Record Quarterly Sales – $69.8

Million Quarterly Net Income –

$2.3 Million Two Acquisitions

Completed and One Pending

Q.E.P. Co., Inc. (Pink Sheets:QEPC) (the

"Company") today reported its consolidated results of operations

for the first quarter of its fiscal year ending February 28,

2013.

The Company reported record net sales of $69.8 million for the

three months ended May 31, 2012, an increase of $2.1 million or

3.0% from the $67.8 million reported in the same period of fiscal

2012. As a percentage of net sales, gross profit was 28.9% in the

first three months of fiscal 2013 compared to 32.7% in the first

three months of fiscal 2012. For the fiscal year ended February 29,

2012, gross profit as a percentage of net sales was 30.2%.

Lewis Gould, Chairman of the Company's Board of Directors,

commented: "We are disappointed with our earnings this quarter

which reflect the decrease in margins that we discussed in our

recent investor calls. Sales for the quarter did increase, however,

showing our efforts to overcome the impact on margins from price

concessions provided to our major customer in order to retain

several strategic products for our Company. We recognize many

retailers are exerting increased pricing pressures and that those

pressures are likely to continue. As a result, the Company's

strategy has changed over the past year to focus increasingly on

synergistic acquisitions that will position the Company for

continued growth and long-term profitability in both domestic and

international markets as well as expanding our sales and marketing

personnel with a heavy emphasis on non-mass merchant accounts. The

Company also is expanding its domestic manufacturing capability and

developing a market position in specialty products." Mr. Gould

continued, "Today we are announcing the completion of two

acquisitions and the initiation of a third. These acquisitions make

us more of a prime manufacturer, something that is important to our

global customer base. In the interim, although our margins have

been adversely impacted, outstanding debt, excluding the impact of

these recent acquisitions, is at an all time low as the Company

continues to concentrate its efforts on sales, cash flow and

increased shareholder value."

The growth in net sales for the quarter as compared to the

fiscal year 2012 first quarter reflects the growth in the breadth

of the Company's US flooring-related product line, as well as the

extension of our product lines in certain of our international

operations, offset somewhat by the strengthening of the US

dollar.

The Company's gross margin was 28.9% for the first quarter of

fiscal 2013 as compared to 32.7% for the first quarter of the prior

fiscal year and 30.2% for the Company's 2012 fiscal year. The

decrease in margin as compared to both the first quarter and the

full year of the prior fiscal year principally reflects reduced

pricing with our major customer coupled with modest cost increases.

In addition, the purchasing power of our international operations

weakened as the US dollar strengthened during the first

quarter.

Operating expenses for the first three months of fiscal 2013 and

2012 were $16.4 million and $15.5 million, respectively, or 23.5%

and 22.9% of net sales, respectively. The increase in operating

expenses as a percentage of net sales principally reflects an

increased investment in personnel, increased freight rates in

certain of the Company's markets and transaction expenses

associated with the Company's recent investment activities. By

comparison, operating expenses for the Company's 2012 fiscal year

also were 23.5% of net sales.

The provision for income taxes as a percentage of income before

taxes for the first three months of fiscal 2013 and 2012 was 36.5%

and 35.0%, respectively. The increase in the effective tax rate

principally reflects the impact of a larger portion of the

Company's earnings being sourced in jurisdictions with higher tax

rates.

Net income for the first three months of fiscal 2013 and 2012

was $2.3 million and $4.1 million, respectively, or $0.68 and

$1.22, respectively, per diluted share.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) for the first quarter of fiscal 2013 decreased to $4.4

million as compared to $7.3 million for the fiscal 2012 first

quarter, a return on net sales of approximately 6.3% in fiscal 2013

and 10.7% in fiscal 2012 principally reflecting the decrease in

gross margin:

| |

|

First Quarter of Fiscal

Year |

| |

|

(In thousands) |

| |

|

2013 |

2012 |

| Net income |

$ 2,286 |

$ 4,132 |

| Add back: |

Interest |

165 |

285 |

| |

Provision for income taxes |

1,314 |

2,225 |

| |

Depreciation and amortization |

602 |

640 |

| EBITDA |

|

$ 4,367 |

$ 7,282 |

Cash provided by operations during the first three months of

fiscal 2013 was $1.2 million as compared to $3.6 million in the

first three months of fiscal 2012, principally reflecting both

reduced operating income and additional investments in working

capital to support increased sales. Cash from operations during

fiscal 2013 was used to reduce aggregate borrowings, purchase

treasury shares and fund capital improvements, while during fiscal

2012 cash from operations also funded the purchase of Porta-Nails,

Inc.

Working capital at the end of the Company's fiscal 2013 first

quarter was $37.4 million, an increase of $1.5 million from $35.9

million at the end of the 2012 fiscal year. Aggregate debt at

the end of the Company's fiscal 2013 first quarter was reduced to

$11.6 million from $12.7 million at the end of the 2012 fiscal

year.

