Route1 Inc. (OTCQB: ROIUD and TSXV: ROI) (the “Company” or

“Route1”), an advanced North American provider of industrial-grade

data intelligence, user authentication and ultra-secure mobile

workforce solutions, today announced its second quarter (Q2)

financial results for the period ended June 30, 2019.

|

Statement of operationsIn 000s of CAD dollars |

Q2 2019 |

Q1 2019 |

Q4 2018 |

Q3 2018 |

Q2 2018 |

Q1 2018 |

| Revenue |

|

|

|

|

|

|

|

Subscription and services |

1,610 |

1,576 |

1,628 |

1,684 |

1,633 |

1,264 |

|

Devices and appliances |

1,819 |

1,883 |

2,440 |

13,207 |

3,936 |

388 |

|

Other |

1 |

3 |

6 |

4 |

7 |

32 |

| Total

revenue |

3,430 |

3,462 |

4,074 |

14,895 |

5,577 |

1,684 |

| Cost of

revenue |

1,672 |

1,700 |

2,216 |

12,311 |

3,620 |

585 |

| Gross

profit |

1,758 |

1,762 |

1,858 |

2,584 |

1,957 |

1,099 |

| Operating

expenses |

1,824 |

1,693 |

1,714 |

2,150 |

1,891 |

1,135 |

| Operating

profit (loss) 1 |

(66) |

69 |

144 |

434 |

65 |

(36) |

| Total other

expenses 2, 3 |

488 |

581 |

499 |

246 |

52 |

244 |

| Net income

gain (loss) |

(554) |

(513) |

(355) |

188 |

13 |

(280) |

|

|

|

1 Before stock-based compensation |

|

2 Includes stock-based compensation, AirWatch litigation, gain on

acquisition and foreign exchange |

| 3 The

reimbursements received from Bench Walk pursuant to its investment

have, based on advice of its auditors, been accounted for as a

long-term non-monetary liability within the consolidated financial

statements, not as a reduction to patent litigation expense. All

such amounts are non-recourse to the Company. In connection with

the terms of the agreement, the Company does not have a present

obligation to pay any amounts until such time as the litigation has

been settled or an event of default has occurred. In the event of

an award or settlement of the litigation, the Company will be

obligated to pay Bench Walk the greater of 10% of such award or

settlement and $2,000,000 or $3,000,000 if the litigation proceeds

to trial. |

|

Subscription revenue and servicesin 000s of CAD

dollars |

Q2 2019 |

Q1 2019 |

Q4 2018 |

Q3 2018 |

Q2 2018 |

Q1 2018 |

| Application software |

1,196 |

1,186 |

1,169 |

1,193 |

1,180 |

1,260 |

| Technology as a service (TaaS) |

311 |

307 |

329 |

289 |

266 |

- |

| Other services |

103 |

83 |

130 |

203 |

186 |

4 |

| Total |

1,610 |

1,576 |

1,628 |

1,684 |

1,633 |

1,264 |

|

Adjusted EBITDAin 000s of CAD dollars |

Q22019 |

Q12019 |

Q42018 |

Q32018 |

Q22018 |

Q12018 |

| Gross Profit |

1,758 |

1,762 |

1,858 |

2,584 |

1,957 |

1,099 |

| Adjusted EBITDA 4 |

200 |

322 |

331 |

627 |

272 |

46 |

| Amortization |

266 |

253 |

187 |

193 |

207 |

82 |

| Operating profit (loss) |

(66) |

69 |

144 |

434 |

65 |

(36) |

| |

| 4 Adjusted EBITDA

is defined as earnings before interest, income taxes, depreciation

and amortization, stock-based compensation, patent litigation,

restructuring and other costs. Adjusted EBITDA does not have any

standardized meaning prescribed under IFRS and is therefore

unlikely to be comparable to similar measures presented by other

companies. Adjusted EBITDA allows Route1 to compare its

operating performance over time on a consistent basis. |

Route1 generated net cash flow from operating

activities of approximately $0.97 million during Q2 2019 compared

with cash generated from operating activities of $0.57 million in

Q2 2018. Non-cash working capital generated was $1.17 million

in Q2 2019 compared to $0.33 million of cash generated in the same

period a year earlier. Net cash used by the day-to-day

operations for the three months ended June 30, 2019 was $0.21

million compared to cash generated of $0.24 million in Q1 2018.

