/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE

SERVICES OR FOR DISSEMINATION IN THE U.S./

High grade gold overprint of VMS copper-gold

layers continues with assays up to 9.6 g/t Au and 6.6% Cu

LONDON, Jan. 31, 2022 /CNW/ - Meridian Mining UK S

(TSXV: MNO) (Frankfurt/Tradegate:

2MM) (OTCQB: MRRDF), ("Meridian" or the "Company") is pleased

to provide an update on results from its ongoing drilling and

exploration programs at its camp scale Cabaçal Copper-Gold VMS

Project ("Cabaçal") in Mato Grosso,

Brazil. The metallurgical drilling program is ongoing, and

first assay results have been returned from holes completed in the

Cabaçal mine's Central Copper Zone ("CCZ"), dispatched prior to the

Christmas – New Year closure period. The program has returned

broader zones of Copper-Gold VMS mineralization than expected,

overprinted by high-grade veins hosting visible gold, further

confirming extensive unexploited potential at Cabaçal.

Highlights of today's update:

- High-grade gold overprinting the VMS copper-gold mineralization

assayed at Cabaçal;

- Meridian reports copper-gold-silver mineralization at Cabaçal

exceeding 1.0 % CuEq over 65m;

- Meridian's metallurgical drill program assays extensive layers

of copper-gold mineralization from shallow depths;

- CD-088 assays 66.1m @ 1.0%

CuEq* (0.6% Cu, 0.6g/t Au & 1.2g/t Ag from

14.1m; including:

-

- 34.1m @ 1.6% CuEq (0.9% Cu,

1.0g/t Au, 1.9g/t Ag & 0.1% Zn) from 45.1m; including:

-

- 9.9m @ 2.0% CuEq (1.2% Cu,

1.2g/t Au, 2.5g/t Ag & 0.1% Zn) from 59.0m; and

- 4.8m @ 4.5% CuEq (2.6% Cu,

3.1g/t Au & 5.3g/t Ag) from 73.7m;

- Significant zones of high-grade gold mineralization confirmed

as being unmined, with peak gold assay values of 9.4 – 9.6 g/t

Au;

-

- 9.6 g/t Au, 1.8% Cu, 3.6g/t Ag over 0.35m from 65.5m

(CBDS11059);

- 9.4g/t Au, 6.6% Cu, 13.0g/t Ag over 0.9m from 75.5m

(CBDS11070);

- The upper copper zone is broader and shallower than limit of

historical sampling reported;

- CD-085 returned wide uninterrupted interval of Cu-Au-Ag

mineralization in the CCZ; including:

-

- 86.2m @ 0.5% CuEq (0.4% Cu,

0.1g/t Au & 0.9g/t Ag) from 21.0m; including:

-

- 0.6m @ 1.4% CuEq (1.0% Cu, 0.6g/t

Au, 2.3g/t Ag, 0.1% Zn) from 54.0m;

- 0.5m @ 1.4% CuEq (1.0% Cu, 0.5g/t

Au, 2.5g/t Ag, 0.2% Zn) from 57.0m;

- 0.4m @ 2.5% CuEq (2.2% Cu, 0.6g/t

Au & 1.7g/t Ag) from 87.5m;

- 12.8m @ 1.2% CuEq (0.8% Cu,

0.5g/t Au, 3.2g/t Ag, 0.1% Zn) from 94.4m; and

- 2.5m @ 0.9% CuEq (0.5% Cu, 0.6g/t

Au, 1.9g/t Ag, 0.1% Zn) from 114.5m.

* Note: Copper Equivalents ("CuEq") have been

calculated using the formula CuEq = ((Cu%*Cu price 1% per tonne) +

(Au ppm*Au price per g/t) + (Ag ppm*Ag price per g/t) + (Zn%*Zn

price 1% per tonne)) / (Cu price 1 % per tonne). Commodity Prices:

Copper ("Cu") and Zinc ("Zn") prices from LME Official Settlement

Price dated April 23, 2021, USD per

Tonne: Cu = USD 9,545.50 and Zn =

USD 2,802.50. Gold ("Au") &

Silver ("Ag") prices from LBMA Precious Metal Prices USD per Troy

ounce: Au = USD 1781.80 (PM) and Ag =

USD 26.125 (Daily). The CuEq values

are for exploration purposes only and include no assumptions for

metallurgical recovery.

