Regulatory News:

Maurel & Prom (Paris:MAU):

- Production up and financial performance in line with changes

in the price of crude

- M&P’s working interest production of 27,406 boepd, up 9%

and 5% compared to the first and second six months of 2022

respectively (25,126 boepd and 26,053 boepd)

- Sales of $299 million in the first half of 2023, down 16%

compared to the first half of 2022 ($355 million), caused by the

marked fall (29%) in the average sale price of oil over the period

($74.8/bbl against $105.0/bbl)

- Continued cost discipline in spite of the inflationary

environment: limited increase in opex & G&A which reached

$88 million against $84 million in the first half of 2022

- EBITDA $164 million; net income $53 million; net current income

(excluding non-recurring items) $70 million

- Net debt down again in spite of an unfavourable change in

the working capital requirement.

- Cash flow from operating activities $87 million ($127 million

before change in the working capital requirement)

- Free cash flow of $38 million

- Net debt of $178 million as at 30 June 2023, down $21 million

over the half year ($200 million as at 31 December 2022)

- Pursuit of growth and return of value to shareholders

- M&P’s discussions with a view to the acquisition of Assala

Energy are well advanced and shareholders will be informed of

progress in due course

- Ongoing discussions with Tanzanian authorities to obtain

approval for the acquisition of Wentworth Resources

- Dividend of €0.23 per share (for a total amount of $49 million)

paid post half-year closing at the start of July 2023.

Key financial indicators

in $ million

H1 2023

H1 2022

Change

Income statement

Sales

299

355

-16%

Opex & G&A

-88

-84

Royalties and production taxes

-37

-45

Change in overlift/underlift position

-9

25

Other

–

–

EBITDA

164

250

-34%

Depreciation, amortisation and provisions

and impairment of production assets

-54

-40

Expenses on exploration assets

-12

-1

Other

-5

-4

Operating income

93

205

-54%

Net financial expenses

-7

-17

Income tax

-51

-68

Share of income/loss of associates

17

17

Net income

53

138

-62%

O/w net income before non-recurring

items

70

143

-51%

Cash flows

Cash flow before income tax

160

250

Income tax paid

-33

-54

Operating cash flow before change in

working capital

127

196

-35%

Change in working capital requirement

-40

3

Operating cash flow

87

199

-56%

Development capex

-57

-44

Exploration investments

-5

–

M&A

–

–

Dividends received

13

6

Free cash flow

38

161

-77%

Net debt service

-39

-105

Dividends paid

–

–

Other

0

-2

Change in cash position

-1

54

N/A

Cash and debt

30/06/2023

31/12/2022

Closing cash

137

138

Gross debt at closing

315

337

Net debt at closing

178

200

-11%

At its meeting of 3 August 2023, chaired by John Anis, the Board

of Directors of the Maurel & Prom Group (“M&P” or “the

Group”) approved the financial statements for the half year ended

30 June 2023.

Olivier de Langavant, Chief Executive Officer at Maurel &

Prom, stated: “As expected, the Group’s financial results for the

first half of 2023 are naturally less than those for the same

period last year, as the price environment has returned to a more

normal level after the significant volatility encountered in 2022.

However, this does not in any way obscure the excellent operational

and financial health of the Group. Production is increasing and

costs continue to be under control in spite of the high rate of

inflation affecting the sector. M&P is consolidating its

position on certain assets, with the extension of the Block 3/05

licence in Angola for example, while moving away from those which

do not fit with its capital allocation policy. This explains the

exit from the deepwater exploration licences in Namibia in

particular. In compliance with its ESG rules and commitments, the

Group continues to work actively to build its future and its growth

through major development projects, while ensuring the

redistribution of value created to shareholders, as shown by the

dividend of €0.23 per share paid at the beginning of July, up 64%

compared to the previous year.”

