Sainsbury to Accelerate Investment in Core Business After Failed Asda Merger -- Update

May 01 2019 - 8:00AM

Dow Jones News

--Sainsbury to cut debt by at least GBP600 million over next

three years

--Grocer plans more investments in its supermarket segment.

--Sainsbury books GBP46 million costs against failed Asda

merger.

By Adriano Marchese

J Sainsbury PLC (SBRY.LN) said Wednesday that it will accelerate

investments in its core business and reduce debt by at least 600

million pounds ($783.8 million) over the next three years after

U.K. regulators blocked its planned merger with Asda.

The number two grocer by market share--which disclosed that the

failed merger cost it GBP46 million--said that it plans to improve

more than 400 of its supermarkets this year, having already

completed a major transformation of how it runs its stores.

Despite the costs and management distraction as it fought

regulators to save its deal to buy Walmart Inc. (WMT)'s U.K. arm

Asda, Sainsbury still managed to report market-beating fiscal 2019

earnings and raise its dividend.

Shares moved up 9.40 pence, or 4.2%, at 231.90 pence on the

news.

However, Chief Executive Mike Coupe still needs to convince the

market of his plan for the grocer's future.

"There is a lot of positive talk in the results as Mike Coupe

tries to reassure the market that he has a grip on the business and

is addressing negatives such as store standards," AJ Bell's Russ

Mould says. However he says Sainsbury needs a plan get its grocery

proposition back on track to have a fighting chance to win back

some market share.

Hargreaves Lansdown's Laith Khalaf adds that Sainsbury isn't out

of the woods yet despite the better-than-expected full-year

results. He points to a number of one-off costs, including that

booked for the failed Asda deal and compares it's flatlining sales

growth with a "resurgent" Tesco PLC (TSCO.LN).

Sainsbury made a pretax profit of GBP239 million for the year

ended March 9 compared with GBP409 million the previous fiscal

year.

Underlying pretax profit--the company's preferred metric which

strips out exceptional and other one-off items--was GBP635 million

compared with GBP589 million the prior year. This beat a forecast

of GBP624.3 million, based on a consensus of 10 analysts provided

by FactSet.

Revenue for the year rose to GBP29.01 billion from GBP28.46

billion. This compares with a GBP28.94 billion forecast based on 15

analysts' estimates provided by FactSet.

The company said Argos, which the company acquired in 2016, has

been fully integrated into the business and delivered GBP160

million in synergies ahead of schedule.hey

The board has declared a final dividend of 7.9 pence a share,

bringing the total year payout to 11.0 pence. This compares with

10.2 pence a year earlier.

Net debt was reduced by GBP222 million to GBP1.64 billion in the

year.

"I am confident in our strategy and also clear on what we need

to do to continue to evolve the business in a highly competitive

market where shopping habits continue to change," Chief Executive

Mike Coupe said. He didn't provide further information on the

company's plan except to say it will update the market on its

progress on Sept. 25 when the company holds its Capital Markets

Day.

Last Thursday Sainsbury and Asda threw in the towel on their

planned merger after the U.K. Competition and Markets Authority

blocked it nearly a year after the two grocers first agreed to

combine.

The merger would have brought together the U.K.'s second- and

third-largest grocers, making it bigger than Tesco PLC (TSCO.LN),

which currently has 27.3% of market share, according to a report by

Kantar Worldpanel. Sainsbury has a 15.4% market share while Asda

has a 15.2% share.

Write to Adriano Marchese at adriano.marchese@dowjones.com

(END) Dow Jones Newswires

May 01, 2019 08:45 ET (12:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

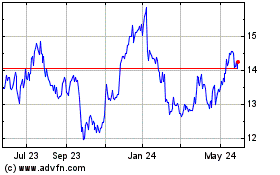

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

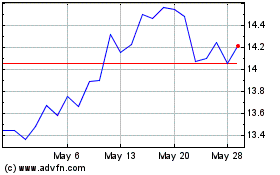

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jan 2024 to Jan 2025