false

0001107280

0001107280

2024-06-30

2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 30, 2024

Date of Report (Date of earliest event reported)

OCULUS VISIONTECH INC.

(Exact name of registrant as specified in its charter)

|

Wyoming

|

0-29651

|

06-1576391

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

507 – 837 West Hastings Street

Vancouver, British Columbia, Canada

|

|

V6C 3N6

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(604) 685-1017

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol (s)

|

Name of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

__________

On June 30, 2024, the Board of Directors (the “Board”) of Oculus VisionTech Inc. (the “Company”) adopted a Share Trading Policy (the “Policy”), with an effective date of June 30, 2024. The purpose of the Policy is to prescribe rules for restricted persons and employees with respect to trading in securities of the Company by these individuals when there is undisclosed material information or pending material developments with respect to the Company. Strict adherence to the Policy and included guidelines will ensure that restricted persons and employees who have access to undisclosed material information will not make use of it by trading in securities of the Company before the information has been fully disclosed to the public and a reasonable period of time for the dissemination of that information has passed.

The foregoing description of the Policy does not purport to be complete and is qualified in its entirety by reference to the full text of the Policy, a copy of which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

|

Item 9.01

|

Financial Statements and Exhibits

|

|

Exhibit

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document).

|

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OCULUS VISIONTECH INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: July 25, 2024

|

By:

|

/s/ Anton J. Drescher

|

|

|

|

|

Anton J. Drescher

Corporate Secretary and CFO

|

|

|

|

|

|

|

__________

- 3 -

Exhibit 99.1

OCULUS VISIONTECH INC.

SHARE TRADING POLICY

(Adopted by the Board of Directors on June 30, 2024)

PURPOSE OF THE POLICY

The purpose of this policy is to prescribe rules for Restricted Persons and Employees with respect to trading in securities of Oculus Visiontech Inc. (the “Company”) by these individuals when there is Undisclosed Material Information or Pending Material Developments with respect to the Company. Strict adherence to this policy and included guidelines will promote investor confidence in securities of the Company by assuring the investing community that Restricted Persons and Employees who have access to Undisclosed Material Information will not make use of it by trading in securities of the Company before the information has been fully disclosed to the public and a reasonable period of time for the dissemination of that information has passed.

| |

I.

|

DEFINITIONS USED IN THIS POLICY

|

“Blackout Period” means the period during which Employees and Restricted Persons are Prohibited from trading in the Company’s securities;

“Company’s securities” or “securities of the Company” includes common stock, options and any other securities that the Company may issue, such as preferred stock, notes, bonds and convertible securities, as well as to derivative securities relating to any of the Company’s securities, whether or not issued by the Company;

“Employees” mean all individuals currently employed by the Company (including independent contractors) who may become aware of Undisclosed Material Information;

“Information Officer” means the individual whom Employees or Restricted Persons may contact to determine whether or not they may execute trades in the market or reveal Undisclosed Material Information in the necessary course of business;

“Material Information” means any information that (i) results in or could reasonably be expected to result in a change in the market price or value of any of the Company’s securities or (ii) there is a substantial likelihood that a reasonable shareholder would consider it important in making an investment decision to hold, buy or sell the Company’s securities ; or view it as significantly altering the ‘total mix’ of information made available about the Company;

“Pending Material Developments” means a proposed transaction of the Company, or other developments regarding the Company’s business would constitute Material Information, [i.e. a decision to proceed with the transaction has not been made by the board of directors;

“Restricted Persons” means:

| |

(a)

|

Directors and officers of the Company; and

|

| |

(b)

|

Employees of the Company who are routinely in possession of Undisclosed Material Information; and

|

“Undisclosed Material Information” means Material Information that has not been publicly disclosed in a manner designed to reach investors generally or information that has been publicly disclosed, but a reasonable period of time for its dissemination has not passed. Generally, for the purposes of this policy, a “reasonable period of time” will be two (2) business days; however, it may be longer depending upon the nature of the Material Information and circumstances related to its disclosure.

If there is any question or concern with respect to the application of this policy to any Restricted Person or Employee of the Company or to any particular circumstance, the Information Officer should be contacted for guidance.

No Employees or Restricted Person shall trade in the securities of the Company when they are aware of Undisclosed Material Information about the Company or about any other company obtained through or on behalf of the Company. In addition, Employees or Restricted Persons are prohibited from informing or ‘tipping’, anyone else about that information. This prohibition extends to other securities whose price or value may reasonably be expected to be affected by changes in the price of the Company’s securities and includes the granting of exercise of stock options.

