TSX VENTURE COMPANIES

ANTIOQUIA GOLD INC. ("AGD")

BULLETIN TYPE: Halt

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Effective at 8:55 a.m. PST, September 24, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

------------------------------------------------------------------------

BREA RESOURCES CORP. ("BCS")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated September 10, 2010,

effective at 12:38 p.m. PST, September 24, 2010 trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Change of Business and/or Reverse Takeover

pursuant to Listings Policy 5.2.

------------------------------------------------------------------------

CARBON FRIENDLY SOLUTIONS INC. ("CFQ")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated September 22, 2010,

effective at the opening, September 24, 2010, trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the proposed transaction.

------------------------------------------------------------------------

CHRYSALIS CAPITAL VII CORPORATION ("SEV.P")

BULLETIN TYPE: CPC-Filing Statement

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's CPC Amended

Filing Statement dated September 22, 2010, for the purpose of filing on

SEDAR.

------------------------------------------------------------------------

CRESO EXPLORATION INC. ("CXT")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating

to an Acquisition Agreement dated September 15 and 16, 2010, between the

Company and Anglo Pacific Group plc. (the "Vendor"), whereby the Company

may reacquire its Right of First Refusal (the "Right") previously

granted to the Vendor relating to the grant by the Company of any

royalties on certain properties.

In order to obtain the right, the Company must issue 500,000 common

shares to the Vendor in the first year upon signing.

For further information, please refer to the Company's press release

dated September 21, 2010.

EXPLORATION CRESO INC. ("CXT")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 24 septembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents relativement a

une convention d'acquisition datee des 15 et 16 septembre 2010 entre la

societe et Anglo Pacific Group plc. (le "vendeur"), selon laquelle la

societe peut reacquerir son droit de premier refus (le "droit")

anterieurement octroye au vendeur en relation avec l'octroi par la

societe des royautes sur certaines proprietes.

Afin d'acquerir le droit, la societe doit emettre 500 000 actions

ordinaires au vendeur pendant la premiere annee suite a la signature.

Pour plus d'information, veuillez vous referer aux communiques de presse

emis par la societe le 21 septembre 2010.

------------------------------------------------------------------------

GOLD HAWK RESOURCES INC. ("GHK")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing a letter of intent (the

"Letter of Intent") dated August 16, 2010 and subsequent share purchase

agreement (the "Share Purchase Agreement") dated September 1, 2010

pursuant to which Gold Hawk Resources Inc. ("Gold Hawk" or the

"Company") has agreed to purchase 100% of the shares of 0830438 B.C.

Ltd. ("Oracle Ridge"). Oracle Ridge's wholly owned US subsidiary, Oracle

Ridge Mining LLC, owns the subsurface mining rights through an option to

purchase and is leasing the surface mining rights necessary to explore,

rebuild and operate the past producing Oracle Ridge Copper Mine located

near Tucson, Arizona.

Pursuant to the Letter of Intent and Share Purchase Agreement, Gold Hawk

will purchase all of the issued and outstanding shares of Oracle Ridge

by issuing an aggregate of 11,200,000 common shares in the capital of

the Company to the shareholders of Oracle Ridge. In addition, Gold Hawk

has agreed to repay at closing approximately $700,000 of indebtedness of

Oracle Ridge.

Upon completion of the acquisition, Oracle Ridge will be a wholly owned

subsidiary of Gold Hawk, and the former shareholders of Oracle Ridge

will be shareholders of Gold Hawk.

Insider / Pro Group Participation: N/A

For further information please read the Company's news releases dated

August 17, 2010, September 1, 2010 and September 24, 2010 available on

SEDAR.

------------------------------------------------------------------------

HIGHLAND RESOURCES INC. ("HI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 20, 2010:

Number of Shares: 5,000,000 shares

Purchase Price: $0.05 per share

Warrants: 5,000,000 share purchase warrants to

purchase 5,000,000 shares

Warrant Exercise Price: $0.10 for a two year period

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert Eadie Y 580,000

Roger Blair Y 500,000

David Salmon Y 100,000

Gary Arca Y 200,000

Finder's Fee: $11,600 and 290,000 finder warrants,

exercisable at $0.10 for a two year period

into one common share, payable to Jordan

Capital Markets

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

------------------------------------------------------------------------

KODIAK EXPLORATION LIMITED ("KXL")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a Purchase Agreement between Kodiak Exploration Limited (the "Company")

and Pro Minerals Inc. (the "Vendor"), whereby the Company is purchasing

a 100% interest in two mineral claims in the Klotz Lake are of Ontario

(the "Property"). In consideration, the Company will issue 300,000

shares and pay $50,000 to the Vendor.

