Carmen Energy Inc. announces corporate update and grant of stock options

February 02 2012 - 5:30AM

PR Newswire (Canada)

CALGARY, Feb. 2, 2012 /CNW/ - Carmen Energy Inc. ("Carmen" or the

"Corporation") is pleased to announce that it has spud a well in

its Hamburg area of Alberta. Management of the Corporation expects

drilling to take up to thirty-five days from the date of spud to

reach contract depth and to review well logs. Additionally, Petrus

Resources Ltd. ("Petrus"), a privately owned energy company based

in Calgary, Alberta is participating in the well and has the right

to earn a 45% working interest in two sections of land in the

Hamburg area of Alberta. Petrus is required to contribute 45% of

the costs to drill to the contract depth, abandon, cap or complete,

equip and tie-in the first option well. The working interest

is subject to the same non-convertible overriding royalty

calculated on 100% of production of 1/15 (min. 5/10% and max

15/20%) on crude and 15/20% on all other petroleum substances that

Carmen is subject to and payable to the original party whose

property Carmen's farmin is with (as previously disclosed in a

press release of the Corporation dated December 9, 2011) and

subject to Crown Royalties. The Corporation's Sylvan Lake

102/14-7-38-3w5 Leduc well has been on production since November 7,

2011, without artificial lift. The first thirty days of production

averaged 35 barrels of oil equivalent ("BOE/d") per day consisting

of 5 barrels of oil per day, 12 barrels of natural gas liquids per

day and 108 Mcf/day net to the Corporation. Plans are being

initiated to put the well on artificial lift. Carmen has a 15%

working interest in the well. Carmen will provide a production

update upon receipt of stabilized rates subsequent to

implementation of artificial lift. The Sylvan Lake 12-22-38-4w5

Leduc well has been completed and tested at noncommercial rates and

is standing awaiting further evaluation. Production at the Jumpbush

area of Alberta well which Carmen owns a 37.5% working interest has

maintained stable production rates of 8 BOE/d (net) comprised of 5

barrels of oil per day and 18 Mcf/day. The Corporation is also

pleased to announce the implementation of an Executive Committee

comprised of three members of the Board of Directors being Randy

Harrison, Archie Nesbitt and Gerald Facciani. The role of the

Executive Committee will be to facilitate financings, negotiate and

review corporate contracts. In conjunction with the implementation

of the Executive Committee, Brian Doherty will relinquish the title

of Chief Executive Officer in order to focus on his duties as

President and Director of the Corporation. Carmen also announces

that Grant MacKenzie, a partner at Burnet, Duckworth and Palmer LLP

has assumed the position of Corporate Secretary and General Counsel

for the Corporation effective immediately. Furthermore, the

Corporation announces that a total of 950,000 stock options have

been granted to the directors, and officers of the Corporation at

an exercise price of $0.19 per share for a period of five years

from the date of grant. The options have been granted in accordance

with the Corporation's stock option plan. About Carmen Energy Inc.:

Carmen is based in Calgary, Alberta and a publicly traded oil and

gas exploration and production company. The focus is on exploration

and development of Western Canadian Sedimentary Basin based oil and

gas properties. The current projects are the Jumpbush properties in

south eastern Alberta, the Ferrybank properties in central Alberta,

the Sylvan Lake area properties in Southern Alberta and the Hamburg

properties in northern western Alberta. Barrels of oil equivalent

(BOE) may be misleading, particularly if used in isolation. The BOE

conversion ratio used in this report is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead. All

BOE conversions in this report are derived by converting gas to oil

in the ratio of six thousand cubic feet of natural gas to one

barrel of oil equivalent (6 Mcf = 1 BOE). It is important to note

that the 1:6 ratio is based on an energy equivalency and the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6:1; utilizing a conversion on a 6:1 may be misleading as an

indication of value. FORWARD LOOKING INFORMATION Certain

information in this news release is forward-looking within the

meaning of certain securities laws, and is subject to important

risks, uncertainties and assumptions. This forward-looking

information includes, among other things, the actual time to reach

contract depth of the Hamburg area well and the review of logs

within thirty-five days from the date of spud, plans to place the

Sylvan Lake well on artificial lift and information with respect to

the Corporation's beliefs, plans, expectations, anticipations,

estimates and intentions and the activities of the

Corporation. The words "may", "could", "should", "would",

"suspect", "outlook", "believe", "anticipate", "estimate",

"expect", "intend", "plan", "target" and similar words and

expressions are used to identify forward-looking information. . The

forward-looking information in this news release describes the

Corporation's expectations as of the date of this news release. The

results or events anticipated or predicted in such forward-looking

information may differ materially from actual results or

events. Material factors which could cause actual results or

events to differ materially from such forward-looking information

include, among others, the risks associated with the oil and gas

industry in general, risks arising from general economic conditions

and adverse industry events, risks arising from operations

generally, reliance on contractual rights such as licences and

leases in the conduct of its business, the uncertainty of reserve

and resource estimates; the uncertainty of estimates and

projections relating to reserves, resources, production, costs and

expenses; reliance on third parties, reliance on key personnel,

possible failure of the business model or business plan or the

inability to implement the business model or business plan as

planned, competition, environmental matters, and insurance or lack

thereof; failure to realize the anticipated benefits of

acquisitions including the Acquisition; ability to access

sufficient capital from internal and external sources; changes in

legislation, including but not limited to tax laws, royalties and

environmental regulations. The Corporation cautions that the

foregoing list of material factors is not exhaustive. When

relying on the Corporation's forward-looking information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential

events. The Corporation has assumed a certain progression,

which may not be realized. It has also assumed that the

material factors referred to in the previous paragraph will not

cause such forward-looking information to differ materially from

actual results or events. However, the list of these factors

is not exhaustive and is subject to change and there can be no

assurance that such assumptions will reflect the actual outcome of

such items or factors. THE FORWARD-LOOKING INFORMATION CONTAINED IN

THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE CORPORATION AS

OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO

CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE

IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON

THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE CORPORATION

MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT

ANY PARTICULAR TIME. Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release. Carmen Energy Inc

CONTACT: Brian DohertyPresident(403) 537-5590

Copyright

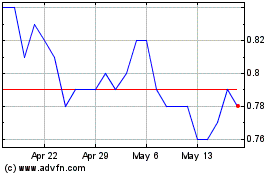

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From Apr 2024 to May 2024

Coelacanth Energy (TSXV:CEI)

Historical Stock Chart

From May 2023 to May 2024