Independent Test: Focus Graphite Succeeds in Producing Extremely

High-Performing Coated Spherical Graphite For Lithium Ion Batteries

Creates the Potential for High Value Sales in the Li-Ion Battery

Sector

OTTAWA, ONTARIO--(Marketwired - May 27, 2014) - Focus Graphite

Inc. (TSX-VENTURE:FMS)(OTCQX:FCSMF)(FRANKFURT:FKC) ("Focus" or the

"Company") is very pleased to announce the results from coin cell

tests for the lithium ion battery market recently performed on Lac

Knife Spherical Graphite ("SPG").

Focus Graphite is

the sole owner of the world-class, high-grade Lac Knife natural

flake graphite project in Quebec. The Company's aim is to become

one of the lowest cost producers of high-purity technology graphite

from a vertically integrated business strategy.

Testing was

conducted by a globally recognized, North American laboratory with

particular expertise in processes related to lithium ion battery

technologies. Its clients are some of the most advanced

technology-related corporations in the world. The laboratory has

completed its testing and has measured the performance properties

of Lac Knife's materials on an environmentally sustainable basis.

Focus Graphite has withheld the name of the laboratory for reasons

of commercial and competitive confidentiality.

Highlights

- Lac Knife SPG battery tests evaluate three proprietary

formulations that responded very well to CR2016 coin cell

performance testing

- Large, medium and fine micron size produced outstanding

performance metrics

- Testing results on the premium medium and fine grades exceed

the performance of benchmark commercially available grades by

significant percentages.

- Tests confirm Focus' capability to tailor lithium ion battery

anode grade graphite and value added products to meet the most

stringent customer specifications

|

Focus Graphite |

Reversible Capacity |

Irreversible Capacity Loss |

|

Surface Area |

|

|

Coin Cell Test Samples |

(Ah/kg) |

(%) |

|

(m2/g) |

|

|

Coarse Carbon Coated SPG Grade (D90=42um) |

362.1 |

6.80 |

% |

0.64 |

% |

|

Medium Carbon Coated SPG Grade (D50=24um) |

363.7 |

1.44 |

% |

0.48 |

% |

|

Fine Carbon Coated SPG Grade (D50=17um) |

365.1 |

1.01 |

% |

1.14 |

% |

A benchmark

commercial grade of SPG provided a reversible capacity (RC) in the

range of 345 to 355 Ah/kg and an irreversible capacity loss (ICL)

of 6.5 %, a significantly higher loss compared to the 1.44% and

1.01% ICL for Lac Knife's medium and fine grade samples shown

above.

In Lockstep With

Industry

"Recent comments by

leading North American auto makers signalled two significant market

realities," said Focus CEO and Director Gary Economo.

"The first is the

need to lower the costs of battery materials to encourage broader

consumer interest in moving to electric vehicles. The second is

that the potential North American battery market may well enjoy a

much larger than anticipated growth in demand," Mr. Economo

said.

"Again, these

results add another layer of material value that holds the

potential to de-risk even further our global enterprise goals," he

said.

A detailed summary

of the SPG tests is provided below.

SPG grades developed

by Focus Graphite may help to solve one of the more difficult

challenges holding back market growth for Li Ion batteries,

"Increasing cycling capacity." One of the problems in using carbon

based materials in Li Ion batteries is that it results in the

formation of a Solid Electrolyte Interface ("SEI") layer which

produces an irreversible capacity loss which generally ranges

between 5 and 10% for benchmark SPG grades currently available in

the market place.

Irreversible

capacity loss means that a portion of the valuable lithium and

graphite is wasted. Thus the efficiency is reduced and the cost

increased. Lac Knife anode graphite is unique in having such a low

loss.

Two premium (medium

and fine) grade SPG's developed by Focus have achieved First Cycle

Irreversible Capacity Losses of 1.44% and 1.01%, respectively,

truly remarkable results. These lower ICL values of the SPG grades

produced by Focus can lead to the production of higher capacity and

longer life Li Ion batteries.

Furthermore, the low

surface areas of the premium coated grades of SPG at 0.48 and 1.14%

m2/g can help to improve the safety of Li Ion batteries. The use of

higher surface area carbons in these batteries can cause the

temperature of the battery to increase and possibly result in the

occurrence of thermal runaways.

