Doré Copper Mining Corp. (the "

Corporation" or

"

Doré Copper") (TSXV: DCMC; OTCQX: DRCMF; FRA:

DCM) is pleased to report positive results from its Preliminary

Economic Assessment (“PEA“) for the restart of the Chibougamau

mining camp. The PEA supports a hub-and-spoke operation with the

high-grade Corner Bay copper-gold deposit as its main underground

mine along with the Devlin copper deposit and the former Joe Mann

gold mine providing feed to its Copper Rand mill (collectively, the

”Project”). The PEA demonstrates attractive project economics with

optionality for expansion into a significantly larger operation,

re-establishing the Chibougamau mining camp as a long-life copper

and gold producer.

All values in this news release are reported in

Canadian dollars (C$) unless otherwise noted.

Doré Copper will be hosting a webinar to review

the PEA results on Tuesday, May 10 at 10:00AM

EST:https://us06web.zoom.us/webinar/register/WN_yaoTJLNPTcGccp-PlAceIA

PEA Highlights

-

Attractive project economics:

- Base

case metal prices of US$3.75/lb Cu and US$1,820/oz

Au:Pre-tax NPV8%

of C$367 million and 30.7% IRRAfter-tax

NPV8% of C$193 million and 22.1%

IRR

- Spot

metal prices of US$4.20/lb Cu and US$1,854/oz Au:

Pre-tax NPV8% of C$555

million and 40.1% IRRAfter-tax

NPV8% of C$303 million and 29.4%

IRR

- Mine

life of 10.5 years: Metal production of 492 Mlbs Cu, 142,000

oz Au

- Average

cash operating costs of US$1.35/lb CuEq and all-in sustaining costs

of US$2.24/lb CuEq

- Light

capital intensity: Initial capital of C$180.6 million

(including C$24 million contingency), translating to a Tier 1

Capital Intensity Index (initial capital / annual CuEq produced) of

US$2.64/lb CuEq or US$0.25/lb CuEq LOM

-

Scalable operation: Mill has 25% excess

grinding capacity (over the maximum annual throughput) providing

opportunities to add, discover, or acquire other properties in the

Chibougamau mining camp

- Long

life tailings storage option with minimal environmental

impact: Implementation of dry stack tailings and ore

sorting technology provides for a maximum capacity of 12 Mt on the

existing Copper Rand tailings management facility (“TMF”)

-

Modernization of the mill and TMF: PEA study

modernizes the existing Copper Rand mill and TMF so that they are

productive and cost efficient and minimizes impact on the

environment

-

Opportunities for mine life extension: Corner Bay

and Joe Mann deposits remain open at depth with strong potential to

add additional resources and extend the mine life. Potential for

additional mill feed during mine life with the advancement of its

exploration projects in Chibougamau mining camp.

Ernest Mast, President and CEO commented, “The

completion of the PEA is a major accomplishment from our team and

gets us closer to our near-term objective of restarting the

Chibougamau mining camp. This achievement has come with the

excellent exploration results from Corner Bay over the last few

years where we have been able to significantly grow the mineral

resources. The PEA represents today’s status of the projects but we

envision scaled expansions and future growth at both Corner Bay and

Joe Mann while eventually sequencing in other deposits across our

large land package in the Chibougamau mining camp. With three

projects in the PEA, the average annual production over the mine

life is approximately 50 Mlbs of copper equivalent, with a high of

90 Mlbs of copper equivalent. Our vision is to operate a viable

sustainable hub-and-spoke operation over multi-decades to become a

significant copper producer in Québec.”

“Our next steps include commencing a feasibility

study and submitting permit application with the provincial

government. We look forward to working with Ouje-Bougoumou

Cree Nation and the towns of Chibougamau and Chapais with the

support of the government to advance the restart of the Chibougamau

mining camp.”

PEA Study Approach

The PEA envisions a hub-and-spoke model

operation starting first with the underground development of the

Devlin deposit via a ramp and secondly with the underground

development of the Corner Bay deposit (main asset) via a ramp. Once

the Devlin deposit is mined out (approximately 4 years), production

at the Joe Mann mine would start and be funded out of cash flow

from operations. Joe Mann benefits from an existing headframe and

shaft, including all surface infrastructures.

A fixed crushing circuit and ore sorter plant

(XRT) would be installed at Corner Bay and would reject the

low-grade and dilution material from the Devlin and Corner Bay

mines. The high-grade material would be transported by trucks to

the refurbished and optimized Copper Rand mill. The filtered

tailings would be transported to a dry stack tailings facility,

which uses part of the footprint at the existing TMF.

The copper and gold concentrate produced would

be transported to the port of Québec City for onward shipping to

international smelters, or to a local smelter. Ocean Partners Ltd.

has the off-take agreement (treatment and refining charges terms

are within standard market rates).