The Property is subject to a 2% net smelter returns royalty ("NSR") in

favour of James Forbes. The Company may acquire 50% of the NSR by paying

$1 million to Mr. Forbes.

Insider / Pro Group Participation: N/A

------------------------------------------------------------------------

KODIAK EXPLORATION LIMITED ("KXL")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

an Option Agreement dated September 13, 2010 between Kodiak Exploration

Limited (the "Company") and Teck Resources Limited (the "Vendor"),

whereby the Company has the option to earn a 100% interest in 6 mining

leases located in the Thunder Bay Mining Division, Klotz Lake Township,

Ontario (the "Property"). In consideration, the Company will issue

100,000 shares to the Vendor and must expend $100,000 in exploration

expenditures in the first year, $400,000 in the second year and $500,000

in the third year. The Property is subject to an option, whereby the

Vendor can earn back a 60% interest by incurring two times the amount of

expenditures on the Property incurred by the Company up to a maximum of

$6 million. The Vendor must give notice to the Company that it will be

exercising this option at any time up to 60 days following the date that

the Company gives notice of having incurred $3 million in expenditures

on the Property.

The Property is subject to a 2% net smelter returns royalty in favour of

the Vendor.

Insider / Pro Group Participation: N/A

------------------------------------------------------------------------

MESSINA MINERALS INC. ("MMI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 1, 2010:

Number of Shares: 1,250,000 shares

Purchase Price: $0.10 per share

Warrants: 1,250,000 share purchase warrants to

purchase 1,250,000 shares

Warrant Exercise Price: $0.12 for a two year period

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Steven Brunelle Y 500,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

------------------------------------------------------------------------

NEVADA GEOTHERMAL POWER INC. ("NGP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 2, 2010:

Number of Shares: 20,700,000 shares

Purchase Price: $0.50 per share

Warrants: 20,700,000 share purchase warrants to

purchase 20,700,000 shares

Warrant Exercise Price: $0.70 for a three year period. If the

closing price of the Company's shares is

$1.00 or higher for 20 consecutive trading

days at ay time after four months and one

day after the closing date, the Company

may, upon notice to warrant holders,

shorten the exercise period to 30 days from

the date of notice.

Number of Placees: 101 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert Sali P 1,000,000

Noelle Tognetti Family Trust P 500,000

Lowell Schmidt P 200,000

Wendie Elliott P 100,000

David Elliott P 200,000

David Lyall P 500,000

Lisa Stefani P 60,000

Finders' Fees: $295,000 cash and 590,000 finder's options

(same terms as above) payable to Global

Resource Investment Ltd.

$200,000 cash and 400,000 finder's options

exercisable at $0.50 for three years and

subject to the same acceleration provisions

as the warrants sold under the private

placement payable to KBH Capital Corp.

(Marin Katusa and Chan-Sheng (Joe) Hung).

$5,000 cash and 10,000 finder's options

(same terms as above) payable to Jacob

Securities Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

------------------------------------------------------------------------

NOVADX VENTURES CORP. ("NDX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second tranche of a Non-Brokered Private Placement announced

August 19, 2010:

Number of Shares: 890,000 shares

Purchase Price: $0.175 per share

Warrants: 445,000 share purchase warrants to purchase

445,000 shares

Warrant Exercise Price: $0.25 for a one year period

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Neil MacDonald Y 280,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

------------------------------------------------------------------------

NQ EXPLORATION INC. ("NQE")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 155,910 common shares at a deemed price of $0.097 per share, in

order to settle an outstanding debt of $15,123.28, and further to a

press release dated September 15, 2010. These shares are to be issued as

payment of accrued interest relating to convertible debentures issued

pursuant to a Private Placement.

Number of Creditors: 2 creditors

The Company shall issue a press release when the shares are issued and

the debt is extinguished.

EXPLORATION NQ INC. ("NQE")

TYPE DE BULLETIN : Emission d'actions en reglement d'une dette

DATE DU BULLETIN : Le 24 septembre 2010

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation de la

societe relativement a l'emission proposee de 155 910 actions ordinaires

au prix repute de 0,097 $ l'action en reglement d'une dette de 15 123,28

$, suite au communique de presse du 15 septembre 2010. Les actions

seront emises en paiement d'interets couru relatif aux debentures

convertibles emises en vertu d'un placement prive.

Nombre de creanciers : 2 creanciers

La societe emettra un communique de presse lorsque les actions seront

emises et que la dette sera reglee.

