Current Report Filing (8-k)

August 20 2019 - 3:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 13, 2019

Commission file number:

1-03319

|

Idaho

|

|

82-0144710

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

|

122 Dickinson Avenue, Toms River, NJ

|

|

08753

|

|

(Address of Registrant’s Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, including area code:

(732) 423-5520

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 8.01 Other Events.

On August 13, 2019, Quad M Solutions, Inc. (the “Company” or “Registrant”), in the ordinary course of its business and pursuant to its ongoing plan of operations to fund its business by the use of convertible note transactions, entered into a Securities Purchase Agreement (“SPA”) with Cavalry Fund LP, an institutional investor and the Lead Invesrtor (“Cavalry”) dated August 13, 2019, a copy of which is filed as Exhibit 99.1 to the Form 8-K.

Pursuant to the terms of the SPA, the Company issued and sold to Cavalry: (i) a 10% Senior Convertible Note dated August 13, 2019 in the principal amount of $225,000 (the “Note”), a copy of which is filed as Exhibit 99.2 hereto; and (ii) a Common Stock Purchase Warrant dated August 13, 2019 (the “Warrant”), a copy of which is filed as Exhibit 99.3 hereto.

The Note provided for a payment to the Company of $202,500, after an original issue discount and professional fees. The material terms of the Note provide that it is: (i) convertible into shares of the Company’s common stock (the “Conversion Shares”) at an exercise price equal to the lower of (a) $0.08 per Conversion Share, or (b) 60% of the 2 lowest closing bid prices during the 20 trading day period prior to the date of determination,, subject to adjustment; (ii) bears interest at the rate of 10% per annum; (iii) is due and payable on February 13, 2019; (iv) has a beneficial ownership limitation provision which provides, in substance, that Cavalry cannot exercise any conversion if, as a result of such conversion, Cavalry would own in excess of 4.99% of the Company’s outstanding shares (the “Beneficial Ownership Limitation”), except that upon 61 days prior notice, Cavalry may increase its Beneficial Ownership Limitation to 9.99% (as more fully described in Section 4(d) of the Note); (v) grants the Company prepayment rights; and (vi) subject to default provisions. Reference is made to the complete terms and conditions of the Note, filed as Exhibit 99.2 hereto.

The Warrant is exercisable for a five (5) year period to purchase 4,945,055 shares (the “Warrant Shares”), subject to adjustment, at an exercise price of $0.08, subject to adjustment, and, if the Company does not have an effective registration statement with respect to the Warrant Shares on the 6

th

month anniversary of the Warrant issuance date of August 13, 2019, the Warrant also may be exercised on a cashless basis. In addition, any exercise of the Warrant is subject to the Beneficial Ownership Limitation provisions contained in Section 4(d) of the Note. Reference is made to the complete terms and conditions of the Warrant, filed as Exhibit 99.3 hereto.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Quad M Solutions, Inc.

|

|

|

|

|

|

|

Dated: August 20, 2019

|

By:

|

/s/ Pat Dileo

|

|

|

|

Name:

|

Pat Dileo

|

|

|

|

Title:

|

Chief Executive Officer (Principal Executive Officer)

|

|

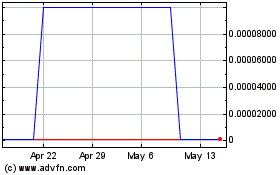

Quad M Solutions (CE) (USOTC:MMMM)

Historical Stock Chart

From Nov 2024 to Dec 2024

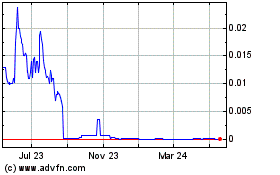

Quad M Solutions (CE) (USOTC:MMMM)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Quad M Solutions Inc (CE) (OTCMarkets): 0 recent articles

More Quad M Solutions, Inc. News Articles