7-Eleven Looks to Expand North American Business -- WSJ

October 07 2016 - 2:02AM

Dow Jones News

By Megumi Fujikawa

TOKYO -- Seven & I Holdings Co., the parent of 7-Eleven,

said it would expand its profitable convenience-store business in

North America and seek acquisition opportunities there, after

prodding from U.S. activist investor Daniel Loeb of hedge fund

Third Point LLC.

The company also plans to divest itself of some unprofitable

businesses in Japan, including department stores.

"We will speed up expansion in North America by accelerating

acquisitions," said Ryuichi Isaka, president of Tokyo-based Seven

& I, at a news conference Thursday.

Mr. Isaka took over as president of the company after a

boardroom clash earlier this year that resulted in the resignation

of Toshifumi Suzuki, who had been at the helm since 1992.

Mr. Isaka survived the battle with Mr. Loeb's backing after the

activist investor criticized a plan by Mr. Suzuki to oust Mr.

Isaka. Mr. Suzuki's plan was rejected by the company's board in

April. Mr. Loeb, whose Third Point fund owns hundreds of millions

of dollars in Seven & I common shares, had advocated for the

company to focus on its convenience stores and turn away from

department stores.

On Thursday, Mr. Isaka avoided saying directly whether he took

Mr. Loeb's opinions into consideration when planning his new

business strategy. Instead, he said he is confident that it will

satisfy all shareholders.

Seven & I plans to increase its store count in North America

to 10,000 by fiscal 2019; at the end of June, it had nearly 8,900

stores in the U.S. and Canada. More than 80% of convenience stores

in the region are owned by smaller companies or individual

proprietors, which Mr. Isaka said made for plenty of acquisition

opportunities.

Some elements of the Japanese-style convenience-store model will

be introduced in North America, he said. Counters featuring hot

snacks are already part of most 7-Eleven stores in Japan and some

overseas. Mr. Isaka said he wanted to introduce these counters to

more stores in North America and wanted the stores to offer more

fresh food such as sandwiches.

The company has already embarked on its North American

expansion. In June, it said it would buy 79 gasoline stations and

convenience stores in California and Wyoming from CST Brands Inc.

At the end of June, Seven & I had 59,831 7-Eleven stores

world-wide, including 18,785 in Japan.

On the department-store front, Seven & I said domestic

retailer H2O Retailing Corp., will operate some of its department

stores in western Japan. Mr. Isaka said H2O was selected because it

has achieved high operating margins and has experience with

department stores.

In the March-August period, Seven & I posted an operating

profit of 181 billion yen ($1.75 billion); Yen160 billion of that

came from convenience-store operations. It reported an operating

loss of Yen1.82 billion for its department-store segment.

Convenience-store competition has also intensified at home. A

merger of two smaller rivals created the country's second-largest

chain of convenience stores, called FamilyMart UNY Holdings Co.

Meanwhile, Mitsubishi Corp. is trying to enhance operations at

Lawson Inc., the third-largest convenience-store operator, by

raising its stake and making it a consolidated subsidiary.

Write to Megumi Fujikawa at megumi.fujikawa@wsj.com

(END) Dow Jones Newswires

October 07, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

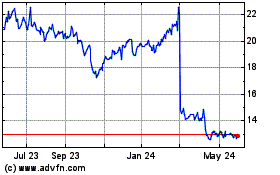

Seven and I (PK) (USOTC:SVNDY)

Historical Stock Chart

From Dec 2024 to Jan 2025

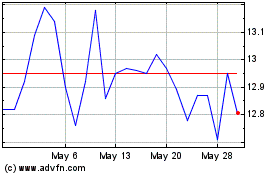

Seven and I (PK) (USOTC:SVNDY)

Historical Stock Chart

From Jan 2024 to Jan 2025