Dr Adrian McArthur, CEO and

President of Meridian, comments, "the frequency that we are now

seeing and assaying higher grade gold intervals, often with visible

gold, overprinting the VMS copper-gold-silver layers of the

historical mine is driving a key project upside. These strong gold

intervals drilled and assayed by Meridian, are at higher grades

than the historical 3.0g/t gold cut-off used by BP Minerals / Rio

Tinto. They show that within the mine's limit, zones of high-grade

gold overprinting the "VMS" copper-gold layers were not mined and

as we have recently discovered extend to the Northwest and

Southeast. Of equal importance, is that the results of these

metallurgical holes are within the mine's limits where historical

production reports documented recoveries of greater than 90% for

copper and gold and +85 % for silver by conventional processes.

This gives us a strong expectation on what our own results will be

from this metallurgical program. These new drill results have been

incorporated into our ongoing geology revision of Cabaçal that is

building upon the significance of the belt's VMS hosted copper-gold

system being overprinted by a later gold event, to realize the

potential of this upside. This combination of strong copper-gold

grades, shallow depths, long intersections, and documented high

metallurgical recoveries highlights the strong open pit potential

of the Cabaçal mine area. The Cabaçal mine area is one of many

prospects within Meridian's licences that hold the controlling

position over the Cabaçal Belt, extending over a 50km strike

length. With the current fully financed drill program extended by

15,000m, we look forward to further

results throughout 2022."

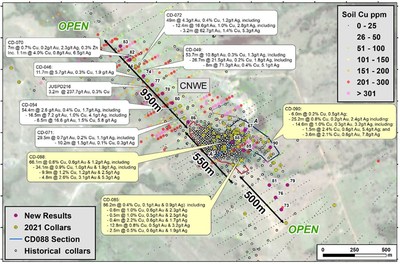

Drilling Program – Cabaçal and Extensions

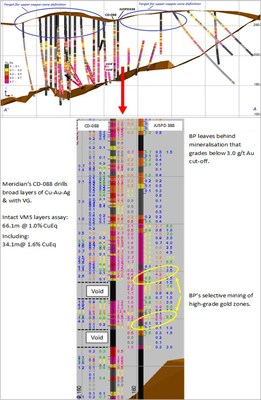

Metallurgical hole CD-088 was drilled as a twin of BP Minerals

hole JUSPD338 in the CCZ (Figure 2). CD-088 intersected mining

voids at 69.48 - 73.68m and 79.77 -

83.40m. Despite the 7.8m of mining voids with the higher-grade gold

intervals of JUSPD338 being mined, the results of CD-088 compare

very favourably to historical intersection, due to the presence of

high-grade visible gold remaining (some of which actually would

have met the historical extraction cut-offs).

The broad composite of CD-088 intersected1:

- 66.1m @ 1.0% CuEq (0.6% Cu,

0.6g/t Au & 1.2g/t Ag) from 14.1m; including

-

- 34.1m @ 1.6% CuEq (0.9% Cu,

1.0g/t Au, 1.9g/t Ag & 0.1% Zn) from 45.1m; including:

-

- 9.9m @ 2.0% CuEq (1.2% Cu, 1.2g/t

Au, 2.5g/t Ag & 0.1% Zn) from 59.0m; including:

-

- 1.7m @ 3.9% CuEq (1.8% Cu, 3.5g/t

Au, & 3.3g/t Ag) from 64.2m;

and

- 4.8m @ 4.5% CuEq (2.6% Cu, 3.1g/t

Au & 5.3g/t Ag) from 73.7m.

