As filed with the Securities and Exchange Commission

on December 8, 2023.

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE

Securities

Act of 1933

KONATEL, INC.

(Exact name of Registrant as specified in its charter)

| Delaware |

80-0973608 |

| (State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

500 N. Central Expressway, Suite 202

Plano, Texas 75074

(Address of Principal Executive Offices)

KonaTel, Inc. 2018 Incentive Stock Option Plan

(“2018” Incentive Stock

Option Plan [year designation reflects change to calendar year end in 2017])

(Full title of the plan)

D. Sean McEwen

500 N. Central Expressway, Suite 202

Plano, Texas 75074

Name and address of agent for service

Telephone number, including area code, of agent for

service: (214) 323-8410

Copies to:

Leonard W. Burningham, Esq.

P.O. Box 521644

Salt Lake City, Utah 84152-1844

(801) 363-7411

Indicate by check mark whether the Registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o |

Accelerated filer o |

| Non-accelerated filer o |

Smaller reporting company x |

| |

Emerging Growth company o |

If an emerging growth company, indicate by check mark if the Registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act.

The purpose of this S-8 Registration Statement is to increase the number

of shares of the Registrant’s common stock available for issuance under its 2018 Incentive Stock Option Plan by 1,700,000 shares.

This amendment leaves 7,848,120 registered shares equaling 1,748,120 shares issued and 6,100,000 reserved shares remaining for future

issuance. We registered 5,901,884 shares in the Form S-8 filed August 25, 2021; added 2,000,000 shares in the Form S-8 filed July 7, 2022;

deducted 1,500,000 shares in the Post-Effective Amendment to the Form S-8 filed August 22, 2022; deducted 253,764 in the Post-Effective

Amendment No. 2 to the Form S-8 filed March 20, 2023; and are adding 1,700,000 shares with this Form S-8 filing, for a total registered

shares of 7,848,120.

CALCULATION OF REGISTRATION FEE

| Title of securities to be registered |

Amount to be registered (1)(3) |

Proposed maximum offering price per share (2) |

Proposed maximum aggregate offering price (2) |

Amount of registration fee (2) |

| Common Stock, $0.001 par value |

1,700,000 |

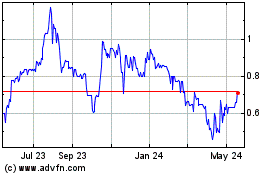

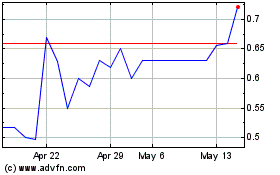

$0.875 |

$1,487,500 |

$219.56 |

(1) Pursuant to Rule 416(c) under

the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement cover interests to be offered or

sold pursuant to the plan described herein.

(2) Estimated solely for the purpose

of determining the registration fee pursuant to Rule 457(h) under the Securities Act based on the average of the high and low sale prices

per share of the Registrant’s $0.001 par value common stock (the “Common Stock”) as quoted on the OTC Markets Group,

Inc. “OTCQB Tier” on December 7, 2023.

(3) Additional 1,700,000 shares

of Common Stock reserved for issuance under the Registrant’s 2018 Incentive Stock Option Plan (the “Plan”).

(This space intentionally left blank.)

KONATEL, INC.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in

Part I of Form S-8 is not required to be filed with the Securities and Exchange Commission (the “Commission”) either as part

of this registration statement (the “Registration Statement”) or as prospectuses or prospectus supplements pursuant to the

introductory “Note” to Part I of Form S-8 and Rule 424 under the Securities Act. The information required in the Section 10(a)

prospectus is included in the documents being maintained and delivered by KonaTel, Inc. (the “Registrant”) to the participants

in the Company’s Plan as required by Part I of Form S-8 and by Rule 428 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents previously

filed (File No. 001-10171) with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

are, as of their respective dates, incorporated by reference in this Registration Statement (the Plan is variously referred to in the

following reports as the “2017 Incentive Stock Option Plan” and the “2018 Incentive Stock Option Plan” by reason

of the fact that the Registrant’s fiscal year end was September 30 at the time of the effectiveness of the Plan, or December 18,

2017; and the fiscal year end of the Registrant was changed to a calendar year end prior to the end of December 31, 2017. The Plan is

one and the same Plan:

(a)

The S-8 Registration Statement, File Number 333-259053, filed with the Commission on August 25, 2021;

(b)

The Annual Report on Form 10-K of the Registrant for the calendar year ended December 31, 2021, filed with the Commission on April

14, 2022;

(c) The

Quarterly Report on Form 10-Q of the Registrant for the quarter ended March 31, 2022, filed with the Commission on May 23, 2022;

(d) The

Current Report on Form 8-K of the Registrant dated June 14, 2022, filed with the Commission on June 21, 2022;

(e)

The S-8 Registration Statement, File Number 333-266052, filed with the Commission on July 7, 2022;

(f)

The Quarterly Report on Form 10-Q of the Registrant for the quarter ended June 30, 2022, filed with the Commission on August 15,

2022;

(g) The

Post-Effective Amendment to the Form S-8 Registration Statement, File Number 333-259053, filed with the Commission on August 22, 2022;

(h) The

Quarterly Report on Form 10-Q of the Registrant for the quarter ended September 30, 2022, filed with the Commission on November 14, 2022;

(i) The

Post-Effective Amendment to the Form S-8 Registration Statement, File Number 333-259053, filed with the Commission on March 20, 2023;

(j) The

Current Report on Form 8-K of the Registrant dated April 6, 2023, filed with the Commission on April 17, 2023;

(k) The

Annual Report on Form 10-K of the Registrant for the calendar year ended December 31, 2022, filed with the Commission on April 17, 2023;

(l) The

Quarterly Report on Form 10-Q of the Registrant for the quarter ended March 31, 2023, filed with the Commission on May 15, 2023;

(m)

The Current Report on Form 8-KA of the Registrant dated June 14, 2022, filed with the Commission on June 17, 2023;

(n) The

Quarterly Report on Form 10-Q of the Registrant for the quarter ended June 30, 2023, filed with the Commission on August 14, 2023;

(o) The

Quarterly Report on Form 10-Q of the Registrant for the quarter ended September 30, 2023, filed with the Commission on November 20, 2023;

and

(p) The

description of the Registrant’s Common Stock is Exhibit 4 in its 10-K Annual Report for the year ended December 31, 2022, filed

with the Commission on April 17, 2023, and all amendments and reports filed for the purpose of updating such description.

In addition, all documents filed

by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this Registration Statement and

prior to the filing of a Post-Effective Amendment that indicates that all shares of Common Stock registered have been sold, or that deregisters

all shares of Common Stock then remaining unsold, shall be deemed to be incorporated by reference in, and to be a part of, this Registration

Statement, from the date of filing of those documents.

