Consolidated Uranium Inc. (the "Company", “CUR” or

“Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF) is

pleased to share an open letter from Chairman and Chief Executive

Officer, Philip Williams, to shareholders of the Company.

Dear Fellow Shareholders:

As we end 2021, I wanted to take a moment to

reflect on our Company’s achievements over the past year and set

out our objectives for the upcoming year and beyond.

Continued Uranium Market

Resurgence

Looking back at our letter from last year, we

noted that uranium prices had increased from the low of US$20.00

per lb in early 2020 to close that year at approximately US$30.00

per lb. At that time, we expected prices, both spot and long term,

to continue to climb and we were not disappointed. As of writing

this letter, according to TradeTech, the weekly spot price

indicator sits at US$43.25 per lb with the long-term price

indicator at US$45.00 per lb. This impressive 42% increase in the

spot price year-over-year tells only part of the story. The spot

price peaked at just over US$50 per lb in September on the back of

aggressive spot market purchases from the Sprott Physical Uranium

Trust, which now holds 41.3 m lbs of U3O8 up from just 18.1 m lbs

at the beginning of the year.

As expected, this continued upward strength in

the uranium price has had a positive impact on share prices for

uranium equites. The best way to see this is by looking at the

performance of North Shore Global Uranium Mining ETF (URNM), which

is now up 82% year-to-date despite correcting 20% from its high of

early November.

Notwithstanding this tremendous performance for

the sector, our view at Consolidated Uranium remains the same as

last year. We continue to expect uranium prices, both spot and long

term, will continue to rise due to the inherent disconnect between

the current price and the required price level that existing supply

can be maintained profitably and new supply can be incentivized to

come online. The disconnect exists for the current level of demand

however, we of course believe the future for nuclear power looks

very bright and any increase in demand could serve to drive prices

even higher. To give readers a sense for where demand might go, we

reference the International Atomic Energy Agency (the “IAEA”)

projections for Nuclear Power Growth published in September 2021.

Under the high case scenario of its new outlook, the IAEA expects

world nuclear capacity could double by 2050. This is the scenario

we are preparing for at Consolidated Uranium.

Evolving the Business Model

Last year we stated that our business model was

“to acquire uranium projects around the globe”, and while that

remains true, we have now added “and develop” to the model. This

distinction is important as we have now reached the point in the

uranium cycle, in our opinion, where value can be created not only

by identifying and acquiring new projects but also by advancing

those projects. To be clear, CUR intends to continue to be an

aggressive, yet judicious, acquirer of assets under the right

circumstances with a view to building out the portfolio and

providing our shareholders with continued diversified exposure to

the sector. However, we expect that 2022 will be characterized as

much by our project-level activities as by new M&A activity.

Read on to find out about the important additions we made to our

board of directors and team to execute these project-level programs

and for more details on the plans for our key projects.

Bolstered Management and

Board

The year 2021 saw the continued build out of the

leadership team at Consolidated Uranium with two key additions. The

first is the appointment of Mark Chalmers to the board of

directors. Mark is a familiar name in the uranium sector in his

role as the CEO of Energy Fuels Inc. (NYSE American: UUUU) (TSX:

EFR), a leading U.S.-based uranium mining company, and CUR’s

largest shareholder. As a mining engineer with decades of

experience in the uranium sector, his wealth of knowledge will be

invaluable to CUR as it builds out and advances its portfolio. The

second and most recent is the appointment of Marty Tunney as

President and Chief Executive Officer. Marty is also a mining

engineer by background, with diverse experience in mine permitting

and development, investment banking and leading public mining

companies. In his dual roles, Marty will be responsible for helping

shape the direction of the Company, with a particular focus on

project advancement and development. In addition, during the past

year, the Company has continued to add to its technical and

operational teams on the ground in its key jurisdictions. Local

expertise is particularly critical for the Company given the global

nature of the portfolio and continued challenges with global

travel.

Growing and Advancing the

Portfolio

To say that 2021 was an active year on the

project acquisition front would be an understatement. We ended last

year with four option agreements signed. During this year, we

closed two of those acquisitions, announced and closed two

additional acquisitions and announced an additional acquisition.

Our global portfolio, including 100% owned projects and projects

under options, now consists of 13 “projects” in four countries,

Australia, Canada, the US and Argentina, with historic uranium and

vanadium resources. Importantly, through the transformational

acquisition and strategic alliance with Energy Fuels, we now own

three past producing uranium and vanadium mines in the US with

potential for near term production as market conditions continue to

improve. In Canada, we added the high grade Matoush project with

strong exploration upside potential. Most recently, we closed the

acquisition of the Laguna Salada uranium and vanadium project in

Argentina. These three projects will see the bulk of our project

level expenditures for the year.