JUSPD338 historically intersected (pre-mining):

- 1.7m @ 0.5% Cu & 1.9g/t Ag

from 18.1m;

- 5.6m @ 0.1% Cu, 0.9g/t Au &

0.4g/t Ag from 35.15m; and

- 41.9m @ 0.9% Cu, 1.0g/t Au &

2.5g/t Ag from 44.0m.

The 7.8m width difference in

higher grade zone (34.1m in CD-088

compared to 41.9m in JUSPD338)

reflects the voids intersected in CD-088 (but note that composited

grade is virtually unchanged). This is consistent with the presence

of high-grade gold mineralization encountered within the broader

mineralized envelop of CD-088 core where visible gold was observed.

The zones may reflect a degree of a nugget effect in the deposit,

and larger diameter core will be considered in strategic areas.

The intervals in JUSPD338 from 0.0 - 18.1m, 19.8 - 35.15m and 40.7 - 44.0m were unsampled in the historical program.

The upper part of CD-088 encountered a more continuous Cu-Au-Ag

layer than reported by the historical sampling, including:

- 13.8m @ 0.3% CuEq (0.3% Cu &

0.7g/t Ag) from 14.1m and

- 9.9m @ 0.4% CuEq (0.1% Cu, 0.6g/t

Au & 0.3g/t Ag) from 32.0m.

In line with drilling procedures, it was necessary to reduce the

core size through the mining voids in CD-088, and some additional

drilling may be conducted to gather the targeted sample mass for

the metallurgical composites, extending the program.

A second metallurgical hole, CD-085, returned a wide interval of

mineralization: 86.2m @ 0.5% CuEq

(0.4% Cu, 0.1g/t Au & 0.9g/t Ag) from 21.0m, which included some discrete narrow

higher-grade zones, and a lower interval of higher-grade Cu-Au-Ag

mineralization:

- 0.6m @ 1.4% CuEq (1.0% Cu, 0.6g/t

Au, 2.3g/t Ag & 0.1% Zn) from 54.0m;

- 0.5m @ 1.4% CuEq (1.0% Cu, 0.5g/t

Au, 2.5g/t Ag & 0.2% Zn) from 57.0m;

- 0.4m @ 2.5% CuEq (2.2% Cu, 0.6g/t

Au & 1.7g/t Ag) from 87.5m;

- 12.8m @ 1.2% CuEq (0.8% Cu,

0.5g/t Au, 3.2g/t Ag & 0.1% Zn) from 94.4m; and

- 2.5m @ 0.9% CuEq (0.5% Cu, 0.6g/t

Au, 1.9g/t Ag & 0.1% Zn) from 114.5m.

The metallurgical program is targeting the spectrum of grade

ranges reflecting vertical and lateral zonation through the Cabaçal

system that would be expected in an open-pit geometry.

Results were received for additional exploratory holes drilled

prior to the Christmas – New Year break. There has been a short

hiatus in the sampling schedule, with Brazil experiencing part of the global

COVID-19 Omicron wave. The Company's testing protocols identified

cases amongst some members of the site team and drill contractors,

who have been isolated and progressively are now returning to work;

no serious cases of illness have been experienced.

|

___________________________

|

|

1For the

purpose of compositing, mining voids are treated as 0m @ zero

grade:

|

The northern-most holes within the CNWE showed a transition out

of the copper-gold zones into a more zinc-rich zone and strengthen

the assumption that the Cu-Au zones deviates to the west, mimicking

trends in the geophysics. There may be some lateral migration of

stepping of the structural position, with the northern-most holes

positioned north of an interpreted E-W structure on the BP Minerals

mapping. The drilling in this northern-most area have also

encountered increasing levels of zinc mineralization, including

peak intervals of 4.0m @ 1.5% Zn from

33.0m and 3.9m @ 1.2% Zn from 59.3m in CD-082. The Company is initiating a

range of geophysical approaches to maximize data over the spectrum

of Cabaçal's base metal deposit styles, with dipole-dipole induced

polarization surveys having commenced over the Cabaçal West area

(down-dip from the Northwest extension environment). A lower

mineralized internal zone is present within part of the CNWE and is

interpreted as being the transition between the two closely

associated VMS feeder systems of the CNWE and the Cabaçal Central

zone. Cross-strike drilling of the CNWE's ~900m strike is now being

planned for Q1 2022; commencing shortly.

