Indiva Completes Supply Agreement and Loan

Amendment with SNDL Extending Maturity by Two Years

Indiva Limited (the "Company" or "Indiva")

(TSXV:NDVA), the leading Canadian producer of cannabis edibles and

other cannabis products, is pleased to announce its financial and

operating results for the second fiscal quarter ended June 30,

2023. All figures are reported in Canadian dollars ($), unless

otherwise indicated. Indiva's financial statements are prepared in

accordance with International Financial Reporting Standards

("IFRS"). For a more comprehensive overview of the corporate

and financial highlights presented in this news release, please

refer to Indiva's Management's Discussion and Analysis of Financial

Condition and Results of Operations for the Three and Six Months

Ended June 30, 2023, and the Company's Condensed Consolidated

Interim Financial Statements for the Three and Six Months Ended

June 30, 2023 and 2022, which are filed on SEDAR+ and available on

the Company's website, www.indiva.com.

"This was a transitional and busy quarter for Indiva, with

several cross currents impacting our results, including the

negative impact from the loss of revenue from our Indiva Life

Lozenges, and partial revenue loss in the quarter from the

transition to contract manufacturing of Wana gummies, offset by

continued growth and excellent market share gains from Pearls by

Gr�n gummies," said Niel Marotta, President and Chief Executive

Officer of Indiva. "While we maintain that the Lozenge products

were compliant with the Cannabis Act and had the positive effect of

migrating dollars from the illicit market to the legal market, we

complied with regulatory orders and discontinued production and

packaging of these products in March 2023, and completed all sales

of finished goods to provincial wholesalers in May 2023. Since that

time, we have innovated and launched a new brand called No Future,

including gummies and 1.2g vape products, which have since shipped

to several provinces. This brand is designed to reset the price

floor on edibles and 1.2g vapes, and pick up where our Lozenges

left off, by providing value for of-age consumers with higher

tolerances requiring larger doses. Our aim is to recapture the

significant incremental market share that our Lozenges left behind,

drive our path to profitability, and in doing so help our regulator

achieve its goal of improving public safety while eliminating the

illicit market for cannabis edibles. While this effort will not

replace the necessary regulatory change that the industry

desperately needs, and for which we will continue to advocate, it

is a step in the right direction and leverages Indiva's wide

distribution network and position as the largest, low-cost producer

of edibles in Canada."

HIGHLIGHTS

Quarterly Performance

- Gross revenue in Q2 2023 was $8.1 million, representing a 21.6%

sequential decrease from Q1 2023, and an 8.5% decrease

year-over-year from Q2 2022. Year-to-date, gross revenue decreased

0.5% year-over-year to $18.5 million.

- Net revenue in Q2 2023 was $7.5 million, representing a 20.3%

sequential decrease from Q1 2023, and a 7.6% decrease

year-over-year from Q2 2022, driven primarily by the loss of

revenue from Indiva Life Lozenges, declines in sales of Wana

gummies, offset by higher sales of Pearls by Gr�n gummies.

Year-to-date, net revenue decreased 0.5% year over year to $16.9

million.

- Net revenue in Q2 from edible products declined to $6.9

million, down 6.2% from $7.3 million in Q1 2023 and down 5.5% from

$7.3 million in the prior year period. Edible product sales

represent 91.3% of net revenue in Q2 2023. Year-to-date net revenue

from edible products decreased 10.1% year-over-year to $14.2

million or 83.7% of net revenue.

- Gross profit before fair value adjustments, impairments and

one-time items declined year-over-year by 18.2% and sequentially by

30.3%, to $2.2 million, or 29.3% of net revenue, versus 33.1% in Q2

2022 and 33.6% in Q1 2023. The decline in gross margin percentage

was due primarily to the loss of high margin lozenges partially

offset by lower unit costs driven by the implementation of

automated equipment in edibles processing and packaging.

Year-to-date, gross profit before fair value adjustments,

impairments and one-time items increased to a record $5.4 million,

or 31.7% of net revenue, versus $5.3 million or 31.3% of net

revenue in the corresponding period last year.

