-- Net Loans Grew 24% in Year-Over-Year

Comparison --

Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

reported financial results for the fourth quarter and full year

ended December 31, 2013.

“Our strong loan growth in 2013 reflects the hard work and

results-driven focus of F&M’s newly expanded lending team,”

said Henry Walker, president of Farmers & Merchants Bank of

Long Beach. “The Bank’s position of strength was further enhanced

during the year with additional strategic hires, as well as the

opening of two new branches – Corona del Mar and Downey.

“F&M is entering 2014 with the financial health, vigor and

core values that have been hallmarks of the Bank since its

inception in 1907,” Walker added.

Income Statement

For the 2013 fourth quarter, total interest income was $43.5

million, compared with $40.4 million in the fourth quarter of 2012.

Total interest income for the year ended December 31, 2013 was

$163.2 million, compared with $171.1 million reported for 2012.

Interest expense for the 2013 fourth quarter was $1.6 million,

essentially in line with interest expense for the same quarter in

2012. Interest expense for the full 2013 year declined to $6.2

million from $7.0 million in 2012, reflecting the protracted low

interest rate environment.

Farmers & Merchants’ net interest income for the 2013 fourth

quarter was $41.9 million, compared with net interest income of

$38.8 million for the same quarter of 2012. Net interest income for

2013 was $157.0 million, versus $164.1 million in 2012.

Farmers & Merchants’ net interest margin was 3.30% for the

year ended December 31, 2013, compared with 3.65% in the previous

year.

The Bank did not have a provision for loan losses in 2013, nor

in 2012, amid continued strength in the quality of its loan

portfolio. The Bank’s allowance for loan losses as a percentage of

loans outstanding was 2.09% at December 31, 2013, compared with

2.57% at December 31, 2012.

Non-interest income was $7.2 million for the 2013 fourth

quarter, compared with $6.2 million in the 2012 fourth quarter.

Non-interest income for the full 2013 year totaled $37.8 million,

versus $26.6 million for 2012.

Non-interest expense for the 2013 fourth quarter was $27.2

million, compared with $26.4 million for the same period last year.

Non-interest expense for the year ended December 31, 2013 was

$104.3 million, compared with $98.5 million last year.

The Bank’s net income for the 2013 fourth quarter was $15.0

million, or $114.41 per diluted share, compared with $13.2 million,

or $101.13 per diluted share, in the 2012 fourth quarter. The

Bank’s net income for 2013 was $62.2 million, or $474.80 per

diluted share, compared with $63.4 million, or $484.13 per diluted

share, for 2012.

Balance Sheet

At December 31, 2013, net loans totaled $2.40 billion, compared

with $1.93 billion at December 31, 2012. The Bank’s deposits grew

to $3.83 billion at the end of 2013, from $3.69 billion at December

31, 2012. Non-interest bearing deposits represented 38.5% of total

deposits at December 31, 2013, versus 40.0% of total deposits at

December 31, 2012. Total assets increased to $5.21 billion at the

close of 2013 from $5.00 billion at December 31, 2012.

At December 31, 2013, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 27.45%, a Tier 1 risk-based capital

ratio of 26.20%, and a Tier 1 leverage ratio of 14.48%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“Our solid loan growth was approached with the conservative

lending standards that are fundamental to F&M’s strength,” said

Daniel Walker, chief executive officer and chairman of the board.

“Additionally, our new branch openings are indicative of the

opportunities we see in Southern California, as we continue to

serve a region where a strong and stable banking partner is a key

ingredient of an economy on the mend.”

About Farmers & Merchants Bank

Founded in Long Beach in 1907 by C.J. Walker, Farmers &

Merchants Bank has 23 branches in Los Angeles and Orange Counties.

The Bank specializes in commercial and small business banking along

with business loan programs. Farmers & Merchants Bank of Long

Beach is a California state chartered bank with deposits insured by

the Federal Deposit Insurance Corporation (Member FDIC) and an

Equal Housing Lender. For more information about F&M, please

visit www.fmb.com.

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (Unaudited) (In thousands except per share

data) Three Months Ended Dec.