Table 1: PEA Summary of Key

Metrics

|

Description |

Unit |

Base Case124-month

Trailing Avg |

Spot PricesMay 9, 2022 |

|

Metal Prices/FX |

|

|

|

|

Copper (Cu) |

US$/lb |

3.75 |

4.20 |

|

Gold (Au) |

US$/oz |

1,820 |

1,854 |

|

Currency Exchange Rate |

USD/CAD |

1.28 |

1.30 |

|

Production Data |

|

|

|

|

Resource Tonnes |

T |

9,150,710 |

9,150,710 |

|

Copper Equiv. Grade |

% |

2.98 |

2.98 |

|

Daily Mill Throughput |

Tpd |

1,350 |

1,350 |

|

Annual Processing Rate |

Ktpa |

490 |

490 |

|

Mine Life |

Years |

10.5 |

10.5 |

|

Avg Annual Production(in concentrate) |

Mlbs CuEq |

53 |

53 |

|

Operating Costs (LOM avg) |

|

|

|

|

Total Operating Costs2 |

C$/t mined |

106 |

106 |

|

|

C$/t milled |

186 |

186 |

|

All-in Sustaining Costs3,4 |

US$/lb CuEq |

2.24 |

2.24 |

|

Capital Costs5 |

|

|

|

|

Initial Capital |

C$M |

180.6 |

180.6 |

|

LOM Sustaining Capex |

C$M |

402.4 |

402.4 |

|

Financial Analysis (unlevered) |

|

|

|

|

Pre-Tax NPV 8% |

C$M |

367 |

555 |

|

Pre-Tax IRR |

% |

30.7 |

40.1 |

|

After-Tax NPV 8% |

C$M |

193 |

303 |

|

After-Tax IRR |

% |

22.1 |

29.4 |

|

Payback Period (Production Start) |

years |

5.5 |

4.2 |

- Base case metal prices based on

24-month trailing average from March 31, 2022.

- Total operating costs include

mining, processing, tailings, surface infrastructures, transport,

and G&A costs. See Table 3.

- AISC includes cash operating costs,

sustaining capital expenses to support the on-going operations,

concentrate transport and treatment charges, royalties and closure

and rehabilitation costs divided by copper equivalent pounds

produced. See Table 3.

- AISC is a non-IFRS financial

performance measures with no standardized definition under IFRS.

Refer to note at end of this news release.

- See Table 2.

Capital Cost

The PEA for the Project outlines an initial

(pre-production) capital cost estimate of C$180.6 million and

sustaining capital costs over the life of mine (“LOM”) of C$402.4

million, which includes the capital to restart Joe Mann and overall

closure costs of C$53.6 million. Initial underground capital costs

include the rehabilitation of the portals at Corner Bay and Devlin,

facilities for water capture and treatment at both locations,

construction of a powerline (16 km, 34 kV powerline to Corner Bay,

and 3.25 km, 34 kV powerline to Devlin), a crushing circuit and ore

sorter at Corner Bay, improvements to existing roads and 4 km of

new roads connecting Corner Bay and Devlin, a new feed material

reception and mill feed conveyor, ball milling and gravity circuit,

rehabilitated flotation and concentrate filtration circuit and new

tailings filtration circuit at the mill, and preparation of an area

on the existing TMF for the placement of filtered tailings and a

water treatment facility.

Table 2: Capex

Estimates

|

Cost Element |

Initial Capital (C$M)1 |

Sustaining Capital

(C$M)1,3 |

|

Mine Costs |

|

|

|

Corner Bay |

14.8 |

247.3 |

|

Devlin |

7.0 |

0.4 |

|

Joe Mann2 |

0.0 |

51.9 |

|

Processing (including Ore Sorting) |

54.2 |

1.1 |

|

Infrastructure |

34.5 |

15.5 |

|

Tailings |

13.8 |

16.7 |

|

EPCM and Indirect Costs4 |

22.8 |

5.5 |

|

Owner’s Costs4 |

9.9 |

3.1 |

|

Subtotal Capex |

$157.1 |

$341.6 |

|

Contingency5 |

23.6 |

7.2 |

|

Reclamation and Closure |

0.0 |

53.6 |

|

Total Capex |

$180.6 |

$402.4 |

- All values stated are undiscounted.

No inflation or depreciation of costs were applied.

- Contingency, owner’s costs, EPCM and indirect costs on Joe

Mann’s initial capital also included in the sustaining

capital.

- Sustaining capital does not include

salvage values, estimated at C$17 M for all sites.

- Includes owner’s costs of 8%,

construction indirects of 10%, and EPCM of 12% for mill and

tailings and 4% for mining of direct costs.

