Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“

Anfield” or the

“

Company”) is pleased to announce that it has

closed its previously announced $4.3 million credit facility (the

“

Credit Facility”) with existing shareholder

Extract Advisors LLC, as Agent, on behalf of Extract Capital Master

Fund Ltd. (each as “

Lender” and collectively,

“

Extract”). The Credit Facility, in addition to

the Company’s recent equity financing, will support the Company’s

asset transaction strategy, including the Marquez-Juan Tafoya

transaction, and ongoing work programs in pursuit of the Shootaring

Canyon mill reactivation.

Terms of the Credit

Facility

The Credit Facility has a maturity date of

October 6, 2028 and bears a coupon of the Secured Overnight

Financing Rate (“SOFR”) plus 5.0% per annum,

payable semi-annually; provided the effective annualized rate of

interest does not exceed an agreed limit. Anfield, with written

notice, may elect to capitalize the interest payable on the Credit

Facility semi-annually, in arrears, at a rate of SOFR plus 7.0%.

The Credit Facility will have an original issue discount of 7%.

In connection with the Credit Facility, Anfield

issued 42,105,263 warrants to Extract, with each warrant entitling

the holder to acquire one common share of the company (a

“Facility Warrant Share”) at an exercise price of

$0.095 per warrant for a period ending on the Maturity Date (the

“Facility Warrants”). For so long as the Credit

Facility remains outstanding, all proceeds from the exercise of the

Facility Warrants by the Lender shall be used to repay the

principal amount of the Credit Facility. As additional

consideration for arranging the Loan, the Lender was paid an

arrangement fee equal to C$100,000.

The Credit Facility contains a voluntary

prepayment option, allowing Anfield to prepay the Credit Facility

at any time after the twelve-month anniversary of the closing date

by paying a prepayment fee equal to 3% of the outstanding amount of

the Credit Facility. The Credit Facility is secured by a corporate

guarantee and share pledge from each of the subsidiaries of Anfield

and contains certain other customary provisions, including certain

covenants and default conditions in favour of Extract.

Advisors and Legal Counsel

Haywood Securities Inc.

(“Haywood”) acted as financial advisor to Anfield.

Cassels Brock & Blackwell LLP acted as legal counsel to

Anfield. In connection with the closing of the Credit Facility,

Anfield issued 1,158,301 shares (the “Commission Fee

Shares”) to Haywood at a price of $0.0777 per Commission

Fee Share, along with a cash fee of $90,000, for acting as

financial advisor to Anfield. Payment of the compensation was made

in accordance with TSX Venture Exchange Policy 5.1 – Loans, Loan

Bonuses, Finder’s Fees and Commissions and approved by the TSX

Venture Exchange.

The Facility Warrants, any Facility Warrant

Shares issued upon exercise of the Facility Warrants, and the

Commission Fee Shares are subject to a hold period which expires on

February 7, 2024.

Incentive Stock Option

Grant

Anfield also announces that it has granted

36,717,828 incentive stock options to certain directors, officers,

employees and consultants of the Company. The options vest

immediately and are exercisable at a price of $0.10 until October

6, 2028.

About Extract

Extract Advisors LLC is a natural resources fund

manager with a concentration in the junior mining sector. Extract

was founded in 2012 and is based in Los Angeles and Toronto.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a publicly

traded corporation listed on the TSX-Venture Exchange (AEC-V), the

OTCQB Marketplace (ANLDF) and the Frankfurt Stock Exchange (0AD).

Anfield is focused on its conventional asset centre, as summarized

below:

Arizona/Utah/Colorado – Shootaring Canyon

Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado, and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Slick Rock Project, the West Slope

Project, the Frank M Uranium Project, as well as the Findlay Tank

breccia pipe. A combined NI 43-101 PEA has been completed for the

Velvet-Wood and Slick Rock Projects. The PEA is preliminary in

nature, and includes inferred mineral resources that are considered

too speculative geologically to have economic considerations

applied to them that would enable them to be categorized as mineral

reserves and, resultantly, there is no certainty that the included

preliminary economic assessment would be realized. All conventional

uranium assets are situated within a 200-mile radius of the

Shootaring Mill.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact:Anfield Energy Inc.Clive MostertCorporate

Communications780-920-5044contact@anfieldenergy.com

www.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR ANY HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, STATEMENTS OR INFORMATION RELATED TO THE USE OF

PROCEEDS FROM THE OFFERING, THE RISKS ASSOCIATED WITH MINERAL

EXPLORATION AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S

MOST RECENT ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN

OTHER PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER

RISKS INCLUDE RISKS ASSOCIATED WITH THE REGULATORY

APPROVAL PROCESS, COMPETITIVE COMPANIES, FUTURE CAPITAL

REQUIREMENTS AND THE COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS

EXPLORATION AND DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE

THAT THE COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY

WILL ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

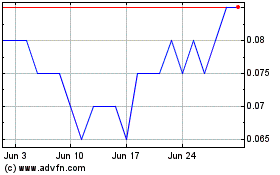

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Apr 2023 to Apr 2024