false

0001402945

0001402945

2023-08-14

2023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2023

Progressive Care Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-52684

|

|

32-0186005

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

400 Ansin Blvd., Suite A

Hallandale Beach, FL 33009

(Address of Principal Executive Offices) (Zip Code)

(305) 760-2053

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition

On August 14, 2023, Progressive Care Inc. (the “Company”) issued a press release announcing its results of operations and financial condition for its most recent fiscal quarter ended June 30, 2023 (“Earnings Press Release”). A copy of the Earnings Press Release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth under this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information set forth under this Item 2.02, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 7.01 Regulation FD Disclosure

On August 14, 2023, the Company issued the Earnings Press Release announcing its financial results for the three months ended June 30, 2023. The Earnings Press Release is posted on the Company’s website.

The information set forth under this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information set forth under this Item 7.01, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act, or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description of Exhibit

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

Progressive Care Inc.

|

| |

|

| |

By

|

/s/ Charles M. Fernandez

|

| |

Name:

|

Charles M. Fernandez

|

| |

Title:

|

Chief Executive Officer

|

Date: August 14, 2023

Exhibit 99.1

Progressive Care Inc. Announces Record Second Quarter 2023 Results with Revenues of $11.6 Million and Gross Margins of 31%

340B Contract Revenue Drives Quarterly Top-Line Growth as Operating Income Reaches Record Levels

Miami, FL – August 14, 2023 – Progressive Care Inc. (OTCQB: RXMD) (“Progressive Care” or the “Company”), a personalized healthcare services and technology provider, today announced financial results for the second quarter ended June 30, 2023. The Company experienced record quarterly revenues of $11.6 million, a 16% growth from the second quarter ended June 30, 2022.

“Over the past few months, our team was focused on ensuring that Progressive Care had a strong financial foundation, one that could support its continued growth while enabling it to capitalize on the large untapped potential we see in the pharmacy and healthcare markets. I am pleased to report that through our efforts, at the end of the second quarter, not only has the Company continued to grow, but we successfully eliminated the Company’s outstanding convertible debt and increased the cash available to operate the business,” said Charles M. Fernandez, Chairman and CEO of Progressive Care Inc. “Looking ahead, we remain committed to further building upon our improved balance sheet, driving growth and better positioning the Company to create shareholder value.”

Second Quarter 2023 Financial Highlights:

|

●

|

Total revenues increased by $1.6 million, or 16%, to $11.6 million during the three months ended June 30, 2023, compared to $10.0 million in the prior year period. Total revenues increased by $0.2 million, or 2%, over revenue reported for the first quarter of 2023.

|

|

●

|

Prescription revenue increased by $0.6 million, or 6%, to $9.9 million during the second quarter of 2023, compared to $9.3 million in the prior year period.

|

|

●

|

340B contract revenue was $2.1 million during the second quarter of 2023, an increase of $1.4 million, compared to $0.7 million in the prior year period. The increase was attributable to an increase in our existing 340B contracts.

|

|

●

|

The Company recorded the highest level of income from operations in recent history of $0.6 million during the second quarter of 2023, an increase of $0.8 million when compared to the prior year period. |

|

●

|

Gross profit margin increased to 31% from 20% reported in the second quarter of 2022 primarily due to the increase in 340B contract revenue which has higher margins than revenue generated from pharmacy operations.

|

|

●

|

Cash balance as of June 30, 2023 was $7.4 million as compared to $6.7 million at December 31, 2022.

|

Organizational Highlights and Recent Business Developments:

|

●

|

On May 1, 2023, the Company appointed Dr. Pamela Roberts as Chief Operating Officer. Dr. Roberts formerly served as the Company’s Director of Pharmacy and Pharmacist-in-Charge.

|

|

●

|

On May 9, 2023, the Company successfully received an investment of $1.0 million from NextPlat Corp. (NASDAQ: NXPL).

|

| ● |

On July 1, 2023, NextPlat Corp., along with two other shareholders, exercised common stock purchase warrants and were issued common stock shares by the Company. As a result, NextPlat Corp. and the two shareholders collectively own approximately 53% of the Company’s voting common stock. |

| ● |

On July 17, 2023, Progressive Care appointed Elizabeth Alcaine and Anthony Armas, both accomplished healthcare executives, as Independent Directors to serve on the Company’s Board. |

