+ NMG has agreed to acquire 100% of Mason Resources’ Lac Guéret

graphite deposit to secure a world-class asset which will underpin

NMG’s planned Phase-3 expansion.

+ Preliminary economic assessment of the Uatnan Mining Project

has demonstrated attractive economics for a targeted production of

approximately 500,000 tonnes of graphite concentrate per annum over

a 24-year life of mine, making it one of the World’s largest

graphite projects in development.

+ NMG is committed to developing the asset in close

collaboration with the Innu First Nation of Pessamit.

+ As for its current operations, NMG is committed to promoting

best-practice environmental assessment, ecoengineering, and

stakeholder engagement.

+ Acquisition to position NMG as a leading graphite producer

with 100% ownership in North America’s two largest and most

advanced projected natural graphite operations leveraging its

knowledgeable workforce of over 100 employees, operational Phase-1

facilities, and clean extraction and processing technologies.

+ Graphite demand for lithium-ion batteries is projected to grow

to more than 10 million tonnes per annum by the end of the decade,

a 537% increase according to Benchmark Mineral Intelligence with a

significant portion within North America where a clear unbalanced

supply and demand situation is anticipated (December 2023).

+ With today’s transaction, NMG will have the ability to service

customers for decades to come with battery-grade graphite extracted

and refined with the exclusive use of hydropower, positioning the

Company as an attractive, ESG-driven, and unique strategic

source.

Nouveau Monde Graphite Inc. (“NMG“ or the “Company”) (NYSE: NMG,

TSX.V: NOU) has entered into an asset purchase agreement with Mason

Resources Inc. (“Mason”) (TSX.V: LLG, OTCQX: MGPHF) for the

acquisition of the entire Lac Guéret Property, targeted for the

development of the Uatnan Mining Project. The transaction

strengthens the Company’s long-term vision to be a dominant force

in the supply of carbon-neutral anode material for the Western

market. NMG’s active commercial discussions with tier-1 battery and

electric vehicle (“EV”) manufacturers, including Panasonic Energy

Co., Ltd. (“Panasonic Energy”), a wholly owned subsidiary of

Panasonic Holdings Corporation (“Panasonic”) (TYO: 6752), confirm

the strong projected demand by battery materials analysts for

graphite. This acquisition of another major asset in Québec,

Canada, reinforces NMG’s fully vertically integrated production

model in North America with the highest ESG standards of the

industry, as validated by Benchmark Mineral Intelligence’s

Sustainability Index.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240122571116/en/

Map of NMG’s assets in Québec, Canada:

the projected Matawinie Mine, Bécancour Battery Material Plant and

Uatnan Mining Project. (Graphic: Business Wire)

Arne H Frandsen, Chair of NMG, declared: “With its very large,

high-quality natural graphite deposit, the acquisition of the Lac

Guéret deposit represents a strategically important move by NMG.

This addition of a world-class asset to NMG’s portfolio of

resources, underpins the Company’s growth prospects and commercial

attractiveness. It also puts us in a unique position in the global

battery materials space. Our leadership and strong technical teams

are looking forward to the smart further development of the Lac

Guéret asset, fully synchronized with NMG’s current execution

plans. We also warmly welcome Mason as a shareholder of NMG as we

build a pioneering – and possibly the largest! – integrated natural

graphite production in the Western World.”

Eric Desaulniers, Founder, President and CEO of NMG, said: “In

light of commercial discussions for our Phase-2 production out of

the Matawinie Mine and Bécancour Battery Material Plant, we are

confident in the current and future demand for ethically sourced

and environmentally produced graphite-based anode material. NMG is

set to match the sustained market growth with a robust expansion

plan now secured in the Uatnan Mining Project. Uitshi-atussemitutau

– NMG aspires to work together with the Innu First Nation of

Pessamit – is our vision for the development of this project. We

are committed to a strong involvement of the First Nation and

active engagement with the region’s community and stakeholders to

ensure a responsible and sustainable development.”

Asset Purchase Agreement

NMG has agreed to acquire 100% of Mason’s Lac Guéret Property,

which consists among other things of 74 map-designated claims

totalling 3,999.52 hectares. The consideration for the acquisition

of the Lac Guéret Property is payable in 6,208,210 common shares of

NMG, representing 9.25% of the pro forma issued and outstanding

shares of NMG, to be issued to Mason upon the closing of the

transaction. A subsequent payment of $5,000,000 will be made to

Mason at the start of commercial production of the contemplated

Uatnan Mining Project. 3,104,105 of the common shares of NMG to be

issued in connection with the transaction will be subject to a

lock-up for a period of 12 months and the remaining 3,104,105

common shares of NMG will be subject to a lock-up of 18 months. The

shares of NMG will also be subject to a four-month hold period

pursuant to Canadian securities laws.

