CannabisNewsWire

Editorial Coverage: The 2018 U.S. Farm Bill

changes the way that CBD-based products are legally classified.

If the federal government permits the sale of cannabis-sourced

products online, established companies in the space could reap huge

rewards.

- The legalization of cannabis in Canada and some U.S. States has

demonstrated the latent demand for cannabis-based products.

- CBD is used to make numerous products and its potential uses

are growing.

- Research suggests that the market for CBD products could grow

to an estimated $22 billion over

the next four years.

There are likely big changes coming to the cannabis sector this

year. The 2018 U.S. Farm Bill took a major step towards the

normalization of cannabis-based products. Now that the bill has

passed into law, industrial hemp — and its byproduct CBD — will be

regulated by the U.S. Department of Agriculture.

SinglePoint Inc. (OTCQB: SING) (SING

Profile) is in a good position to take full advantage

of the changes in how CBD products are regulated. Major producers

such as Cronos Group Inc. (NASDAQ: CRON) (TSX:

CRON), Aphria Inc. (NYSE: APHA) (TSX:

APHA), Medical Marijuana Inc. (OTC: MJNA)

and OrganiGram Holdings Inc. (OTCQX: OGRMF) (TSX.V:

OGI) are also well-placed to expand into the CBD space,

but they may have to compete with a new class of growers.

There are more than 80 kinds of psychoactive compounds found in

the cannabis plant. While most people are familiar with THC, which

is used recreationally, CBD has shown promise in

treating everything from insomnia to serious neurological

disorders. The 2018 Farm Bill leaves THC-based products under the

jurisdiction of the Drug Enforcement Agency (DEA) but gives

jurisdiction of CBD-based products to the individual states. Most

industry experts predict that the popularity of these products will

explode as they become easily available due to the new

regulations.

To view an infographic of this editorial, click here.

A Waiting Market

Until now, CBD-based products were subject to federal

regulations, which made them impossible to distribute nationally.

They have been sold on a statewide basis in areas that allowed

their use, but anyone who dealt with these products was shut out of

the federal banking system because the crop — and its subsequent

products — were categorized as illegal at a federal level.

With the signing of the new legislation, that appears likely to

change. SinglePoint

(OTCQB: SING) is an established distributor of CBD

products and owns a decade-old web domain. Not only does the

company have experience with marketing and distributing CBD-based

products, it also has a background in payments processing.

CBD-based products are a new, largely unfamiliar area that may

pose challenges for new companies entering the space. Universal

standards for many CBD products have yet to be established or

identified, so having a positive market image will likely be a

significant benefit. Established companies with an existing client

base and a positive reputation may be in a better position to

leverage growth in the CBD sector. SinglePoint seems to fit this

criteria well.

Wide-Open Potential

There is a big difference between cannabis grown for medicinal

use and hemp that can now be used as a feedstock for CBD in the

United States. Major cannabis producers have a much higher cost of

production than hemp growers. With new changes that the 2018 Farm

Bill creates for hemp farmers, the price of CBD may fall substantially.

Instead of being cultivated in near-laboratory conditions,

industrial hemp is grown like any other commercial crop. Now that

CBD can be refined out of commercially produced hemp, it will be

difficult for anyone but U.S. hemp farmers to compete on price when

it comes to CBD.

Additionally, the 2018 Farm Bill normalizes the CBD economy at a

federal level. For the first time, hemp growers can use the banking

system, insure their crops, and even sell their future hemp

production via futures. Like any new market, it will take time for

the infrastructure to be developed, but early movers in the space

may have a significant advantage.

Big Changes for CBD

SinglePoint is in a unique position in the emerging CBD space.

As both an online marketer and payments processor, the company

looks to be in a strong position to help deliver CBD products to

their target markets. The company has a strong strategy to grow its presence in the CBD space.

Unlike many of the other publicly traded, cannabis-focused

companies, SinglePoint has no connection with cannabis plants and

cultivation, so the company should be able to take full advantage

of the recently passed 2018 Farm Bill.

It appears that there is no shortage of potential CBD-based

products. Currently, CBD is integrated into everything from lotions

and edibles to beer and oil. With the legalization of CBD widely

anticipated, research will almost certainly lead to additional

discoveries into CBD properties and benefits, as well as the

creation of new products targeting specific market segments.

The emerging CBD economy is also supported by the ability for

hemp producers to raise funds publicly. Much like the Canadian

cannabis producers that were able to expand quickly because of

their publicly traded equities, U.S. hemp producers can now go

public and leverage public interest in CBD to expand their

operations.