Financial performance

The Group’s consolidated sales for the first six months amounted

to $299 million, 16% lower than for the first six months of 2022

($355 million), in line with the fall in the average sale price of

oil ($74.8/bbl compared to $105/bbl; i.e. a drop of 29%.

Opex & G&A were $88 million over the period, a limited

increase of 5% compared to their level in the first half of 2022

($84 million). Royalties and production taxes were $37 million.

EBITDA was $164 million Depreciation and amortisation charges

stood at $54 million. Expenses on exploration assets of $12 million

correspond to drilling expenses incurred on the COR-15 permit in

Colombia ($5 million) as well as impairment of Namibian assets ($7

million) following return of the exploration licences to the

authorities. Current operating income amounted to $93 million.

Net of financial expense (structurally negative at $7million),

income tax ($51 million), and the share of income from equity

associates ($17 million, mainly referring to the 20.46% stake in

Seplat Energy), the Group’s net income fell to $53 million in the

first half of 2023. Current net income, excluding exploration

expenses in particular, amounted to $70 million.

Turning to cash flows, operating activities generated $127

million in the first half.2023, before the change in working

capital requirement. The change in working capital requirement had

a negative impact of $40 million over the period, caused in

particular by an increase in receivables from SOGARA, the Gabon

national refining company, amounting to $24 million as at 30 June

2023. A memorandum of understanding was signed with the Republic of

Gabon in July 2023, providing for recovery of the receivable via a

mechanism for charging to the recoverable costs of Ezanga with no

financial loss.

After taking into account $57 million development capex

(including $33 million of drilling development expenditure in

Gabon), $5 million exploration capex (relating to drilling

operations in Colombia) and $13 million received in dividends in

relation to the 20.46% holding in Seplat Energy, free cash flow

before financing stood at $38 million.

Net debt service was $39 million, including $23 million

repayment of principal. The change in cash position was therefore

-$1 million.

Available liquidity as at 30 June 2023 was $137 million

(compared to $138 million as at 31 December 2022) and covered only

the cash position, as the $67 million RCF tranche was fully drawn.

This excludes the sum placed in escrow as part of the offer

announced on 5 December 2022 for Wentworth Resources, which

amounted to $81 million as at 30 June 2023.

Gross debt amounted to $315 million at 31 March 2023, including

$236 million in a bank loan and $79 million in a shareholder loan.

The first quarterly maturities on both instruments since the 2022

refinancing were paid in April 2023, for a total amount of $23

million ($19 million for the bank loan and $4 million for the

shareholder loan).

Net debt therefore amounted to $178 million at 30 June 2023, a

decrease of $21 million compared to 31 December 2022 ($200

million).

Production activities

Q1

2023

Q2

2023

H1

2023

H1

2022

H2

2022

Change H1 2023 vs.

H1

2022

H2

2022

M&P working interest

production

Gabon (oil)

b/j

15,839

15,719

15,779

13,828

15,451

+14%

+2%

Angola (oil)

b/j

3,424

4,097

3,763

3,902

3,580

-4%

+5%

Tanzania (gas)

Mpc/j

46.7

47.6

47.2

44.4

42.1

+6%

+12%

Total

bep/j

27,054

27,755

27,406

25,126

26,053

+9%

+5%

Average sale price

Oil

$/bbl

75.2

74.0

74.8

105.0

90.5

-29%

-17%

Gas

$/mmBtu

3.76

3.77

3.77

3.50

3.51

+8%

+7%

M&P’s working interest oil production (80%) on the Ezanga

permit stood at 15,779 bopd for the first half of 2023, an increase

of 2% compared to the second half of 2022.

M&P’s working interest gas production (48.06%) on the Mnazi

Bay permit was 47.2 mmcfd for the first half of 2023, up 12% from

the second half of 2022.

M&P working interest production from Blocks 3/05A and 3/05

(20%) in the first half of 2023 was 3,763 bopd, an increase of 5%

on the second half of 2022.