|

Balance sheet extractsIn 000s of CAD dollars |

Jun 302019 |

Mar 312019 |

Dec 312018 |

Sep 302018 |

Jun 302018 |

Mar 312018 |

| Cash |

702 |

367 |

1,073 |

2,289 |

1,084 |

600 |

| Total current assets |

6,219 |

5,106 |

3,664 |

5,881 |

4,872 |

6,172 |

| Total current liabilities |

8,626 |

6,033 |

4,034 |

5,917 |

5,227 |

6,749 |

| Net working capital |

(2,407) |

(927) |

(370) |

(36) |

(355) |

(577) |

| Total assets |

12,268 |

8,803 |

6,673 |

8,733 |

7,892 |

9,179 |

| Bank debt and seller notes |

1,862 |

- |

- |

- |

- |

- |

| Total shareholders’ equity 3 |

854 |

860 |

1,465 |

1,928 |

1,888 |

1,931 |

PCS Mobile Acquisition

On June 28, 2019, Route1 acquired Portable

Computer Systems, Inc. (“PCS Mobile”). The Company completed

the purchase of PCS Mobile for total consideration of U.S. $2.5

million. Consideration consisted of: (a) U.S. $1,030,000 in

cash; (b) U.S. $500,000 by way of 11.2 million common shares of

Route1 Inc.; (c) U.S. $250,000 in an unsecured note with principal

amortization annually in arrears with amortization of $80,000 in

year one and two; and $90,000 in the third year, and an annual

interest rate of 3% paid annually in arrears, and (d) U.S. $720,000

in an unsecured note with amortization monthly in arrears with a

straight line amount of $20,000, an annual interest rate of 2.37%

paid monthly in arrears, with a condition of payment that the

continued employment of each of Ms. Pakkebier and Mr. Murphy, who

are married.

Additional transaction terms include no

assumption of indebtedness, a minimum cash balance of $200,000, a

working capital balance that is reflective of the time of year and

the nature of business, and a key employee non-compete and

non-solicitation for a period equivalent to the term of employment

plus two years.

PCS Mobile is a computer reseller with expertise

in mobile data applications, including wireless products for

in-vehicle use. The company offers guidance and

state-of-the-art mobile devices for a wide range of applications

including utilities, telecommunications, field services, insurance,

healthcare, Fire/EMT, police and public safety - as well as state

and local government.

Based in Denver, Colorado, PCS Mobile services

customers primarily located in the Southwestern and Rocky Mountain

regions of the U.S. Rugged devices and applications include but are

not limited to Panasonic Toughbook mobile computers, Xplore and

Getac rugged tablets, Genetec license plate recognition solutions,

and accessories from Gamber-Johnson and Havis.

Based on prior year’s results and short history

as a Route1 company, Route1 expects PCS Mobile to add annualized

revenue of approximately U.S. $15 million with a gross margin of

16% to 25%. The EBITDA contribution from PCS Mobile is

expected to be consistent with current Route1 results.

Dr. Barry West joins the

Board

Earlier today, Dr. Barry West, a career

technologist and business leader with over 30 years in the

information technology field with an emphasis on cybersecurity and

cloud computing, joined the Board of Directors of Route1.

Barry is currently the Founder and CEO of West

Wing Advisory Services, LLC. Dr. West retired in May 2018 as

the Senior Advisor and Senior Accountable Official for Risk

Management at the U.S. Department of Homeland Security (“DHS”).

This included spearheading the Cybersecurity Executive Order.

In all, Barry has 28 years of U.S. Government service

including being the Chief Information Officer at six different U.S.

Government agencies or organizations: Federal Deposit Insurance

Corporation, the Pension Benefit Guaranty Corporation, the

Department of Commerce, Federal Emergency Management Agency during

Hurricane Katrina, and the National Weather Service. He also

was briefly the Acting Deputy CIO at DHS prior to his

retirement.

Dr. West has represented the U.S. Government

information technology community at four different world-wide

gatherings of NATO countries. Barry has held prior positions

in the private sector including President of MicroTech, President

of Mason Harriman Group and Executive Vice President of SE

Solutions.

Barry is the past President of two of the

largest IT associations in the United States: the American Council

for Technology and the Association for Federal Information

Resources Management (“AFFIRM”) where he was presented the AFFIRM

President’s Award in Public Sector for 2017-2018.

Dr. West completed his Executive Doctorate

degree in Business from Georgia State University with a focus on

Cloud Computing in 2014. Dr. West was appointed in 2017 by

Georgia State University to be their Executive-In-Residence.

He has published in IEEE Computer Society, IT Professional journal

and the European Journal of Information Systems (EJIS) journal

article where his research focusing on cloud computing was selected

for publication. Dr. West received an Honorary Doctorate

degree in Business from his alma mater Northern Michigan University

in May 2015 where he also delivered the Commencement Speech for the

Spring 2015 graduates.

