Voxtur Analytics Corp. (

TSXV: VXTR; OTCQB: VXTRF)

("Voxtur" or the "Company"), a North American technology company

creating a more transparent and accessible real estate lending

ecosystem, today announced its financial results for the three

months and year ended December 31, 2023. The Company's Audited

Consolidated Financial Statements for year ended December 31, 2023,

and the related Management's Discussion and Analysis ("MD&A")

are available at www.sedarplus.ca and at www.voxtur.com.

"Despite facing challenges throughout 2023 with

unprecedented increases in mortgage rates and management changes,

we remain dedicated in our commitment to growth and resilience,“

said Gary Yeoman, CEO of Voxtur. “Our optimism is rooted in the

belief that setbacks are merely stepping stones toward greater

success. As we navigate these fluctuations, we're doubling down on

innovation, strategic initiatives, and unwavering dedication to

decreasing our debt. With a clear vision and proactive measures in

place, we are confident in our ability to adapt, thrive, and

deliver long-term value to our stakeholders.”

Financial Results for Q4 and year to date (“YTD”)

2023:

On November 1, 2023, the Company finalized the

sale of its wholly owned appraisal management company (“AMC”)

business. In accordance with International Financial Reporting

Standards, the Company has presented its AMC business as a

discontinued operation for the year ended December 31, 2023,

resulting in the reporting of revenue and gross profit excluding

discontinued operations for the three months and year ended

December 31, 2023 and 2022.

The disposal of the AMC business enabled the

Company to repay the full balance of approximately $22M term debt

facilities, and retain the remaining funds for working capital

purposes. Annual principal and interest savings related to

the reduction of the debt balance will be approximately $8.2M.

|

|

Unaudited |

|

Audited |

|

|

Three months ended December 31 |

|

Years ended December |

|

(In thousands of Canadian dollars) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

Revenue - continuing operations1 |

$ |

9,886 |

|

$ |

20,263 |

|

|

$ |

48,959 |

|

$ |

60,208 |

|

|

Gross profit - continuing operations1 |

|

6,073 |

|

|

9,881 |

|

|

|

31,527 |

|

|

27,987 |

|

|

Gross profit as a % of Revenue1 |

|

61 |

% |

|

49 |

% |

|

|

64 |

% |

|

46 |

% |

|

Adjusted EBITDA - continuing operations, Unaudited1,2 |

$ |

(3,915 |

) |

$ |

(1,468 |

) |

|

$ |

(10,399 |

) |

$ |

(16,344 |

) |

Discussion with respect to the above-noted results can be found

in the Company’s MD&A available at www.sedarplus.ca and at

www.voxtur.com.

1Calculations include results from continuing operations which

excludes discontinued operations related to the Company's AMC

business.

2 Adjusted EBITDA is an unaudited non-GAAP

measure and does not have any standardized meaning prescribed under

IFRS and, therefore, may not be comparable to similar measures

employed by other reporting issuers. Management believes Adjusted

EBITDA provides meaningful information with respect to the

financial performance and value of the Company, as items that may

obscure the underlying trends in the business performance are

excluded. Adjusted EBITDA is defined and calculated by the Company

as earnings (loss) before interest, taxes,

depreciation/amortization of property and equipment, intangible

assets and right-of-use assets, share-based compensation expense,

foreign exchange gains (losses) recorded through profit and loss,

impairment losses and other costs or income that are: (i)

non-operating; (ii) non-recurring; and/or (iii) related to

strategic initiatives. The Company classifies income or costs as

non-recurring if income or costs similar in nature are not

reasonably expected to occur within the next two years nor have

occurred during the prior two years, and such costs are

significant.

Earnings Call Details:

The Company will host a conference call on

Tuesday, April 30th, 2024, at 9:00 a.m. Eastern Time, to discuss

financial results and highlights for the fourth quarter and year

ended December 31, 2023.

The conference call can be accessed live by

dialing +1(800)-717-1738 or

+1(289)-514-5100. Please dial in ten minutes prior to the

scheduled start time. A digital recording of the call will be

available for replay on Voxtur's website.

