0001575858

false

0001575858

2023-09-11

2023-09-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September

11, 2023

PUREBASE

CORPORATION

(Exact

name of registrant as specified in charter)

| Nevada |

|

000-55517 |

|

27-2060863 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

8625

State Hwy, 124

Ione,

CA 95640

(Address

of principal executive offices)

(855)

743-6478

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.02 Unregistered Sales of Equity Securities

Reference

is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

The

common stock issuable upon the exercise of the Option will be exempt from registration under Section 4(a)(2) under of the Securities

Act of 1933, as amended, as transactions by an issuer not involving any public offering.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Effective

September 11, 2023, Brady Barto (“Barto”) was appointed to serve on the Board of Directors of Purebase Corporation (the “Company”).

Barto,

age 42, has worked for Signal Hill Petroleum, Inc. (“Signal Hill”) for the past 18 years and has been the Exploration Manager

for the past 12 years. Signal Hill is a private family owned California-based energy company involved in gas and oil exploration, development

and production in urban areas. Prior to becoming the Exploration Manager, Barto served as the Land Manager and Manager- Real Estate Projects

for Signal Hill. Barto also serves as a Commissioner on the Planning Commission for the City of Newport Beach, CA. Barto earned a Bachelor

of Business Administration degree from Chapman College in 2005.

Barto

was selected as a director for, among other things, his expertise in the financing and development of natural resources.

The

Company entered into a twelve-month director agreement with Barto, effective September 11, 2023 (the “Agreement”), which

will automatically renew unless Barto gives 30 days prior written notice of his desire not to renew the Agreement. Pursuant to the Agreement,

Barto will be paid $1,000 per month for serving as a director, which shall accrue as debt until the Company has its first cash flow positive

month. At the completion of the term of the Agreement or if Barto has been removed or resigned, any accrued amount owed will be paid

in shares of the Company’s common stock at the lower of $0.15 per share or the 20-day volume weighted average price from the date

of termination or resignation.

On

September 11, 2023, Barto was granted a five-year option to purchase 200,000 shares of the Company’s common stock at an exercise

price of $0.15 per share (the “Option”) pursuant to an option agreement with the Company (the “Option Agreement”).

Shares subject to the Option become exercisable one year from the date of grant.

There

are no arrangements or understandings between Barto and any other person pursuant to which he was appointed as a director of the Company.

Barto is the son of Craig Barto who is an owner of Signal Hill. Craig Barto, along with directors John Bremer and Scott Dockter, are

owners of US Mine Corp. and US Mine LLC, both of which have extensive business relationships with the Company. There are no family relationships

between Barto and any of the Company’s other officers or directors, or in any transactions in which Barto had, or will have, a

direct or indirect material interest, other than as described above.

The

foregoing description of the Agreement and the Option Agreement is qualified in its entirety by reference to the full text of the Agreement

and the Option Agreement, copies of which are attached hereto as Exhibit 10.38 and Exhibit 10.39, respectively, and are incorporated

herein in their entirety by reference.

Item

7.01 Regulation FD Disclosure.

On

September 12, 2023, the Company issued a press release announcing the appointment of Brady Barto as a director. A copy of the press release

is filed as Exhibit 99.1 to this Report and incorporated herein by reference.

The

information in this Item 7.01 of this Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed

incorporated by reference in any of the Company’s filings under the Securities Act, or the Exchange Act, whether made before or

after the date hereof, except as shall be expressly set forth by specific reference to this Report in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

September 14, 2023 |

PUREBASE

CORPORATION |

| |

|

|

| |

By: |

/s/

A. Scott Dockter |

| |

|

A.

Scott Dockter |

| |

|

Chief

Executive Officer |

Exhibit

10.38

DIRECTOR

AGREEMENT

THIS

AGREEMENT (The “Agreement”) is effective as of the 11th day of September 2023, and is by and between Purebase

Corporation, a Nevada corporation (hereinafter referred to as the “Company”), and Brady Barto (hereinafter

referred to as the “Director” or “Barto”).

BACKGROUND

Each

of the Board of Directors of the Company and the Director desires to memorialize the role of the Director and to have the Director perform

the duties required of such position in accordance with the terms and conditions of this Agreement.

AGREEMENT

NOW

THEREFORE, in consideration for the above recited promises and the mutual promises contained herein, the adequacy and sufficiency of

which are hereby acknowledged, the Company and the Director hereby agree as follows:

| 1. |

DUTIES.