Following publication of the decree of approval on 10 May, the

licence of Block 3/05 has now been extended from 2025 to 2040.

Discussions between the operator of the block and the regulator

with a view to finalising the improved tax terms associated with

the extension of the licence have successfully concluded and

implementation of the terms is now pending validation by the

authorities.

Exploration activities

M&P launched a farm-out process in November 2022 with a view

to finding a partner for exploration licences PEL-44 and PEL-45,

operated by M&P with an 85% working interest. The process ended

during the first half of 2023 without resulting in any offers from

companies invited to examine technical data on the two assets.

M&P therefore decided not to apply to enter the next

exploration phase, which includes drilling obligations, and the

licences for both PEL-44 and PEL-45 expired on 15 June 2023. This

marks the end of the Group’s operations in Namibia.

After exploratory drilling operations on the COR-15 permit ended

in February 2023, M&P analysed the data collected to determine

the prospectivity remaining on the permit. This exercise did not

enable identification of any new significant targets, in an asset

for which the Group is now free of any obligation for works.

Drilling activities

The C18 Maghèna drilling rig newly acquired by the Group and

operated by Caroil was commissioned in March 2023 and is currently

carrying out the drilling campaign on the Ezanga permit.

As part of its drilling services for third parties, in June 2023

Caroil signed an agreement with Perenco for a five-month drilling

campaign starting in Q4 2023, for which the C3 drilling rig is

currently being upgraded. The C16 drilling rig continues to be

deployed on the drilling campaign for Assala Energy in the south of

the country.

Information on the possible offer for

Assala Energy Holdings Ltd

Following our announcement on 14 June 2023 regarding a possible

offer for Assala Energy Holdings (“Assala”), M&P confirms that

it remains in advanced discussions with the shareholders of Assala

with respect to the proposed acquisition of all the shares of

Assala (the "Proposed Acquisition"). Assala is an onshore oil

company in Gabon, active in production (upstream), transport and

storage (midstream), with working interest production of

approximately 45,000 bopd in 2022.

There can be no assurance that agreement between the parties

will be reached on final terms and that the Proposed Acquisition

will complete.

M&P will update shareholders as to progress made in relation

to the Proposed Acquisition in due course.

Information on the current offer for

Wentworth Resources

On 23 February 2023, Wentworth Resources shareholders approved

M&P's offer by voting in favour of the Scheme at the Court

Meeting and in favour of its implementation at the General

Shareholders’ Meeting.

As part of the approvals process for this transaction as

detailed in Part III of the Scheme Document, M&P requires

approvals of Tanzania’s Fair Competition Commission (the “FCC”).

The FCC issued a decision notice that M&P’s application shall

not be determined at this time and will be marked closed by the

FCC. M&P is consulting with the relevant Tanzanian government

stakeholders in order to find a solution and bring the acquisition

to a successful conclusion. M&P is also consulting with

relevant Tanzanian government stakeholders about national oil and

gas company TPDC’s demand to exercise a right of first refusal to

the acquisition.

The completion of the acquisition of Wentworth Resources remains

subject to these approvals by the Tanzanian authorities, which is

expected in the second half of 2023. M&P will communicate on

this subject in due course.

Français

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding

the financial position, results, business and industrial strategy

of Maurel & Prom. By nature, forecasts contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

forecasts are based on assumptions we believe to be reasonable, but

which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070 / Bloomberg MAU.FP /

Reuters MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803296173/en/

Maurel & Prom Press, shareholder and investor

relations Tel: +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor

relations/Media relations Louis-Victor Delouvrier/Nicolas Merigeau

Tel: +33 (0)1 44 71 98 53/+33 (0)1 44 71 94 98

maureletprom@newcap.eu

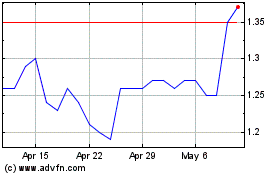

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Apr 2023 to Apr 2024