Any statement contained in a

document incorporated, or deemed to be incorporated, by reference herein, shall be deemed to be modified or superseded for purposes of

this Registration Statement to the extent that a statement contained herein or incorporated herein by reference or in any other subsequently

filed document that is or is deemed to be incorporated by reference herein modifies or supersedes that statement. Any statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

See Exhibit 4(v), “Description of Securities,”

in “Item 8. Exhibits,” below.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers

The Registrant is incorporated

under the laws of the State of Delaware. Section 102(b)(7) of the Delaware General Corporation Law (the “DGCL”) permits a

corporation to provide in its certificate of incorporation that a director of a corporation shall not be personally liable to the corporation

or its stockholders for monetary damages for breach of fiduciary duties as a director, except for liability for any:

| |

· |

breach of a director’s duty of loyalty to the corporation or its stockholders; |

| |

|

|

| |

· |

act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| |

|

|

| |

· |

unlawful payment of dividends or redemption of shares (DGCL Section 174); or |

| |

|

|

| |

· |

transaction from which the director derives an improper personal benefit. |

Section 145 of the DGCL provides,

in general, that a Delaware corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened,

pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than a derivative action

by or in the right of the corporation), by reason of the fact that such person is or was a director, officer, employee or agent of the

corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another enterprise. The

indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually

and reasonably incurred by such person in connection

with such action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not

opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe

such person’s conduct was unlawful. In the case of a derivative action, a Delaware corporation may indemnify any such person against

expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement

of such action or suit if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the

best interests of the corporation, except that no indemnification will be made in respect of any claim, issue or matter as to which such

person will have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or any other court

in which such action was brought determines such person is fairly and reasonably entitled to indemnity for such expenses. To the extent

that a present or former director or officer of a Delaware corporation is successful on the merits or otherwise in defense of any action,

suit or proceeding referred to above, or in defense of any claim, issue or matter therein, Section 145 of the DGCL provides that such

person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection

with such action, suit or proceeding.

Section 174 of the DGCL provides,

among other things, that a director, who willfully or negligently approves of an unlawful payment of dividends or an unlawful stock purchase

or redemption, may be held liable for such actions. A director who was either absent when the unlawful actions were approved or dissented

at the time, may avoid liability by causing his or her dissent to such actions to be entered in the books containing minutes of the meetings

of the board of directors at the time such action occurred or immediately after such absent director receives notice of the unlawful acts.

Regarding indemnification for

liabilities arising under the Securities Act which may be permitted for directors or officers pursuant to the foregoing provisions, the

Registrant is informed that, in the opinion of the Commission, such indemnification is against public policy, as expressed in the Securities

Act and is therefore unenforceable.

The Registrant’s Amended

and Restated Certificate of Incorporation authorizes it to, and its Amended and Restated Bylaws provide that it shall, indemnify its directors

and officers to the fullest extent permitted by the DGCL and also pay expenses incurred in defending any such proceeding in advance of

its final disposition upon delivery of an undertaking, by or on behalf of an indemnified person, to repay all amounts so advanced if it

should be determined ultimately that such person is not entitled to be indemnified under the bylaws or the DGCL.

As permitted by the DGCL, the

Registrant has entered into indemnification agreements with each of its directors and certain of its officers. These agreements require

it to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their

service to the Registrant, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified.

The Registrant has an insurance

policy covering its officers and directors with respect to certain liabilities, including liabilities arising under the Securities Act,

or otherwise.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

Exhibit

Number |

|

Description of Exhibit |

|

Filing |

| 4(i) |

|

Amended and Restated Certificate of Incorporation |

|

Filed with the 8-KA-1 Current Report dated November 15, 2017, filed on December 20, 2017, and incorporated herein by reference. |

| 4(ii) |

|

Certificate of Amendment of Certificate of Incorporation |

|

Filed with the 8-K Current Report dated February 7, 2018, filed on February 12, 2018, and incorporated herein by reference (Name change only). |

| 4(iii) |

|

Amended and Restated Bylaws |

|

Filed with the 8-KA-1 Current Report dated November 15, 2017, filed on December 20, 2017, and incorporated herein by reference. |

| 4(iv) |

|

Amended and Restated Bylaws |

|

Filed herewith (Name change only). |

| 4(v) |

|

Description of Securities |

|

Filed with Form 10-K for the year ended December 31, 2022, filed on April 17, 2023, see Exhibit 4, and incorporated by reference |

| 4(vi) |

|

Revised Form of KonaTel, Inc. 2018 Incentive Stock Option Agreement for Employees |

|

Filed herewith |

| 4(vii) |

|

Revised Form of KonaTel, Inc. 2018 Incentive Stock Option Agreement for Director/Officer |

|

Filed herewith |

| 5 |

|

Opinion of Leonard W. Burningham, Esq., counsel for the Registrant |

|

Filed herewith |

| 23.1 |

|

Consent of Leonard W. Burningham, Esq. (contained in Exhibit 5 to this Registration Statement) |

|

Filed herewith |

| 23.2 |

|

Consent of Haynie & Company |

|

Filed herewith |

Item 9. Undertakings.

A. The undersigned Registrant

hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement; provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) of this

section do not apply if the registration statement is on Form S-8 and the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section

15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

B. The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of

1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the

securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the

event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid

by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of

such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Plano, State of Texas, on December 8, 2023.

KONATEL, INC.

Date: December 8, 2023 By: /s/D. Sean McEwen

D. Sean McEwen

Chairman and CEO

Pursuant to the requirements of the Securities Act

of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

Date: December 8, 2023 /s/ D. Sean McEwen

D. Sean McEwen

Chairman and CEO

Date: December 8,

2023

/s/ Brian R. Riffle

Brian R. Riffle

Chief Financial Officer

Date: December 8,

2023

/s/ Charles D. Griffin

Charles D. Griffin

President and COO

Date: December 8,

2023

/s/ B. Todd Murcer

B. Todd Murcer

EVP, Finance and Secretary

Date: December 8,

2023

/s/ Robert Beaty

Robert Beaty

Director

Date: December 8, 2023 /s/ Jeffrey Pearl

Jeffrey Pearl

Director

KONATEL, INC.

AMENDED AND RESTATED BYLAWS

ARTICLE I - STOCKHOLDERS

Section 1: Annual Meeting.

An annual meeting of the stockholders, for the election of directors to succeed those whose terms expire and for the transaction of such other business as may properly come before the meeting, shall be held at such place, on such date, and at such time as the Board of Directors shall each year fix, which date shall be within thirteen (13) months of the last annual meeting of stockholders or, if no such meeting has been held, the date of incorporation.