- Includes contingency of 15% for all

initial capital, owner’s costs, construction indirects, and

EPCM.

Operating Costs

Operating costs estimates were developed using

first principles methodology, vendor quotes received from Q4 2021

to Q1 2022, and productivities being derived from benchmarking and

industry best practices. Over the LOM, the average operating cost

for the Project is estimated at C$106/t mined and C$186/t

milled.

The average cash operating costs over the LOM is

US$1.35/lb CuEq and the average AISC is US$2.24 /lb CuEq.

Table 3: Operating Cost

Summary

|

|

Average LOM |

|

Mining |

C$61/t mined / C$108/t milled |

|

Processing (including Ore Sorting) |

C$32/t milled |

|

Tailings1 |

C$7/t milled |

|

Infrastructure and TransportG&A |

C$28/t milledC$12/t milled |

|

Total operating costs |

C$186/t milled |

|

Cash operating costs

2,4,5 |

US$1.35 /lb CuEq |

|

All-in sustaining costs

3,4,5 |

US$2.24 /lb CuEq |

- Tailings filtration costs are in

processing costs.

- Cash operating cost includes

mining, processing, tailings, surface infrastructures, transport,

and G&A to the point of production of the concentrate at the

Copper Rand site divided by copper equivalent pounds produced. It

excludes off-site concentrate costs, sustaining capital expenses,

closure/rehabilitation and royalties. CuEq calculation assumes

metal base case prices.

- AISC includes cash operating costs,

sustaining capital expenses to support the on-going operations,

concentrate transport and treatment charges, royalties and closure

and rehabilitation costs divided copper equivalent pounds

produced.

- Copper equivalent (CuEq) costs uses

only payable gold in concentrate and is applied as a credit against

costs.

- Cash operating cost and AISC are

non-IFRS financial performance measures with no standardized

definition under IFRS. Refer to note at end of this news

release.

- Numbers may not add up due to

rounding.

Economic Analysis and

Sensitivities

The PEA indicates that the potential economic

returns from the Project justify its further evaluation by

advancing to a feasibility study.

Table 4: Summary of Economic

Analysis1,2

|

|

Base Case |

|

Metal Price Assumptions (US$) |

$3.75/lb Cu, $1,820/oz Au |

|

Exchange Rate (USD/CAD) |

1.28 |

|

|

Pre-tax |

After-tax |

|

NPV (8% discount) |

C$366 M |

C$193 M |

|

IRR |

30.7% |

22.1% |

|

Payback Period |

4.2 yrs |

5.5 yrs |

|

EBITDA |

C$1,313 M |

C$1,313 M |

|

LOM Undiscounted Net Cash Flow |

C$747 M |

C$455 M |

- The analysis assumes that the

Project is 100% equity financed (unlevered).

- Appropriate deductions are applied

to the concentrate produced, including treatment, refining,

transport and insurance costs.

The Project generates cumulative cash flow of

C$455 million on an after-tax basis and C$747 million pre-tax at a

base case of $3.75/lb Cu based on an average mill throughput of

1,350 tpd over 10.5 years. The 2% net smelter return (“NSR”)

royalty over the Joe Mann mine, and the 15% net operating profits

interest (NPI) royalty and the 2% NSR on the gross value of the

mineral products exceeding US$60 million over Devlin have been

applied to the cash flow model for a total of C$13.3 million

undiscounted.

The PEA economic analysis is significantly

influenced by copper prices. At spot metal prices of US$4.20/lb Cu

and US$1,854/oz Au, the Project generates an after-tax Net Present

Value (“NPV”) using an 8% discount rate of $303 million and an

after-tax IRR of 29.4% with a payback period of 4.2 years from the

commencement of production. Outlined below in Table 5 is a detailed

sensitivity analysis across various commodity prices.

Table 5: Sensitivity

Analysis

| Copper Prices (US$/lb) |

3.40 |

Base Case 3.75 |

4.10 |

Spot4.20 |

| Gold Prices (US$/oz) |

1,650 |

1,820 |

1,820 |

1,854 |

|

Pre-tax NPV (8% discount) (C$M) |

228 |

367 |

494 |

555 |

|

After-tax NPV (8% discount) (C$M) |

107 |

193 |

269 |

303 |

|

Pre-tax IRR (%) |

23.2 |

30.7 |

37.2 |

40.1 |

|

After-tax IRR (%) |

16.1 |

22.1 |

27.2 |

29.4 |

Opportunities

- Add Corner Bay’s silver and molybdenum content (currently

excluded for mineral resources)

