Golden Sky Minerals Corp.

(AUEN.V) OTC

(LCKYF) (the “Company” or “Golden Sky”)

is pleased to announce that, subject to regulatory approval, it has

closed their private placement financing (the “Financing”)

consisting of Non Flow Units and Flow-Through Units, for total

gross proceeds of $3,343,148.88

“We are very proud to close this over-subscribed

financing and we are grateful for the support of both new and

existing strategic investors, including two institutional funds

Crescat Capital LLC and the Cordillera Minerals 2021 Flow-Through

Limited Partnership,” stated John Newell President “These funds

will enable us to accelerate our exploration plans at both our

Hotspot property in the Yukon Territories and the newly acquired

Rayfield Project in south central British Columbia. We expect that

2021 will be a breakout year for Golden Sky Minerals, supported by

this financing, allowing the company to deliver on our plans well

into 2022."

The Company has closed on 4,291,308

non-flow-through Units for gross proceeds of $1,802,349.36 (the

“NFT Units”), each $0.42 NFT Unit consisting of 1 common share of

the Company and 1 common share purchase warrant (the “Unit

Warrants”), with each Unit Warrant being exercisable for an

additional common share of the Company at $0.60 for 24 months from

date of issuance, subject to the right of the Company to accelerate

the exercise period should, after the expiration of the 4 month

hold, shares of the Company trade close at or above $1.50 for 10

consecutive trading days.

The Company has also closed on 2,963,076

flow-through units for gross proceeds of $1,540,799.52 (the “FT

Units”), each $0.52 FT Unit consisting of 1 flow-through share and

1 common share purchase warrant (the “FT Unit Warrants”), with each

full FT Unit Warrant being exercisable at $0.80 for a common share

of the Company for 12 months from date of issuance, subject to the

right of the Company to accelerate the exercise period should,

after the expiration of the 4 month hold, shares of the Company

trade close at or above $1.50 for 10 consecutive trading days. The

flow-through shares will entitle the holder to receive tax benefits

applicable to flow-through shares in accordance with the provisions

of the Income Tax Act (Canada).

On receipt of regulatory approval and in

accordance with the policies of the TSX Venture Exchange, cash

finders’ fees totaling $107,578.14 will be paid.

The Financing was affected with two (2) insiders

of the Company subscribing for 62,000 - non-flow-through and

100,000 flow-through Units for aggregate subscription proceeds of

$78,040, that portions of the Financing a “related party

transaction” within the meaning of TSX Venture Exchange Policy 5.9

of the and Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions (“MI-61-101”). In

connection with the participation of the insiders, the Company

intends to rely upon the exemptions from the formal valuation and

minority shareholder approval requirements of MI 61-101 set forth

in sections 5.5(a) and 5.7(1)(a) of MI 61-101 on the basis that the

fair market value (as determined under MI 61-101) of the

participation does not exceed twenty-five percent (25%) of the

market capitalization of the Company (as determined under MI

61-101).

All securities issued pursuant to the Financing

are subject to a 4-month hold period.

About Crescat Capital LLC:

Crescat is a global macro asset management firm

headquartered in Denver, Colorado. Crescat's mission is to grow and

protect wealth over the long term by deploying tactical investment

themes based on proprietary value-driven equity and macro models.

Crescat's goal is industry leading absolute and risk-adjusted

returns over complete business cycles with low correlation to

common benchmarks. Crescat's investment process involves a mix of

asset classes and strategies to assist with each client's unique

needs and objectives and includes Global Macro, Long/Short, Large

Cap and Precious Metals funds.

Crescat is advised by its technical consultant

Dr. Quinton Hennigh on gold and silver resource companies. Dr.

Hennigh became an economic geologist after obtaining his PhD in

Geology/Geochemistry from the Colorado School of Mines. He has more

than 30 years of exploration experience with major gold mining

firms that include Homestake Mining, Newcrest Mining and Newmont

Mining. Recently, Dr. Hennigh founded Novo Resources Corp (TSXV:

NVO) and currently serves as Chairman. Among his notable project

involvements are First Mining Gold's Springpole gold deposit in

Ontario, Kirkland Lake Gold's acquisition of the Fosterville gold

mine in Australia, the Rattlesnake Hills gold deposit in Wyoming,

and Lion One's Tuvatu gold project in Fiji, among many others.

Dr. Quinton Hennigh states:

“Golden Sky has two projects that caught our

attention, Hotspot and Rayfield. Hotspot, Yukon, is a newly

discovered epithermal gold system hosted by Eocene volcanic

rocks. Last season, Golden Sky drilled a 100 gram-meter hole

making this an incipient discovery in our view, one in need of

immediate follow up. The newly acquired Rayfield project, BC,

encompasses an intrusive center displaying multiple prospective

alkaline porphyry targets. Historic drilling has encountered

narrow intervals of high grades of Cu and Au. We are

keen to see the proceeds from this financing used to hit both

projects hard this year”.