Some exploratory drilling targeting the SE extension has been

undertaken. Better results: CD-079: 20.7m @ 0.5% CuEq from 68.3m, CD-081: 24.1 @ 0.5% CuEq from 90.7m, are positioned more in line with the

refined strike projection of the main workings, below the gabbro

sill to the Southeast. Some of the holes drilled off the previous

projection were mineralized but sub-grade and have now aided in

refining follow-up drill targets, for Q1 2022.

Table 1: Cabaçal Assays reported today.

|

Hole Id

|

Zone*

|

Intercept

|

Grade

|

From

|

|

CuEq

|

Cu

|

Au

|

Ag

|

Zn

|

Pb

|

|

|

(m)

|

(%)

|

(%)

|

(g/t)

|

(g/t)

|

(%)

|

(%)

|

(m)

|

|

|

|

|

|

|

|

|

|

|

|

CD-088

|

CCZ

|

66.1

|

1.0

|

0.6

|

0.6

|

1.2

|

0.0

|

0.0

|

14.1

|

|

Including

|

34.1

|

1.6

|

0.9

|

1.0

|

1.9

|

0.1

|

0.0

|

45.1

|

|

Including

|

9.9

|

2.0

|

1.2

|

1.2

|

2.5

|

0.1

|

0.0

|

59.0

|

|

Including

|

1.7

|

3.9

|

1.8

|

3.5

|

3.3

|

0.0

|

0.0

|

64.2

|

|

And

|

4.8

|

4.5

|

2.6

|

3.1

|

5.3

|

0.0

|

0.0

|

73.7

|

|

|

|

|

|

|

|

|

|

|

|

CD-087

|

pending

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CD-086

|

pending

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CD-085

|

CCZ

|

86.2

|

0.5

|

0.4

|

0.1

|

0.9

|

0.0

|

0.0

|

21.0

|

|

Including

|

0.6

|

1.4

|

1.0

|

0.6

|

2.3

|

0.1

|

0.0

|

54.0

|

|

And

|

0.5

|

1.4

|

1.0

|

0.5

|

2.5

|

0.2

|

0.0

|

57.0

|

|

and

|

0.4

|

2.5

|

2.2

|

0.6

|

1.7

|

0.0

|

0.0

|

87.5

|

|

And

|

12.8

|

1.2

|

0.8

|

0.5

|

3.2

|

0.1

|

0.0

|

94.4

|

|

|

2.5

|

0.9

|

0.5

|

0.6

|

1.9

|

0.1

|

0.0

|

114.5

|

|

|

|

|

|

|

|

|

|

|

|

CD-084

|

CNWE

|

9.4

|

0.6

|

0.3

|

0.6

|

0.3

|

0.0

|

0.0

|

18.0

|

|

Including

|

1.1

|

3.8

|

1.6

|

3.7

|

1.9

|

0.0

|

0.0

|

23.0

|

|

|

7.3

|

0.3

|

0.0

|

0.0

|

2.7

|

0.7

|

0.3

|

61.8

|

|

Hole Id

|

Zone*

|

Intercept

|

Grade

|

From

|

|

CuEq

|

Cu

|

Au

|

Ag

|

Zn

|

Pb

|

|

|

(m)

|

(%)

|

(%)

|

(g/t)

|

(g/t)

|

(%)

|

(%)

|

(m)