- Potential to extend mine life by expanding mineral resources at

both Corner Bay and Joe Mann once operation starts

- Surplus grinding capacity at the Copper Rand mill

- Underpins potential for low-cost organic production growth

(other nearby assets, including Cedar Bay and Copper Rand) to be

evaluated during LOM)

- Potential to increase Corner Bay and Devlin concentrate grades

which would decrease treatment charges and shipping costs

- Potential labour cost savings by self-performance for various

mill rehabilitation activities

- Potential to install a 25 kV line from the Québec grid to

Corner Bay (PEA design has a 34 kV line)

- Potential for a carbon neutral operation with PEA design to

utilize power from the Québec grid, minimizing trucked material

with ore sorting technology and implementing trolley-assist hauling

technology at the Corner Bay mine site. In the feasibility study,

the Corporation will attempt to be carbon neutral by the end of

Devlin’s mine life (approximately 4 years).

Mineral Resources

The basis for the PEA uses an updated mineral

resource estimate for the Corner Bay deposit (effective date March

30, 2022) and previously published MRE for Devlin and Joe Mann,

respectively October and July 2021, restated with an updated

effective date of March 30, 2022. The PEA reports on mineral

resources, not mineral reserves.

Table 6: Mineral Resource

Estimates

|

Deposit |

Category |

Tonnage |

Grade |

Contained |

|

|

|

000 tonnes |

% Cu |

g/t Au |

M lbs Cu |

000 oz Au |

|

Corner Bay |

Indicated |

2,675 |

2.66 |

0.26 |

157 |

22 |

|

|

Inferred |

5,829 |

3.44 |

0.27 |

442 |

51 |

|

Devlin |

Measured |

121 |

2.74 |

0.29 |

7.3 |

1 |

|

|

Indicated |

654 |

2.06 |

0.19 |

29.7 |

4 |

|

|

Measured & Indicated |

775 |

2.17 |

0.20 |

37.0 |

5 |

|

|

Inferred |

484 |

1.79 |

0.17 |

19.2 |

3 |

|

Joe Mann |

Inferred |

608 |

0.24 |

6.78 |

3.3 |

133 |

|

Total |

Measured & Indicated |

3,450 |

2.55 |

0.25 |

194.0 |

27 |

|

Total |

Inferred |

6,921 |

3.04 |

0.83 |

464.5 |

187 |

Notes:

- CIM (2014) definitions were followed for Mineral

Resources.

- The effective date of the Mineral Resources is March 30,

2022.

- Mineral Resources are estimated using an exchange rate of

US$0.75/C$1.00.

- Mineral

Resources at Joe Mann are estimated using a long-term gold price of

US$1,800/oz Au, and a metallurgical gold recovery of 83%. Mineral

Resources at Corner Bay and Devlin are estimated using a long-term

copper price of US$3.75/lb, and a metallurgical copper recovery of

95%.

- Mineral

Resources are estimated at a cut-off grade of 2.60 g/t Au at Joe

Mann, 1.3% Cu at Corner Bay and 1.2% Cu at Devlin.

- A minimum mining

width of 1.2 m was used at Joe Mann and a small number of lower

grade blocks have been included for continuity. A minimum mining

width of 2.0 m was used at Corner Bay, and a minimum height of 1.8

m was applied at Devlin.

- Bulk density

ranges by deposit and vein from 2.84 t/m3 to 3.1 t/m3.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic

viability.

- Numbers may not

add up due to rounding.

Mining

Projected mined tonnes from the Project (Corner

Bay, Devlin and Joe Mann) are expected to total 9.15 Mt, ramping up

to a maximum capacity of 3,000 tpd over a mine life of 10.5

years.

Figure 1 accompanying this

announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/32d731e6-44b7-4733-b63c-3e2e2b4ba225

Corner Bay Mine

Underground mining at Corner Bay would use the

existing single portal and two kilometers of development to three

levels down to 115 meters. The development would extend the decline

ramps to a depth of 1,326 meters. Most of the material would be

mined by longhole open stoping with pillars then backfilled and

AVOCA, a longitudinal longhole retreat mining method. A fleet of

nine battery electric haul trucks with trolley assist and six

loaders would be required at maximum capacity. Trade off studies

were completed to evaluate between a shaft, 42 tonne battery

electric trucks with BaaS (Battery as a Service) technology and 50

tonne diesel trucks and it was concluded that the use of 42 tonne

battery electric trucks was the best economic option. In addition,

the electric truck technology will provide benefits related to less

ventilation requirements, better air quality and lower diesel

consumption.

The mined material would be transported to

surface and crushed at site with an integrated XRT (X-ray

transmission) ore sorting circuit. Test work on material selected

from the development mineralized material stockpiled at surface,

which was extracted during the preparation of the 2008 bulk sample,

indicated that the average grade of the mineralized material is

upgraded 1.54 times and 47% of the crushed mined material would be

rejected. The high-grade material pre-concentrate would be

transported by trucks to the Copper Rand mill located approximately

47 km from the mine site.

