Maersk Profit Rises Amid Surging Demand, Freight Rates

February 10 2021 - 2:18AM

Dow Jones News

By Dominic Chopping

A.P. Moeller-Maersk AS said Wednesday that it saw surging demand

in the fourth quarter while freight rates spiked due to bottlenecks

across the entire supply chain, including a shortage of ships and

containers.

As a result, the first quarter of 2021 is expected to be

stronger than the fourth quarter of 2020, the company said.

The Danish shipping giant posted a quarterly net profit

attributable to shareholders of $1.3 billion, compared with a loss

of $72 million a year earlier, and against the $1.39 billion seen

in an analyst forecast from FactSet.

Revenue rose 16% to $11.26 billion against $10.91 billion

expected.

Maersk, which is considered a barometer of global trade, said

shipping volumes rose 3.2% and average freight rates surged 18%,

while fuel costs fell 14% on the year.

"Ocean performed at record level in the quarter as a consequence

of the strong rebound of demand which led to full capacity

utilization but also to bottlenecks, higher costs and difficulties

in meeting our customer reliability promises," said Chief Executive

Soren Skou.

Organic volume growth in its main ocean unit is expected to be

in line with global container demand at an expected 3%-5% in 2021,

with the highest growth seen in the first-half of the year.

Maersk expects underlying earnings before interest, tax,

depreciation and amortization in 2021 at between $8.5 billion-$10.5

billion from $8.3 billion in 2020, with underlying EBIT of $4.3

billion-$6.3 billion from $4.2 billion in 2020 and free cash flow

above $3.5 billion versus $4.2 billion in 2020.

For 2021-22, accumulated capital expenditure is still expected

at $4.5 billion-$5.5 billion.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

February 10, 2021 03:03 ET (08:03 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

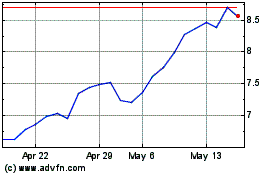

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Dec 2024 to Jan 2025

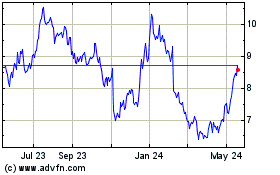

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Jan 2024 to Jan 2025