The Company requires that the Director be available to perform the duties of a director customarily related to this function as may

be determined and assigned by the Board of Directors of the Company and as may be required by the Company’s constituent instruments,

including its certificate or articles of incorporation, bylaws and its corporate governance and board committee charters, each as

amended or modified from time to time, and by applicable law, including by the Nevada Revised Statutes (the “NRS”). |

| |

|

| |

The

Director agrees to devote as much time as is necessary to perform completely the duties as the Director of the Company, including

duties as a member of any committees as the Director may hereafter be appointed to by the Board of Directors. |

| |

|

| |

The

Director will perform such duties described herein in accordance with the general fiduciary duty of directors arising under the NRS.

Such duties include but are not limited to assisting the Company with the development of business and new business strategies relating

to the objectives of the Company, participation in the Company’s investor relations activities including road shows and shareholder

communication activities, and participation in corporate strategy decisions of the Company. |

| |

|

| 2. |

TERM.

The term of this engagement shall be for twelve (12) months from the date of this Agreement (the “Term”), or until the

Director’s removal or resignation. Barto shall be notified within 30 days before the end of the Term whether his contract shall

be renewed under the same terms of Compensation in Paragraph 3. |

| 3. |

COMPENSATION.

For all services to be rendered by the Director in any capacity hereunder, the Company agrees to pay the Director a combination of

cash and stock. |

| |

■ |

Cash

Fees: Barto shall receive a fee of $1,000.00 per month in cash. This fee shall accrue as debt to the Company until the Company

has its first cash-flow positive month. At this point, the Company shall make arrangements to pay Barto the debt owed to him for

these services. If a debt is still owed to Barto when the original Term is completed, or he has been removed or he has resigned,

then the Debt owed to Barto shall be converted into common stock at the lower of price of $0.15 or the 20-day WVAP closing from the

last date of Barto being on the Board. The Company shall convert the Barto Debt and issue to Barto shares of common stock of the

Company within 10 business days of the completion of the original Term, his removal or his resignation. |

| |

|

|

| |

■ |

Equity

Fees: Within 10 days upon signing of this contract, Barto shall be granted (two hundred thousand) 200,000 stock options that

have a strike price of $0.15. These options will be exercisable for a period of 5 years from the effective date. These stock options

are not transferable to another party and Barto will be subject to all the SEC reporting requirements associated with the grant,

exercise and sale of this equity compensation. |

| 4. |

EXPENSES.

In addition to the compensation provided in paragraph 3 hereof, the Company will reimburse the Director for pre-approved reasonable

business-related expenses incurred in good faith in the performance of the Director’s duties for the Company. Such payments

shall be made by the Company upon submission by the Director of a signed statement itemizing the expenses incurred. Such statement

shall be accompanied by sufficient documentary matter to support the expenditures. |

| |

|

| 5. |

CONFIDENTIALITY.

The Company and the Director each acknowledge that, in order for the intents and purposes of this Agreement to be accomplished, the

Director shall necessarily be obtaining access to certain confidential information concerning the Company and its affairs, including,

but not limited to business methods, information systems, financial data and strategic plans which are unique assets of the Company

(“Confidential Information”). The Director covenants not to, either directly or indirectly, in any manner, utilize

or disclose to any person, firm, corporation, association or other entity any Confidential Information. |

| |

|

| 6. |

NON-COMPETE.

During the term of this Agreement and for a period of twelve (12) months following the Director’s removal or resignation from

the Board of Directors of the Company or any of its subsidiaries or affiliates (the “Restricted Period”), the

Director shall not, directly or indirectly, (i) in any manner whatsoever engage in any capacity with any business competitive with

the Company’s current lines of business or any business then engaged in by the Company, any of its subsidiaries or any of its

affiliates (the “Company’s Business”) for the Director’s own benefit or for the benefit of any person

or entity other than the Company or any subsidiary or affiliate; or (ii) have any interest as owner, sole proprietor, shareholder,

partner, lender, director, officer, manager, employee, consultant, agent or otherwise in any business competitive with the Company’s

Business; provided, however, that the Director may hold, directly or indirectly, solely as an investment, not more than two percent

(2%) of the outstanding securities of any person or entity which are listed on any national securities exchange or regularly traded

in the over-the-counter market notwithstanding the fact that such person or entity is engaged in a business competitive with the

Company’s Business. In addition, during the Restricted Period, the Director shall not develop any property for use in the Company’s

Business on behalf of any person or entity other than the Company, its subsidiaries and affiliates. |

| |

|

| 7. |

TERMINATION.

With or without cause, the Company and the Director may each terminate this Agreement at any time upon 5 (five) days written notice,

and the Company shall be obligated to pay to the Director the compensation and expenses due up to the date of the termination. Nothing

contained herein or omitted herefrom shall prevent the shareholder(s) of the Company from removing the Director with immediate effect

at any time for any reason. |

| 8. |

INDEMNIFICATION.