Changing Production Profiles

The 2018 Farm Bill is a huge positive for U.S.-based hemp

producers and CBD consumers.

One of the largest publicly traded cannabis producers available

to U.S. investors, Cronos Group (NASDAQ: CRON) (TSX:

CRON) owns two fully licensed cannabis producers in Canada

and has other interests spread around the world. The company has

maintained a multibillion-dollar valuation, despite some weakness

in the publicly traded cannabis sector. In addition to producing

cannabis in Canada, the company is involved in the distribution of

cannabis products in many of the markets in which it operates. In

the third quarter last year, the company reported increased

revenues by 186 percent and sold 213 percent more kilos of cannabis

than in the same time a year earlier.

Aphria (NYSE: APHA) (TSX: APHA) has grown its

presence in the Canadian cannabis space via acquisitions and

strategic investments and is one of the largest publicly traded

cannabis producers. The company made two high-profile acquisitions

last year, taking over Broken Coast Cannabis and buying Nuuvera, a

Canadian cannabis company with already-existing strategic exposure

to German and Italian markets. The vast majority of the company’s

production capacity for cannabis is concentrated in a single

facility, called Aphria One, which is located in Leamington,

Ontario.

Medical Marijuana (OTC: MJNA) has been

operating in the legal cannabis space for longer than most. The

company owns numerous subsidiaries, including HempMeds, Kannalife

and Kannaway. It also operates an international division, which has

developed a substantial presence in Brazil, where it was the first

company to introduce legal cannabis-based medicines to the

Brazilian market. The company also has a direct marketing structure

for cannabis products and appears to be well-placed to grow in the

emerging CBD market.

OrganiGram Holdings (OTCQX: OGRMF) (TSX.V: OGI)

is the parent company of Organigram Inc., one of the largest

licensed producers of cannabis in Canada. The company delivers

industry-leading yields from its growing facilities and is focused

on expanding in the Canadian market for recreational and medicinal

cannabis. Organigram developed a portfolio of brands for a variety

of uses, including The Edison Cannabis Company, Ankr Organics,

Trailer Blazer and Trailer Park Buds. In addition to growing

cannabis, OrganiGram also distributes it.

With the passage of the 2018 Farm Bill changing the legal status

of CBD, it is estimated that the CBD market will grow to be a $22

billion industry by 2022. SinglePoint has created a solid platform

to be a part of that industry.

For more information on SinglePoint, visit SinglePoint Inc.

(OTCQB: SING)

About CannabisNewsWire

CannabisNewsWire (CNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

CannabisNewsBreaks that summarize

corporate news and information, (3) enhanced press release

services, (4) social media distribution and optimization services,

and (5) a full array of corporate communication solutions. As a

multifaceted financial news and content distribution company with

an extensive team of contributing journalists and writers, CNW is

uniquely positioned to best serve private and public companies that

desire to reach a wide audience of investors, consumers,

journalists and the general public. CNW has an ever-growing

distribution network of more than 5,000 key syndication outlets

across the country. By cutting through the overload of information

in today’s market, CNW brings its clients unparalleled visibility,

recognition and brand awareness. CNW is where news, content and

information converge.

Receive Text Alerts

from CannabisNewsWire: Text "Cannabis" to

21000

For more information please visit https://www.CannabisNewsWire.com and

or https://CannabisNewsWire.News

Please see full terms of use and disclaimers on the

CannabisNewsWire website applicable to all content provided by CNW,

wherever published or re-published: http://CNW.fm/Disclaimer

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

DISCLAIMER: CannabisNewsWire (CNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by CNW are

solely those of CNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable CNW for any investment

decisions by their readers or subscribers. CNW is a news

dissemination and financial marketing solutions provider and is NOT

registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, CNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

CNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and CNW undertakes no

obligation to update such statements.

Source:

CannabisNewsWire

Contact:

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

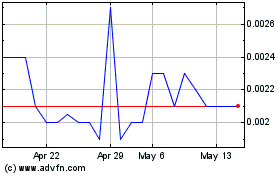

Medical Marijuana (PK) (USOTC:MJNA)

Historical Stock Chart

From Oct 2024 to Nov 2024

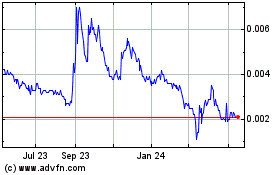

Medical Marijuana (PK) (USOTC:MJNA)

Historical Stock Chart

From Nov 2023 to Nov 2024