Section 2: Special Meetings.

Special meetings of the stockholders, for any purpose or purposes prescribed in the notice of the meeting, may be called by the Board of Directors or the chief executive officer and shall be held at such place, on such date, and at such time as they or he or she shall fix.

Section 3: Notice of Meetings.

Written notice of the place, date, and time of all meetings of the stockholders shall be given, not less than ten (10) nor more than sixty (60) days before the date on which the meeting is to be held, to each stockholder entitled to vote at such meeting, except as otherwise provided herein or required by law (meaning, here and hereinafter, as required from time to time by the Delaware General Corporation Law or the Certificate of Incorporation of the Corporation).

When a meeting is adjourned to another place, date or time, written notice need not be given of the adjourned meeting if the place, date and time thereof are announced at the meeting at which the adjournment is taken; provided, however, that if the date of any adjourned meeting is more than thirty (30) days after the date for which the meeting was originally noticed, or if a new record date is fixed for the adjourned meeting, written notice of the place, date, and time of the adjourned meeting shall be given in conformity herewith. At any adjourned meeting, any business may be transacted which might have been transacted at the original meeting.

Section 4: Quorum.

At any meeting of the stockholders, the holders of a majority of all of the shares of the stock entitled to vote at the meeting, present in person or by proxy, shall constitute a quorum for all purposes, unless or except to the extent that the presence of a larger number may be required by law. Where a separate vote by a class or classes is required, a majority of the shares of such class or classes present in person or represented by proxy shall constitute a quorum entitled to take action with respect to that vote on that matter.

1

If a quorum shall fail to attend any meeting, the chairman of the meeting or the holders of a majority of the shares of stock entitled to vote who are present, in person or by proxy, may adjourn the meeting to another place, date, or time.

Section 5: Organization.

Such person as the Board of Directors may have designated or, in the absence of such a person, the chief executive officer of the Corporation or, in his or her absence, such person as may be chosen by the holders of a majority of the shares entitled to vote who are present, in person or by proxy, shall call to order any meeting of the stockholders and act as chairman of the meeting. In the absence of the Secretary of the Corporation, the secretary of the meeting shall be such person as the chairman appoints.

Section 6: Conduct of Business.

The chairman of any meeting of stockholders shall determine the order of business and the procedure at the meeting, including such regulation of the manner of voting and the conduct of discussion as seem to him or her in

order. The date and time of the opening and closing of the polls for each matter upon which the stockholders will vote at the meeting shall be announced at the meeting.

Section 7: Proxies and Voting.

At any meeting of the stockholders, every stockholder entitled to vote may vote in person or by proxy authorized by an instrument in writing or by a transmission permitted by law filed in accordance with the procedure established for the meeting. Any copy, facsimile telecommunication or other reliable reproduction of the writing or transmission created pursuant to this paragraph may be substituted or used in lieu of the original writing or transmission for any and all purposes for which the original writing or transmission could be used, provided that such copy, facsimile telecommunication or other reproduction shall be a complete reproduction of the entire original writing or transmission.

All voting, including on the election of directors but excepting where otherwise required by law, may be by a voice vote; provided, however, that upon demand therefore by a stockholder entitled to vote or by his or her proxy, a stock vote shall be taken. Every stock vote shall be taken by ballots, each of which shall state the name of the stockholder or proxy voting and such other information as may be required under the procedure established for the meeting. The Corporation may, and to the extent required by law, shall, in advance of any meeting of stockholders, appoint one or more inspectors to act at the meeting and make a written report thereof. The Corporation may designate one or more persons as alternate inspectors to replace any inspector who fails to act. If no inspector or alternate is able to act at a meeting of stockholders, the person presiding at the meeting may, and to the extent required by law, shall, appoint one or more inspectors to act at the meeting. Each inspector, before entering upon the discharge of his duties, shall take and sign an oath faithfully to execute the duties of inspector with strict impartiality and according to the best of his ability. Every vote taken by ballots shall be counted by an inspector or inspectors appointed by the chairman of the meeting.

2

All elections shall be determined by a plurality of the votes cast, and except as otherwise required by law, all other matters shall be determined by a majority of the votes cast affirmatively or negatively.

Section 8: Stock List.

A complete list of stockholders entitled to vote at any meeting of stockholders, arranged in alphabetical order for each class of stock and showing the address of each such stockholder and the number of shares registered in his or her name, shall be open to the examination of any such stockholder, for any purpose germane to the meeting, during ordinary business hours for a period of at least ten (10) days prior to the meeting, either at a place within the city where the meeting is to be held, which place shall be specified in the notice of the meeting, or if not so specified, at the place where the meeting is to be held.

The stock list shall also be kept at the place of the meeting during the whole time thereof and shall be open to the examination of any such stockholder who is present. This list shall presumptively determine the identity of the stockholders entitled to vote at the meeting and the number of shares held by each of them.

Section 9: Consent of Stockholders in Lieu of Meeting.

Any action required to be taken at any annual or special meeting of stockholders of the Corporation, or any action which may be taken at any annual or special meeting of the stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the Corporation by delivery to its registered office in Delaware, its principal place of business, or an officer or agent of the Corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to the Corporation's registered office shall be made by hand or by certified or registered mail, return receipt requested.

Every written consent shall bear the date of signature of each stockholder who signs the consent and no written consent shall be effective to take the corporate action referred to therein unless, within sixty (60) days of the date the earliest dated consent is delivered to the Corporation, a written consent or consents signed by a sufficient number of holders to take action are delivered to the Corporation in the manner prescribed in the first paragraph of this Section.

ARTICLE II - BOARD OF DIRECTORS

Section 1: Number and Term of Office.

The number of directors who shall constitute the whole Board shall be such number as the Board of Directors shall from time to time have designated, except that in the absence of any such designation, such number shall be three (3). Each director shall be elected for a term

3

of one year and until his or her successor is elected and qualified, except as otherwise provided herein or required by law.

Whenever the authorized number of directors is increased between annual meetings of the stockholders, a majority of the directors then in office shall have the power to elect such new directors for the balance of a term and until their successors are elected and qualified. Any decrease in the authorized number of directors shall not become effective until the expiration of the term of the directors then in office unless, at the time of such decrease, there shall be vacancies on . the board which are being eliminated by the decrease.

Section 2: Vacancies.

If the office of any director becomes vacant by reason of death, resignation, disqualification, removal or other cause, a majority of the directors remaining in office, although less than a quorum, may elect a successor for the unexpired term and until his or her successor is elected and qualified.

Section 3: Regular Meetings.

Regular meetings of the Board of Directors shall be held at such place or places, on such date or dates, and at such time or times as shall have been established by the Board of Directors and publicized among all directors. A notice of each regular meeting shall not be required.