The Company shall indemnify, defend and hold harmless the Director, to the full extent allowed by the law of the State of Nevada

and as provided by, or granted pursuant to, any charter provision, bylaw provision, vote of stockholders or disinterested directors

or otherwise, to action in the Director’s official capacity; provided, however, that, in accordance with the NRS and federal

securities laws, such indemnification shall not apply where the Director engages in actions or omissions which involve intentional

misconduct, fraud or knowing violation of law. |

| |

|

| 9. |

NOTICE.

Any and all notices referred to herein shall be sufficient if furnished in writing at the addresses specified on the signature page

hereto or, if to the Company, to the Company’s address as specified in filings made by the Company with the U.S. Securities

and Exchange Commission. |

| |

|

| 10. |

GOVERNING

LAW. This Agreement shall be interpreted in accordance with, and the rights of the parties hereto shall be determined by, the

laws of the State of Nevada without reference to that state’s conflicts of laws principles. |

| |

|

| 11. |

ASSIGNMENT.

The rights and benefits of the Company under this Agreement shall be transferable, and all the covenants and agreements hereunder

shall inure to the benefit of, and be enforceable by or against, its successors and assigns. The duties and obligations of the Director

under this Agreement are personal and therefore the Director may not assign any right or duty under this Agreement without the prior

written consent of the Company. |

| |

|

| 12. |

GENERAL. |

| |

a. |

SEVERABILITY.

If any provision of this Agreement shall be declared invalid or illegal, for any reason whatsoever, then, notwithstanding such invalidity

or illegality, the remaining terms and provisions of this Agreement shall remain in full force and effect in the same manner as if

the invalid or illegal provision had not been contained herein. |

| |

|

|

| |

b. |

EFFECT

OF WAIVER. The waiver by either party of the breach of any provision of this Agreement shall not operate as or be construed as a

waiver of any subsequent breach thereof. |

| |

|

|

| |

c. |

ARTICLE

HEADINGS. The article headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning

or interpretation of this Agreement. |

| |

|

|

| |

d. |

COUNTERPARTS.

This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one instrument. Facsimile

execution and delivery of this Agreement is legal, valid and binding for all purposes. |

| |

|

|

| |

e. |

ENTIRE

AGREEMENT. Except as provided elsewhere herein, this Agreement sets forth the entire agreement of the parties with respect to its

subject matter and supersedes all prior agreements, promises, covenants, arrangements, communications, representations or warranties,

whether oral or written, by any officer, employee or representative of any party to this Agreement with respect to such subject matter. |

[Remainder

of Page Left Blank Intentionally]

IN

WITNESS WHEREOF, the parties have executed this Agreement to be effective as of September 13, 2023.

| |

PUREBASE

CORPORATION |

| |

|

|

| |

By: |

/s/

a.Scott Dockter |

| |

Name: |

A.

Scott Dockter |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

DIRECTOR: |

| |

|

|

| |

/s/ Brady Barto |

| |

Brady Barto |

Exhibit

10.39

THE

OPTION GRANTED PURSUANT TO THIS AGREEMENT AND THE SECURITIES ISSUABLE UPON THE EXERCISE THEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED, OR UNDER ANY STATE BLUE SKY OR SECURITIES LAWS IN RELIANCE UPON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS

OF SUCH ACT AND BLUE SKY LAWS, AND MAY NOT BE SOLD, PLEDGED OR OTHERWISE TRANSFERRED IN THE ABSENCE OF SUCH REGISTRATION OR QUALIFICATION,

OR AN EXEMPTION FROM THE REGISTRATION OR QUALIFICATION REQUIREMENTS OF SUCH ACT OR LAWS.

PUREBASE

CORPORATION

OPTION

AGREEMENT

Section

1. Definitions.

Capitalized

terms used herein shall have the meanings set forth below.

“Agreement”

shall mean this Option Agreement.

“Company”

shall mean Purebase Corporation, a Nevada corporation.

“Date

of Grant” shall mean the date specified in the Notice of Option Grant.

“Grantee”

or “Optionee” means the individual named in the Notice of Option Grant attached to this Agreement.

“Notice

of Option Grant” means the Notice of Option Grant dated the date hereof granted to the Grantee.

“Securities

Act” shall mean the Securities Act of 1933, as amended.

“Shares”

or “Stock” shall mean the Common Stock of the Company.

“Transfer”

shall mean any direct or indirect sale, assignment, transfer, gift, pledge, encumbrance or other disposition.