- In Q2 2023, Indiva sold products containing 82.2 million

milligrams of cannabinoids, the active ingredient in edible

products, which represents a 26.5% decrease when compared to the

111.9 million milligrams in product sold in Q1 2023, and an 86.0%

increase compared to 44.2 million milligrams sold in Q2 2022. The

decrease was a function of lower sales and a mix shift towards

products with lower average cannabinoid content due primarily to

the loss of lozenge revenue.

- Inventory impairment charges in the quarter totaled $0.7

million and $1.5 million cumulatively year-to-date related to bulk

lozenges and packaging which cannot be sold due to Health Canada's

recent order to halt production and sale of these products, the

write off of aged and out of spec bulk and finished goods, as well

as certain marketing, packaging and raw materials. The Company will

continue to work to monetize any impaired inventory which remains

saleable.

- Operating expenses in the quarter increased 0.2% sequentially,

and decreased 7.2% year-over-year, representing 43.1% of net

revenue, versus 34.3% in Q1 2023 and 42.9% in Q2 2022. Operating

expenses increased sequentially primarily due to higher marketing

and sales costs offset by lower general and administrative costs.

Year-to-date, operating expenses decreased by 7.4% to $6.5 million

primarily due to lower marketing costs, partially offset by

increased research and development costs related to new product

development.

- EBITDA was a positive $0.6 million in the quarter due to a

one-time gain on the sale of Wana license rights to Canopy.

Adjusted EBITDA declined sequentially in Q2 2023 to a loss of $0.6

million, versus a profit of $0.4 million in Q1 2023, and a loss of

$0.1 million in Q2 2022 due to lower sales and lower gross margins.

Year-to-date, adjusted EBITDA was a loss of $0.2 million versus a

loss of $0.5 million in the corresponding period last year. See

"Non-IFRS Measures", below.

- Comprehensive net loss of $1.0 million included a one-time gain

of $2.1 million on the sale of license rights offset by non-cash

charges for impairment of inventory and assets held for sale

totaling $0.8 million. Excluding these amounts, comprehensive loss

increased to $2.3 million versus an adjusted loss of $1.3 million

in Q1 2023 and $2.0 million in Q2 2022.

Operational Highlights for the Second Quarter 2023

- Initial deliveries of Pearls by Gr�n gummies were made to the

province of Alberta. Four flavours were delivered including

Blackberry Lemonade 1:1:1 CBN:CBD:THC, Blue Razzleberry 3:1

CBG:THC, Pomegranate 4:1 CBD:THC and Sour Apple THC. The Company

expects meaningful revenue contribution from Pearls gummies in this

important market.

- Indiva introduced three new Wana gummie SKUs including Citrus

Burst Sativa 5:1 CBD/THC, Wild Raspberry Indica 5:1 CBD/THC and

Pineapple Passionfruit 1:1:1 CBD/THC/CBG.

- Indiva introduced three new chocolates into the Alberta market

under the Indiva 1432 brand, namely 1:1 CBN/THC Dark Chocolate, 1:1

THC/CBD Cookies and Cream and 1:1 THC/CBD Caramel Dark

Chocolate.

- Pearls by Gr�n gummies continued to gain market share in

Ontario and British Columbia, quickly becoming one of the top

edibles in the country. Pearls Blue Razzleberry became the top

selling edible product at the OCS in Q2.

- On May 30, 2023 Indiva and Canopy Growth ("Canopy")

entered into a contract manufacturing agreement, under which Canopy

received control of all distribution, marketing, and sales of Wana

branded products in Canada, and Indiva received the exclusive right

to manufacture and supply Wana™ branded products in Canada to

Canopy for a period of five years, with the ability to renew for an

additional five-year term upon mutual agreement of the parties. As

consideration, Indiva completed a non-brokered private placement

offering of common shares of Indiva whereby Canopy subscribed for

an aggregate purchase price of $2,155,617. The balance of the

consideration will be paid by Canopy to Indiva as follows: (i)

additional consideration representing a value of $844,383; (ii) a

cash payment of $1,250,000 on May 30, 2024.