Section 4: Special Meetings.

Special meetings of the Board of Directors may be called by one-third (1/3) of the directors then in office (rounded up to the nearest whole number) or by the chief executive officer and shall be held at such place, on such date, and at such time as they or he or she shall fix. Notice of the place, date, and time of each such special meeting shall be given each director by whom it is not waived by mailing written notice not less than five (5) days before the meeting or by telegraphing or telexing or by facsimile transmission of the same not less than twenty-four (24) hours before the meeting. Unless otherwise indicated in the notice thereof, any and all business may be transacted at a special meeting.

Section 5: Quorum.

At any meeting of the Board of Directors, a majority of the total number of the whole Board shall constitute a quorum for all purposes. If a quorum shall fail to attend any meeting, a majority of those present may adjourn the meeting to another place, date, or time, without further notice or waiver thereof.

Section 6: Participation in Meetings By Conference Telephone.

Members of the Board of Directors, or of any committee thereof, may participate in a meeting of such Board or committee by means of conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other and such participation shall constitute presence in person at such meeting.

4

Section 7: Conduct of Business.

At any meeting of the Board of Directors, business shall be transacted in such order and manner as the Board may from time to time determine, and all matters shall be determined by the vote of a majority of the directors present, except as otherwise provided herein or required by law. Action may be taken by the Board of Directors without a meeting if all members thereof consent thereto in writing, and the writing or writings are filed with the minutes of proceedings of the Board of Directors.

Section 8: Powers.

The Board of Directors may, except as otherwise required by law, exercise all such powers and do all such acts and things as may be exercised or done by the Corporation, including, without limiting the generality of the foregoing, the unqualified power:

(1) To declare dividends from time to time in accordance with law;

(2) To purchase or otherwise acquire any property, rights or privileges on such terms as it shall determine;

(3) To authorize the creation, making and issuance, in such form as it may determine, of written obligations of every kind, negotiable or non-negotiable, secured or unsecured, and to do all things necessary in connection therewith;

(4) To remove any officer of the Corporation with or without cause, and from time to time to devolve the powers and duties of any officer upon any other person for the time being;

(5) To confer upon any officer of the Corporation the power to appoint, remove and suspend subordinate officers, employees and agents;

(6) To adopt from time to time such stock option, stock purchase, bonus or other compensation plans for directors, officers, employees and agents of the Corporation and its subsidiaries as it may determine;

(7) To adopt from time to time such insurance, retirement, and other benefit plans for directors, officers, employees and agents of the Corporation and its subsidiaries as it may determine; and

(8) To adopt from time to time regulations, not inconsistent with these By-laws, for the management of the Corporation's business and affairs.

Section 9: Compensation of Directors.

Directors, as such, may receive, pursuant to resolution of the Board of Directors, fixed fees and other compensation for their services as directors, including, without limitation, their services as members of committees of the Board of Directors.

5

ARTICLE III - COMMITTEES

Section 1: Committees of the Board of Directors.

The Board of Directors, by a vote of a majority of the whole Board, may from time to time designate committees of the Board, with such lawfully delegable powers and duties as it thereby confers, to serve at the pleasure of the Board and shall, for those committees and any others provided for herein, elect a director or directors to serve as the member or members, designating, if it desires, other directors as alternate members who may replace any absent or disqualified member at any meeting of the committee. Any committee so designated may exercise the power and authority of the Board of Directors to declare a dividend, to authorize the issuance of stock or to adopt a certificate of ownership and merger pursuant to Section 253 of the Delaware General Corporation Law if the resolution which designates the committee or a supplemental resolution of the Board of Directors shall so provide. In the absence or disqualification of any member of any committee and any alternate member in his or her place, the member or members of the committee present at the meeting and not disqualified from voting, whether or not he or she or they constitute a quorum, may by unanimous vote appoint another member of the Board of Directors to act at the meeting in the place of the absent or disqualified member.

Section 2: Conduct of Business.

Each committee may determine the procedural rules for meeting and conducting its business and shall act in accordance therewith, except as otherwise provided herein or required by law. Adequate provision shall be made for notice to members of all meetings; one-third (1/3) of the members shall constitute a quorum unless the committee shall consist of one (1) or two (2) members, in which event one (1) member shall constitute a quorum; and all matters shall be determined by a majority vote of the members present. Action may be taken by any committee without a meeting if all members thereof consent thereto in writing, and the writing or writings are filed with the minutes of the proceedings of such committee.

ARTICLE IV - OFFICERS

Section 1: Generally.

The officers of the Corporation shall consist of a President, one or more Vice Presidents, a Secretary, a Treasurer and such other officers as may from time to time be appointed by the Board of Directors. Officers shall be elected by the Board of Directors, which shall consider that subject at its first meeting after every annual meeting of stockholders. Each officer shall hold office until his or her successor is elected and qualified or until his or her earlier resignation or removal. Any number of offices may be held by the same person. The Board of Directors shall elect from among · its members a Chairman of the Board, who shall serve a minimum term of two (2) years; and if desired, and a Vice Chairman of the Board.

6

Section 2: Chairman of the Board and Vice Chairman of the Board.

Unless otherwise provided by the Board of Directors, the Chairman of the Board of Directors, if one is elected, shall preside, when present, at all meetings of the stockholders and the Board of Directors. The Chairman of the Board shall have such other powers and shall perform such duties as the Board of Directors may from time to time designate.

Unless otherwise provided by the Board of Directors, in the absence of the Chairman of the Board, the Vice Chairman of the Board, if one is elected, shall preside, when present, at all meetings of the stockholders and the Board of Directors. The Vice Chairman of the Board shall have such other powers and shall perform such duties as the Board of Directors may from time to time designate.

Section 3: President.

The President shall be the chief executive officer of the Corporation. Subject to the provisions of these By-laws and to the direction of the Board of Directors, he or she shall have the responsibility for the general management and control of the business and affairs of the Corporation and shall perform all duties and have all powers which are commonly incident to the office of chief executive or which are delegated to him or her by the Board of Directors. He or she shall have power to sign all stock certificates, contracts and other instruments of the Corporation which are authorized and shall have general supervision and direction of all of the other officers, employees and agents of the Corporation.

Section 4: Vice President.

Each Vice President shall have such powers and duties as may be delegated to him or her by the Board of Directors. One (1) Vice President shall be designated by the Board to perform the duties and exercise the powers of the President in the event of the President's absence or disability.

Section 5: Treasurer.

The Treasurer shall have the responsibility for maintaining the financial records of the Corporation. He or she shall make such disbursements of the funds of the Corporation as are authorized and shall render from time to time an account of all such transactions and of the financial condition of the Corporation. The Treasurer shall also perform such other duties as the Board of Directors may from time to time prescribe.