As part of the Company's strategy of growing sales outside of

its traditional sales channels, since the end of the Company's 2013

fiscal first quarter on May 31st, the Company made two investments

totaling $7.1 million. The investments were funded by a combination

of available cash and the Company's domestic revolving credit

facility.

During June 2012, the Company acquired Nupla Corporation and two

sister companies (collectively "Nupla") for $6.2 million, net of

cash acquired. Nupla manufactures and distributes professional

grade fiberglass handled striking, digging, cutting and fire tools

operating out of two facilities totaling approximately 80,000

square feet in Sun Valley, California and Oklahoma City, Oklahoma.

The acquisition will be accounted for as a purchase and included in

the Company's future results of operations. Nupla's net sales and

its earnings before income taxes, depreciation and amortization for

the calendar year 2011 were $12.4 million and $1.4 million,

respectively. The purchase price equaled the fair value of net

assets acquired consisting primarily of accounts receivable,

inventory, trademarks, trade accounts payable and accrued

liabilities.

In June 2012, the Company also acquired the assets of a prime US

supplier for approximately $900 thousand. The supplier is

a manufacturer of injection molded products, including trowels,

spacers and other products that previously were supplied to the

Company and to the supplier's other US-based customers. This new

manufacturing capability will provide new market opportunities for

the Company worldwide and will serve to supply our non-US

operations.

In addition to the two investments described above, the Company

has entered into a bridge loan agreement with Imperial Industries,

Inc. (OTCBB:IPII) ("Imperial") to provide Imperial with up to $500

thousand to fund its operations until it can complete a shareholder

vote for the proposed sale of Imperial to the Company for an amount

not to exceed $.30 per share (approximately $770

thousand). Imperial manufactures and markets stucco and

plaster products, roof tile mortar, adhesive products and pool

finish products.

The Company will be hosting a

conference call to discuss these results and to answer your

questions at 10:00 a.m. Eastern Time on Thursday, June 21, 2012. If

you would like to join the conference call, dial 1-877-941-2068

toll free from the US or 1-480-629-9712 internationally

approximately 10 minutes prior to the start time and ask for the

Q.E.P. Co., Inc. First Quarter Conference Call / Conference ID

4545896. A replay of the conference call will be available until

midnight June 28th by calling 1-877-870-5176 toll free from the US

and entering pin number 4545896; internationally, please call

1-858-384-5517 using the same pin number.

Q.E.P. Co., Inc., founded in 1979, is a leading worldwide

manufacturer, marketer and distributor of a comprehensive line of

hardwood flooring, flooring installation tools, adhesives and

flooring related products targeted for the professional installer

as well as the do-it-yourselfer. Under brand names including QEP®,

ROBERTS®, Capitol®, Harris®Wood, Vitrex®, PRCI®, BRUTUS®

Porta-Nailer® and Elastiment®, the Company markets over 3,000

flooring and flooring related products. In addition to a

complete hardwood flooring line, Q.E.P. products are used primarily

for surface preparation and installation of wood, laminate, ceramic

tile, carpet and vinyl flooring. The Company sells its products to

home improvement retail centers and specialty distribution outlets

in 50 states and throughout the world.

This press release contains forward-looking statements,

including statements regarding pricing pressures, future growth and

long-term profitability, shareholder value, cost increases, sales

growth, benefits of acquisitions, potential acquisitions and

capital availability. These statements are not guarantees of future

performance and actual results could differ materially from our

current expectations.