Closing of the transaction is expected to occur on or before

January 31, 2024, and is subject to certain standard conditions,

including the receipt of the final approval from the TSX Venture

Exchange.

The asset purchase agreement supersedes and terminates the

previously announced investment agreement and option and joint

venture agreement between NMG and Mason.

Planned Development of the Uatnan Mining Project

NMG published in 2023 a preliminary economic assessment (“PEA”),

according to National Instrument 43-101 Standards of Disclosure for

Mineral Projects, for the Uatnan Mining Project. The PEA, conducted

by engineering firms BBA Inc. and GoldMinds Geoservices Inc.,

showed strong economics for NMG’s updated operational parameters

and production volumes targeting the production of approximately

500,000 tonnes of graphite concentrate per annum over a 24-year

life of mine (“LOM”).

Table 1: Operational Parameters of the Uatnan

Mining Project

OPERATIONAL PARAMETERS

LOM

24 years

Nominal annual processing rate

3.4 M tonnes

Stripping ratio (LOM)

1.3:1

Average grade (LOM)

17.5% Cg

Average graphite recovery

85%

Average annual graphite concentrate

production (LOM)

500,000 tonnes

Finished product purity

94% Cg

The PEA is preliminary in nature and includes Inferred Mineral

Resources, considered too speculative geologically to have the

economic considerations applied to them that would enable them to

be categorized as Mineral Reserves, and there is no certainty that

the PEA will be realized. Mineral resources that are not mineral

reserves have not demonstrated economic viability. Additional

trenching and/or drilling will be required to convert inferred

mineral resources to indicated or measured mineral resources. There

is no certainty that the resources development, production, and

economic forecasts on which this PEA is based will be realized.

Table 2: Economic Highlights of the Uatnan

Mining Project

ECONOMIC HIGHLIGHTS

Uatnan Mining Project

Pre-tax NPV (8% discount rate)

C$ 3,613 M

After-tax NPV (8 % discount rate)

C$ 2,173 M

Pre-tax IRR

32.6%

After-tax IRR

25.9%

Pre-tax payback

2.8 years

After-tax payback

3.2 years

Initial CAPEX

C$ 1,417 M

Sustaining CAPEX

C$ 147 M

LOM OPEX

C$ 3,236 M

Annual OPEX

C$ 135 M

OPEX per tonne of graphite concentrate

C$ 268/tonne

Concentrate selling price

US$ 1,100/tonne

All costs are in Canadian dollars with the

exception of the graphite sale price which is provided in US

dollars.

Table 3: Current Pit-Constrained Mineral

Resource Estimate

IN-PIT CONSTRAINED MINERAL

RESOURCES

Tonnes (Mt)

Grade (% Cg)

Cg (Mt)

Measured

19.02

17.9

3.40

Indicated

46.62

16.9

7.89

Total Measured + Indicated

65.64

17.2

11.30

Inferred

17.82

17.2

3.07

Notes :

- The Mineral Resources provided in this table were estimated by

M. Rachidi P.Geo., and C. Duplessis, Eng., (QPs) of GoldMinds

Geoservices Inc., using current Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Standards on Mineral Resources and

Reserves, Definitions and Guidelines.

- Mineral Resources which are not Mineral Reserves do not have

demonstrated economic viability. The estimate of Mineral Resources

may be materially affected by environmental, permitting, legal,

title, market or other relevant issues. The quantity and grade of

reported Inferred Mineral Resources are uncertain in nature and

there has not been sufficient work to define these Inferred Mineral

Resources as indicated or Measured Mineral Resources. There is no

certainty that any part of a Mineral Resource will ever be

converted into Mineral Reserves.

- The Mineral Resources presented here were estimated with a

block size of 3mE x 3mN x 3mZ. The blocks were interpolated from

equal-length composites (3 m) calculated from the mineralized

intervals.

- The Mineral Resource estimate was completed using the inverse

distance to the square methodology utilizing three runs. For run 1,

the number of composites was limited to ten with a maximum of two

composites from the same drillhole. For runs two and three the

number of composites was limited to ten with a maximum of one

composite from the same drillhole.

- The Measured Mineral Resources classified using a minimum of

four drillholes. Indicated resources classified using a minimum of

two drillholes. The Inferred Mineral Resources were classified by a

minimum of one drillholes.

- Tonnage estimates are based on a fixed density of 2.9

t/m3.

- Mineral Resources are stated at a cut-off grade of 5.75%

C(g).

The Uatnan Mining Project lies within Nitassinan, the Innu of

Pessamit’s ancestral territory, and the Rivière-aux-Outardes

municipality located in the Côte-Nord administrative region,

Québec, Canada, approximately 220 km as the crow flies, north

northwest of the town of Baie-Comeau. The Uatnan Mining Project is

accessible by road 389 and then by following Class 1 forestry

roads.