Section 6: Secretary.

The Secretary shall issue all authorized notices for, and shall keep minutes of, all meetings of the stockholders and the Board of Directors. He or she shall have charge of the corporate books and shall perform such other duties as the Board of Directors may from time to time prescribe.

7

Section 7: Delegation of Authority.

The Board of Directors may from time to time delegate the powers or duties of any officer to any other officers or agents, notwithstanding any provision hereof.

Section 8: Removal.

Any officer of the Corporation may be removed at any time, with or without cause, by the Board of Directors.

Section 9: Action with Respect to Securities of Other Corporations.

Unless otherwise directed by the Board of Directors, the President or any officer of the Corporation authorized by the President shall have power to vote and otherwise act on behalf of the Corporation, in person or by proxy, at any meeting of stockholders of or with respect to any action of stockholders of any other corporation in which this Corporation may hold securities and otherwise to exercise any and all rights and powers which this Corporation may possess by reason of its ownership. of securities in such other corporation.

ARTICLE V - STOCK

Section 1: Certificates of Stock.

Each stockholder shall be entitled to a certificate signed by, or in the name of the Corporation by, _the President or a Vice President, and by the Secretary or an Assistant Secretary, or the Treasurer or an Assistant Treasurer, certifying the number of shares owned by him or her. Any or all of the signatures on the certificate may be by facsimile.

Section 2: Transfers of Stock.

Transfers of stock shall be made only upon the transfer books of the Corporation kept at an office of the Corporation or by transfer agents designated to transfer shares of the stock of the Corporation. Except where a certificate is issued in accordance with Section 4 of Article V of these By-laws, an outstanding certificate for the number of shares involved shall be surrendered for cancellation before a new certificate is issued therefor.

Section 3: Record Date.

In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders, or to receive payment of any dividend or other distribution or allotment of any: rights or to exercise any rights in respect of any change, conversion or exchange of stock or for the purpose of any other lawful action, the Board of Directors may fix a record date, which record date shall not precede the date on which the resolution fixing the record date is adopted and which record date shall not be more than sixty (60) nor less than ten (10) days before the date of any meeting of stockholders, nor more than sixty (60) days prior to the time for such other action as hereinbefore described; provided, however, that if no record date is fixed by the

8

Board of Directors, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held, and, for determining stockholders entitled to receive payment of any dividend or other distribution or allotment of rights or to exercise any rights of change, conversion or exchange of stock or for any other purpose, the record date shall be at the close of business on the day on which the Board of Directors adopts a resolution relating thereto.

A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting; provided, however, that the Board of Directors may fix a new record date for the adjourned meeting.

In order that the Corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the Board of Directors may fix a record date, which shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors, and which record date shall be not more than ten (10) days after the date upon which the resolution fixing the record date is adopted. If no record date has been fixed by the Board of Directors and no prior action by the Board of Directors is required by the Delaware General Corporation Law, the record date shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the Corporation in the manner prescribed by Article I, Section 9 hereof. If no record date has been fixed by the Board of Directors and prior action by the Board of Directors is required by the Delaware General Corporation Law with respect to the proposed action by written consent of the stockholders, the record date for determining stockholders entitled to consent to corporate action in writing shall be at the close of business on the day on which the Board of Directors adopts the resolution taking such prior action.

Section 4: Lost, Stolen or Destroyed Certificates.

In the event of the loss, theft or destruction of any certificate of stock, another may be issued in its place pursuant to such regulations as the Board of Directors may establish concerning proof of such loss, theft or destruction and concerning the giving of a satisfactory bond or bonds of indemnity.

Section 5: Regulations.

The issue, transfer, conversion and registration of certificates of stock shall be governed by such other regulations as the Board of Directors may establish.

ARTICLE VI - NOTICES

Section 1: Notices.

Except as otherwise specifically provided herein or required by law, all notices required to be given to any stockholder, director, officer, employee or agent shall be in writing and may in every instance be effectively given by hand delivery to the recipient thereof, by depositing such notice in the mails, postage paid, or by sending such notice by prepaid telegram or mailgram. Any such notice shall be addressed to

9

such stockholder, director, officer, employee or agent at his or her last known address as the same appears on the books of the Corporation. The time when such notice is received, if hand delivered, or dispatched, if delivered through the mails or by telegram or mailgram, shall be the time of the giving of the notice.

Section 2: Waivers.

A written waiver of any notice, signed by a stockholder, director, officer, employee or agent, whether before or after the time of the event for which notice is to be given, shall be deemed equivalent to the notice required to be given to such stockholder, director, officer, employee or agent. Neither the business nor the purpose of any meeting need be specified in such a waiver.

ARTICLE VII - MISCELLANEOUS

Section 1: Facsimile Signatures.

In addition to the provisions for use of facsimile signatures elsewhere specifically authorized in these By-laws, facsimile signatures of any officer or officers of the Corporation may be used whenever and as authorized by the Board of Directors or a committee thereof.

Section 2: Corporate Seal.

The Board of Directors may provide a suitable seal, containing the name of the Corporation, which seal shall be in the charge of the Secretary. If and when so directed by the Board of Directors or a committee thereof, duplicates of the seal may be kept and used by the Treasurer or by an Assistant Secretary or Assistant Treasurer.

Section 3: Reliance upon Books, Reports and Records.

Each director, each member of any committee designated by the Board of Directors, and each officer of the Corporation shall, in the performance of his or her duties, be fully protected in relying in good faith upon the books of account or other records of the Corporation and upon such information, opinions, reports or statements presented to the Corporation by any of its officers or employees, or committees of the Board of Directors so designated, or by any other person as to matters which such director or committee member reasonably believes are within such other person's professional or expert competence and who has been selected with reasonable care by or on behalf of the .Corporation.

Section 4: Fiscal Year.

The fiscal year of the Corporation shall be as fixed by the Board of Directors.

Section 5: Time Periods.

In applying any provision of these By-laws which requires that an act be done or not be done a specified number of days prior to an event or that an act be done during a period of a specified number of days prior to an event, calendar days· shall be used, the day of the doing of the act shall be excluded, and the day of the event shall be included.

10

ARTICLE VIII - INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 1: Right to Indemnification.

Each person who was or is made a party or is threatened to be made a party to or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter a "proceeding"), by reason of the fact that he or she is or was a director or an officer of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan (hereinafter an "indemnitee"), whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the Delaware General Corporation Law, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than such law permitted the Corporation to provide prior. to such amendment), against all expense, liability and loss (including attorneys' fees, judgments, fines, ERISA excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such indemnitee in connection therewith; provided, however, that, except as provided in Section 3 of this ARTICLE VIII with respect to proceedings to enforce rights to indemnification, the Corporation shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board of Directors of the Corporation.