-Financial Information

Follows-

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF EARNINGS |

| (In thousands except per share

data) |

| (Unaudited) |

| |

|

|

| |

For the Three

Months Ended May 31, |

| |

2012 |

2011 |

| |

|

|

| Net sales |

$ 69,835 |

$ 67,774 |

| Cost of goods sold |

49,669 |

45,614 |

| Gross profit |

20,166 |

22,160 |

| |

|

|

| Operating expenses: |

|

|

| Shipping |

6,870 |

6,452 |

| General and

administrative |

5,144 |

5,145 |

| Selling and

marketing |

4,423 |

4,095 |

| Other income, net |

(36) |

(174) |

| Total operating

expenses |

16,401 |

15,518 |

| |

|

|

| Operating income |

3,765 |

6,642 |

| |

|

|

| Interest expense, net |

(165) |

(285) |

| |

|

|

| Income before provision for income

taxes |

3,600 |

6,357 |

| |

|

|

| Provision for income taxes |

1,314 |

2,225 |

| |

|

|

| Net income |

$ 2,286 |

$ 4,132 |

| |

|

|

| Net income per share: |

|

|

| Basic |

$ 0.69 |

$ 1.26 |

| Diluted |

$ 0.68 |

$ 1.22 |

| |

|

|

| Weighted average number of

common |

|

|

| shares

outstanding: |

|

|

| Basic |

3,330 |

3,285 |

| Diluted |

3,367 |

3,392 |

| |

|

|

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME |

| (In thousands) |

| (Unaudited) |

| |

|

|

| |

For the Three

Months Ended May 31, |

| |

2012 |

2011 |

| |

|

|

| Net income |

$ 2,286 |

$ 4,132 |

| |

|

|

| Unrealized currency translation adjustments,

net of tax |

779 |

(510) |

| |

|

|

| Comprehensive income |

$ 3,065 |

$ 3,622 |

| |

|

|

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE

SHEETS |

| (In thousands except per share

values) |

| |

|

|

| |

May 31, 2012

(Unaudited) |

February 28,

2012 |

| |

|

|

| ASSETS |

|

|

| Cash |

$ 979 |

$ 976 |

| Accounts receivable, less allowance for

doubtful accounts of $491 and |

|

|

| $495 as of May 31, 2012 and February

29, 2012, respectively |

37,392 |

35,386 |

| Inventories |

33,336 |

31,441 |

| Prepaid expenses and other current

assets |

2,503 |

2,596 |

| Deferred income taxes |

1,499 |

1,484 |

| Current assets |

75,709 |

71,883 |

| |

|

|

| Property and equipment, net |

11,120 |

11,546 |

| Deferred income taxes, net |

655 |

686 |

| Intangibles, net |

2,455 |

2,542 |

| Other assets |

445 |

552 |

| |

|

|

| Total Assets |

$ 90,384 |

$ 87,209 |

| |

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

| |

|

|

| Trade accounts payable |

$ 18,803 |

$ 17,437 |

| Accrued liabilities |

12,639 |

10,954 |

| Lines of credit |

4,539 |

5,215 |

| Current maturities of notes payable |

2,297 |

2,343 |

| Current liabilities |

38,278 |

35,949 |

| |

|

|

| Notes payable |

4,796 |

5,102 |

| Other long term liabilities |

723 |

723 |

| Total Liabilities |

43,797 |

41,774 |

| |

|

|

| Preferred stock, 2,500 shares authorized,

$1.00 par value; 337 shares |

|

|

| issued and outstanding at May 31, 2012

and February 29, 2012 |

337 |

337 |

| Common stock, 20,000 shares authorized, $.001

par value; 3,795 |

|

|

| and 3,793 shares issued; 3,319 and

3,338 shares outstanding |

|

|

| at May 31, 2012 and February 29, 2012,

respectively |

4 |

4 |

| Additional paid-in capital |

10,675 |

10,666 |

| Retained earnings |

40,199 |

37,917 |

| Treasury stock, 474 and 455 shares held at

cost at May 31, 2012 |

|

|

| and February 29, 2012,

respectively |

(4,561) |

(4,201) |

| Accumulated other comprehensive income |

(67) |

712 |

| Shareholders' Equity |

46,587 |

45,435 |

| |

|

|

| Total Liabilities and Shareholders'

Equity |

$ 90,384 |

$ 87,209 |

| |

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF CASH FLOWS |

| (In thousands) |

| (Unaudited) |

| |

|

|

| |

For the Three

Months Ended May 31, |

| |

2012 |

2011 |

| |

|

|

| Operating activities: |

|

|

| Net income |

$ 2,286 |

$ 4,132 |

| Adjustments to reconcile net income to net

cash |

|

|

| provided by operating activities: |

|

|

| Depreciation and

amortization |

602 |

640 |

| Other non-cash

adjustments |

15 |

127 |

| Changes in assets and liabilities, net of

acquisition: |

|

|

| Accounts receivable |

(2,762) |

(3,046) |

| Inventories |

(2,667) |

3,333 |

| Prepaid expenses and

other assets |

135 |

1,313 |

| Trade accounts payable

and accrued liabilities |

3,597 |

(2,856) |

| Net cash provided by operating

activities |

1,206 |

3,643 |

| |

|

|

| Investing activities: |

|

|

| Acquisition |

-- |

(959) |

| Capital expenditures |

(180) |

(371) |

| Net cash used in

investing activities |

(180) |

(1,330) |

| |

|

|

| Financing activities: |

|

|

| Net (repayments)

borrowings under lines of credit |

(379) |

1,550 |

| Repayments of notes

payable |

(310) |

(3,205) |

| Purchase of treasury

stock |

(280) |

(243) |

| Dividends and other |

5 |

(3) |

| Net cash used in

financing activities |

(964) |

(1,901) |

| |

|

|

| Effect of exchange rate changes on

cash |

(59) |

12 |

| |

|

|

| Net increase in cash |

3 |

424 |

| Cash at beginning of

period |

976 |

447 |

| Cash at end of period |

$ 979 |

$ 871 |

CONTACT: Q.E.P. Co., Inc.

Richard A. Brooke

Senior Vice President and

Chief Financial Officer

561-994-5550

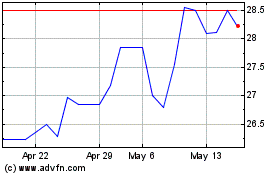

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025