Sustainability is center to NMG’s value proposition and will be

reflected in the next phase of work as the Company prioritizes the

signature of a pre-development agreement with the Innu First Nation

of Pessamit. The Company plans to maintain a transparent dialogue

with the First Nation as it advances the project development to

ensure the respect of their rights, the protection of the

environment, their culture and way of life, as well as the

inclusion of their perspective, and traditional knowledge.

As NMG’s team expands its relationships with the First Nation,

the community and local stakeholders, the Company will prepare for

subsequent studies to advance the Uatnan Mining Project. NMG has

already mapped out a detailed workplan to enable the preparation of

a feasibility study, including on-site fauna and flora inventories,

geological surveys, environmental studies, impact assessment,

stakeholder consultation, etc. True to its practices in developing

the Matawinie Mine, NMG is committed to a responsible, sustainable,

and inclusive process to bring the Uatnan Mining Project from

opportunity to engineering, construction and commercial

production.

NMG will leverage its team of over 100 employees from all

specialties – from metallurgy and environment to mining, research

and development, and sales – plus its operational Phase-1

concentration and processing facilities to support the development

of the Uatnan Mining Project.

Market Underpinnings

NMG’s acquisition of the Lac Guéret Property aims at securing

the asset in view of the growing demand for locally produced

natural graphite and the Company’s planned Phase-3 expansion to

supply the Western market.

Pushed by growth in electric vehicles, energy storage systems

and other clean technology applications, graphite demand for

lithium-ion batteries is projected to reach to over 10 million

tonnes per annum by 2030, a 537% increase according to Benchmark

Mineral Intelligence’s (December 2023) latest market

assessment.

In late 2023, China and the U.S. have sharpened their respective

trade instruments targeting graphite materials. China now enforces

restrictions on Chinese graphite materials exports. The U.S.

Government has indicated that battery material sourced from China

and other foreign entities of concern will not be eligible for EV

tax credits under the Inflation Reduction Act. These recent

political developments reaffirm the importance of establishing of a

local, resilient, and ESG-compliant supply chain of graphite to

support battery and EV production.

NMG is projected to become the largest natural graphite producer

in North America, fully integrated from ore to anode material, and

with demonstrated sustainability performance.

Scientific and technical information presented in this press

release was reviewed and approved by Eric Desaulniers, MSc, P.Geo.,

a Qualified Person as defined under NI 43-101.

About Nouveau Monde Graphite

Nouveau Monde Graphite is striving to become a key contributor

to the sustainable energy revolution. The Company is working

towards developing a fully integrated source of carbon-neutral

battery anode material in Québec, Canada, for the growing

lithium-ion and fuel cell markets. With enviable ESG standards, NMG

aspires to become a strategic supplier to the world’s leading

battery and automobile manufacturers, providing high-performing and

reliable advanced materials while promoting sustainability and

supply chain traceability. www.NMG.com

About Mason Resources

Mason Resources Inc. is a Canadian corporation focused on

seeking investment opportunities. Mason is the largest shareholder

of Black Swan Graphene Inc. (“Black Swan”) (TSX.V: SWAN) (OTCQB:

BSWGF) focusing on the large-scale production of patented

high-performance and low-cost graphene products aimed at several

industrial sectors, including concrete and polymers, which are

expected to require large volumes of graphene and, in turn, large

volumes of graphite. Black Swan aims at leveraging Québec’s

emerging graphite industry to establish an integrated supply chain.

In 2023, Black Swan, Nationwide Engineering Research &

Development Ltd., and Arup Group Ltd. announced strategic

partnerships and, in 2024, Black Swan announced a commercial

agreement with Hubron International Ltd. Black Swan’s graphene

processing technology was developed over the span of a decade by

Thomas Swan & Co. Ltd., a United Kingdom-based global chemicals

manufacturer, with a century-long track record. For more

information: www.masonresourcesinc.com and

www.blackswangraphene.com.

Subscribe to our news feed: https://bit.ly/3UDrY3X

Cautionary Note

All statements, other than statements of historical fact,

contained in this press release including, but not limited to those

describing the closing of the transaction, the results of the PEA,

trends in legislation, consumer preferences, and industry

standards, NMG’s performance with respect to the initiatives

described in this press release, the nature of relationships with

stakeholders such as the local community including the Innu First

Nation of Pessamit, future demand for batteries and graphite, the

intended production of carbon-neutral anode material, Mineral

Resource estimates (including assumptions and estimates used in

preparing the Mineral Resource estimates), the general business and

operational outlook of the Company, the Company’s future growth and

business prospects, the Company’s ESG commitments, initiatives and

goals, the Company’s goal to become the largest natural graphite

producer in North America and those statements which are discussed

under the “About Nouveau Monde” paragraph and elsewhere in the

press release which essentially describe the Company’s outlook and

objectives, constitute “forward-looking information” or

“forward-looking statements” (collectively, “forward-looking

statements”) within the meaning of Canadian and United States

securities laws, and are based on expectations, estimates and

projections as of the time of this press release. Forward-looking

statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company as of

the time of such statements, are inherently subject to significant

business, economic and competitive uncertainties and contingencies.

