Apollo Silver Corp. (“

Apollo” or

the “

Company”) (TSX.V:APGO, OTCQB:APGOF,

Frankfurt:6ZF0) is pleased to provide the following operational and

corporate update. As part of the 2022 Metallurgical Test Program

for the Calico Silver Project (“Calico” or the “Project”), an

initial assessment of the quality of barite in the deposit was

completed. This initial test work illustrated that a high quality

barite concentrate could be produced, warranting a follow up

investigation. As a follow-up to these positive results, and in

anticipation of adding barite to the mineral resource inventory at

Waterloo, further samples have been selected for assay to

characterize the distribution of barite in the deposit.

HIGHLIGHTS

-

Concentrate with up to 94.6% barite produced via

flotation;

-

Barite concentrate meets or exceeds the standards for

chemical and physical specifications for drilling fluids for use in

the petroleum industry as defined by the American Petroleum

Institute (“API”);

-

Further testing now underway includes barite analysis of 79

samples using various assay techniques; and

-

Barite is on the U.S. Geological Survey (“USGS”) Critical

Minerals List, as it is critical for domestic metallurgical

applications in the energy industry.

“The test work we have commenced is an important

step towards including barite in a 2024 resource update at Calico,”

commented Apollo’s President and CEO Tom Peregoodoff. “The results

from this program will enable us to determine the most efficient

and cost-effective method for analyzing our drill material for

barite. We have extensive sample coverage over the entirety of the

Waterloo deposit and with a comprehensive assay program later this

year, we will have a very good understanding of the distribution of

barite. This will enable us to include this critical mineral in our

planned 2024 resource update for Calico.”

BARITE RESOURCE DEVELOPMENT

In the 2022 Final List of Critical Minerals,

published by the USGS, barite was identified as one of many

minerals which “…play a significant role in our national security,

economy, renewable energy development and infrastructure.” Barite

is critical for domestic metallurgical applications in the energy

industry, with 90% of the barite sold in the U.S. used as a

weighting agent in petroleum drilling. According to the USGS 2022

Mineral Commodity Report, the U.S. has a net import reliance of

more than 75% as a percentage of consumption and over half of that

total is imported from China.

In 2023, the Company completed two important

steps towards including barite in an updated mineral resource

estimate for Calico, expected in 2024. As reported on May 2, 2023,

results from initial metallurgical test work showed that barite

concentrates of up to 94% barite were achieved. In addition, barite

quality analysis was completed and confirmed that the barite

concentrate produced meets or exceeds the quality requirements for

us in the U.S. as set by the API.

As a follow up to these positive results and as

the next step to adding barite to the mineral resource inventory at

Waterloo, the Company has begun a test program designed to

determine the optimal assay technique for barite. Using 79 samples

distributed across the deposit, barite concentration will be

analyzed to determine the best method to use to assay for barite in

future test work. Typically, multi-element analytic assay methods

under report barium; this program aims to determine the best

analytical method for barium in order to then be able to ensure we

are reporting the maximum concentration in each sample. Once

results of this test work have been completed and the best method

is identified, a comprehensive re-assay program of select drilling

pulps will be completed, with the goal of then updated the Waterloo

mineral resource estimate with the addition of barite.

In 1979 ASARCO calculated an estimate of barite

in the Waterloo deposit. The estimate reported a total of 33.9

million tonnes of mineralized rock in the deposit at a grade of

13.4% barite for a total of 4.5 million tonnes of barite at a grade

of 93%. ASARCO assumed a 50% recovery and a cost of $70 per short

ton of barite concentrate. Please refer to Table 1 for the results

of and further information of this estimate and results are

reported here as documented in original documents. The reader is

cautioned not to treat this historical estimate or any part of it

as a current mineral resource or reserve. An independent Qualified

Person has not completed sufficient work to classify this as a

current mineral resource or reserve and therefore the Company is

not treating the historical estimate as a current mineral resource

or mineral reserve.

Table 1: ASARCO (1979) Waterloo

Historical Silver and Barite Mineral Reserve at 25 g/t Ag

cut-off

|

Tonnage |

Average Grade |

Contained Metal |

|

Tons (Mst) |

Tonnes (Mt) |

Grade-Silver (g/t) |

Grade-Silver (opt) |

Grade-Barite (%) |

Barite (Mt) |

Silver (Moz) |

Silver (AgEq) (Moz) |

|

37.2 |

33.9 |

92.9 |

2.71 |

13.4 |

4.5 |

100.9 |

146.5 |

Reference to the historic reserves at the

Waterloo Property prepared by ASARCO refer to an internal company

document prepared by ASARCO, dated 1979 (unpublished).

