LEADING EDGE MATERIALS ANNOUNCES UP TO

C$4,500,000 NON-BROKERED PRIVATE PLACEMENT

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES OR ANY OTHER JURISDICTION

IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL. ANY FAILURE

TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF U.S.

SECURITIES LAWS. THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER,

OR A SOLICITATION OF ANY OFFER, TO BUY OR SUBSCRIBE FOR ANY

SECURITIES IN LEADING EDGE MATERIALS IN ANY JURISDICTION.

Vancouver, July 15, 2024 – Leading Edge

Materials Corp. (“Leading Edge Materials” or

the “Company”) (TSXV: LEM) (Nasdaq First North: LEMSE) (OTCQB:

LEMIF) announces the intent to complete a non-brokered private

placement of up to 45,000,000 units (“Units”) at a price of C$0.10

per Unit for aggregate gross proceeds of up to C$4,500,000 (the

“Private Placement”).

Leading Edge Materials intends to use net

proceeds for the Company’s projects, located in Sweden and Romania

and for general working capital and corporate purposes.

Each Unit will consist of one (1) common share

(each, a “Common Share”) in the capital of the Company and one (1)

Common Share purchase warrant (a “Warrant”). Each Warrant will

entitle the holder to purchase one Common Share (a “Warrant Share”)

at a price of C$0.20 per Warrant Share until the date which is four

(4) years from the closing date of the Private Placement (the

“Closing Date”).

The Company expects certain insiders of the

Company to participate in the Private Placement. Any participation

by insiders in the Private Placement constitutes a “related party

transaction” as defined under Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). However, the Company expects to rely on exemptions

from the formal valuation and minority shareholder approval

requirements of MI 61-101 based on the fact that neither the fair

market value of the Units subscribed for by the insiders, nor the

consideration for the Units paid by such insiders, would exceed 25%

of the Company’s market capitalization as at the date of this news

release.

The Private Placement is directed towards

Canadian, Nordic and other international investors. All

securities issued under the Private Placement, including securities

issuable on exercise of the Warrants, will be delivered from Canada

and are subject to a hold period expiring four months and one day

from the Closing Date. The minimum investment for European Economic

Area (“EEA“) investors in the Private Placement will be an amount

equivalent to at least EUR 100,000.

The Private Placement is subject to certain

conditions including, but not limited to, the receipt of all

necessary regulatory approvals, including the approval of the TSX

Venture Exchange.

A finders’ fees may be payable on a portion of

the Private Placement.

The securities have not been, and will not be,

registered under the U.S. Securities Act, or any U.S. state

securities laws, and may not be offered or sold in the U.S. or to,

or for the account or benefit of, United States persons absent

registration or an applicable exemption from the registration

requirements of the U.S. Securities Act and applicable U.S. state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of these securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful.

This news release is not a prospectus under

Regulation (EU) 2017/1129 (the “EU Prospectus Regulation”). The

Company has not authorized any offer of securities to the public

(as defined in the EU Prospectus Regulation) in any EEA member

state and no such prospectus has been or will be prepared in

connection with the Private Placement.

On behalf of the Board of

Directors,

Leading Edge Materials

Corp.

Kurt Budge, CEO

For further information, please contact the Company

at:info@leadingedgematerials.com www.leadingedgematerials.com

Follow usTwitter: https://twitter.com/LeadingEdgeMtlsLinkedin:

https://www.linkedin.com/company/leading-edge-materials-corp/

About Leading Edge Materials

Leading Edge Materials is a Canadian public company focused on

developing a portfolio of critical raw material projects located in

the European Union. Critical raw materials are determined as such

by the European Union based on their economic importance and supply

risk. They are directly linked to high growth technologies such as

batteries for electromobility and energy storage and permanent

magnets for electric motors and wind power that underpin the clean

energy transition towards climate neutrality. The portfolio of

projects includes the 100% owned Woxna Graphite mine (Sweden),

Norra Karr HREE project (Sweden) and the 51% owned Bihor Sud Nickel

Cobalt exploration alliance (Romania).