Total projected mined tonnes from Corner Bay are

expected to be 7.60 Mt ramping up to a maximum capacity of 2,600

tpd over a mine life of 10.5 years.

Devlin Mine

Access to the shallow Devlin deposit would

require the enlargement of the existing decline ramp (305 meters)

and existing drifts (364 meters). Underground mining would use a

combination of room and pillar and drift and fill mining methods.

Devlin will produce 951,000 tonnes of material over a mine life of

four years and reach a maximum mining rate of 760 tpd. Mining and

surface activities at Devlin will be done by a contractor.

The mined tonnes would be trucked 15.6 km to the

Corner Bay site for crushing and sorting in combination with the

Corner Bay mined tonnes. With the mineralized material having a

thickness of 1 to 2 meters and the wall rock being essentially

barren, ore sorting technology is expected to work well.

Preliminary test work on core from drilling simulating a 2.3 meter

mining height resulted in upgrading the grade by 65% and rejecting

40% of the material.

Joe Mann Mine

As the Devlin mine become depleted, the Joe Mann

mine would be restarted. Once the mine would be dewatered, the

Corporation would start an underground exploration program with the

objective of augmenting the mineral resources to increase the mine

life beyond the PEA study.

Longhole mining method was chosen for Joe Mann

with the mined material to be brought to surface using the existing

shaft and hoist. The mined material would be transported by trucks

to the Corner Bay site (total of 43.5 km) for crushing and then

transported by trucks to the Copper Rand mill for processing.

In the PEA, the Joe Mann mine has a mine life of

four years with maximum production of 590 tpd. It is anticipated

that additional mineral resource can be defined to increase mine

life.

Metallurgy and Processing

The PEA relies on the metallurgical results of

the operational data from the processing of a Corner Bay bulk

sample in 2008 at the Copper Rand mill, historical flotation tests

done on Corner Bay mineralized material, recent material sorting

test results completed by Corem on Corner Bay and Devlin

mineralized material, recent flotation tests on Devlin completed by

SGS Canada Inc., and historical operational data from Joe Mann when

it was treated in the Copper Rand mill. The expected metal

recoveries for the three proposed mines are shown in Table 7.

Table 7: LOM Recovery Rates

|

Project |

Cu Recovery % |

Au Recovery, % |

Cu Grade in Concentrate, % |

|

Corner Bay |

93.2 |

78.0 |

24.7 |

|

Devlin |

95.5 |

72.5 |

20.5 |

|

Joe Mann |

93.9 |

83.6 |

15.9 |

The PEA proposes to refurbish the Copper Rand

mill, which closed in 2008 after approximately 50 years of

operation. The mill was constructed in 1959 and expanded twice in

the early 1980s and again in 2001. Historically, the mill operated

with a mixture of local ores at an instantaneous rate of 2,700

tpd.

The existing crushing and conveying circuit at

the Copper Rand mill will not be used or upgraded since it is more

efficient to install a new crushing circuit and ore sorting plant

at Corner Bay. The sorted pre-concentrate will be trucked to the

Copper Rand site and stockpiled by the mill building where it will

be reclaimed in a hopper and fed via a single conveyor to a new

1,500 kW ball mill (4.0 meters diameter by 7.15 meters long) to be

located in the 1984 expansion area of the existing mill. This new

ball mill will replace the existing 1950’s rod mill and four ball

mills in the circuit. This will result in significantly less

project execution risk and a mill that will require less manpower

and be superior in terms of energy efficiency, process control and

safety. The ball mill discharge will be pumped to a new

hydro-cyclone in closed circuit. The hydro-cyclone underflow will

flow to a screen and the undersize will feed two gravity

concentrators. The hydro-cyclone overflow, at an 80% passing size

of 100 µm, will flow by gravity to the existing flotation area

where sequential rougher and scavenger flotation will recover the

copper. The rougher concentrate treated by regrinding and cleaner

flotation will produce a copper concentrate with an average grade

of 23.7% Cu over LOM. The gravity gold bearing concentrate will be

blended into the copper concentrate. The concentrate is considered

very clean as it does not contain any elevated deleterious

elements. The moisture content of the concentrate will be reduced

to approximately 8% before being transported to the port of Québec

City for onward shipping to international smelters, or to a local

smelter.

Figure 2 accompanying this

announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e03038b7-ec2c-4b42-b462-9ae5d37dd075

Infrastructure and TMF

The Project benefits greatly from substantial

infrastructure in place, including the mill facility, all weather

access roads, 25 kV powerline and a 10.5 MW substation sufficient

for the mill power requirements, TMF, office building, core shack

and water supply.