For purposes of this Policy, the Corporate Controller, supported as necessary y the Chief Financial Officer of the Company, has been appointed as the Information Officer. If, for any reason, the Information Officer is not available, the Chief Executive Officer is the designated backup. When Employees or Restricted Persons have concerns about whether or not certain information is Undisclosed Material Information, they should contact the Information Officer or, if he is not available, his backup, to obtain permission before executing any trades in securities of the Company. If the information is such that it would influence Employees or Restricted Persons to buy or sell securities of the Company then that fact alone suggest that it is Material Information. Restricted Persons and Employees should err on the side of caution in such matters.

| |

3.

|

Undisclosed Material Information

|

No Employees or Restricted Person shall reveal Undisclosed Material Information to any person unless the disclosure must occur in the necessary course of business (e.g. discussions with the Company’s bankers or advisers where the disclosure of such information is necessary). The Information Officer or, if he is not available, his backup, should be consulted to determine if it is appropriate to reveal the Undisclosed Material Information in the circumstances.

| |

4.

|

Undisclosed Material Information of Other Companies

|

Where Employees or restricted Persons become aware of Undisclosed Material Information concerning another public corporation in the course of employment with the Company, they shall not trade, or recommend a trade, in the securities of that Company until the information is publicly disclosed and a reasonable period of time for its dissemination has passed. The information Officer or, if he is not available, his backup, should be consulted to determine what would be a “reasonable period of time” in the circumstances.

Restricted Persons are prohibited from trading whenever there are Pending Material Developments, even if they are unaware of the details of the same. In the circumstances where there is Pending Material Developments with respect to the Company, a confidential notice will be sent to all Restricted Persons, as well as to other Employees if it is determined appropriate, informing them as to the Blackout Period with respect to such Pending Material Development at which they shall cease trading until further notice. No reason for the Blackout trading restriction will be provided.

As an alternative to a total prohibition on trading during a Blackout Period, senior management may make the determination that trades may occur during the Blackout Period but only with the express prior approval by the Information Officer of each such trade. This alternative will only be available during a Blackout Period if the written notice of such Blackout Period so states.

It is the responsibility of senior management to make the determination as to when a pending transaction would constitute a Pending Material Development. As guidance, a Blackout Period must at least commence once negotiations on a proposed transaction have progressed to a point where it reasonably could be expected that the market price of the Company’s securities would change if the status of the transaction were publicly disclosed or a reasonable shareholder would consider it important in making an investment decision with regard to the Company.

Restricted Persons should not engage in any of the following activities:

| |

1.

|

Trading in the Company’s securities on a short-term basis. Any securities of the Company purchased on the open market should be held for a minimum of six months and ideally longer. The U.S. Securities Exchange Commission’s (the “SEC”) “short swing profit” rule already prevents officers and directors from selling any securities of the Company within six months of purchase. However, the rule does not apply to certain grants of stock options and stock option exercises under stockholder approved plans.

|

| |

2.

|

Purchases of the Company’s securities on margin

|

| |

3.

|

Short sales of the Company’s securities

|

| |

4.

|

Buying or selling put or call options or other derivative securities relating to securities of the Company.

|

| |

5.

|

Engaging in hedging or monetizing transactions, such as collars, equity swaps, prepaid variable forwards and exchange funds with respect to the Company’s securities.

|

| |

6.

|

Participating in investment clubs that invest in the Company’s securities

|

| |

7.

|

Holding the Company’s securities in a margin account or otherwise pledging the Company’s securities.

|

| |

8.

|

Placing standing orders of greater than 72 hours.

|

Restricted Persons are also prohibited from trading in the Company’s securities during a blackout period imposed under an “individual account” retirement or pension plan of the Company, during which at least 50% of the plan participants are unable to purchase, sell or otherwise acquire or transfer an interest in equity securities of the Company, due to a temporary suspension of trading by the Company or the plan fiduciary.

| |

6.

|

Post Termination Transactions

|

This policy continues to apply to trading in the Company’s securities or the securities of other entities with which the Company has a relationship even after a person ceases to be a Restricted Person or Employee. If a Restricted Person or Employee is in possession of Undisclosed Material information when his or her relationship with the Company is terminated, he or she may not trade in the securities of the Company or the entity with which the Company has a relationship and to which the information related until that information is no longer Undisclosed Material Information.

Transactions that may be necessary or justifiable for independent reasons (such as the need to raise money for an emergency expenditure) are no exception to this policy. Further, it also does not matter whether the undisclosed Material Information was pertinent to the decision to trade; any trading by a person subject to this policy while in the possession of undisclosed Material Information violates the law. Even the appearance of an improper transaction must be avoided in order to preserve our reputation for adhering to the highest standards of conduct.