Loan Amendment and Supply Agreement with SNDL

Indiva is pleased to announce that it has amended the terms of

its existing non-revolving term loan facility (the "Amended Term

Loan") with SNDL Inc. ("SNDL"), and has also entered

into a supply agreement with SNDL (the "Supply Agreement")

whereby SNDL will supply the Company with certain distillate

products on an exclusive basis. The Supply Agreement provides for

minimum monthly purchase commitments by the Company (the

"Minimum Purchase Commitment"). The prices of all products

supplied under the Supply Agreement are subject to periodic

adjustments depending on prevailing market pricing. The Supply

Agreement has an initial term of thirty (30) months, which

automatically renews for successive twelve (12) month periods,

unless earlier terminated. Provided that the aggregate minimum

purchase commitment under the Supply Agreement has been met, the

Supply Agreement will automatically terminate upon the re-payment

of the Amended Term Loan, unless the Company elects otherwise. The

Amended Term Loan extends the maturity date to February 24, 2026

and extends the existing security interest in favour of SNDL under

the Amended Term Loan to the Minimum Purchase Commitment. The

interest rate and other terms of the Amended Term Loan remain the

same except for the addition of an event of default, whereby a

default under the Supply Agreement (which is not cured by the

applicable time period set out in the Supply Agreement) would

constitute an event of default under the Amended Term Loan.

Events Subsequent to Quarter End

- Indiva launched a new value-focused brand called No Future,

including four gummy SKUs and three 1.2g vape SKUs. The Company has

already begun shipping product to British Columbia and Alberta and

is expected to ship to Ontario in September. Initial orders have

been robust, and encouragingly, replenishment orders have already

been received for both gummies and vapes.

- Indiva rebranded the Indiva Life Sandwich Cookies as "Doppio:

same delicious cookie, with a new look and a new name".

- The Company received acceptance of 13 new SKUs for listing, the

majority of which were derived from in-house innovation, including

four No Future Gummies in Ontario, Alberta and British Columbia and

three No Future 1.2g vape products in Ontario and Alberta along

with one No Future vape in British Columbia. Six additional SKUs

received acceptance across multiple brands including Bhang, Doppio,

1432 and a 25-pack CBD gummy SKU under the Pearls by Gr�n

brand.

Market Share

- Data from Hifyre Inc. for the second quarter of 2023 shows

strong sell-through of Indiva's edible products. Please note that

Indiva's sales and market share have been adjusted to remove Wana

sales reflecting the transaction which closed May 30, 2023. With

21.8% share of sales across British Columbia, Alberta,

Saskatchewan, Manitoba, and Ontario, Indiva continues to lead in

the #1 market share position in the edibles category on an

aggregate basis:

- Ontario: #1 with 25.7% market share.

- Alberta: #4 with 15.7% market share.

- British Columbia: #1 with 15.9% market share.

- Saskatchewan: #6 with 7.1% market share.

- Manitoba: #4 with 8.6% market share.

- Gummies: Indiva's Pearls by Gr�n gummies ranked as #5 in the

edibles category with 7.8% share based on sales and 11.6%

sub-category share, ranked as #3 in the edibles category based on

units sold with 12.5% share despite not yet being available in

Alberta until May.

- Chocolate: Indiva held 39.5% total sub-category share, as

Bhang® continued to lead the chocolate category with 35.2%

sub-category share.

- Baked Goods: Indiva led the baked goods category with 67.0%

sub-category share, driven by the success of Doppio, formerly

Indiva Life Double-Stuffed Sandwich Cookies.

- Product ranking in Q2 2023 showed two of the Top 10 edible SKUs

are from Indiva's Pearls by Gr�n gummies.

- Based on data from British Columbia, Alberta, Ontario, Manitoba

and Saskatchewan, the edibles category increased by 1.0% in Q2 2023

to $67.6 million in retail sales from $66.9 million in Q1 2023 and

increased by 16.2% versus $58.2 million in Q2 2022.

Outlook

- The Company expects Q3 2023 net revenue to improve sequentially

and year-over-year compared to the same period last year driven by

new product introduction. Gross margins are expected to continue to

trend higher in the second half of the year as the Company

continues to achieve further efficiencies of scale from the

implementation of automation in production and packaging activities

and from the introduction of margin accretive products.

