 and Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI

61-101”). For their participation in the Offering, the

Company has relied upon the exemption from the formal valuation

requirements contained in Section 5.5(a) of MI 61-101 and has

relied upon the exemption from the minority shareholder approval

requirements contained in Section 5.7(1)(a) of MI 61-101.

The securities offered pursuant to the Offering

have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the “U.S. Securities

Act”) or any U.S. state securities laws, and may not be

offered or sold in the United States or to, or for the account or

benefit of, United States persons absent registration or any

applicable exemption from the registration requirements of the U.S.

Securities Act and applicable U.S. state securities laws. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy securities in the United States, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a publicly

traded corporation listed on the TSX-Venture Exchange (AEC-V), the

OTCQB Marketplace (ANLDF) and the Frankfurt Stock Exchange (0AD).

Anfield is focused on its conventional asset centre, as summarized

below:

Arizona/Utah/Colorado – Shootaring Canyon

Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado, and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Slick Rock Project, the West Slope

Project, the Frank M Uranium Project, as well as the Findlay Tank

breccia pipe. A combined NI 43-101 PEA has been completed for the

Velvet-Wood and Slick Rock Projects. The PEA is preliminary in

nature, and includes inferred mineral resources that are considered

too speculative geologically to have economic considerations

applied to them that would enable them to be categorized as mineral

reserves and, resultantly, there is no certainty that the included

preliminary economic assessment would be realized. All conventional

uranium assets are situated within a 200-mile radius of the

Shootaring Mill.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact:Anfield Energy Inc.Clive MostertCorporate

Communications780-920-5044contact@anfieldenergy.com

www.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR ANY HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, STATEMENTS OR INFORMATION RELATED TO THE USE OF

PROCEEDS FROM THE OFFERING, THE RISKS ASSOCIATED WITH MINERAL

EXPLORATION AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S

MOST RECENT ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN

OTHER PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER

RISKS INCLUDE RISKS ASSOCIATED WITH THE REGULATORY

APPROVAL PROCESS, COMPETITIVE COMPANIES, FUTURE CAPITAL

REQUIREMENTS AND THE COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS

EXPLORATION AND DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE

THAT THE COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY

WILL ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

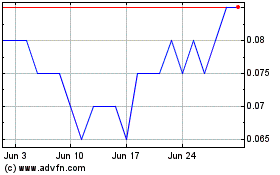

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Apr 2023 to Apr 2024