A 16 km forestry road from Québec Highway 167

will be upgraded and constructed to access the Corner Bay mine

site, decreasing the distance between Corner Bay and Copper Rand

mill by over 9 km one way. The Devlin mine site will be accessed

via a 3.25 km upgraded road branching off from the Corner Bay road.

Both mine sites are designed to be compact with required

infrastructure near the portal. A substation connected to the

Québec grid and a 34 kV powerline will supply power to the Corner

Bay and Devlin mines. The Joe Mann mine will utilize the existing

logging roads and powerline to site.

The TMF is located 1.5 km by road from the

Copper Rand mill within the existing Copper Rand TMF. The tailings

will be thickened and pumped to a newly constructed filtration

plant at the mill site. The filtered tailings will then be trucked

1.5 km, placed and compacted to the targeted density. The dry stack

tailings facility (filtered tailings) will be built within the

footprint of the existing Copper Rand TMF. A liner will be used to

separate the filtered tailings from the in-situ tailings. The

run-off water from the filtered tailings facility will be treated

in a water treatment plant and discharged into the existing Copper

Rand TMF polishing pond. Water will flow by gravity from the

polishing pond into Lac Doré as it presently occurs. The proposed

TMF has capacity to be expanded to approximately 12 Mt of tailings,

representing an increase of 7.5 Mt from the current design of 4.5

Mt.

Workforce

The Project plans to source most of its

workforce locally. The peak workforce during operations is

estimated at approximately 320 persons.

Next Steps

Doré Copper is currently completing a 45,000

meter exploration drilling program at Corner Bay, which will be

followed by a 5,000 meter exploration drilling program at Devlin.

This exploration drilling program is focused on upgrading the

Inferred Resource to Indicated Resource for the feasibility study,

which is expected to commence during Q3. Doré Copper has engaged

Englobe, based in Québec City, to assist the Corporation in

submitting a provincial environmental impact study later this year.

Baseline work is already underway and community consultation is

expected to commence in Q2.

Technical Report and Qualified

Persons

The PEA was prepared by BBA Inc. (“BBA”) with

several consulting firms contributing to sections of the study. BBA

Inc., the leading consulting firm for this study, recently

completed the refurbishment of Eldorado Gold’s Sigma mill that

included upgrading most of the existing mechanical equipment and

preparing a detailed commissioning strategy.

|

Consulting Firms |

Area of Responsibility |

Qualified Person1 |

| BBA

Inc. |

Mine and plant design, mines capital costs and operating costs |

Priyadarshi Hem, M.Eng, P.Eng |

| |

Infrastructure |

David Willock P.Eng |

| |

Metallurgy, processing and process plant operating costs |

Patrica Dupuis P.Eng |

| |

Process plant and infrastructure capital cost |

Mathieu Bélisle, P.Eng |

|

|

Financial analysis |

Colin Hardie P.Eng (ON), M.Eng, MBA |

|

SLR Consulting (Canada) Ltd. |

Mineral Resource Estimate Geological technical informationQA/QC

review of drilling and sampling data |

Luke Evans, M.Sc., P.Eng, ing.,Valerie Wilson, M.Sc., P.Geo,

andMarie-Christine Gosselin, B.Sc., P.Geo |

|

SRK Consulting |

Tailings design and water management |

Jean-François St-Laurent, ing., P.Eng (ON), M.Sc. |

|

WSP |

Environmental studies and permittingRestauration and closure |

Simon Latulippe, P.Eng |

1. The Qualified Persons are independent as

defined by Canadian Securities Administrators National Instrument

43-101 (“NI 43-101”) “Standards of Disclosure for Mineral

Projects”. The Qualified Persons are not aware of any

environmental, permitting, legal, title, taxation, socio-economic,

marketing, political, or other relevant factors that could

materially affect the PEA.

All scientific and technical data contained in

this presentation has been reviewed and approved by Ernest Mast,

P.Eng., President and CEO, a Qualified Person for the purposes of

NI 43-101. The Qualified Persons mentioned above have reviewed and

approved their respective technical information contained in this

news release.

The Company cautions that the results of the PEA

are preliminary in nature and include inferred mineral resources

that are considered too speculative geologically to have economic

considerations applied to them to be classified as mineral

reserves. There is no certainty that the results of the PEA will be

realized.

A NI 43-101 technical report supporting the PEA

will be filed on SEDAR within 45 days of this news release and will

be available at that time on the Corporation’s

website. Readers are encouraged to read the Technical Report

in its entirety, including all qualifications, assumptions and

exclusions that relate to the details summarized in this news

release. The Technical Report is intended to be read as a whole,

and sections should not be read or relied upon out of context.