------------------------------------------------------------------------

NYAH RESOURCES CORP. ("NRU")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement, Remain

Halted

BULLETIN DATE: September 24, 2010

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a purchase agreement (the "Agreement") dated July 7, 2010, between Nyah

Resources Corp. (the "Company") and Valencia Ventures Inc. ("Valencia")

- a TSX-Venture listed company. Pursuant to the Agreement, the Company

will sell the Agnew North and South Lake Properties (the "Properties")

to Valencia (the "Disposition"). This Disposition does not include the

1.5% net smelter return royalty (the " North NSR") on the Agnew North

Lake Property granted to Ursa Major Minerals Incorporated ("URSA") and

the 2% net smelter return royalty (the "South NSR") on the Agnew South

Lake Property granted to Eric Marion. Valencia will have the right to

buy out 50% of the North NSR from URSA by making a $2,000,000 payment

and leave URSA with a tail of 0.75% North NSR in perpetuity. Valencia

can also purchase a portion of the first 50% of the North NSR on a pro-

rated basis. Valencia will also have the option to buy out 50% of the

South NSR within two years from Eric Marion by making a $270,000

payment. The Disposition is classified as a Non-Arm's Length Transaction

as there are common directors, Stan Bharti and Bernhard Wilson and a

common officer, Patrick Gleeson.

As consideration, Valencia must pay the Company $500,000 and an

additional aggregate payment of $500,000, which is payable in the form

of cash or shares of Valencia at the option of Valencia.

For further information, please refer to the Company's press releases

dated July 7, 2010 and September 23, 2010 and information circular dated

August 20, 2010.

------------------------------------------------------------------------

NYAH RESOURCES CORP. ("NRU")

BULLETIN TYPE: Name Change and Consolidation, Graduation, Remain Halted

BULLETIN DATE: September 24, 2010

TSX Venture Tier 1 Company

Further to the Company's press release dated September 21, 2010, the

Company completed its previously announced Reverse Take-Over ("RTO")

with Forbes and Manhattan (Coal) Inc. effective September 20, 2010.

Minority shareholders of the Company approved the RTO at a special

meeting held September 20, 2010. Shareholders also approved in

connection with the RTO a consolidation of the Company's capital on a

39.8 old for 1 new basis and a change in its name to Forbes and

Manhattan Coal Corp. For further information on the RTO, please refer to

the Company's Information Circular dated August 20, 2010.

Graduation:

TSX Venture Exchange has been advised that the Company's shares will be

listed and commence trading on Toronto Stock Exchange at the opening

Monday, September 27, 2010, under the name "Forbes and Manhattan Coal

Corp." with the symbol "FMC".

As a result of this Graduation, there will be no further trading under

the symbol NRU" on TSX Venture Exchange after September 24, 2010, and

its shares will be delisted from TSX Venture Exchange at the

commencement of trading on Toronto Stock Exchange.

------------------------------------------------------------------------

PACIFIC SAFETY PRODUCTS INC. ("PSP")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 5 and August 18,

2010:

Convertible Debenture 40 units for total principal amount of

$1,000,000

Each unit consists of $25,000 principal

amount of convertible debentures and 62,500

warrants.

Conversion Price: Convertible into common shares at $0.10 per

share.

Maturity date: August 18, 2013

Warrants Each warrant will have a term of 12 months

from the date of issuance of the notes and

entitle the holder to purchase one common

share. The warrants are exercisable at the

price of $0.10 in the first 6 months of

exercise and at $0.12 for the second and

final 6 months of exercise.

Interest rate: 10% per annum. At the discretion of the

Company shares may be issued in lieu of

cash as described in the August 5, 2010

press release by the Company.

Number of Placees: 9 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / Principal Amount

Rick Marks Y $200,000

Karen Marks Y $100,000

Kevin Duggan Y $50,000

Brian Morrison P $75,000

Christopher R. Rankin P $75,000

Hueniken & Company Limited

(Horst Hueniken) P $50,000

Michael Bird P $50,000

No Finder's Fee.

------------------------------------------------------------------------

PENFOLD CAPITAL ACQUISITION III CORPORATION ("PNF.P")

BULLETIN TYPE: Halt

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Effective at the opening, September 24, 2010, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

------------------------------------------------------------------------

PLANET EXPLORATION INC. ("PXI")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

AMENDMENT:

Further to the TSX Venture Exchange Bulletin dated September 21, 2010

the Exchange has accepted an amendment with respect to a Non-Brokered

Private Placement announced August 23, 2010:

There we additional ProGroups that participated. They are as follows:

