Klondike Silver Samples 53 oz/ton Ag, 6.38% Pb, 10.49% Zn and Announces 2010 Exploration Plans for Stenson Property

November 10 2009 - 9:59PM

Marketwired Canada

Klondike Silver Corp. (the "Company") (TSX VENTURE:KS) is pleased to announce

that based on results from trenching and sampling in the Jackson basin area in

2009, an aggressive exploration program is planned in the northern part of the

basin for the 2010 field season. Work in 2009 focused in the area of the

past-producing Jackson mine. Little work was done on the large claim group

immediately to the north, referred to as the Stenson property and including the

western extension of the Bonton and Dardenelles veins. Past work on the Stenson

by Klondike Silver has included a soil geochemical program, a ground

magnetometer-VLF-EM survey and trenching.

Soil and geophysical surveys confirmed the east to northeasterly trend of

Stenson mineralization and helped direct the trenching program which exposed a

silver-lead-zinc vein. Analyses of selected samples of the vein returned values

up to 53 oz/ton Ag, 6.38% Pb and 10.49% Zn.

Work in 2009 extended the soil and geophysical surveys to the west, towards the

Bonton and Dardenelle showings. These deposits are interpreted to be on strike

with the Stenson and are unusually rich with reported production (BC Minfile

data base) of 760 tons containing 207 oz/ton Ag, 27.5% Pb and 0.6% Zn

(Dardenelles) and 13 tons containing 229 oz/ton Ag and 22.3% Pb (Bonton).

Proposed exploration is intended to focus on the western slopes of Jackson Creek

between Stenson and Bonton showings. This work will include some fill-in soil

geochemical and geophysical surveys followed by trenching in an attempt to

expose the mineralized structure. The Company is encouraged by the high grades

of the mineralized showings on east side of the property, the continuity and

strength of the structure where exposed, and its similarity to the past

producing Jackson lode.

Further to the Company's news release of October 27, 2009, the Company announces

that it has amended its private placement of up to 2,500,000 units for total

proceeds of up to $162,500. The financing will consist of flow through units

priced at $0.065 per unit. Each of the units will consist of one flow through

common share and one non-flow through, non-transferable share purchase warrant

entitling the holder to purchase one additional common share for five years at a

price of $0.10 per share in the first two years and $0.15 per share for the

remaining three years. Proceeds from the private placement will be used for

exploration expenditures.

The Company is also pleased to announce that it has arranged for a private

placement of up to 12,000,000 units for total proceeds of up to $960,000. The

financing will consist of flow through units priced at $0.08 per unit and

non-flow through units priced at $0.065 per unit. Each of the units will consist

of one flow through or non-flow through common share and one non-flow through,

non-transferable share purchase warrant entitling the holder to purchase one

additional common share for five years at a price of $0.10 per share in the

first two years and $0.15 per share for the remaining three years. In accordance

with Exchange policies, finders' fees may be paid on the funds raised. The

private placement is subject to regulatory approval and the proceeds will be

used for exploration programs and general working capital.

The Qualified Person for the purpose of National Instrument 43-101 is Trygve

Hoy, PEng, PhD who has read and agreed with the technical information in this

news release.

About Klondike Silver:

Klondike Silver is a member of the Hughes Exploration Group of Companies and is

led by a team with a stellar track record of discovery and development in

Canada.

Klondike Silver Corp. has assembled a quality portfolio of silver properties in

historic mineral districts in North America, and is applying advanced

exploration technologies to add value to these core assets. Klondike Silver is

reviving the Gowganda and Elk Lake silver camps in Ontario, and the world-famous

Klondike district of Yukon Territory. The Company owns a 100 TPD fully

operational flotation mill in Sandon, BC, which is currently processing material

from local mines in the historic Slocan Silver Camp. As well, Klondike Silver

entered into a joint venture with Kootenay Gold Inc. to explore a

copper-porphyry property in the state of Sonoro in northern Mexico.

Visit Klondike Silver's web-site: www.klondikesilver.com to see Smartstox

interviews with Company President, Richard Hughes.

The statements made in this news release may contain forward-looking statements

that may involve a number of risks and uncertainties. Actual events or results

could differ materially from the Company's expectations and projections.

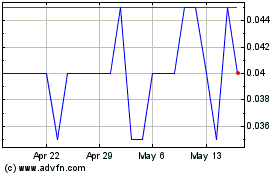

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Nov 2024 to Dec 2024

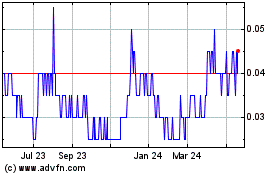

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Dec 2023 to Dec 2024