About Cordillera Minerals Group

Ltd.:

The Cordillera Minerals Group Ltd. creates tax

advantaged flow-through limited partnerships and invests in

Canadian junior mineral issuers who have an experienced and strong

management team, and prolific assets and exploration drill targets

that offer their investors upside potential and capital

appreciation on their

investment. www.cordilleramineralsgroup.com

Mr. Bruce Fair, President and CEO, Cordillera

Minerals Group Ltd., added, “Our Partnerships goal is to look for

companies with projects in British Columbia but who also have

geographical diversification and assets in other provinces or

territories. We anticipate a flow-through investment in a company

like Golden Sky Minerals with 100 percent owned Yukon and British

Columbia assets, along with a growth-focused management team makes

Golden Sky Minerals an attractive company for our Flow-Through

Limited Partnership at a very modest current valuation.

The company is currently drilling 100% owned

Bulls Eye Property with no underlying royalty, which is adjacent to

K2 Gold Wels property in the Yukon, with plans to move to the 100%

owned Hotspot Property with no underlying royalty, which is also in

the Yukon. In addition, the funds will be used to advance the

Rayfield Copper Gold property in south central British Columbia,

and general working capital purposes.

About Golden Sky

Minerals Corp.:

Golden Sky Minerals Corp. is a well-funded

junior grassroots explorer focused on the discovery of new precious

metal and copper projects through systematic exploration in metal

endowed terranes, located in tier one mining jurisdictions. Golden

Sky's focus is developing their portfolio of projects to resource

stage. The drill ready projects include Hotspot, Bullseye, and

Luckystrike, all in the Yukon. In addition, the recent property

purchase of the Rayfield Copper Gold Project in southern British

Columbia adds to the company's building a substantial early-stage

project pipeline in Canada.

ON BEHALF OF

THE BOARD

John Newell, President and Chief Executive

Officer

For new information from the Company's programs,

please visit Golden Sky's website at www.GoldenSkyMinerals.com or

contact John Newell by telephone (604) 568-8807 or by email at

info@goldenskyminerals.com or

john.newell@goldenskyminerals.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Forward-Looking Statements

Statements contained in this news release that

are not historical facts are “forward-looking information” or

“forward-looking statements” (collectively, “Forward-Looking

Information”) within the meaning of applicable Canadian securities

legislation. In certain cases, Forward-Looking Information can be

identified by the use of words and phrases such as “anticipates”,

“expects”, “understanding”, “has agreed to” or variations of such

words and phrases or statements that certain actions, events or

results “would”, “occur” or “be achieved”. Although Golden Sky has

attempted to identify important factors and risks that could affect

Golden Sky and may cause actual actions, events or results to

differ materially from those described in Forward-Looking

Information, there may be other factors and risks that cause

actions, events or results not to be as anticipated, estimated or

intended, including, without limitation: inherent risks involved in

the exploration and development of mineral properties; the

uncertainties involved in interpreting drill results and other

exploration data; the potential for delays in exploration or

development activities; the geology, grade and continuity of

mineral deposits; the possibility that future exploration,

development or mining results will not be consistent with Golden

Sky’s expectations; accidents, equipment breakdowns, title and

permitting matters; labour disputes or other unanticipated

difficulties with or interruptions in operations; fluctuating metal

prices; unanticipated costs and expenses; uncertainties relating to

the availability and costs of financing needed in the future,

including to fund any exploration programs on its projects; that

Golden Sky may not be able to confirm historical exploration

results and other risks set forth in Golden Sky's public filings at

www.sedar.com. In making the forward-looking statements in this

news release, Golden Sky has applied several material assumptions,

including the assumption that general business and economic

conditions will not change in a materially adverse manner. There

can be no assurance that Forward-Looking Information will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on Forward-Looking

Information. Except as required by law, Golden Sky does not assume

any obligation to release publicly any revisions to Forward-Looking

Information contained in this news release to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events.

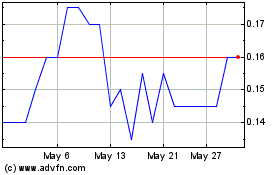

Golden Sky Minerals (TSXV:AUEN)

Historical Stock Chart

From Nov 2024 to Dec 2024

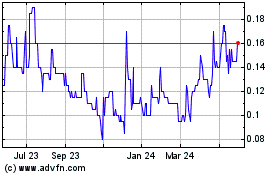

Golden Sky Minerals (TSXV:AUEN)

Historical Stock Chart

From Dec 2023 to Dec 2024