No Employee or Restricted Person shall trade in the Company’s securities when Material Information has not been disclosed and for a reasonable period of time following the disclosure of that information. The purpose of the Blackout Period is to allow the market to fully reflect the Material Information in the price of the Company’s securities. The information Officer(s), in consultation with senior management, will be responsible for setting the length of the Blackout Period and notifying Employees and Restricted Persons of it.

The Information Officer should consider setting, and advising of, specific and routine Blackout Periods for routine and scheduled material announcements, such as quarterly and annual financial information; [for example, everyone involved with financial statement preparation or approval should be subject to a regular Blackout Period two (2) weeks prior to the scheduled release of the statements and forty-eight (48) hours after their actual release].

| |

9.

|

Insider Trading Reports

|

In British Columbia, directors, senior officers and any persons beneficially owning or controlling more than 10% of the voting rights of a public corporation are required to file insider trading reports on SEDI (system for Electronic Disclosure by Insiders) within ten (10) days of change in their ownership position in any securities of the Company (this includes the grant of options or other convertible securities to such persons or the exercise by them of such options or convertible securities).

In the United States, section16(a) of the Securities Exchange Act of 1934, as amended, requires directors, Section 16 officers and 10% owners of the Company to file reports on Forms 3, 4, 5 as appropriate, to report their transactions and holdings involving equity securities of the Company. Section 16 requires reporting on all acquisitions and dispositions of options and other derivative securities by “insiders” (directors, officers and certain key employees). Derivative securities include options, warrants, convertible securities, stock appreciation rights or similar rights. Section 16 has mandated reporting of most transactions in the Company’s securities within two business days.

Although the preparation and filing of these reports legally are the sole responsibility of the directors, officers and 10% owners of the Company, the Company recognizes that the reporting requirements are complex and that mistakes can result in disclosures which are embarrassing to the reporting person and the Company. Accordingly, if an individual falls into one of these categories, that individual should consult the Information Officer, or if he is not available, his backup, if he/she has any questions with respect to any individual proposed trades in securities or with respect to his/her statutory obligations regarding insider trading report filings in general and the Company will assist such Restricted Persons in making these filings.

When Employees or Restricted Persons are shown to have been trading on Undisclosed Material Information it causes great embarrassment to the Company. As a result, the Company may take its own disciplinary actions, which could result in termination of employment or implementation of a probationary period. The Company will also report the manner to the appropriate regulatory authorities.

The prohibition against trading on Undisclosed Material Information as set forth in Canadian securities legislation can be enforced through a wide range of penalties, including:

| |

(a)

|

Fines and penal sanctions;

|

| |

(b)

|

Civil actions for damages;

|

| |

(c)

|

An accounting to the Company for any benefit or advantage received; and

|

| |

(d)

|

Administrative sanctions by securities commissions, such as cease trade orders and removal of trading exemptions.

|

Insider trading is also prohibited by the U.S. federal and state laws and is pursued vigorously by the SEC, the Department of Justice as well as other U.S. federal and state enforcement authorities. Punishment for insider trading can be severe and could include significant fines or several times the amount of profits gained or losses avoided, as well as imprisonment. A company (as well as possibly any supervisory person) that fails to take appropriate steps to prevent illegal trading in its securities may also be subject to punishment which could include significant civil and criminal fines. In addition, a person who tips others may also be liable for transactions by the tippees to whom he or she has disclosed Undisclosed Material Information. Tippers can be subject to the same penalties and sanctions as the tippees, and the SEC has imposed large penalties even when the tipper did not profit from the transaction.

The Company will review this policy annually to ensure that it is achieving its purpose. Based on the results of the review, the policy may be revised accordingly.

v3.24.2

Document And Entity Information

|

Jun. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

OCULUS VISIONTECH INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jun. 30, 2024

|

| Entity, Incorporation, State or Country Code |

WY

|

| Entity, File Number |

0-29651

|

| Entity, Tax Identification Number |

06-1576391

|

| Entity, Address, Address Line One |

507 – 837 West Hastings Street

|

| Entity, Address, City or Town |

Vancouver

|

| Entity, Address, State or Province |

BC

|

| Entity, Address, Country |

CA

|

| Entity, Address, Postal Zip Code |

V6C 3N6

|

| City Area Code |

604

|

| Local Phone Number |

685-1017

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001107280

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

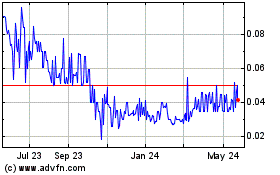

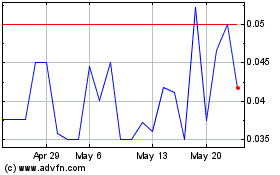

Oculus (QB) (USOTC:OVTZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Oculus (QB) (USOTC:OVTZ)

Historical Stock Chart

From Feb 2024 to Feb 2025