Waterloo Provides Update on Qualifying Transaction

July 23 2009 - 6:17PM

Marketwired Canada

Waterloo Resources Ltd. (TSX VENTURE:WAT.P) ("Waterloo"), a Vancouver based

Capital Pool Company listed on the TSX Venture Exchange (the "Exchange") is

providing an update on the status of its "Qualifying Transaction" further to its

news release dated March 9, 2009.

Waterloo has entered into an amending agreement with Eagle Plains Resources Ltd.

("Eagle Plains") (TSX VENTURE:EPL) whereby the regulatory approval deadline

under the Option Agreement between the parties has been extended to August 31,

2009. Pursuant to the Option Agreement dated effective September 8, 2008 between

Waterloo and Eagle Plains, as amended on May 31, 2009, Waterloo has a right to

earn up to a 75% interest in the Ice River Property located 45 km east of Golden

in British Columbia, Canada. In addition, pursuant to the terms of the amending

agreement, Waterloo's expenditure requirements will remain the same; however, a

portion of the funding for the second year work program will now be delayed

until year four. Cash payments of Eagle Plains will remain unchanged; however,

an additional 50,000 shares will be issued to Eagle Plains on the third

anniversary of the Effective Date (as defined in the Option Agreement).

The Option Agreement is intended to constitute Waterloo's "Qualifying

Transaction" under the policies of the Exchange.

Concurrent Private Placement - Update

Waterloo proposes to complete, concurrently with the closing of the Qualifying

Transaction, a non-brokered private placement of up to 3,200,000 units of

Waterloo at a price of $0.10 per unit, for gross proceeds of up to $320,000.

Each unit will consist of one common share of Waterloo and one warrant.

The private placement will also include up to an additional 2,000,000

"flow-through" units at a price of $0.10 per unit, for gross proceeds of up to

$200,000. Each flow-through unit will consist of one flow-through common share

of Waterloo and one non-flow-through warrant.

Warrants comprising both the units and flow-through units will be transferable

(subject to applicable securities laws) and will entitle the holder thereof to

purchase one non-flow-through common share of Waterloo at a price of $0.155 per

share for a period of five years following the closing of the private placement.

All securities under the private placement will be issued after giving effect to

a proposed two for one share subdivision.

The proceeds of the private placement will be used to fund the costs associated

with completing the Qualifying Transaction, the proposed work programs on the

Ice River Project, and for general working capital purposes.

Changes to Principals of Resulting Issuer

Waterloo is pleased to announce that, on completion of the Qualifying

Transaction, the following persons are anticipated to be the principals of the

resulting issuer.

Marcel de Groot, Chief Executive Officer and Director

Mr. de Groot is a Chartered Accountant and a founding partner of Pathway Capital

Ltd., a Vancouver based private venture capital company. He is currently the

chairman of Luna Gold Corp. and a director of Underworld Resources Inc. and

Keegan Resources Inc., which are public companies listed in Canada.

Shannon Shaw, Director

Ms. Shaw is a P. Geo. with a B.Sc. in geology and chemistry and a M.Sc. in

geology. She is President and senior geochemist with pHase Geochemistry Inc. and

has over twelve years of experience in environmental consulting in the mining

industry, pertaining particularly to the specialization of acid rock drainage,

waste management and water quality predictions. She has worked on a wide variety

of mining projects in North America, South America, Australia and Indonesia for

clients from industry, regulatory agencies, and other consulting groups. She has

published extensively in her field and recently co-authored a best management

practices document for the International Atomic Energy Agency of the United

Nations.

Greg Smith, Director

Mr. Smith is a Chartered Accountant and holds a Bachelor's of Commerce in

International Business from University of Victoria. Mr. Smith is currently the

CFO of Minefinders Corporation Ltd., a mining and exploration company listed on

the TSX and NYSE AMEX. Mr. Smith also worked at Goldcorp Inc. where he oversaw

the design and implementation of Sarbanes-Oxley compliance programs and, prior

to that, he spent over five years in the mining group at KPMG LLP in Vancouver.

Sam Wong, Chief Financial Officer

Mr. Wong is a Chartered Accountant and holds a Bachelor's of Commerce from the

University of British Columbia. Mr. Wong is currently the controller of Pathway

Capital Ltd., a Vancouver based private venture capital firm. Previously, he was

a professional staff accountant with an international accounting firm where he

gained valuable experience senioring large teams for audits under Canadian and

US GAAP for public multi-national clients (including major mining companies).

Further details of the proposed Qualifying Transaction are contained in

Waterloo's news releases dated September 24, 2008 and March 9, 2009 (as updated

by this news release).

Trading in Waterloo's common shares on the Exchange will remain halted pending

completion of the Qualifying Transaction.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the

proposed transaction and has neither approved nor disapproved the contents of

this press release.

ON BEHALF OF WATERLOO RESOURCES LTD.

Marcel de Groot, President, Chief Executive Officer and Director

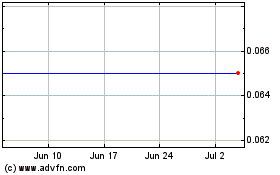

Whatcom Capital II (TSXV:WAT.P)

Historical Stock Chart

From May 2024 to Jun 2024

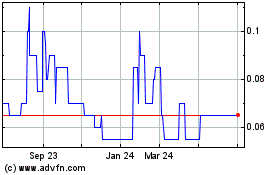

Whatcom Capital II (TSXV:WAT.P)

Historical Stock Chart

From Jun 2023 to Jun 2024