OPERATING AND FINANCIAL RESULTS FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2023 AND 2022

Three months ended

June

30

Six

months ended

June

30

(in thousands of

$, except gross margin % and per share figures)

2023

2022

2023

2022

Gross revenue

8,133.1

8,891.3

18,502.4

18,590.1

Net revenue

7,506.1

8,126.5

16,918.2

17,005.1

Gross margin before fair value adjustments

and impairments

2,201.9

2,690.8

5,363.3

5,319.2

Gross margin before fair value adjustments

and impairments (%)

29.3%

33.1%

31.7%

31.3%

Loss and comprehensive loss

994.8

2,501.8

3,247.3

5,575.9

Adjusted EBITDA[1]

(610.3)

(149.7)

(195.5)

(528.1)

Net and comprehensive earnings per share –

basic and diluted

(0.01)

(0.02)

(0.02)

(0.04)

1 See "Non-IFRS Measures", below.

Operating Expenses

Three months ended

June

30

Six

months ended

June

30

(in thousands of

$)

2023

2022

2023

2022

General and administrative

1,475.3

1,359.7

3,060.0

2,807.8

Marketing and sales

1,405.3

1,625.4

2,617.4

3,356.1

Research and development

225.2

225.1

491.9

335.8

Share-based compensation

34.1

176.7

100.2

288.0

Expected credit loss (recovery)

(1.2)

(2.3)

(0.7)

(0.5)

Depreciation of property, plant, and

equipment

47.3

51.8

97.5

98.9

Amortization of intangible assets

51.9

51.9

103.7

103.7

Total operating expenses

3,237.9

3,488.2

6,469.9

6,989.9

CONFERENCE CALL - Tuesday, August 29, 2023 at 10:30 a.m.

(EST):

The Company will host a conference call to discuss its results

on Tuesday, August 29, 2023 at 10:30 a.m. (EST). Interested

participants can join by dialing 416-764-8658 or 1-888-886-7786.

The conference ID is 16708083.

A recording of the conference call will be available for replay

following the call. To access the recording please dial

416-764-8691 or 1-877-674-6060. The replay ID is 708083#. The

recording will remain available until Thursday, September 28,

2023.

ABOUT INDIVA

Indiva is proud to be Canada's #1 producer of cannabis edibles.

We set the gold standard for quality and innovation with our

award-winning products, across a wide range of brands including

Pearls by Gr�n, Bhang Chocolate, Indiva Doppio Sandwich Cookies,

Indiva 1432 Chocolate, and No Future Gummies and Vapes, as well as

other Indiva branded extracts. Indiva manufactures its top-quality

products in its state-of-the-art facility in London, Ontario, and

has a corporate workforce remotely distributed across Southern

Ontario. Click here to connect with Indiva on LinkedIn, Instagram,

and here to find more information on the Company and its

products.

DISCLAIMER AND READER ADVISORY

General

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) has in any way passed upon the merits of the

contents of this news release and neither of the foregoing entities

accepts responsibility for the adequacy or accuracy of this news

release or has in any way approved or disapproved of the contents

of this news release.

Certain statements contained in this news release constitute

forward-looking information. These statements relate to future

events or future performance. The use of any of the words "could",

"intend", "expect", "believe", "will", "projected", "estimated" and

similar expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on the parties' current belief or

assumptions as to the outcome and timing of such future events.