Summary Financials for the Three Months Ended June 30, 2023 and 2022

| |

|

Three Months Ended June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

$ Change

|

|

|

% Change

|

|

|

Total revenues, net

|

|

$ |

11,556,085 |

|

|

$ |

9,973,584 |

|

|

$ |

1,582,501 |

|

|

|

16 |

% |

|

Total cost of revenue

|

|

|

7,997,239 |

|

|

|

7,943,231 |

|

|

|

54,008 |

|

|

|

1 |

% |

|

Total gross profit

|

|

|

3,558,846 |

|

|

|

2,030,353 |

|

|

|

1,528,493 |

|

|

|

75 |

% |

|

Operating expenses

|

|

|

2,934,674 |

|

|

|

2,227,623 |

|

|

|

707,051 |

|

|

|

32 |

% |

|

Income (loss) from operations

|

|

|

624,172 |

|

|

|

(197,270 |

) |

|

|

821,442 |

|

|

|

(416 |

)% |

|

Other loss

|

|

|

(5,261,198 |

) |

|

|

(682,586 |

) |

|

|

(4,578,612 |

) |

|

|

671 |

% |

|

Loss before income taxes

|

|

|

(4,637,026 |

) |

|

|

(879,856 |

) |

|

|

(3,757,170 |

) |

|

|

427 |

% |

|

Income taxes

|

|

|

— |

|

|

|

(866 |

) |

|

|

866 |

|

|

|

(100 |

)% |

|

Net loss attributable to common shareholders

|

|

$ |

(4,637,026 |

) |

|

$ |

(880,722 |

) |

|

$ |

(3,756,304 |

) |

|

|

427 |

% |

Financial Results for the Three Months Ended June 30, 2023

For the three months ended June 30, 2023 and 2022, we recognized total revenue from operations of approximately $11.6 million and $10.0 million, respectively, an overall increase of approximately $1.6 million for the three months ended June 30, 2023, when compared to the three months ended June 30, 2022. The increase in revenue was primarily attributable to an increase in prescription revenue of approximately $0.6 million and an increase in 340B contract revenue of approximately $1.4 million, which was offset by a decrease in COVID-19 testing revenue of approximately $0.4 million, when compared to the prior year period.

Gross profit margins increased from 20% for the three months ended June 30, 2022, to 31% for the three months ended June 30, 2023. The increase in gross profit margins during the second quarter of 2023 compared to the same period in 2022, was primarily attributable to the increase in 340B contract revenue, which has higher margins than revenue generated from pharmacy operations.

Income from operations increased by approximately $0.8 million for the three months ended June 30, 2023, to approximately $0.6 million, when compared to the three months ended June 30, 2022, as a result of the increase in gross profit of approximately $1.5 million, partially offset by the increase in operating expenses of approximately $0.7 million.

Net Loss

We had a net loss of approximately $4.6 million and $0.9 million for the three months ended June 30, 2023 and 2022, respectively. The increase in net loss is attributable to the debt conversion expense of approximately $5.2 million recorded in the current period.

Quarterly Report on Form 10-Q Available

The Company’s Quarterly Report on Form 10-Q, available at www.sec.gov and on the Company’s website, contains a thorough review of its financial results for the three months ended June 30, 2023.

About Progressive Care

Progressive Care Inc. (OTCQB: RXMD), through its subsidiaries, is a Florida health services organization and provider of Third-Party Administration (TPA), data management, COVID-19 related diagnostics and vaccinations, 340B contracted pharmacy services, prescription pharmaceuticals, compounded medications, provider of tele-pharmacy services, the sale of anti-retroviral medications, medication therapy management (MTM), the supply of prescription medications to long-term care facilities, and health practice risk management.

Forward-Looking Statements

Forward-Looking Statements contained herein that are not based upon current or historical fact are forward-looking in nature and constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements reflect the Company’s expectations about its future operating results, performance, and opportunities that involve substantial risks and uncertainties. When used herein, the words “anticipate,” “believe,” “estimate,” “upcoming,” “plan,” “target,” “intend” and “expect” and similar expressions, as they relate to Progressive Care Inc., its subsidiaries, or its management, are intended to identify such forward-looking statements. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties, and other factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2022 that could cause the Company’s actual results, performance, prospects, and opportunities to differ materially from those expressed in, or implied by, these forward-looking statements.

Public Relations Contact

Carlos Rangel

info@progressivecareus.com

v3.23.2

Document And Entity Information

|

Aug. 14, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Progressive Care Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 14, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-52684

|

| Entity, Tax Identification Number |

32-0186005

|

| Entity, Address, Address Line One |

400 Ansin Blvd.

|

| Entity, Address, Address Line Two |

Suite A

|

| Entity, Address, City or Town |

Hallandale Beach

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33009

|

| City Area Code |

305

|

| Local Phone Number |

760-2053

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

true

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001402945

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

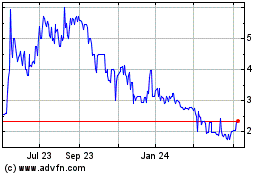

Progressive Care (QB) (USOTC:RXMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

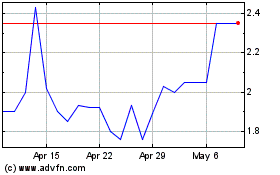

Progressive Care (QB) (USOTC:RXMD)

Historical Stock Chart

From Apr 2023 to Apr 2024