|

|

CD-083

|

CNWE

|

11.0

|

0.2

|

0.1

|

0.1

|

1.2

|

0.1

|

0.1

|

10.0

|

|

|

15.0

|

0.1

|

0.1

|

0.0

|

1.5

|

0.2

|

0.1

|

25.0

|

|

|

|

|

|

|

|

|

|

|

|

CD-082

|

CNWE

|

30.4

|

0.5

|

0.2

|

0.2

|

1.9

|

0.4

|

0.2

|

23.0

|

|

Including

|

4.0

|

0.5

|

0.0

|

0.0

|

1.1

|

1.5

|

0.1

|

33.0

|

|

|

3.9

|

0.5

|

0.1

|

0.1

|

4.3

|

1.2

|

0.4

|

59.3

|

|

|

|

|

|

|

|

|

|

|

|

CD-081

|

CSE

|

24.1

|

0.5

|

0.5

|

0.1

|

1.3

|

0.0

|

0.0

|

90.7

|

|

|

3.0

|

0.6

|

0.4

|

0.2

|

3.8

|

0.2

|

0.0

|

118.3

|

|

|

|

|

|

|

|

|

|

|

|

CD-080

|

CNWE

|

18.0

|

0.2

|

0.1

|

0.0

|

0.3

|

0.0

|

0.0

|

24.0

|

|

|

11.7

|

0.2

|

0.1

|

0.1

|

0.5

|

0.1

|

0.0

|

45.0

|

|

|

17.7

|

0.3

|

0.1

|

0.4

|

0.3

|

0.0

|

0.0

|

60.1

|

|

|

14.3

|

0.6

|

0.4

|

0.4

|

0.8

|

0.0

|

0.0

|

106.7

|

|

Including

|

0.7

|

3.4

|

0.9

|

4.0

|

6.4

|

0.2

|

0.1

|

120.4

|

|

|

|

|

|

|

|

|

|

|

|

CD-079

|

CSE

|

20.7

|

0.5

|

0.3

|

0.3

|

0.8

|

0.0

|

0.0

|

68.3

|

|

Including

|

1.1

|

3.9

|

0.4

|

5.6

|

4.9

|

0.0

|

0.0

|

87.0

|

|

|

|

|

|

|

|

|

|

|

|

CD-078

|

CNWE

|

7.0

|

0.2

|

0.1

|

0.0

|

0.2

|

0.0

|

0.0

|

19.0

|

|

|

13.2

|

0.2

|

0.1

|

0.2

|

0.2

|

0.0

|

0.0

|

35.5

|

|

|

2.6

|

0.2

|

0.0

|

0.2

|

0.0

|

0.0

|

0.0

|

55.6

|

|

|

6.0

|

0.2

|

0.1

|

0.0

|

0.3

|

0.0

|

0.0

|

64.0

|

|

|

19.7

|

0.2

|

0.2

|

0.1

|

0.1

|

0.0

|

0.0

|

84.0

|

|

|

14.9

|

0.6

|

0.3

|

0.4

|

0.6

|

0.0

|

0.0

|

113.0

|

|

Including

|

4.1

|

0.8

|

0.2

|

1.0

|

0.1

|

0.0

|

0.0

|

114.3

|

|

|

|

|

|

|

|

|

|

|

|

CD-077

|

CNWE

|

17.0

|

0.2

|

0.1

|

0.1

|

0.2

|

0.0

|

0.0

|

12.0

|

|

|

23.5

|

0.2

|

0.2

|

0.1

|

0.1

|

0.0

|

0.0

|

35.0

|

|

|

0.4

|

1.2

|

0.4

|

1.2

|

0.5

|

0.0

|

0.0

|

89.0

|

|

|

10.7

|

0.5

|

0.3

|

0.2

|

1.0

|

0.2

|

0.0

|

104.0

|

|

Including

|

1.5

|

1.7

|

1.3

|

0.5

|

2.2

|

0.0

|

0.0

|

107.0

|

|

|

|

|

|

|

|

|

|

|

|

CD-076

|

CSE

|

12.0

|

0.1

|

0.1

|

0.0

|

0.4

|

0.0

|

0.0

|

57.0

|

|

|

2.0

|

0.2

|

0.2

|

0.0

|

0.2

|

0.0

|

0.0

|

75.0

|

|

|

3.0

|

0.2

|

0.2

|

0.0

|

0.3

|

0.0

|

0.0

|

82.0

|

|

|

3.3

|

0.2

|

0.2

|

0.0

|

0.3

|

0.0

|

0.0

|

97.7

|

|

|

2.3

|

0.2

|

0.2

|

0.0

|

0.3

|

0.0

|

0.0

|

111.0

|

|

|

|

|

|

|

|

|

|

|

|

CD-075

|

CW

|

6.3

|

0.2

|

0.2

|

0.0

|

1.1

|

0.0

|

0.0

|

461.0

|

|

|

5.5

|

0.2

|

0.1

|

0.1

|

0.9

|

0.2

|

0.1

|

495.9

|

|

Hole Id

|

Zone*

|

Intercept

|

Grade

|

From

|

|

CuEq

|

Cu

|

Au

|

Ag

|

Zn

|

Pb

|

|

|

(m)

|

(%)

|

(%)

|

(g/t)

|

(g/t)

|

(%)

|

(%)

|

(m)

