Q.E.P. Co., Inc. Reports Fiscal 2011 Record Earnings

May 19 2011 - 9:52AM

Net Sales - $237.9 Million

Net Income - $9.4 Million or $2.77 Per Diluted

Share

Q.E.P. CO., INC. (Pink Sheets:QEPC) (the

"Company") today reported its consolidated results of operations

for the fiscal year ended February 28, 2011:

| |

Year Ended February

28 |

| (In thousands, except per share data) |

2011 |

2010 |

| |

|

|

| Net sales |

$ 237,886 |

$ 205,853 |

| Cost of goods sold |

164,334 |

140,486 |

| Gross profit |

73,552 |

65,367 |

| |

|

|

| Costs and expenses |

58,383 |

51,655 |

| |

|

|

| Operating income |

15,169 |

13,712 |

| Interest expense, net |

(1,363) |

(1,156) |

| |

|

|

| Income before provision for income

taxes |

13,806 |

12,556 |

| Provision for income taxes |

4,372 |

3,579 |

| |

|

|

| Net income |

$ 9,434 |

$ 8,977 |

| |

|

|

| Net income per share: |

|

|

| Basic |

$ 2.84 |

$ 2.59 |

| Diluted |

$ 2.77 |

$ 2.57 |

| |

|

|

| Weighted average number of common shares

outstanding: |

|

|

| Basic |

3,314 |

3,468 |

| Diluted |

3,409 |

3,496 |

Lewis Gould, Chairman of the Company's Board of Directors,

commented: "This year's results reflect positively on the Company's

continued progress in successfully expanding its business while

maintaining a diligent focus on controlling costs. This year's

success also provides a stronger foundation for future growth

within our industry. The February 2010 acquisition of Harris®Wood

has been successfully integrated into our operations and our growth

in net assets remains at historic highs while we continue to pay

down debt and increase share value." Mr. Gould added, "We are

continuously evaluating opportunities to expand our product lines

and customer base, increase market share and improve performance.

We continue to seek synergistic acquisitions and in this regard,

this month, the Company acquired Porta-Nails, Inc., a manufacturer

of quality wood floor installation equipment and fasteners. This

acquisition expands the product line in our ROBERTS® distributor

and tool rental business."

The growth in fiscal 2011 net sales reflects the expansion of

the Company's operations to include a comprehensive line of

hardwood flooring through the acquisition of its Harris®Wood

operations, a modest year over year growth in net sales from the

Company's operations outside of North America, a decrease in

certain accumulated sales allowances and the benefit of changes in

currency exchange rates.

Gross profit showed substantial improvement associated with

increased sales. As a percent of net sales, gross profit was 30.9%

in fiscal 2011 versus 31.8% in fiscal 2010 reflecting the lower

margins inherent in our Harris®Wood operations offset by both

improved product mix in the Company's other operations and the

increased purchasing power of its international operations

associated with changes in currency exchange rates.

While operating expenses for fiscal 2011 increased compared to

fiscal 2010, as a percentage of sales operating expenses decreased

to 24.5% in fiscal 2011 compared to 25.1% in fiscal 2010. The

overall increase in costs reflects the costs of supporting higher

sales volume, including both personnel and marketing efforts. Both

fiscal years' results also reflect realized currency translation

losses and other costs associated with the restructuring of certain

international operations.

The Company's results of operations also were impacted by a

modest increase in interest expense, principally resulting from the

financing of the Harris®Wood acquisition offset by reductions in

other debt outstanding, and an increase in the fiscal 2011

effective tax rate to 31.7% from 28.5% in fiscal 2010, which

reflected larger tax benefits associated with our international

operations.

Separately, the Company noted that during fiscal year 2011

aggregate borrowings decreased over 19% from $26.8 million to $21.7

million and that the Company purchased 109 thousand treasury shares

for $1.4 million during the fiscal year. Working capital at the end

of the Company's fiscal 2011 year was $27.6 million, an increase

from $20.2 million at the end of the Company's 2010 fiscal

year.

The Company also announced that today it posted its consolidated

fiscal 2011 audited financial statements on the Investor Relations

section of its website at www.qepcorporate.com and that it expects

to announce its first quarter fiscal year 2012 results during the

week beginning June 20, 2011.

If you would be interested in participating in a conference call

to discuss the Company's fiscal year 2011 results and its first

quarter 2012 results, please contact Ms. Paula Siegel at

561-994-5550 to indicate your interest. If there is sufficient

investor interest, the Company will schedule a call to take place

after it announces its first quarter results and notify investors

by issuing a press release and through a posting on its website at

www.qepcorporate.com in the Investor Relations

section. Alternatively, the Company encourages investors who

have questions concerning its results to contact the Company's

Chief Financial Officer.

Q.E.P. Co., Inc., founded in 1979, is a leading worldwide

manufacturer, marketer and distributor of a comprehensive line of

hardwood flooring, flooring installation tools, adhesives and

flooring related products targeted for the professional installer

as well as the do-it-yourselfer. Under brand names including QEP®,

ROBERTS®, Capitol®, Harris®Wood, Vitrex®, PRCI®, BRUTUS® and

Elastiment®, the Company markets over 3,000 flooring and flooring

related products. In addition to a complete hardwood flooring

line, Q.E.P. products are used primarily for surface preparation

and installation of wood, laminate, ceramic tile, carpet and vinyl

flooring. The Company sells its products to home improvement retail

centers and specialty distribution outlets in 50 states and

throughout the world.

This press release contains forward-looking statements,

including statements regarding market share, Company performance,

cost control and potential growth associated with

acquisitions, new products and customers. These statements are not

guarantees of future performance and actual results could differ

materially from our current expectations.

CONTACT: Q.E.P. Co., Inc.

Richard A. Brooke

Senior Vice President and

Chief Financial Officer

561-994-5550

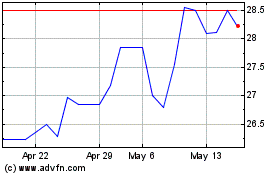

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025