Figure 1: The following

Galvanostatic charge-discharge curve for the fine SPG grade

illustrates the very promising nature of the Lac Knife concentrate.

To view Figure 1,

please visit the following link:

http://media3.marketwire.com/docs/fms-figure1.pdf.

This material has

demonstrated a reversible capacity of 365.08 Ah/kg and an

irreversible capacity loss of an ultra low 1.01%. The performance

metric is calculated between the two curves in the chart above is

the difference between 368.8 and 365.08 on a percentage basis.

Approximately an 80% improvement over commercial benchmark grades

was achieved.

The unique

properties of the Lac Knife high carbon content concentrate that

grades 98% C even in the finer grade products down to 200 mesh (75

microns) that are usually the most difficult products to sell. This

holds the potential to allow Focus market access to significantly

higher margin value added products with a finer grade lower cost

product creating a unique opportunity. Additionally, Focus plans to

offer the higher value large flake to other growing markets.

The -100 mesh size

(150 microns), 98% C and +65 mesh size (230 microns) flake products

spheronize very well establishing a unique Lac Knife concentrate

quality.

Potentially these

excellent Irreversible Capacity Loss ("ICL") results from the Lac

Knife high quality flake uncoated concentrate are due to low

reactivity at the flake edges compared to other graphite

concentrates underlying its inherent value as a feed to the

secondary battery market in a green technology revolution.

Also included in the

study is a scanning electron photomicrograph of the 99.98 %

purified high purity large flake graphite (See Figure 2 below)

produced on both a laboratory and pilot plant scale from 98% C Lac

Knife +65 mesh flake concentrate. This photomicrograph indicates

that the Lac Knife concentrates are uniquely suited to produce high

purity lithium ion battery grade graphite. What is important to

note is that Lac Knife graphite concentrate consists of very pure

graphite flakes with impurities located on the surface of the

flakes.

Figure 2: Photomicrograph of

Thermally Purified Flake Graphite showing exceptionally clean

surfaces and grading 99.98% C. To view Figure 2, please visit the

following link:

http://media3.marketwire.com/docs/fms-figure2.pdf.

Such surface

impurities can be removed by using less expensive technologies. In

the most competitive concentrates on the market, the impurities are

intercalated or sandwiched within the layers and are more difficult

to remove requiring higher cost processing methods during

purification.

Figure 3: Photomicrograph of

Thermally Purified Spherical Graphite grading 99.9% C. To view

Figure 3, please

visit the following link:

http://media3.marketwire.com/docs/fms-figure3.pdf.

The quality of the

Lac Knife concentrate is continuing to create the potential for

increased margins through to value added products and confirms the

Company's plan to evaluate the potential of secondary

transformation for as much of the Lac Knife production as is

possible. The potential for increased margins from the secondary

transformation of graphite concentrate is not included in the

current Preliminary Economic Assessment for the project.

Current prices for

coated, spherical graphite are at the $8,000 per tonne point. This

compares to $20,000 per tonne for battery grade synthetic graphite,

the only alternative for the anode in the battery.

"Commercially and

competitively, these results open the door for Focus to confidently

accelerate our plans to market and sell our battery grade, high

margin products to potential partners and customers," said Focus

President and COO Don Baxter.

"The data presented

validates Lac Knife's potential to become a North American source

of low-cost high purity flake graphite concentrate that could,

possibly, lead to the production of batteries with better

performance," Mr. Baxter stated.

"Further, these

results enable us to continue with our vision of producing value

added products. In particular, Focus' Director of Manufacturing and

Technology Dr. Joseph Doninger and our Consultant, Mr. George

Hawley have the capability to lead Focus through the development of

various lithium ion battery products with the aim of building

higher margin applications and downstream products" Mr. Baxter

said.

Dr. Doninger said:

"The Lac Knife premium medium and fine grades of coated SPG at

1.44% and 1.01% first cycle irreversible capacity losses and 0.48

and 1.14 m2/g surface areas are better than any similar sized SPGs

that I've ever seen."