A presentation that summarizes the PEA results

of the Project is available on the Corporation website.

Town Hall Webinar

Ernest Mast, President and CEO of Doré Copper

will discuss the results of the PEA at a webinar on Tuesday, May

10, 10:00 AM EST.

To participate in the Town Hall Webinar, please

register here with your full

name:https://us06web.zoom.us/webinar/register/WN_yaoTJLNPTcGccp-PlAceIA

About Doré Copper Mining

Corp.

Doré Copper Mining Corp. aims to be the next

copper producer in Québec with an initial production target of +50

Mlbs of copper equivalent annually by implementing a hub-and spoke

operation model with multiple high-grade copper-gold assets feeding

its centralized Copper Rand mill. The Corporation has delivered its

PEA in May 2022 and plans to commence a feasibility study and

submit permit applications by mid-year.

The Corporation has consolidated a large land

package in the prolific Lac Doré/Chibougamau and Joe Mann mining

camps that has produced 1.6 billion pounds of copper and

4.4 million ounces of gold1. The land package includes 13

former producing mines, deposits and resource target areas within a

60-kilometre radius of the Corporation’s Copper Rand Mill.

For further information, please contact:

|

Ernest Mast |

Laurie Gaborit |

|

President and Chief Executive Officer |

Vice President, Investor Relations |

|

Phone: (416) 792-2229 |

Phone: (416) 219-2049 |

|

Email: ernest.mast@dorecopper.com |

Email: laurie.gaborit@dorecopper.com |

Visit: www.dorecopper.com Facebook: Doré Copper MiningLinkedIn:

Doré Copper Mining Corp.Twitter: @DoreCopperInstagram:

@DoreCopperMining

- Sources for historic production

figures: Economic Geology, v. 107, pp. 963–989 - Structural and

Stratigraphic Controls on Magmatic, Volcanogenic, and Shear

Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp,

Northeastern Abitibi, Canada by François Leclerc et al. (Lac

Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the

Joe Mann Property dated January 11, 2016 by Geologica

Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann

mine).

Information Concerning Estimates of

Mineral Resources Mineral resources that are not mineral

reserves do not have demonstrated economic viability. Therefore,

investors are cautioned not to assume that all or any part of an

inferred mineral resource could ever be mined economically. It

cannot be assumed that all or any part of “measured mineral

resources,” “indicated mineral resources,” or “inferred mineral

resources” will ever be upgraded to a higher category. The mineral

resource estimates contained herein may be subject to legal,

political, environmental or other risks that could materially

affect the potential development of such mineral resources. Refer

to the Technical Report, once filed, for more information with

respect to the key assumptions, parameters, methods and risks of

determination associated with the foregoing.

Non-IFRS Financial Measures

Doré Copper has included certain non-IFRS financial measures in

this news release, such as capital intensity index, initial capital

cost, cash operating cost and AISC per pound of copper equivalent

produced, unit operating costs, and EBITDA which are not measures

recognized under IFRS and do not have a standardized meaning

prescribed by IFRS. As a result, these measures may not be

comparable to similar measures reported by other corporations. Each

of these measures used are intended to provide additional

information to the user and should not be considered in isolation

or as a substitute for measures prepared in accordance with

IFRS.

A description of the significant cost components that make-up

the forward-looking non-IFRS financial measures cash operating cost

and AISC per pound of copper equivalent produced is shown in the

table below.

|

Total Sustaining Capital and Closure Costs |

C$402.4M |

|

|

Total Cash Operating Costs |

C$966.5 M |

|

|

Historical All-in Sustaining Costs |

C$0.0 M |

|

|

Commercial Costs |

C$223.9 M |

|

|

NSR Royalties |

C$13.3 M |

|

|

Total All-In Sustaining Costs for AISC

Calculation |

C$1,606.1 M |

|

|

Mill Recovered Copper Equivalent (Mlbs) |

560.8 |

|

|

Exchange Rate USD/CAD |

1.28 |

|

|

Cash Operating Costs |

US$1.35/lb CuEq |

|

|

All-in Sustaining Costs |

US$2.24/lb CuEq |

|

|

|

|

|

Cautionary Note to United States

Investors Doré Copper prepares its disclosure in

accordance with the requirements of securities laws in effect in

Canada, which differ from the requirements of U.S. securities laws.