Section 2: Right to Advancement of Expenses.

The right to indemnification conferred in Section 1 of this ARTICLE VIII shall include the right to be paid by the Corporation the expenses (including attorney's fees) incurred in defending any such proceeding in advance of its final disposition (hereinafter an "advancement of expenses"); provided, however, that, if the Delaware General Corporation Law requires, an advancement of expenses incurred by an indemnitee in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such indemnitee, including, without limitation, service to an employee benefit plan) shall be made only upon delivery to the Corporation of an undertaking (hereinafter an "undertaking"), by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal (hereinafter a "final adjudication") that such indemnitee is not entitled to be indemnified for such expenses under this Section 2 or otherwise. The rights to indemnification and to the advancement of expenses conferred in Sections 1 and 2 of this ARTICLE VIII shall be contract rights and such rights shall continue as to an indemnitee who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the indemnitee's heirs, executors and administrators.

11

Section 3: Right of Indemnitee to Bring Suit.

If a claim under Section 1 or 2 of this ARTICLE VIII is not paid in full by the Corporation within sixty (60) days after a written claim has been received by the Corporation, except in the case of a claim for an advancement of expenses, in which case the applicable period shall be twenty (20) days, the indemnitee may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim. If successful in whole or in part in any such suit, or in a suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the indemnitee shall be entitled to be paid also the expense of prosecuting or defending such suit. In (i) any suit brought by the indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the indemnitee to enforce a right to an advancement of expenses) it shall be a defense that, and (ii) in any suit brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the Corporation shall be entitled to recover such expenses upon a final adjudication that, the indemnitee has not met any applicable standard for indemnification set forth in the Delaware General Corporation Law. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) to have made a determination prior to the commencement of such suit that indemnification of the indemnitee is proper in the circumstances because the indemnitee has met the applicable standard of conduct set forth in the Delaware General Corporation Law, nor an actual determination by the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) that the indemnitee has not met such applicable standard of conduct, shall create a presumption that the indemnitee has not met the applicable standard of conduct or, in the case of such a suit brought by the indemnitee, be a defense to such suit. In any suit brought by the indemnitee to enforce a right to indemnification or to an advancement of expenses hereunder, or brought by the Corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that the indemnitee is not entitled to be indemnified, or to such advancement of expenses, under this ARTICLE VIII or otherwise shall be on the Corporation.

Section 4: Non-Exclusivity of Rights.

The rights to indemnification and to the advancement of expenses conferred in this ARTICLE VIII shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, the Corporation's Certificate of Incorporation, By-laws, agreement, vote of stockholders or disinterested directors or otherwise.

Section 5: Insurance.

The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the Delaware General Corporation Law.

12

Section 6: Indemnification of Employees and Agents of the Corporation.

The Corporation may, to the extent authorized from time to time by the Board of Directors, grant rights to indemnification and to the advancement of expenses to any employee or agent of the Corporation to the fullest extent of the provisions of this Article with respect to the indemnification and advancement of expenses of directors and officers of the Corporation.

ARTICLE IX- LIMITATION OF BOARD OF DIRECTOR AUTHORITY

Shareholder Consent Requirement.

For a period of two (2) years beginning on the date of the Closing (as defined therein) of the Agreement and Plan of Merger (respectively, the "Merger Agreement" and the "Merger") dated November 15, 2017, the following actions require the vote or consent of a majority of the outstanding voting securities of the Corporation, unless unanimously approved by the Board of Directors:

Increase the compensation of any employee of the Corporation in excess of $20,000 in any one calendar year. For these purposes, the term compensation includes any form of remuneration or monetary benefit.

Issue stock, create a new class of stock, grant options or warrants, modify any shareholder, option holder or warrant holder right, grant conversion rights, or take any other action that directly or indirectly dilutes the outstanding stock of the Corporation; excepting the issuance of stock pursuant to the Merger Agreement, and including, without limitation, stock underlying incentive stock options issued under Section 6.4(e) thereof and stock contemplated to be sold pursuant to Section 6.4(g) thereof, which issuances shall all be deemed to have been consented to by the Key Holders and McEwen as of the Closing of the Merger;

Issue debt in excess of $100,000 in aggregate in any one calendar year; Approve a plan of merger, reorganization, or conversion;

Sell, transfer or otherwise convey the assets of the Corporation other than in ordinary course of the business of the Corporation;

Enter into a contract or other transaction having a total aggregate contractual liability in excess of $100,000 in any one calendar year; and

Modify this Article IX.

ARTICLE X - AMENDMENTS

Except as otherwise provided herein, these By-laws may be amended or repealed by the majority of the Board of Directors at any Director meeting, except that any amendment to Article IX shall require unanimous approval by the Board of Directors, or by the vote of a majority of the outstanding voting securities of the Corporation at any shareholder meeting or by written consent of a majority of the shareholders pursuant to Article 1,Section 9 hereof. This Amendment was effective January 16, 2018.

Dated: June 28, 2022 /s/ Todd Murcer

Todd Murcer, Secretary

13

KONATEL, INC.

FORM OF EMPLOYEE INCENTIVE STOCK OPTION

AGREEMENT

| Name of Optionee:NAME |

|

| No. of Common Shares Covered: AMT |

Date of Grant:DATE |

| Exercise Price Per Common Share: $PRICE (FMV on Grant Date) |

Expiration Date: DATE |

| Exercise Schedule: |

|

| |

|

|

Date(s) of

Exercisability and Vesting |

No. of Common Shares as to which the

Option becomes Exercisable |

| DATE |

AMT |

| |

|

| |

|

| |

|

|

This is an Employee Incentive

Stock Option Agreement (the “Agreement”) between KonaTel, Inc. (the “Company”), and the optionee identified above

(the “Optionee”), effective as of the Date of Grant specified above.

Recitals:

WHEREAS, the Board of Directors

of the Company (the “Board”) and any Committee of the Board authorized by the Board with the responsibility of determining

the grants of Options on the Shares (the “Committee”) hereby grants the Option to the Optionee to purchase the number of shares

of $0.001 par value common stock of the Company (the “Shares”) specified at the beginning of this Agreement under the following

terms and conditions:

| 1. | Grant. The Optionee is granted the Option

to purchase the number of Shares specified at the beginning of this Agreement. |

| 2. | Exercise Price. The price to the Optionee

of each Share subject to the Option will be the Exercise Price specified at the beginning of this Agreement, which price may not be less

than the Fair Market Value as of the Date of Grant or, if the Optionee owns or is deemed to own stock possessing more than 10% of the

combined voting power of all classes of stock of the Company, 110% of the Fair Market Value as of the Date of Grant. |

| 3. | Incentive Stock Option. The Option is

intended to be an “incentive stock option” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended

(the “Code”), provided that to the extent the Option or part thereof fails to qualify as an incentive stock option, it will

be treated as a non-statutory stock option. |

| 4. | Exercise Schedule. The Option will vest

and become exercisable as to the number of Shares and on the dates specified in the Exercise Schedule at the beginning of this Agreement.