|

|

|

|

|

|

|

|

|

|

|

|

CD-074

|

CNWE

|

18.3

|

0.2

|

0.2

|

0.0

|

0.2

|

0.0

|

0.0

|

26.0

|

|

|

10.0

|

0.7

|

0.5

|

0.1

|

2.4

|

0.0

|

0.0

|

53.0

|

|

|

18.9

|

0.6

|

0.3

|

0.5

|

1.1

|

0.0

|

0.0

|

77.0

|

|

Including

|

2.8

|

1.4

|

1.1

|

0.5

|

3.3

|

0.0

|

0.0

|

79.2

|

|

and

|

2.8

|

1.7

|

0.6

|

1.8

|

1.8

|

0.0

|

0.0

|

88.3

|

|

|

|

|

|

|

|

|

|

|

|

CD-073

|

CSE

|

11.8

|

0.1

|

0.1

|

0.0

|

0.2

|

0.0

|

0.0

|

83.2

|

|

|

2.5

|

0.3

|

0.3

|

0.0

|

0.6

|

0.0

|

0.0

|

100

|

|

|

6.0

|

0.2

|

0.1

|

0.0

|

0.4

|

0.0

|

0.0

|

117

|

|

|

1.3

|

0.8

|

0.6

|

0.2

|

5.9

|

0.2

|

0.0

|

132.5

|

|

|

|

|

|

|

|

|

|

|

|

CD-067

|

ECZ

|

4.5

|

0.5

|

0.1

|

0.7

|

0.6

|

0.0

|

0.0

|

1.5

|

|

|

7.3

|

0.2

|

0.1

|

0.0

|

0.7

|

0.0

|

0.0

|

10.0

|

|

|

13.7

|

0.4

|

0.3

|

0.1

|

1.3

|

0.0

|

0.0

|

30.0

|

|

|

8.1

|

1.1

|

0.9

|

0.3

|

3.7

|

0.2

|

0.0

|

50.4

|

|

Drill

Details

|

|

Hole

Id

|

Dip

|

Azimuth

|

EOH

|

|

CD-088

|

-90

|

0

|

100.4

|

|

CD-087

|

-90

|

0

|

81.0

|

|

CD-086

|

-50

|

60

|

124.1

|

|

CD-085

|

-65

|

45

|

137.2

|

|

CD-084

|

-60

|

45

|

99.1

|

|

CD-083

|

-50

|

60

|

51.8

|

|

CD-082

|

-50

|

60

|

72.4

|

|

CD-081

|

-60

|

45

|

139.2

|

|

CD-080

|

-50

|

60

|

145.5

|

|

CD-079

|

-50

|

60

|

106.0

|

|

CD-078

|

-50

|

60

|

138.1

|

|

CD-077

|

-50

|

60

|

131.6

|

|

CD-076

|

-50

|

45

|

165.9

|

|

CD-075

|

-70

|

45

|

590.8

|

|

CD-074

|

-50

|

60

|

130.1

|

|

CD-073

|

-50

|

45

|

166.2

|

|

CD-067

|

-50

|

45

|

99.80

|

* CCZ: Central Copper Zone, CNWE: Cabaçal Northwest

Extension, CW: Cabaçal West, CSE: Cabaçal Southeast

Notes

General exploratory holes have been drilled HQ through the

saprolite and upper bedrock and then reduced to NQ – mineralized

intervals represent half HQ or NQ drill core. Metallurgical holes

are drilled HQ from surface, and reduced only if voids are

intersected (to NQ on the first and BQ after the second void.

Samples represent quarter HQ core, and half NQ-BQ core). Samples

have been analysed at the accredited SGS laboratory in Belo Horizonte. Gold analyses have been

conducted by FAA505 (fire assay of a 50g charge), and base metal

analysis by methods ICP40B and ICP40B_S (four acid digest with

ICP-OES finish). Visible gold intervals are sampled by metallic

screen fire assay method MET150-FAASCR. Samples are held in the

Company's secure facilities until dispatched and delivered by staff

and commercial couriers to the laboratory. Pulps are retained for

umpire testwork, and ultimately returned to the Company for

storage. The Company submits a range of quality control samples,

including blanks and gold and polymetallic standards supplied by

ITAK and OREAS, supplementing laboratory quality control

procedures. True widths are approximately 80% of downhole lengths

and assay figures and intervals rounded to 1 decimal place.

Qualified Person

Dr Adrian McArthur, B.Sc. Hons, PhD.

