Current Report Filing (8-k)

May 11 2020 - 2:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

April 22, 2020

Date of Report

(Date of earliest event reported)

APPLife Digital Solutions, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-56144

|

82-4868628

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

555 California St.

Suite 4925

San Francisco, CA 94194

Phone: (415) 659-1564

(Address and Telephone Number of Registrant’s Principal Executive Offices and Principal Place of Business)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Item 1.01 Entry into a Material Definitive Agreement.

On April 22, 2020, APPlife Digital Solutions Inc. (the “Company”), entered into a letter agreement (the “Agreement”) with Maxim Group, LLC (“Maxim”) for Maxim to provide general financial advisory, investment banking, and digital marketing services for the Company. The fees paid to Maxim in exchange for the services under the Agreement shall be (i) a cash fee of 8% of the amount of capital raised, invested or committed; and (ii) a cash fee for unallocated expenses of 1% of the amount of capital raised, invested or committed; and (iii) a five (5) year warrant to purchase shares of the Company’s common stock (the “Common Stock”) equal to eight percent (8%) of the number of shares of the Common Stock underlying the securities issued in the Financing. Further, the Company shall issue 1,000,000 shares of Common Stock to Maxim upon the execution of the Agreement, 1,250,000 shares of Common Stock upon execution of this Agreement that will be held in escrow for seven (7) months , unless the Company provides notice of termination of the Agreement within thirty (30) days of the date that is six (6) months from execution of the Agreement. If and when the 1,250,000 shares of Common Stock are released from escrow to Maxim, those shares shall be subject to a twelve (12) month lockup following receipt of the shares by Maxim. Lastly, the Company shall issue 1,500,000 shares of Common Stock to Maxim upon the up-listing of the Company’s Common Stock to a national exchange (NASDAQ or NYSE).

The foregoing information is a summary of the Agreement described above, is not complete, and is qualified in its entirety by reference to the full text of the Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K. Readers should review the Agreement for a complete understanding of the terms and conditions of the transaction described above.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

Exhibit NumberDescription___________________________________________

10.1Letter Agreement with Maxim Group, LLC dated April 22, 2020

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 11, 2020

APPLIFE DIGITAL SOLUTIONS, INC.

/s/ Matthew Reid

Matthew Reid

Principal Executive Officer

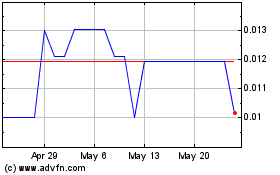

AppLife Digital Solutions (QB) (USOTC:ALDS)

Historical Stock Chart

From Nov 2024 to Dec 2024

AppLife Digital Solutions (QB) (USOTC:ALDS)

Historical Stock Chart

From Dec 2023 to Dec 2024