We would be remiss not to mention the exciting

developments surrounding our Moran Lake project in Labrador and the

creation of Labrador Uranium (“LUR”). In a natural extension of our

business model, we determined that to maximize the value of Moran

Lake it made sense to combine it with other projects in the

province owned by Altius Minerals and Mega Uranium and form a new

company with a separate and dedicated management team to focus on

exploration and potential resource expansion. This concept was met

with strong enthusiasm from the investment community securing C$8

million in financing with a listing expected in Q1 2022.

Importantly, CUR shareholders will gain direct exposure to this

exciting new uranium vehicle by receiving LUR shares on a pro rata

basis based on the number of CUR shares held at the time of

completion of the spin-out transaction.

The Future is Bright

With a busy and successful year nearly complete

we now turn our attention to 2022 and we believe the future is

bright. Just over a month ago, we closed a financing for proceeds

of C$20 million, which provides for a very healthy balance sheet

entering 2022. As discussed above, these funds are expected to be

allocated toward project-level expenditures as well as pursuing new

project acquisition opportunities.

In closing, we believe our investment

case remains strong for existing and new shareholders:

- CUR is in the right sector at the

right time; uranium is currently in a bull trend and has the

potential to deliver robust returns for equity investors;

- CUR has the right team; which

together boasts decades of uranium, M&A, exploration and mine

development expertise;

- CUR has the right portfolio;

located in top tier mining and uranium jurisdictions with high

grades on a global scale with significant past expenditures and

near-term production potential; and

- CUR has a proven track record; in

less than two years, the Company has executed multiple M&A

transactions, secured multiple financings and has increased market

recognition as measured by share price and trading liquidity.

I would like to thank all of you for supporting

and joining us on this journey.

Yours truly,

Philip Williams, Chairman and Chief Executive

Officer

Grant of Compensation

Securities

Pursuant to CUR’s long term incentive plan, the

Company has granted certain officers, directors, employees and

consultants options to purchase an aggregate of 1,450,000 common

shares of the Company and an aggregate of 650,000 restricted share

units. The options are exercisable at a price of $2.79 per common

share for a period of five years and vest over three years as

follows: one-third vesting immediately, one-third vesting after one

year and one-third vesting after two years. The restricted share

units, each of which entitles the holder to receive one common

share of the Company, vest over three years as follows: one-third

vesting after one year, one-third vesting after two years and

one-third vesting after three years. The options and restricted

share units are subject to approval of the TSX Venture

Exchange.

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development. Most recently, the

Company completed a transformational strategic acquisition and

alliance with Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR), a

leading U.S.-based uranium mining company, and acquired a portfolio

of permitted, past-producing conventional uranium and vanadium

mines in Utah and Colorado. These mines are currently on stand-by,

ready for rapid restart as market conditions permit, positioning

CUR as a near-term uranium producer.For More Information,

Please Contact

Philip

WilliamsPresident and

CEOpwilliams@consolidateduranium.com

Mars Investor Relations +1 647

557 6640 cur@marsinvestorrelations.com

Twitter: @ConsolidatedUr

www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including expectations regarding Uranium prices

and the potential to deliver robust returns for equity investors,

expectations regarding world nuclear capacity, expectations

regarding potential value creation from project acquisitions and

advancement, expectations regarding project-level activities and

new M&A activity, expectations regarding the anticipated timing

for listing of LUR, the anticipated use of proceeds from recent

financings and the Company’s ongoing business plan. Generally, but

not always, forward-looking information and statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or the negative connotation

thereof or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved” or the negative

connotation thereof. Such forward-looking information and

statements are based on numerous assumptions, including that

general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms, and that third party

contractors, equipment and supplies and governmental and other

approvals required to conduct the Company’s planned exploration and

development activities will be available on reasonable terms and in

a timely manner. Although the assumptions made by the Company in

providing forward-looking information or making forward-looking

statements are considered reasonable by management at the time,

there can be no assurance that such assumptions will prove to be

accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no current mineral reserves or resources, reliance on

key management and other personnel, potential downturns in economic

conditions, actual results of exploration activities being

different than anticipated, changes in exploration programs based

upon results, and risks generally associated with the mineral

exploration industry, environmental risks, changes in laws and

regulations, community relations and delays in obtaining

governmental or other approvals.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

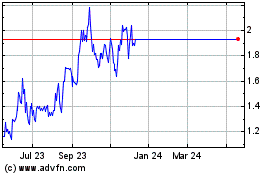

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024