FAusIMM., CEO and President of Meridian as well as a Qualified

Person as defined by National Instrument 43-101, has supervised the

preparation of the technical information in this news release.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President and Director

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Stay up to date by subscribing for news alerts here:

https://meridianmining.co/subscribe/

Follow Meridian on Twitter:

https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

ABOUT MERIDIAN

Meridian Mining UK S is focused on the acquisition, exploration,

and development activities in Brazil. The Company is currently focused on

resource development of the Cabaçal VMS Copper-Gold project,

exploration in the Jaurú & Araputanga Greenstone belts located

in the state of Mato Grosso;

exploring the Espigão polymetallic project and the Mirante da Serra

manganese project in the State of Rondônia Brazil.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking

information or forward-looking statements for the purposes of

applicable securities laws. These statements include, among others,

statements with respect to the Company's plans for exploration,

development and exploitation of its properties and potential

mineralization. These statements address future events and

conditions and, as such, involve known and unknown risks,

uncertainties, and other factors, which may cause the actual

results, performance, or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the statements. Such risk factors include, among others,

failure to obtain regulatory approvals, failure to complete

anticipated transactions, the timing and success of future

exploration and development activities, exploration and development

risks, title matters, inability to obtain any required third party

consents, operating risks and hazards, metal prices, political and

economic factors, competitive factors, general economic conditions,

relationships with strategic partners, governmental regulation and

supervision, seasonality, technological change, industry practices

and one-time events. In making the forward-looking statements, the

Company has applied several material assumptions including, but not

limited to, the assumptions that: (1) the proposed exploration,

development and exploitation of mineral projects will proceed as

planned; (2) market fundamentals will result in sustained metals

and minerals prices and (3) any additional financing needed will be

available on reasonable terms. The Company expressly disclaims any

intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events or

otherwise except as otherwise required by applicable securities

legislation.

The Company cautions that it has not completed any feasibility

studies on any of its mineral properties, and no mineral reserve

estimate or mineral resource estimate has been established.

Geophysical exploration targets are preliminary in nature and not

conclusive evidence of the likelihood of a mineral deposit.

The TSX Venture Exchange has neither approved nor disapproved

the contents of this news release. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

SOURCE Meridian Mining UK Societas