Insider=Y /

Name ProGroup=P / # of Units

Elaine Henderson P 100,000

Laura Wait P 100,000

William Stanimir P 100,000

Brandon Boddy P 100,000

Marion Nelson P 100,000

John Gunther P 1,000,000

Fred Hofman P 100,000

Peter Ross and Sheila Ross P 100,000

Court Moore P 100,000

Kyle McLean P 150,000

------------------------------------------------------------------------

SAMA RESOURCES INC. ("SME")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced September 2, 2010:

Number of Shares: 2,500,000 shares

Purchase Price: $0.40 per share

Warrants: 1,250,000 share purchase warrants to

purchase 1,250,000 shares

Warrant Exercise Price: $0.55 for a one year period

Number of Placees: 1 placee

Agent's Fee: $80,000 cash and 200,000 Agent's Warrants

exercisable at $0.40 for two years payable

to Macquarie Private Wealth Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

------------------------------------------------------------------------

SIENNA GOLD INC. ("SGP")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to

the letter of intent between the Company and Vena Resources Inc.

("Vena") pursuant to which the Company will acquire 400 hectares of land

southeast of the Company's IGOR property located in northern Peru. In

consideration, the Company will pay an aggregate of USD$60,000 through

the issuance 355,000 common shares at a deemed price of $0.155 per share

and USD$5,000 cash.

No Insider / Pro Group Participation.

This transaction was disclosed in the Company's press release dated

August 27, 2010

------------------------------------------------------------------------

SKANA CAPITAL CORP. ("SKN")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver, BC

to Calgary, AB.

------------------------------------------------------------------------

SUPERIOR MINING INTERNATIONAL CORPORATION ("SUI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 21, 2010:

Number of Shares: 3,300,000 shares

Purchase Price: $0.12 per share

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

John Proust Y 416,667

Kjeld Thygesen Y 83,333

John Atkinson Y 830,000

Cyrus Driver Y 100,000

Finders' Fees: $1,800 payable to Mackie Research Capital

Corporation

$3,600 payable to Johan Mosaheb

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

TASMAN METALS LTD. ("TSM")

BULLETIN TYPE: Halt

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Effective at 6:22 a.m. PST, September 24, 2010, trading in the shares of

the Company was halted pending contact with the Company; this regulatory

halt is imposed by Investment Industry Regulatory Organization of

Canada, the Market Regulator of the Exchange pursuant to the provisions

of Section 10.9(1) of the Universal Market Integrity Rules.

------------------------------------------------------------------------

TASMAN METALS LTD. ("TSM")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

Effective at 8:00 a.m. PST, September 24, 2010, shares of the Company

resumed trading, an announcement having been made over StockWatch.

------------------------------------------------------------------------

WILLIAMS CREEK EXPLORATIONS LIMITED ("WCX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 27, 2010:

Number of Shares: 11,891,344 shares

Purchase Price: $0.15 per share

Number of Placees: 13 placees

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

------------------------------------------------------------------------

WIN-ELDRICH MINES LIMITED ("WEX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 24, 2010

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 17, 2010:

Number of Shares: 4,000,000 shares

Purchase Price: $0.20 per share

Warrants: 4,000,000 share purchase warrants to

purchase 4,000,000 shares

Warrant Exercise Price: $0.35 for a two year period

Number of Placees: 14 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Perry D. Muller Y 750,000

Lazarus Investment Partners LLLP Y 1,000,000

(Portfolio managed)

Wayne J. White P 250,000

Earl Harrison Y 375,000

Jeffrey G. Gall Y 37,918

Finder's Fee: $7,000 in cash payable to Brant Securities

Limited.

Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.

For futher details, please refer to the Company's news release dated

September 16, 2010.

------------------------------------------------------------------------

NEX COMPANIES

BI-OPTIC VENTURES INC. ("BOV.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: September 24, 2010

NEX Company

Further to TSX Venture Exchange Bulletin dated September 20, 2010,

effective 8:34 a.m. PST, September 24, 2010, trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Change of Business and/or Reverse Takeover

pursuant to Listings Policy 5.2.

------------------------------------------------------------------------

LANDER ENERGY CORPORATION ("LAE.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: September 24, 2010

NEX Company

Further to TSX Venture Exchange Bulletin dated September 22, 2010,

effective at the opening, September 24, 2010, trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Change of Business and/or Reverse Takeover

pursuant to Listings Policy 5.2.

------------------------------------------------------------------------

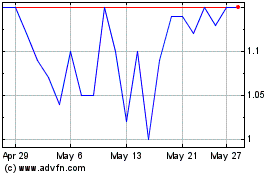

Western Exploration (TSXV:WEX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Western Exploration (TSXV:WEX)

Historical Stock Chart

From Mar 2024 to Mar 2025