About Voxtur

Voxtur is a transformational proptech company

that is redefining industry standards in a dynamic lending

environment. The company offers targeted data analytics to simplify

the multifaceted aspects of the lending lifecycle for investors,

lenders, government agencies and servicers. Voxtur’s proprietary

data hub and workflow platforms more accurately and efficiently

value real estate assets, providing critical due diligence that

enables market participants to effectively originate, trade, or

service defaults on mortgage loans. As an independent and

transparent mortgage technology provider, the company offers

primary and secondary market solutions in the United States and

Canada. For more information, visit www.voxtur.com.

Forward-Looking Information

This news release contains certain

forward-looking statements and forward-looking information

(collectively, “forward-looking information”) which reflect the

expectations of management regarding the Company’s future growth,

financial performance and objectives and the Company’s strategic

initiatives, plans, business prospects and opportunities. These

forward-looking statements reflect management’s current

expectations regarding future events and the Company’s financial

and operating performance and speak only as of the date of this

press release. By their very nature, forward-looking statements

require management to make assumptions and involve significant

risks and uncertainties, should not be read as guarantees of future

events, performance or results, and give rise to the possibility

that management’s predictions, forecasts, projections, expectations

or conclusions will not prove to be accurate, that the assumptions

may not be correct and that the Company’s future growth, financial

performance and objectives and the Company’s strategic initiatives,

plans, business prospects and opportunities, including the

duration, impact of and recovery from the COVID-19 pandemic, will

not occur or be achieved. Any information contained herein that is

not based on historical facts may be deemed to constitute

forward-looking information within the meaning of Canadian and

United States securities laws. Forward-looking information may be

based on expectations, estimates and projections as at the date of

this news release, and may be identified by the words “may”,

“would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”,

“believe”, “estimate”, “expect” or similar expressions.

Forward-looking information may include but is not limited to the

anticipated financial performance of the Company and other events

or conditions that may occur in the future. Investors are cautioned

that forward-looking information is not based on historical facts

but instead reflects estimates or projections concerning future

results or events based on the opinions, assumptions and estimates

of management considered reasonable at the date the information is

provided. Although the Company believes that the expectations

reflected in such forward-looking information are reasonable, such

information involves risks and uncertainties, and undue reliance

should not be placed on such information, as unknown or

unpredictable factors could have material adverse effects on future

results, performance, or achievements of the Company. Among the key

factors that could cause actual results to differ materially from

those projected in the forward-looking information include but are

not limited to: additional costs related to acquisitions,

integration of acquired businesses, and implementation of new

products; changing global financial conditions, especially in light

of the COVID-19 global pandemic; reliance on specific key employees

and customers to maintain business operations; competition within

the Company’s industry; a risk in technological failure, failure to

implement technological upgrades, or failure to implement new

technological products in accordance with expected timelines;

changing market conditions related to defaulted mortgage loans, and

the failure of clients to send foreclosure and bankruptcy referrals

in volumes similar to those prior to the COVID-19 global pandemic;

failure of governing agencies and regulatory bodies to approve the

use of products and services developed by the Company; the

Company’s dependence on maintaining intellectual property and

protecting newly developed intellectual property; operating losses

and negative cash flows; and currency fluctuations. Accordingly,

readers should not place undue reliance on forward-looking

information contained herein. Factors relating to the Company’s

financial guidance and targets disclosed in this press release

include, in addition to the factors set out above, the degree to

which actual future events accord with, or vary from, the

expectations of, and assumptions used by, Voxtur‘s management in

preparing the financial guidance and targets.

This forward-looking information is provided as

of the date of this news release and, accordingly, is subject to

change after such date. The Company does not assume any obligation

to update or revise this information to reflect new events or

circumstances except as required in accordance with applicable

laws.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Voxtur's common shares are traded on the TSX

Venture Exchange under the symbol VXTR and in the US on the OTCQB

under the symbol VXTRF.

Contact:

Jordan RossChief

Investment Officer

Tel: (416) 708-9764

jordan@voxtur.com

For media inquiries:Jacob GaffneyTel:

(817)471-7627jacob@gaffneyaustin.com

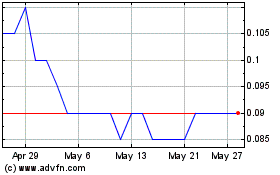

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Dec 2023 to Dec 2024