Section

2. Grant of Option.

Subject

to the terms and conditions set forth in the Notice of Option Grant and this Agreement, the Company hereby grants to the Grantee the

option to purchase the number of Shares indicated in the Notice of Option Grant. The grant to the Grantee is personal and cannot be Transferred

without the prior written consent of the Company.

Section 3. Right to Exercise.

3.1 Subject

to the other provisions contained in this Agreement and the Notice of Option Grant, the option may be exercised at any time by delivery

of notice to the Company and payment of the applicable exercise price. The Grantee or the Grantee’s authorized representative may

exercise this option by giving written notice to the Company. The notice shall be signed by the person exercising this option and if

the option is being exercised by the representative of the Grantee, the notice shall be accompanied by proof satisfactory to the Company

of the representative’s right to exercise this option.

3.2

In the event that the Company determines that it is required to withhold any tax as a result of the exercise of this option, the Grantee,

as a condition to the exercise of this option, shall make arrangements satisfactory to the Company to enable it to satisfy all federal,

state and local withholding requirements. The Optionee shall also make arrangements satisfactory to the Company to enable it to satisfy

any withholding requirements that may arise in connection with the vesting or disposition of Shares issued in connection with exercising

this option.

Section

4. Representations and Warranties.

Recognizing

that the Company will be relying on the information and on the representations and warranties set forth herein, the Grantee hereby acknowledges,

represents and warrants to, and agrees with, the Company to the representations and warranties set forth below, which shall be true and

correct as of the date hereof and upon each date that the Grantee exercises the option.

(a) I

represent and warrant that I am acquiring and will hold the option and the Shares received upon exercise of such option for investment

for my account only, and not with a view to, or for resale in connection with, any “distribution” of the option and the Shares

within the meaning of the Securities Act.

(b) I

understand that the option and the Shares have not been registered under the Securities Act or any state securities laws by reason of

a specific exemption therefrom and that the option and the Shares must be held indefinitely, unless they are subsequently registered

under the Securities Act or I obtain an opinion of counsel (in form and substance satisfactory to the Company and its counsel) that registration

is not required.

(c) I

acknowledge that the Company is under no obligation to register the option or the Shares subject to the Option.

(d) I

am aware of the adoption of Rule 144 by the Securities and Exchange Commission under the Securities Act, which permits limited public

resales of securities acquired in a non-public offering, subject to the satisfaction of certain conditions. These conditions include

(without limitation) that certain current public information about the issuer is available, that the resale occurs only after the holding

period required by Rule 144 has been satisfied, that the sale occurs through an unsolicited “broker’s transaction”

and that the amount of securities being sold during any three-month period does not exceed specified limitations.

(e) I

will not Transfer or otherwise dispose of the option and the Shares subject thereto in violation of the Securities Act, the Securities

Exchange Act of 1934, or the rules promulgated thereunder, including Rule 144 under the Securities Act or any blue sky or state securities

laws or regulations.

(f) I

acknowledge that I have received and had access to such information as I consider necessary or appropriate for deciding whether to invest

in the option and the Shares subject thereto and that I had an opportunity to ask questions and receive answers from the Company regarding

the terms and conditions of the issuance of the option and the Shares subject thereto.

(g) I

am aware that my investment in the Company is speculative and subject to the risk of complete loss.

(h) I

acknowledge that I am an “accredited investor”, as such term is defined under the Securities Act.

(i) I

acknowledge that I am acquiring the option and the Shares subject thereto to all the terms of the Notice of Grant and this Agreement.

Section 5. Miscellaneous.

5.1 This

Agreement and the rights and obligations hereunder are not transferable or assignable by the Grantee.

5.2

This Agreement and the rights, powers and duties set forth herein shall be binding upon and inure to the benefit of the heirs, executors,

administrators, successors, legal representatives and permitted successors and assigns of the parties hereto.

5.3

Neither this Agreement nor any provisions hereof shall be waived, modified, discharged or terminated except by an instrument in writing

signed by the party against whom any such waiver, modification, discharge or termination is sought.

5.4 Any

notice or other communication required or permitted to be given hereunder shall be in writing and shall be mailed by certified mail,

return receipt requested, nationally recognized overnight delivery service or by hand to (a) the Optionee at his address on the books

of the Company, and (b) to the Company, at its principal address. Any notice or other communications given by certified mail shall be

deemed given at the time of certification thereof, except for a notice changing a party’s address, which shall be deemed given

at the time of receipt thereof.

5.5 This

Agreement shall be deemed to have been made under, and shall be governed by, and construed in accordance with, the substantive laws of

the State of Nevada (excluding the law thereof which requires the application of or reference to the law of any other jurisdiction).

