Form 8-K - Current report

August 19 2024 - 8:31AM

Edgar (US Regulatory)

false

PUBLIC CO MANAGEMENT CORP

0001141964

0001141964

2024-08-16

2024-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Commission File Number 000-50098

Date of Report (Date of earliest event

reported): August 16, 2024

| PUBLIC COMPANY MANAGEMENT CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

88-0493734 |

| (State or other jurisdiction of incorporation) |

|

(IRS Employer Identification No.) |

| 9340 Wilshire Boulevard, Suite 203 |

|

|

| Beverly Hills, CA |

|

90212 |

| (Address of principal executive offices) |

|

( Zip Code) |

| Not applicable |

| (Former name or former address, if changed since last report.) |

| 310.862.1957 |

| (Registrant’s Telephone Number, Including Area Code) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

PCMC |

OTC Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

Effective on August 16 , 2024, the Company

entered into a non-binding letter of intent with DACTA SG Pte. Ltd., a Singapore corporation (“Dacta”). The letter of intent contemplates

that the Company will enter into a business combination with the stakeholders or equity holders in Dacta with a change of control. The

letter of intent is intended to serve as an outline of the proposed principal terms and conditions regarding the acquisition and is subject

to the execution and closing of a definitive agreement and contemplates that each party will conduct a business, financial, and legal

due diligence investigation of the other, each to their satisfaction.

Dacta provides solutions in cybersecurity, digital

transformation and artificial intelligence to support its clients protection of sensitive data, proved efficiency and innovation and offers

computational power, preparing it customers for future challenges and opportunities. Dacta provides critical infrastructure security that

protects the computer systems, applications, networks, data and digital assets that a society depends on for national security, economic

health and public safety. It provides unauthorized access to network resources and detects and stops cyberattacks and network security

breaches in progress. It ‘agent’ provides endpoint security and is installed on the customer’s servers, desktops, laptops,

mobile devices; it protects these devices and their users against attacks and also protects the network against adversaries who

use endpoints to launch attacks.

Dacta works with its customers to identify, assess

and mitigate risks. It implements security controls to address attacks, with responses It detects vulnerability in real time and, in the

event of an incident, assists in minimizing data loss and downtime.

The Company has issued, in exchange for the payment

of $100,000 by Chad Crowley (“Investor”), the right of the Investor to certain shares of the Company’s capital

stock, subject to the terms and conditions of the instrument (a modified Simple Agreement for Future Equity). The instrument provides

that after June 30, 2025, if there is an equity financing before the expiration or termination of the instrument, the Company will automatically

issue to the Investor a number of shares of preferred stock or common stock sold in the equity financing equal to the purchase amount

divided by the price per share of the preferred stock or common stock. Equity financing means a bona fide transaction or series of transactions

with the principal purpose of raising capital, pursuant to which the Company issues and sells shares of preferred stock or common stock

at a fixed pre-money valuation with an aggregate sales price of not less than $5,000,000, excluding all subsequent convertible securities.

The parties have agreed upon the valuation of four (4%) interest in the Company for purposes of the instrument. The instrument is not

preferred stock or common stock and the Investor may not be getting an equity stake in the Company in return for the payment.

The instrument provides for a finders fee to a

finder who only introduced the parties, the finder will be issued a warrant to purchase the equivalent of ten (10%) percent of the preferred

stock or common stock, on the same terms, conditions and participation of the Investor, with the warrant expiring five (5) years from

the closing as provided in the instrument.

The Securities Act of 1933, as amended, defines

as applicable to the instrument, an equity security to include any stock or similar security, certificate of interest or participation

in any profit sharing agreement, preorganization certificate or subscription, transferable share, voting trust certificate or certificate

of deposit for an equity security, limited partnership interest, interest in a joint venture, or certificate of interest in a business

trust; any security future on any such security; or any security convertible, with or without consideration into such a security, or carrying

any warrant or right to subscribe to or purchase such a security; or any such warrant or right; or any put, call, straddle, or other option

or privilege of buying such a security from or selling such a security to another without being bound to do so.

The Investor is an accredited investor as such

term is defined in Rule 501 of Regulation D under the Securities Act. Regulation D is a non-exclusive safe harbor under the

Securities Act and to the extent that the Securities Act may be applicable, the Company relied on Regulation D and Section 4(2) of said

Act. The Investor had been advised that the instrument and the underlying securities, have not been registered under the Securities Act,

or any state securities laws and, therefore, cannot be resold unless they are registered under the Securities Act and applicable state

securities laws or unless an exemption from such registration requirements is available. The Investor purchased the instrument and the

securities to be acquired by the Investor is for his own account for investment, not as a nominee or agent, and not with a view to, or

for resale in connection with, the distribution thereof.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Public Company Management Corporation |

| |

|

| Date: August 19, 2024 |

/s/ Quinn Tran |

| |

Quinn Tran, President and Chief Executive Officer |

v3.24.2.u1

Cover

|

Aug. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 16, 2024

|

| Entity File Number |

000-50098

|

| Entity Registrant Name |

PUBLIC CO MANAGEMENT CORP

|

| Entity Central Index Key |

0001141964

|

| Entity Tax Identification Number |

88-0493734

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

9340 Wilshire Boulevard

|

| Entity Address, Address Line Two |

Suite 203

|

| Entity Address, City or Town |

Beverly Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90212

|

| City Area Code |

310

|

| Local Phone Number |

862.1957

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

PCMC

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

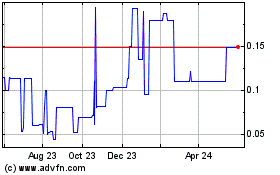

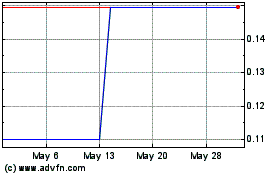

Public Company Management (PK) (USOTC:PCMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Public Company Management (PK) (USOTC:PCMC)

Historical Stock Chart

From Nov 2023 to Nov 2024