Current Report Filing (8-k)

February 20 2019 - 1:23PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 14, 2019

Commission file number:

1-03319

|

Mineral Mountain Mining & Milling Company

|

|

(Exact name of registrant as specified in its charter)

|

|

Idaho

|

|

82-0144710

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification Number)

|

Mineral Mountain Mining & Milling Company

13 Bow Circle, Suite 170

Hilton Head, South Carolina 29928

(917) 587-8153

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

(Former name and former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

Item 4.02

|

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

|

Mineral Mountain Mining & Milling Company (“we”, “our”, the “Company”) is filing this Form 8-K to provide notice that it intends to restate the financial statements and to amend portions of its “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Reports on Form 10-K for the fiscal years ended September 30, 2016, September 30, 2017 and September 30, 2018, which we originally filed with the Securities and Exchange Commission (the “Original Form 10-K’s”). Additionally, the Company intends to restate the unaudited financial statements and to amend portions of its “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Reports on Form 10-Q for the quarters ending December 31, 2017, March 31, 2018, June 30, 2018 and December 31, 2018, which we originally filed with the Securities and Exchange Commission (the “Original Form 10-Q’s”). The financial statements during these periods should no longer be relied upon.

In November 2018, information came to the attention of Company management that led it to investigate whether one of the Company’s property and mineral leases, its Alaska Property and Mineral Lease, qualified for early adoption of ASU No. 2016-02, resulting in the recognition of a right of use asset and lease liability in accordance with ASC 842, was the absolute best accounting practice or whether, had the Company not chosen early adoption, lease payments should have been expensed as incurred in accordance with ASC 840. Company management concluded on February 14, 2019 and notified the Board that it was in the Company’s best interest to account for the Alaska Property and Mineral Lease payments as expenses as incurred pursuant to ASC 840.

On February 15, 2019, the Company’s independent registered public accounting firm, Fruci & Associates II, PLLC (“Fruci”), concurred that the audited consolidated financial statements included in the Original Form 10-K’s and the unaudited consolidated financial statements included in the 10-Q’s should be amended accordingly.

In the Original Form 10-K’s, the Company’s management had decided the Alaska Property and Mineral Lease qualified for early adoption of ASU No. 2016-02 (ASC 842), resulting in the recognition of a right of use asset and lease liability, as there was a significant infrastructure asset present on the Company’s leased property and an exclusive right to use that infrastructure pursuant to the terms of the Alaska Property and Mineral Lease.

As discussed above, management has now decided that it is in the Company’s best interest to account for the lease payments by the Company pursuant to the Alaska Property and Mineral Lease as expenses as incurred in accordance with ASC 840, despite the presence of the significant infrastructure asset on site. Additionally, management determined that the Alaska Property and Mineral Lease should not be applied to the assets of the Company pursuant to ASC 842.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Mineral Mountain Mining & Milling Company

|

|

|

|

|

|

|

Dated: February 20, 2019

|

By:

|

/s/ Sheldon Karasik

|

|

|

|

|

Sheldon Karasik

|

|

|

|

|

Chief Executive Officer (Principal Executive Officer)

|

|

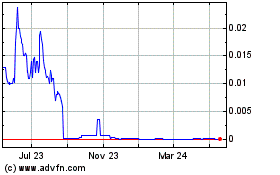

Quad M Solutions (CE) (USOTC:MMMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

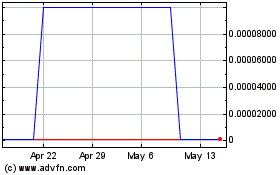

Quad M Solutions (CE) (USOTC:MMMM)

Historical Stock Chart

From Dec 2023 to Dec 2024