5.6 This

Agreement, may be signed in counterparts and by facsimile or other electronic means, each of which shall be an original, and both of

which shall together constitute one and the same instrument.

IN

WITNESS WHEREOF, the parties have executed this Agreement as of September 13, 2023.

| |

PUREBASE

CORPORATION |

| |

|

|

| |

By: |

/s/

A.Scott Dockter |

| |

Name: |

A.

Scott Dockter |

| |

Title: |

Chief

Executive Officer |

| |

|

|

| |

GRANTEE: |

| |

|

|

| |

/s/ Brady Barto |

| |

Brady Barto |

PUREBASE

CORPORATION

NOTICE

OF OPTION GRANT

Purebase

Corporation (the “Company”) is pleased to advise you that pursuant to the attached Option Agreement you have been

granted the following options to purchase shares of common stock of the Company:

| Name

of Grantee: |

Brady

Barto |

| Number

of Shares: |

200,000 |

| Date

of Grant: |

September

11, 2023 |

| Exercise

Price: |

$0.15 |

| Expiration

Date: |

September

11, 2028 |

| |

|

| Vesting

Schedule: |

All

options granted hereunder shall be immediately exercisable. |

By

your signature and the signature of the Company, you and the Company agree that this option is granted under and governed by the terms

and conditions of the Option Agreement, which is attached to and made a part of this document.

| GRANTEE: |

|

PUREBASE

CORPORATION |

| |

|

|

|

|

| |

/s/

Brady Barto |

|

By: |

/s/

A.Scott Dockter |

| Name:

|

Brady

Barto |

|

Name: |

A.

Scott Dockter |

| |

|

|

Title: |

Chief

Executive Officer |

Address:

2461

Crestview Drive

Newport

Beach, CA 92663

BBarto@SHPI.net

Cell:

(949) 232-5979

Exhibit

99.1

Purebase

Corporation welcomes new director, Brady Barto

IONE,

CA, September 12, 2023 - Purebase Corporation (OTCPK: PUBC), (“Purebase”) a diversified mineral resource company, headquartered

in Ione, California. Effective September 11, 2023, Purebase Corporation welcomes Brady Barto to its Board of Directors who comes from

Signal Hill Petroleum where he currently holds the position of Exploration Manager and has been with the company for over eighteen years.

Mr. Barto also is a Planning Commissioner for the City of Newport Beach and holds a degree in Business Administration (B.B.A.), Entrepreneurship/Entrepreneurial

studies from Chapman University.

Barto’s

addition to the Board of Directors demonstrates Purebase Corporation’s desire to have proven leadership to guide the Company forward.

Barto stated, “I am excited to join the Board of Directors at Purebase Corporation. The company’s innovative approach to

low carbon cement via metakaolin represents a crucial step in sustainable construction practices. I believe my expertise in exploration

and sustainability will complement the Board’s existing skills and contribute to Purebase’s long-term success.”.)

Scott

Dockter, Purebase Corporation’s CEO, added “Brady brings a wealth of experience to our organization, and I expect him to

make an immediate impact on our operations. As we navigate through the opportunities in front of us, Brady will help us direct the best

transactions. He is a great asset for our organization and will help strengthen our Board.”

About

Purebase Corporation

Purebase

Corporation (OTCPK:PUBC) is a diversified resource company that acquires, develops, and markets minerals for use in agriculture, construction,

and other specialty industries.

Safe

Harbor

This

press release contains statements, which may constitute “forward-looking statements”. Those statements include statements

regarding the intent, belief, or current plans or expectations of Purebase Corporation and members of its management team as well as

the assumptions on which such statements are based. Such forward-looking statements are not guarantees of future performance and involve

risks and uncertainties, and actual results may differ materially from those contemplated by such forward-looking statements. Risks and

other important factors concerning Purebase’s business are described in the Company’s Annual Report on Form 10-K for the

year ended November 30, 2022, and other periodic and current reports filed with the Securities and Exchange Commission. The Company is

under no obligation to, and expressly disclaims any such obligation to update its forward-looking statements, whether as a result of

new information, future events or otherwise.

Investor

Contacts

Emily

Tirapelle - Purebase Corporation | emily.tirapelle@purebase.com.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

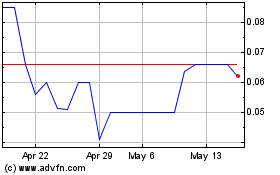

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Apr 2024 to May 2024

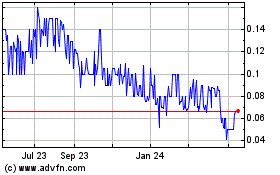

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From May 2023 to May 2024