The Exercise Schedule will be cumulative; thus, to the extent the Option has not already been exercised and has not expired, terminated

or been cancelled, the Optionee or the person otherwise entitled to exercise the Option as provided herein may at any time, and from time

to time, purchase all or any portion of the Shares then purchasable under the exercise schedule. |

The Option may also be exercised in full

(notwithstanding the Exercise Schedule) under the circumstances described in Section 8 of this Agreement if it has not expired prior thereto.

| a. | Timing. The Option will immediately expire

on the earliest of: |

| i. | The time of 5:00 PM Eastern Time on the Expiration

Date specified at the beginning of this Agreement; |

| ii. | The expiration of the period after the termination

or resignation of the employment of the Optionee within which the Option can be exercised (as specified in Section 7 of this Agreement);

or |

| iii. | Regardless of whether any Shares are

vested or otherwise, upon the resignation or termination of the Optionee’s employment for cause, or if it is determined by the

Company within ten (10) days after termination of the Optionee’s employment that cause existed for termination by the Company,

the date of such determination. |

| b. | Expiration Final. In no event may anyone

exercise the Option, in whole or in part, after it has expired, notwithstanding any other provision of this Agreement. |

| c. | Rescission. If the Option is exercised,

and prior to the delivery of the certificate representing the Shares so purchased, it is determined that cause for termination existed,

then the Company, in its sole discretion, may rescind the Option exercise by the Optionee and terminate the Option. |

| 6. | Procedure to Exercise Option. |

| a. | Notice of Exercise. The Option may be

exercised by delivering written notice of exercise to the Company at the principal executive office of the Company, to the attention of

the Company’s Secretary, in the NOTICE OF STOCK OPTION EXERCISE form attached to this Agreement. The notice shall state the number

of Shares to be purchased and shall be signed by the person exercising the Option. If the person exercising the Option is not the Optionee,

he/she also must submit appropriate proof of their right to exercise the Option. |

| b. | Tender of Payment. Upon giving notice

of any exercise hereunder, the Optionee shall provide for payment to the Company of the Exercise Price of the Shares being purchased through

one or a combination of the following methods: |

| i. | Cash (including check, bank draft or money order);

or |

| ii. | By delivery to the Company of unencumbered Shares

having an aggregate Fair Market Value on the date of exercise equal to the Exercise Price of such Shares. |

| c. | Limitation on Payment by Shares. Notwithstanding

Section 6(b) hereof, the Option may not be exercised through payment of any portion of the Exercise Price with Shares if, in the opinion

of the Board, payment in such manner could have adverse financial accounting consequences for the Company that were not applicable at

the time of the Date of Grant. |

| d. | Delivery of Certificates. As soon as

practicable after the Company receives the notice and payment of the Exercise Price provided for above, it shall deliver to the person

exercising the Option, in the name of such person, a certificate or certificates representing the Shares being purchased. The Company

shall pay any original issue or transfer taxes with respect to the issue or transfer of the Shares and all fees and expenses incurred

by it in connection therewith. All Shares so issued shall be fully-paid and nonassessable. Notwithstanding anything to the contrary in

this Agreement, no certificate for Shares distributable under this Agreement shall be issued and delivered unless the issuance of such

certificate complies with all applicable legal requirements including, without limitation, compliance with the provisions of applicable

state securities laws, the Securities Act of 1933, as amended (the “Securities Act”), the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and the General Rules and Regulations of the United States Securities and Exchange Commission

(the “SEC”) promulgated under the Securities Act and the Exchange Act, including published interpretations thereof by the

SEC. |

| 7. | Employment Requirement. The Option may

be exercised only while the Optionee remains an employee of the Company or a parent or subsidiary thereof, and only if the Optionee has

been continuously so employed since the date the Option was granted; provided that: |

| a. | Post-Employment. The Option may be exercised

for ninety (90) days after resignation or termination of the Optionee’s employment, if such cessation is for a reason other than

death or disability, but only to the extent that it was exercisable immediately prior to such resignation or termination; provided, however,

that if resignation or termination of the Optionee’s employment shall have been for cause, the Option shall immediately expire,

and all rights to purchase Shares, vested or otherwise, hereunder, shall immediately expire upon such termination. |

| b. | Death or Disability. The Option may be

exercised to the extent that the Option was vested and exercisable as of the date of the death or disability of the Optionee, for ninety

(90) days after resignation or termination of the Optionee’s employment, if such resignation or termination of the Optionee’s

employment is because of death or disability of the Optionee. |

| 8. | Acceleration of Vesting. |

| a. | Change in Control. If a change in control

(as defined below) of the Company or buyout of the operations of the Company shall or is to occur, then the Option, if not already exercised

in full or otherwise terminated, expired or cancelled, shall become immediately vested and exercisable in full and shall remain exercisable

for a period of thirty (30) days following the completion of the change in control. |

| b. | Discretionary Acceleration. Notwithstanding

any other provisions of this Agreement to the contrary, the Board or any Committee may, in its sole discretion, declare at any time that

the Option shall be immediately exercisable. |

| 9. | Limitation on Transfer. During the lifetime

of the Optionee, only the Optionee or their guardian or legal representative may exercise the Option. The Option may not be assigned or

transferred by the Optionee otherwise than by will or the laws of descent and distribution or pursuant to a qualified domestic relations

order as defined by the Code or Title I of the Employee Retirement Income Security Act, or the rules thereunder. |

| 10. | No Shareholder Rights Before Exercise.