Terms relating to mineral resources in this news release are

defined in accordance with NI 43-101 under the guidelines set out

in CIM Definition Standards on Mineral Resources and Mineral

Reserves, adopted by the Canadian Institute of Mining, Metallurgy

and Petroleum Council on May 19, 2014, as amended ("CIM

Standards"). The U.S. Securities and Exchange Commission (the

"SEC") has adopted amendments effective February 25, 2019 (the "SEC

Modernization Rules") to its disclosure rules to modernize the

mineral property disclosure requirements for issuers whose

securities are registered with the SEC under the U.S. Securities

Exchange Act of 1934. As a result of the adoption of the SEC

Modernization Rules, the SEC will now recognize estimates of

"measured mineral resources", "indicated mineral resources" and

"inferred mineral resources", which are defined in substantially

similar terms to the corresponding CIM Standards. In addition, the

SEC has amended its definitions of "proven mineral reserves" and

"probable mineral reserves" to be substantially similar to the

corresponding CIM Standards.

U.S. investors are cautioned that while the

foregoing terms are "substantially similar" to corresponding

definitions under the CIM Standards, there are differences in the

definitions under the SEC Modernization Rules and the CIM

Standards. Accordingly, there is no assurance any mineral resources

that Doré Copper may report as "measured mineral resources",

"indicated mineral resources" and "inferred mineral resources"

under NI 43-101 would be the same had Doré Copper prepared the

resource estimates under the standards adopted under the SEC

Modernization Rules. In accordance with Canadian securities laws,

estimates of "inferred mineral resources" cannot form the basis of

feasibility or other economic studies, except in limited

circumstances where permitted under NI 43-101.

Cautionary Note Regarding

Forward-Looking Statements This news release includes

certain "forward-looking statements" under applicable Canadian

securities legislation. Forward-looking statements include

predictions, projections and forecasts and are often, but not

always, identified by the use of words such as "seek",

"anticipate", "believe", "plan", "estimate", "forecast", "expect",

"potential", "project", "target", "schedule", "budget" and "intend"

and statements that an event or result "may", "will", "should",

"could" or "might" occur or be achieved and other similar

expressions and includes the negatives thereof. Specific

forward-looking statements in this press release include, but are

not limited to the results of the PEA, including the projected

production, operating costs, capital costs, sustaining costs, metal

price assumptions, cash flow projections, processing mineralized

material, metal recoveries and grades, concentrate grade, mine life

projections, production rates at each project, process capacity,

mining and processing methods, changes to the existing TMF,

proposed PEA production schedule and metal production profile,

estimation of mineral resources, estimated NPV and IRR, payback

period, sensitivities, opportunities outlined in the PEA, potential

to further enhance the economics of the Project, securing the

required permits and licenses for further studies to consider

operation, PEA demonstrating attractive project economics with

optionality for expansion into a significantly larger operation,

re-establishing the Chibougamau mining camp as a long-life copper

and gold producer, existing mill having 25% excess capacity, PEA

study modernizing the existing Copper Rand mill and TMF so that

they are productive and cost efficient and minimizing impact on the

environment, potential for additional mill feed during mine life

with the advancement of the Corporation’s exploration projects in

Chibougamau mining camp, operating a viable hub-and spoke operation

over multi-decades to become a significant copper producer in

Quebec, commencing a feasibility study in Q3, submitting permit

application with the provincial government later this year,

potential labour cost savings by self-performance for various mill

rehabilitation activities, potential for a carbon neutral

operation, Corporation attempting in the feasibility study to be

carbon neutral by the end of Devlin’s mine life (approximately 4

years), aiming to be the next copper producer in Québec with an

initial production target of +50 Mlbs of copper equivalent

annually; implementing a hub-and spoke operation model; and

initiating a feasibility study and permit applications after the

PEA.

All statements other than statements of

historical fact included in this release, including, without

limitation, statements regarding the timing and ability of the

Corporation to receive necessary regulatory approvals, and the

plans, operations and prospects of the Corporation and its

properties are forward-looking statements. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable, are subject to known

and unknown risks, uncertainties and other factors which may cause

actual results and future events to differ materially from those

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, actual exploration

results, changes in project parameters as plans continue to be

refined, future metal prices, availability of capital and financing

on acceptable terms, general economic, market or business

conditions, uninsured risks, regulatory changes, delays or

inability to receive required regulatory approvals, health

emergencies, pandemics and other exploration or other risks

detailed herein and from time to time in the filings made by the

Corporation with securities regulators. Although the Corporation

has attempted to identify important factors that could cause actual

actions, events or results to differ from those described in

forward-looking statements, there may be other factors that cause

such actions, events or results to differ materially from those

anticipated. There can be no assurance that such statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements. The Corporation disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

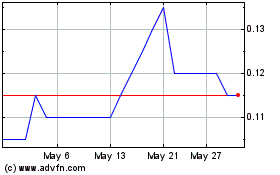

Dore Copper Mining (TSXV:DCMC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dore Copper Mining (TSXV:DCMC)

Historical Stock Chart

From Jan 2024 to Jan 2025