These estimates and assumptions may prove to be incorrect.

Moreover, these forward-looking statements were based upon various

underlying factors and assumptions, including the current

technological trends, the business relationship between the Company

and its stakeholders, the ability to operate in a safe and

effective manner, the timely delivery and installation at estimated

prices of the equipment supporting the production, assumed sale

prices for graphite concentrate, the accuracy of any Mineral

Resource estimates, future currency exchange rates and interest

rates, political and regulatory stability, prices of commodity and

production costs, the receipt of governmental, regulatory and third

party approvals, licenses and permits on favorable terms, sustained

labor stability, stability in financial and capital markets,

availability of equipment and critical supplies, spare parts and

consumables, the various tax assumptions, CAPEX and OPEX estimates,

all economic and operational projections relating to the project,

local infrastructures, the Company’s business prospects and

opportunities and estimates of the operational performance of the

equipment, and are not guarantees of future performance.

Forward-looking statements are subject to known or unknown risks

and uncertainties that may cause actual results to differ

materially from those anticipated or implied in the forward-looking

statements. Risk factors that could cause actual results or events

to differ materially from current expectations include, among

others, those risks, delays in the scheduled delivery times of the

equipment, the ability of the Company to successfully implement its

strategic initiatives and whether such strategic initiatives will

yield the expected benefits, the availability of financing or

financing on favorable terms for the Company, the dependence on

commodity prices, the impact of inflation on costs, the risks of

obtaining the necessary permits, the operating performance of the

Company’s assets and businesses, competitive factors in the

graphite mining and production industry, changes in laws and

regulations affecting the Company’s businesses, including the

changes in China’s policy regarding restrictions on Chinese

graphite materials exportations, political and social acceptability

risk, environmental regulation risk, currency and exchange rate

risk, technological developments, the impacts of the global

COVID-19 pandemic and the governments’ responses thereto, and

general economic conditions, as well as earnings, capital

expenditure, cash flow and capital structure risks and general

business risks. A further description of risks and uncertainties

can be found in NMG’s Annual Information Form dated March 23, 2023,

including in the section thereof captioned “Risk Factors”, which is

available on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov. Unpredictable or unknown factors not discussed in this

Cautionary Note could also have material adverse effects on

forward-looking statements.

Many of these uncertainties and contingencies can directly or

indirectly affect, and could cause, actual results to differ

materially from those expressed or implied in any forward-looking

statements. There can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Forward-looking statements are provided for the purpose

of providing information about management’s expectations and plans

relating to the future. The Company disclaims any intention or

obligation to update or revise any forward-looking statements or to

explain any material difference between subsequent actual events

and such forward-looking statements, except to the extent required

by applicable law.

The market and industry data contained in this press release is

based upon information from independent industry publications,

market research, analyst reports and surveys and other publicly

available sources. Although the Company believes these sources to

be generally reliable, market and industry data is subject to

interpretation and cannot be verified with complete certainty due

to limits on the availability and reliability of raw data, the

voluntary nature of the data-gathering process and other

limitations and uncertainties inherent in any survey. The Company

has not independently verified any of the data from third-party

sources referred to in this press release and accordingly, the

accuracy and completeness of such data is not guaranteed.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Further information regarding the Company is available in the

SEDAR+ database (www.sedarplus.ca), and for United States readers

on EDGAR (www.sec.gov), and on the Company’s website at:

www.NMG.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240122571116/en/

MEDIA Julie Paquet VP Communications & ESG Strategy

+1-450-757-8905 #140 jpaquet@nmg.com

INVESTORS Marc Jasmin Director, Investor Relations

+1-450-757-8905 #993 mjasmin@nmg.com

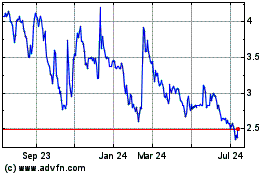

Nouveau Monde Graphite (TSXV:NOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

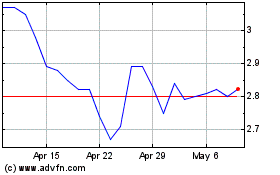

Nouveau Monde Graphite (TSXV:NOU)

Historical Stock Chart

From Apr 2023 to Apr 2024