Historic reserves are reported here as documented in

original documents. The historic reserves were calculated prior to

the implementation of the current Canadian Institute of Mining’s

(“CIM”) standards for mineral resource estimation (as defined by

the CIM Definition Standard on Mineral Resources and Ore Reserves

dated May 10, 2014) as required by NI 43-101 and has no comparable

resource classification. The reader is cautioned not to

treat them, or any part of them, as current mineral resources or

reserves. An independent Qualified Person has not completed

sufficient work to classify these estimates as current mineral

resources or reserves and therefore the Company is not treating the

historical estimate as a current mineral resources or mineral

reserves. The reliability of the historical estimate is

considered reasonable, reliable, and relevant to be included here

in that they demonstrated simply the barite mineral potential of

the Waterloo Property. This historic resource estimate for silver

has been superseded by the Calico Silver Project current mineral

resource estimate, announced March 6, 2023. There is no current

resource estimate for barite.

OPERATIONAL UPDATE

While the junior mining market has remained

volatile for some time, Apollo has focused on ensuring it remains

well positioned to advance its Calico Silver-Barite asset. The

Company has continued to carefully evaluate all capital allocations

to ensure it is well positioned to benefit from a rebound in market

conditions.

With this overriding objective the Company has

made the decision to terminate the Arizona Silver District Option

to Purchase Agreement, with an effective date of January 15, 2024.

Notice has been served to the vendor to this effect.

In order to maintain the option to purchase the

Langtry portion of the Calico project, the Company has made the

required annual option payments of US$25,000 and US$100,000 to

Athena Minerals Inc., and Bruce D. Strachan and Elizabeth Strachan

Trust, respectively.

ABOUT THE

PROJECT

Location

The Project is located in San Bernardino County,

California and comprises the adjacent Waterloo and Langtry

properties which total 2,950 acres. The Project is 15 km (9 miles)

from the city of Barstow and has an extensive private gravel road

network spanning the property. There is commercial electric power

within 5 km (3 miles) of the Project.

Geology and

Mineralization

The Project is situated in the southern Calico

Mountains of the Mojave Desert, in the south-western region of the

Basin and Range tectonic province. This 15 km (9 mile) long

northwest- southeast trending mountain range is dominantly composed

of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks

and dacitic intrusions. Mineralization at Calico comprises

high-level low-sulfidation silver-dominant epithermal vein-type,

stockwork-type and disseminated-style associated with

northwest-trending faults and fracture zones and mid-Tertiary

(~19-17 Ma) volcanic activity. Gold and barite also form a

significant component of the mineralized system. Calico represents

a district-scale mineral system endowment with approximately 6,000

m (19,685 ft) in mineralized strike length controlled by Apollo.

Silver and gold mineralization are oxidized and hosted within the

sedimentary Barstow Formation and in contact with the upper

volcaniclastic units of the Pickhandle formation. The current

mineral resource at Calico comprises 110 million ounces

(“Moz”) silver (“Ag”) classified as Measured and Indicated

(“M&I”) declared at Waterloo at an average grade of 100 grams

per tonne (“g/t”) Ag; and 51 Moz Ag classified as Inferred

(720,000 oz Ag in the Waterloo deposit at 77 g/t Ag and 50 Moz Ag

in the Langtry deposit at 81 g/t Ag) (see news release March 6,

2023).

QUALIFIED

PERSONS

The scientific and technical information

contained in this news release was reviewed and approved by Cathy

Fitzgerald, M.Sc., P.Geo., Apollo’s Vice President of Exploration

and Resource Development for the Company. Ms. Fitzgerald is a

Qualified Person as defined by the Canadian Securities

Administrators National Instrument 43-101 Standards of Disclosure

for Minerals Projects. Ms. Fitzgerald is a registered Professional

Geoscientist in British Columbia, Canada and is not independent of

the Company.

Please visit www.apollosilver.com for further

information.