Actual future results may differ materially. In particular, this

news release contains forward-looking information relating to,

among other things, (i) the Company's outlook for and expected

operating margins and future financial results, including the

Company's ability to achieve a year-over-year and sequential growth

of net revenue in Q3 2023 and to achieve higher gross margins in

the second half of the fiscal year due to efficiencies of scale and

the introduction of margin accretive products, (ii) the projected

growth of its business and operations (including existing and new

segments thereof), and the future business activities of, and

developments related to, the Company within such segments after the

date of this news release, including the anticipated introduction

of new product offerings (iii) the Company's ability to capture

and/or maintain its market share in any jurisdiction, (iv) the

Company's ability to deliver on its commitments for existing or new

listings of products, including scaling of existing products on a

national basis, (v) the Company's ability to shift its revenue mix

away from licensed products and towards products developed by the

Company, (vi) the Company's ability to monetize any impaired

saleable inventory, and (vii) the proposed telephone conference

call expected to be held by the Company on August 29, 2023. Various

assumptions or factors are typically applied in drawing conclusions

or making the forecasts or projections set out in forward-looking

information. Those assumptions and factors are based on information

currently available to the Company, and include, without

limitation, assumptions about the Company's future business

objectives, goals, and capabilities, the cannabis market, the

regulatory framework applicable to the Company and its operations,

and the Company's financial resources. Although the Company

believes that the assumptions underlying, and the expectations

reflected in, forward-looking statements in this news release are

reasonable, it can give no assurance that such expectations will

prove to have been correct. A number of factors could cause actual

events, performance or results to differ materially from what is

projected in the forward-looking statements. Specifically, readers

are cautioned that forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company, as

applicable, to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements, including, but not limited to, risks

and uncertainties related to: (i) the available funds of the

Company and the anticipated use of such funds, (ii) the

availability of financing opportunities, (iii) legal and regulatory

risks inherent in the cannabis industry, (iv) risks associated with

economic conditions, (v) dependence on management, (vi) public

opinion and perception of the cannabis industry, (vii) risks

related to contracts with third-party service providers, (vii)

risks related to the enforceability of contracts, (viii) reliance

on the expertise and judgment of senior management of the Company,

and ability to retain such senior management, (ix) risks related to

proprietary intellectual property and potential infringement by

third-parties, (x) risks relating to the management of growth

and/or increasing competition in the industry, (xi) risks

associated to cannabis products manufactured for human consumption,

including potential product recalls, (xii) risks related to the

economy generally, and (xiii) risk of litigation.

The forward-looking information contained in this news release

is made as of the date hereof and the Company is not obligated to,

and does not undertake to, update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws.

Because of the risks, uncertainties and assumptions inherent in

forward-looking information, investors should not place undue

reliance on forward looking information. The foregoing statements

expressly qualify any forward-looking information contained

herein.

This news release contains future-oriented financial information

and financial outlook information (collectively, "FOFI")

about the Company's prospective results of operations, which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set out in the above paragraph. FOFI contained in

this news release was approved by management as of the date of this

news release and was provided for the purpose of providing further

information about the Company's future business operations. The

Company disclaims any intention or obligation to update or revise

any FOFI contained in this news release, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law. Readers are cautioned that the FOFI contained in

this document should not be used for purposes other than for which

it is disclosed herein.

Non-IFRS Measures

This news release makes reference to certain non-IFRS measures.

These measures are not recognized measures under IFRS, do not have

a standardized meaning prescribed by IFRS, and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of our results of operations from management's

perspective. Accordingly, these measures should not be considered

in isolation nor as a substitute for analysis of our financial

information reported under IFRS.

The non-IFRS measure used in this news release includes

"Adjusted EBITDA". The Company calculates Adjusted EBITDA as a sum

of net revenue, other income, cost of inventory sold, production

salaries and wages, production supplies and expense, general and

administrative expense, and sales and marketing expense, as

determined by management. Adjusted license fee eliminates 50% of

the fee which is equivalent to the Company's share of the joint

venture company to which the license fee is paid. Adjusted EBITDA

is provided to assist readers in determining the ability of the

Company to generate cash from operations and to cover financial

charges. Management believes that Adjusted EBITDA provides useful

information to investors as it is an important indicator of an

issuer's ability to generate liquidity through cash flow from

operating activities and equity accounted investees. Adjusted

EBITDA is also used by investors and analysts for assessing

financial performance and for the purpose of valuing an issuer,

including calculating financial and leverage ratios. The most

directly comparable financial measure that is disclosed in the

financial statements of the Company to which the non-IFRS measure

relates is income (loss) from operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230829619536/en/

INVESTORS Anthony Simone Phone: 416-881-5154 Email:

ir@indiva.com

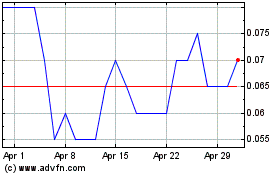

Indiva (TSXV:NDVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Indiva (TSXV:NDVA)

Historical Stock Chart

From Apr 2023 to Apr 2024