Barry is also an Emeritus member of the

Government Business Executive Forum and the current Co-Chair for

the Consumer Electronics Show (“CES”) Government 2020.

AirWatch Litigation Update

On August 28, 2019, Route1 filed a motion

related to the August 7, 2019 order that granted AirWatch’s motion

for summary judgment of non-infringement of Route1’s U.S. Patent

No. 7,814,216 (the “Order”). In the Order, Route1’s

infringement claims were dismissed and AirWatch’s counterclaims for

a declaration of invalidity of Route1’s U.S. Patent No. 7,814,216

(“the ‘216 Patent”) were left intact for trial commencing December

2, 2019. In its August 23, 2019 motion, Route1 is asking the

Court for the following relief: (1) to permit Route1 to immediately

appeal the summary judgment ruling to the U.S. Court of Appeals for

the Federal Circuit; and (2) to either (a) dismiss AirWatch’s

counterclaim for invalidity of the ‘216 Patent without prejudice to

AirWatch’s right to re-assert that claim should Route1 prevail on

its appeal, or (b) postpone the trial on AirWatch’s counterclaim

until after Route1’s appeal of the summary judgment order is

concluded.

Stock Option Grant

Route1 today granted employee stock options in

the aggregate amount of 400,000 with an exercise price of $0.50 per

share price. The stock options expire on August 27, 2024 and will

vest thirty percent on the first anniversary, thirty percent on the

second anniversary and the remainder on the third

anniversary. Under the Company’s stock option plan, 10% of

the issued capital is reserved for issuance or a total of 3,506,060

options. As of today’s date, including the above grant, a

total of 3,462,500 options are currently outstanding under the

stock option plan.

Investor Conference Call and

Webcast

Route1 will hold a conference call and web cast

to discuss the Company’s financial results and provide a business

update on Tuesday, September 3, 2019 at 4 p.m. eastern.

Participants should dial Toll-Free: 1-800-289-0438 or

Toll/International: 1-323-794-2423 at least 10 minutes prior to the

conference, pass code 6063095. For those unable to attend the

call, a replay will be available on Tuesday, September 3, 2019

after 7 p.m. at Toll-Free 1-844-512-2921 or Toll/International

1-412-317-6671, pass code 6063095 until 11:59 pm on Tuesday,

September 17, 2019.

The webcast will be presented live at

http://public.viavid.com/index.php?id=135980.

About Route1 Inc.Route1,

operating under the trade names GroupMobile and PCS

Mobile, is an advanced North American provider of

industrial-grade data intelligence, user authentication, and

ultra-secure mobile workforce solutions. The Company helps all

manner of organizations, from government and military to the

private sector, to make intelligent use of devices and data for

immediate process improvements while maintaining the highest level

of cyber security. Route1 is listed on the OTCQB in the

United States under the symbol ROIUF and in Canada on the TSX

Venture Exchange under the symbol ROI. For more information,

visit: www.route1.com.

For More Information, Contact:

Tony BusseriChief Executive Officer, Route1 Inc.+1 416

814-2635tony.busseri@route1.com

This news release, required by applicable

Canadian laws, does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities in the United

States. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”) or any state securities laws and may not be

offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

© 2019 Route1 Inc. All rights reserved. No part

of this document may be reproduced, transmitted or otherwise used

in whole or in part or by any means without prior written consent

of Route1 Inc.

See https://www.route1.com/terms-of-use/ for notice of

Route1’s intellectual property.

This news release contains statements that are

not current or historical factual statements that may constitute

forward-looking statements. These statements are based on certain

factors and assumptions, including, approval by the TSX Venture

Exchange of the share consolidation the impact of the share

consolidation on the trading volume, price and liquidity of the

common shares, expected financial performance, business prospects,

technological developments, and development activities and like

matters. While Route1 considers these factors and assumptions to be

reasonable, based on information currently available, they may

prove to be incorrect. These statements involve risks and

uncertainties, including but not limited to the risk factors

described in reporting documents filed by the Company. Actual

results could differ materially from those projected as a result of

these risks and should not be relied upon as a prediction of future

events. The Company undertakes no obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which such statement is made, or to reflect the

occurrence of unanticipated events, except as required by law.

Estimates used in this presentation are from Company sources.

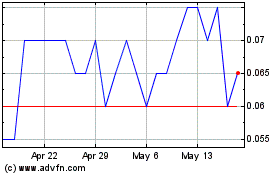

Route 1 (TSXV:ROI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Route 1 (TSXV:ROI)

Historical Stock Chart

From Jan 2024 to Jan 2025