31, Twelve Months Ended Dec. 31, 2013 2012

2013 2012 Interest income: Loans

$ 28,351 $ 26,060 $ 105,163 $ 112,157 Securities available-for-sale

1,778 2,364 8,067 10,794 Securities held-to-maturity 13,323 11,720

49,441 47,112 Deposits with banks 31 286 488 1,051 Total

interest income 43,483 40,430 163,159 171,114

Interest

expense: Deposits 1,296 1,328 5,049 5,840 Securities

sold under repurchase agreements 277 292 1,116 1,147 Total

interest expense 1,573 1,620 6,165 6,987 Net interest income

41,910 38,810 156,994 164,127

Provision for loan

losses - - - - Net interest income after provision for

loan losses 41,910 38,810 156,994 164,127

Non-interest

income: Service charges on deposit accounts 1,151 1,136

4,554 4,598 Gains on sale of securities 261 303 1,308 345 Other

real estate owned income 482 293 3,757 2,797 Merchant bankcard

income 2,348 2,178 9,358 8,822 Other income 2,942 2,291 18,837

10,071 Total non-interest income 7,184 6,201 37,814 26,633

Non-interest expense: Salaries and employee

benefits 15,726 13,012 55,986 48,271 FDIC and other insurance

expense 123 1,667 4,825 6,479 Occupancy expense 1,944 1,732 6,987

6,500 Equipment expense 1,434 1,552 6,026 5,634 Other real estate

owned expense 285 1,033 528 4,476 Amortization of public welfare

investments 2,020 1,866 8,082 7,762 Merchant bankcard expense 1,929

1,749 7,493 6,821 Legal and professional services 885 953 3,604

2,882 Marketing expense 790 998 3,770 3,424 Other expense 2,101

1,790 6,961 6,268 Total non-interest expense 27,237 26,352

104,262 98,517 Income before income tax expense 21,857

18,659 90,546 92,243

Income tax expense 6,878 5,420

28,382 28,856

Net income $ 14,979

$ 13,239 $ 62,164 $

63,387 Basic and diluted earnings per common share $

114.41 $ 101.13 $ 474.80 $ 484.13

FARMERS &

MERCHANTS BANK OF LONG BEACH Balance Sheets (Unaudited)

(In thousands except share and per share data)

Dec. 31, 2013 Dec. 31, 2012 Assets

Cash and due from banks: Noninterest-bearing balances $

65,261 $ 60,914 Interest-bearing balances 20,755 253,087 Securities

available-for-sale 427,942 630,055 Securities held-to-maturity

2,145,289 1,942,085 Loan held for sale 465 2,364 Gross loans

2,454,302 1,982,076 Less allowance for loan losses (51,251 )

(50,994 ) Less unamortized deferred loan fees, net (1,704 ) (364 )

Net loans 2,401,347 1,930,718

Other real estate owned, net

14,502 17,696 Public welfare investments 27,722 35,804 Bank

premises and equipment, net 66,212 60,504 Net deferred tax assets

23,512 26,060 Other assets 21,579 29,674

Total assets $ 5,214,586 $

4,988,962 Liabilities and

Stockholders' Equity Liabilities:

Deposits: Demand, non-interest bearing $ 1,475,888 $ 1,474,215

Demand, interest bearing 413,291 346,991 Savings and money market

savings 1,080,774 1,011,029 Time deposits 861,489 853,631

Total deposits 3,831,442 3,685,866 Securities

sold under repurchase agreements 595,991 551,293 Other liabilities

27,986 34,543

Total liabilities

4,455,419 4,271,702

Stockholders' Equity: Common Stock, par value $20;

authorized 250,000 shares; issued and outstanding 130,928 shares

2,619 2,619 Additional paid-in capital 12,044 12,044 Retained

earnings 742,408 695,169 Accumulated other comprehensive income

2,096 7,427

Total stockholders' equity

759,167 717,259 Total

liabilities and stockholders' equity $ 5,214,586

$ 4,988,961

Farmers & Merchants Bank of Long BeachJohn HinrichsExecutive

Vice President562-437-0011, ext. 5035orPondelWilkinson Inc.Evan

PondelInvestor Relations310-279-5980investor@pondel.com

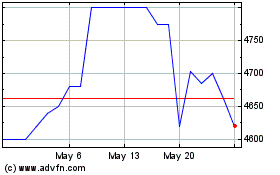

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025