No person shall have any of the rights of a shareholder of the Company with respect to any Share subject to the Option until the Share

actually is issued to him/her upon exercise of the Option. |

| 11. | Discretionary Adjustment. In the event

of any reorganization, merger, consolidation, recapitalization, liquidation, reclassification, stock dividend, stock split, combination

of shares, rights offering, or extraordinary dividend or divestiture (including a spin off), or any other change in the corporate structure

or Shares of the Company, the Board or the Committee (or if the Company does not survive any such transaction, a comparable committee

of the Board of Directors of the surviving corporation) may, without the consent of the Optionee, make such adjustment as it determines

in its discretion to be appropriate as to the number and kind of securities granted herein and, in order to prevent dilution or enlargement

of rights of the Optionee, the number and kind of securities issuable upon exercise of the Option and the exercise price hereof. |

| 12. | Tax Effect of Transfer of Shares. The

Optionee hereby acknowledges that if any Shares received pursuant to the exercise of any portion of the Option are sold within two (2)

years from the Date of Grant or within one (1) year from the effective date of exercise of the Option, or if certain other requirements

of the Code are not satisfied, such Shares will be deemed under the Code not to have been acquired by the Optionee pursuant to an “incentive

stock option” as defined in the Code; and that the Company shall not be liable to the Optionee in the event the Option for any reason

is deemed not to be an “incentive stock option” within the meaning of the Code. Furthermore, the Optionee will promptly notify

the Company, in writing, of any sale of Shares received through the exercise of any portion of the Option within two (2) years from the

Date of Grant or within one (1) year from the effective date of exercise of the Option. |

| 13. | Interpretation of This Agreement. All

decisions and interpretations made by the Board or the Committee, if there is a Committee, with regard to any question arising hereunder

shall be binding and conclusive upon the Company and the Optionee. |

| 14. | Discontinuance of Employment. This Agreement

shall not give the Optionee a right to continued employment with the Company or any parent or subsidiary of the Company, and the Company

or any such parent or subsidiary employing the Optionee may terminate their employment at any time and otherwise deal with the Optionee

without regard to the effect it may have upon them under this Agreement. |

| 15. | Option Subject to Articles of Incorporation

and Bylaws. The Optionee acknowledges that the Option and the exercise thereof is subject to the Articles of Incorporation, as amended

from time to time, and the Bylaws, as amended from time to time, of the Company, and any applicable federal or state laws, rules or regulations. |

| 16. | Obligation to Reserve Sufficient Shares.

The Company shall at all times during the term of the Option reserve and keep available a sufficient number of Shares to satisfy this

Agreement. |

| 17. | Binding Effect. This Agreement shall

be binding in all respects on the heirs, representatives, successors and assigns of the Optionee. |

| 18. | Choice of Law. This Agreement is entered

into under the laws of the State of Delaware and shall be construed and interpreted thereunder without regard to its conflict of law principles

for all matters, including fundamental or procedural laws. |

| 19. | Change in Control. For

all purposes of this Agreement, “Change in Control” shall mean: (i) the completion of one or more transactions by which any

person or entity (and his, her or its affiliates) becomes the beneficial owner of 50.1% or more of the voting power of the Company’s

securities; or (ii) any merger, consolidation or liquidation of the Company in which the Company is not the continuing or surviving company

or pursuant to which stock would be converted into cash, securities or other property, other than a merger of the Company in which the

holders of the shares of stock immediately before the merger have the same proportionate ownership of the Common Stock of the surviving

company immediately after the merger; or (iii) substantially all of the assets of the Company are sold or otherwise to parties that are

not within a “controlled group of corporations” (as defined in Section 1563 of the Internal Revenue Code of 1986, as amended)

in which the Company is a member at the time of such sale or transfer. |

The Optionee and the Company have executed

this Agreement effective as of DATE.

OPTIONEE:

_______________________________________

NAME

KONATEL, INC.:

By ____________________________________

D. Sean McEwen

Chairman and Chief Executive

Officer

NOTICE OF STOCK

OPTION EXERCISE

KonaTel, Inc.

500 N. Central Expressway,

Suite 202

Plano, TX 75074

Attention: Board of Directors

Dear Ladies and Gentlemen:

I

am the holder of ________________ Stock Options, granted to me under the KonaTel, Inc. (the “Company”) 2018 Incentive

Stock Option Plan, granted on ________________________ (Date of Grant) for the purchase of ________________ shares of $0.001 par

value Common Stock of the Company (“Shares”) at a purchase price of $________ per share, which was the Fair Market Value

of the Company’s common stock on the Date of Grant per Share.

I hereby

exercise my option to purchase ________________ Shares, for which I have enclosed: please enter one of three (3) choices (“cash,”

“personal check” or “Stock Certificate No.(s)”_____________ in the total aggregate amount of __________________.

Please register my stock certificate as follows:

Name(s):___________________________________

Street Address:______________________________

City, State &

Zip Code:________________________

Social Security

No.:__________________________

In connection with your

acceptance of this Notice of Stock Option Exercise, I hereby represent, warrant and covenant as follows:

I am purchasing the Shares

for my own account for investment only, and not with a view to, or for sale in connection with, any distribution of the Shares in violation

of the Securities Act of 1933 (the “Securities Act”), or any rule or regulation under the Securities Act.

I have had such opportunity

as I have deemed adequate to obtain from representatives of the Company such information as is necessary to permit me to evaluate the

merits and risks of my investment in the Company.

I have sufficient experience

in business, financial and investment matters to be able to evaluate the risks involved in the purchase of the Shares and to make an informed

investment decision with respect to such purchase.

I can afford a complete

loss of the value of the Shares and am able to bear the economic risk of holding such Shares for an indefinite period.

I understand that: (i) the

Shares underlying the Option(s) exercised hereby have been registered under the Securities Act (or additional reserved Shares under the

Company’s 2018 Incentive Stock Option Plan will be registered as soon as is reasonably practical [the “Plan Shares”]);

(ii) the Plan Shares must be sold in full compliance with the provisions of the Securities Act and the Exchange Act and the General

Rules and Regulations of the SEC promulgated thereunder, including, but not limited to the Company’s “Insider Trading Policy”

and the Company’s “Section 16 Exchange Act Memorandum,” of which I hereby acknowledge I have received and reviewed respective

copies thereof; and (iii) “control” Plan Shares (those held directors, officers and other “affiliates” of

the Company, including 10% shareholders) must be resold in accordance with the provisions of SEC Rule 144, except the “holding period”

requirements of subparagraph (d) thereof are not applicable for any such registered Plan Shares.

Very truly yours,

___________________________________________

Signature

KONATEL, INC.

FORM OF DIRECTOR/OFFICER INCENTIVE STOCK OPTION

AGREEMENT

| Name of Optionee:NAME |

|

| No. of Common Shares Covered: AMT |

Date of Grant:DATE |

| Exercise Price Per Common Share: $PRICE (110% FMV on Grant Date) |

Expiration Date: DATE |

| Exercise Schedule: |

|

| |

|

|

Date(s) of

Exercisability and Vesting |

No. of Common Shares as to which the

Option becomes Exercisable |

| DATE |

AMT |

| |

|

| |

|

| |

|

|

This is a Director/Officer Incentive

Stock Option Agreement (the “Agreement”) between KonaTel, Inc. (the “Company”), and the optionee identified above

(the “Optionee”), effective as of the Date of Grant specified above.

Recitals:

WHEREAS, the Board of Directors

of the Company (the “Board”) and any Committee of the Board authorized by the Board with the responsibility of determining