ON BEHALF OF THE BOARD OF DIRECTORS

Tom Peregoodoff Chief Executive Officer

For further

information, please

contact:

Tom Peregoodoff Chief Executive

OfficerTelephone: +1 (604) 428-6128 tomp@apollosilver.com

About Apollo

Silver Corp.

Apollo Silver Corp. has assembled an experienced

and technically strong leadership team who have joined to advance

world class precious metals projects in tier-one jurisdictions. The

Company is focused on advancing its Calico Project, composed of the

Waterloo and Langtry silver resources, located in San Bernardino

County, California.

Neither the

TSX Venture

Exchange nor its

Regulation Services

Provider (as

that term is

defined in policies of

the TSX Venture Exchange) accepts responsibility for the adequacy

or accuracy of this release.

Cautionary

Statement Regarding

“Forward-Looking” Information

This news release includes “forward-looking

statements” and “forward-looking information” within the meaning of

Canadian securities legislation. All statements included in this

news release, other than statements of historical fact, are

forward-looking statements including, without limitation,

statements with respect to the potential of the Calico Project; the

potential for identification of gold and barite resources at

Calico; the potential to expand the resource estimate and upgrade

its confidence level, including prospective mineralization on

strike and at depth; geological interpretations; future silver

recoveries; timing and execution of future planned drilling and

exploration activities; timing of completion of the updated mineral

resource estimate and 2023 preliminary economic assessment.

Forward-looking statements include predictions, projections and

forecasts and are often, but not always, identified by the use of

words such as “anticipate”, “believe”, “plan”, “estimate”,

“expect”, “potential”, “target”, “budget” and “intend” and

statements that an event or result “may”, “will”, “should”, “could”

or “might” occur or be achieved and other similar expressions and

includes the negatives thereof.

Forward-looking statements are based on the

reasonable assumptions, estimates, analysis, and opinions of the

management of the Company made in light of its experience and its

perception of trends, current conditions and expected developments,

as well as other factors that management of the Company believes to

be relevant and reasonable in the circumstances at the date that

such statements are made. Forward-looking information is based on

reasonable assumptions that have been made by the Company as at the

date of such information and is subject to known and unknown risks,

uncertainties and other factors that may have caused actual

results, level of activity, performance or achievements of the

Company to be materially different from those expressed or implied

by such forward-looking information, including but not limited to:

risks associated with mineral exploration and development; metal

and mineral prices; availability of capital; accuracy of the

Company’s projections and estimates; realization of mineral

resource estimates, interest and exchange rates; competition; stock

price fluctuations; availability of drilling equipment and access;

actual results of current exploration activities; government

regulation; political or economic developments; environmental

risks; insurance risks; capital expenditures; operating or

technical difficulties in connection with development activities;

personnel relations; contests over title to properties; changes in

project parameters as plans continue to be refined; and impact of

the COVID-19 pandemic. The estimate of mineral resources may be

materially affected by environmental, permitting, legal, title,

taxation, sociopolitical, marketing, or other relevant issues. The

quantity and grade of reported inferred mineral resources in this

estimation are uncertain in nature and there has been insufficient

exploration to define these inferred mineral resources as an

indicated or measured mineral resource and it is uncertain if

further exploration will result in upgrading them to an indicated

or measured mineral resource category. Forward-looking statements

are based on assumptions management believes to be reasonable,

including but not limited to the price of silver, gold and barite;

the demand for silver, gold and barite; the ability to carry on

exploration and development activities; the timely receipt of any

required approvals; the ability to obtain qualified personnel,

equipment and services in a timely and cost-efficient manner; the

ability to operate in a safe, efficient and effective matter; and

the regulatory framework regarding environmental matters, and such

other assumptions and factors as set out herein. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that forward-looking statements will prove to be

accurate and actual results, and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward looking

information contained herein, except in accordance with applicable

securities laws. The forward-looking information contained herein

is presented for the purpose of assisting investors in

understanding the Company’s expected financial and operational

performance and the Company’s plans and objectives and may not be

appropriate for other purposes. The Company does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

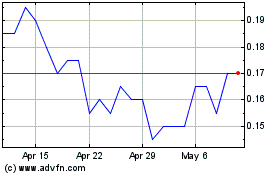

Apollo Silver (TSXV:APGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apollo Silver (TSXV:APGO)

Historical Stock Chart

From Apr 2023 to Apr 2024