Additional

Information

This information is information that Leading

Edge Materials Corp. (publ). is obliged to make public pursuant to

the EU Market Abuse Regulation. The information was submitted for

publication through the agency of the contact person set out above,

at July 15, 2024 at 8:30 am Vancouver time.

Leading Edge Materials is listed on the TSXV

under the symbol “LEM”, OTCQB under the symbol “LEMIF” and Nasdaq

First North Stockholm under the symbol “LEMSE”. Mangold

Fondkommission AB is the Company’s Certified Adviser on Nasdaq

First North and may be contacted via email CA@mangold.se or by

phone +46 (0) 8 5030 1550.

Reader Advisory

This press release does not constitute an offer,

or a solicitation of any offer, to buy or subscribe for any

securities in Leading Edge Materials in any jurisdiction.

This news release may include forward-looking

information that is subject to risks and uncertainties. All

statements within, other than statements of historical fact, are to

be considered forward-looking, including statements with respect to

the closing of the Private Placement, the receipt of regulatory

approvals, and the use of proceeds from the Private Placement.

Although the Company believes the expectations expressed in such

forward-looking information are based on reasonable assumptions,

such information is not a guarantee of future performance and

actual results or developments may differ materially from those

contained in forward-looking information. Factors that could cause

actual results to differ materially from those in forward-looking

information include, but are not limited to, fluctuations in market

prices, successes of the operations of the Company, the Company’s

ability to close the Private Placement, the Company’s ability to

obtain the required regulatory approvals, continued availability of

capital and financing and general economic, market or business

conditions. There can be no assurances that such information will

prove accurate and, therefore, readers are advised to rely on their

own evaluation of such uncertainties. The Company does not assume

any obligation to update any forward-looking information except as

required under the applicable securities laws.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Important information for EEA

Investors

The release, announcement or distribution of

this press release may, in certain jurisdictions, be subject to

restrictions. The recipients of this press release in jurisdictions

where this press release has been published or distributed shall

inform themselves of and follow such restrictions. This press

release does not constitute an offer, or a solicitation of any

offer, to buy or subscribe for any securities in Leading Edge

Materials in any jurisdiction.

Any investment decision in connection with the

Private Placement must be made on the basis of all publicly

available information relating to the Company and the Company’s

shares/Units. The information contained in this announcement is for

background purposes only and does not purport to be full or

complete. No reliance may be placed for any purpose on the

information contained in this announcement or its accuracy or

completeness. This announcement does not purport to identify or

suggest the risks (direct or indirect) which may be associated with

an investment in the Company or the new shares/Units.

This press release is not a prospectus for the

purposes of the EU Prospectus Regulation. Leading Edge Materials

has not authorized any offer to the public of Units, shares or

rights in any member state of the EEA and no prospectus has been or

will be prepared in connection with the Private Placement. In any

EEA Member State, the Private Placement will only be addressed to

and is only directed at investors with a minimum subscription and

allotment amount equivalent to at least EUR 100,000.

In the United Kingdom, this document and any

other materials in relation to the securities described herein is

only being distributed to, and is only directed at, and any

investment or investment activity to which this document relates is

available only to, and will be engaged in only with, “qualified

investors” who are (i) persons having professional experience in

matters relating to investments who fall within the definition of

“investment professionals” in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

“Order”); or (ii) high net worth entities falling within Article

49(2)(a) to (d) of the Order (all such persons together being

referred to as “relevant persons”). In the United Kingdom, any

investment or investment activity to which this communication

relates is available only to, and will be engaged in only with,

relevant persons. Persons who are not relevant persons should not

take any action on the basis of this document and should not act or

rely on it.

- LEM - News Release Announcing the Financing

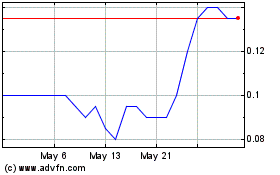

Leading Edge Materials (TSXV:LEM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Leading Edge Materials (TSXV:LEM)

Historical Stock Chart

From Dec 2023 to Dec 2024