Battery

manufacturers require a cost competitive alternative to current

sources of natural SPG. China produces about 90% of the world's

purified natural SPG, utilizing methods that are generally regarded

as environmentally unsustainable.

Qualified

Persons

Don Baxter, P. Eng.,

Focus President & Chief Operating Officer, is a Qualified

Person as defined by NI 43-101 guidelines, has reviewed and

approved the technical content of this news release.

About Focus

Graphite

Focus Graphite Inc.

is an emerging mid-tier junior mining development company, a

technology solutions supplier and a business innovator. Focus is

the owner of the Lac Knife graphite deposit located in the

Côte-Nord region of north-eastern Québec. The Lac Knife project

hosts a NI 43-101 compliant Measured and Indicated Mineral Resource

Estimate* of 9.6 million tons grading 14.77% graphitic carbon (Cg)

as crystalline graphite with an additional Inferred Mineral

Resource Estimate* of 3.1 million tons grading 13.25% Cg of

crystalline graphite. Focus' goal is to assume an industry

leadership position by becoming a low-cost producer of

technology-grade graphite. On November 7, 2013 the Company released

the results of an updated Preliminary Economic Assessment ("PEA")

of the Lac Knife Project that indicated that the project has very

good potential to become a graphite producer. As a

technology-oriented enterprise with a view to building long-term,

sustainable shareholder value, Focus also invests in the

development of graphene applications and patents through Grafoid

Inc.

* Mineral

resources are not mineral reserves and do not have demonstrated

economic viability

Forward Looking

Statement

This News Release

contains "forward-looking information" within the meaning of

Canadian securities legislation. All information contained herein

that is not clearly historical in nature may constitute

forward-looking information. Generally, such forward-looking

information can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including but not limited to: (i)

volatile stock price; (ii) the general global markets and economic

conditions; (iii) the possibility of write-downs and impairments;

(iv) the risk associated with exploration, development and

operations of mineral deposits; (v) the risk associated with

establishing title to mineral properties and assets; (vi)the risks

associated with entering into joint ventures; (vii) fluctuations in

commodity prices; (viii) the risks associated with uninsurable

risks arising during the course of exploration, development and

production; (ix) competition faced by the resulting issuer in

securing experienced personnel and financing; (x) access to

adequate infrastructure to support mining, processing, development

and exploration activities; (xi) the risks associated with changes

in the mining regulatory regime governing the resulting issuer;

(xii) the risks associated with the various environmental

regulations the resulting issuer is subject to; (xiii) risks

related to regulatory and permitting delays; (xiv) risks related to

potential conflicts of interest; (xv) the reliance on key

personnel; (xvi) liquidity risks; (xvii) the risk of potential

dilution through the issue of common shares; (xviii) the Company

does not anticipate declaring dividends in the near term; (xix) the

risk of litigation; and (xx) risk management. Forward-looking

information is based on assumptions management believes to be

reasonable at the time such statements are made, including but not

limited to, continued exploration activities, no material adverse

change in metal prices, exploration and development plans

proceeding in accordance with plans and such plans achieving their

stated expected outcomes, receipt of required regulatory approvals,

and such other assumptions and factors as set out herein. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated, estimated or intended.

There can be no assurance that such forward-looking information

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such

forward-looking information. Such forward-looking information has

been provided for the purpose of assisting investors in

understanding the Company's business, operations and exploration

plans and may not be appropriate for other purposes. Accordingly,

readers should not place undue reliance on forward-looking

information. Forward-looking information is made as of the date of

this News Release, and the Company does not undertake to update

such forward-looking information except in accordance with

applicable securities laws.

Focus Graphite Inc.Mr. Don Baxter, P.EngPresident and Chief

Operating

Officer705-789-9706dbaxter@focusgraphite.comwww.focusgraphite.com

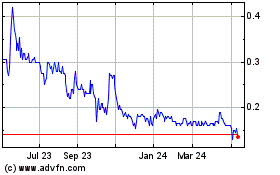

Focus Graphite (TSXV:FMS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Focus Graphite (TSXV:FMS)

Historical Stock Chart

From Dec 2023 to Dec 2024